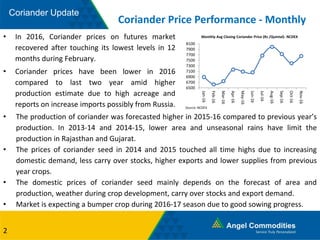

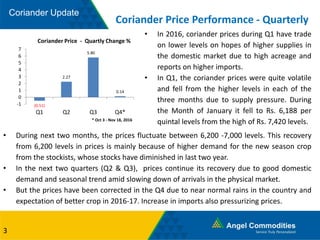

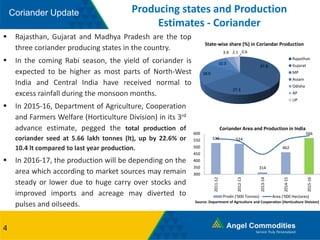

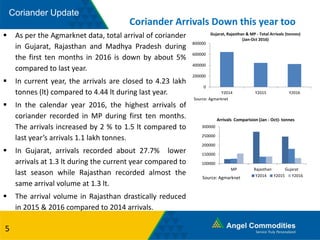

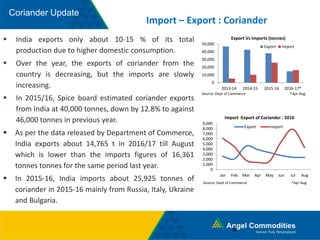

Coriander prices are expected to trend down in the coming year due to sufficient supplies and a better crop forecast for the next season. Production of coriander was higher in 2015-16 compared to previous years, and arrivals have been down 5% so far in 2016 due to higher stocks. Imports have been rising while exports have been decreasing. Sowing of the next crop has begun and prices will depend on sowing progress and demand. With good production last year and sufficient supplies, prices are expected to ease to Rs. 7,200-7,000 per quintal over the coming months if sowing is normal.