Here are three things I hope to achieve:

1. Provide insightful analysis and recommendations to help address logistical constraints in Sub-Saharan African ports and their hinterlands.

2. Facilitate productive discussions on how to improve infrastructure like roads, railways, and cold storage to better connect ports and regional markets.

3. Offer a balanced perspective on opportunities and challenges with growing trade and investment from countries like China, considering both economic benefits as well as need for responsible partnerships.

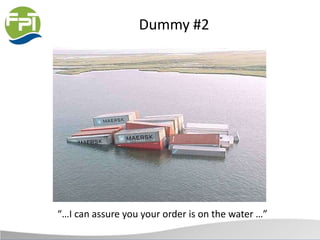

![“If you’re smart enough to make [grow]

it, aggressive enough to sell it –

then any dummy can get it there.”

Lalonde quoted in Langley (1986)](https://image.slidesharecdn.com/7446ba98-6a5b-4f55-98bf-6faddbfa6204-151118190941-lva1-app6891/85/Cool-Logistics-2012-lin-2-320.jpg)