Embed presentation

Download to read offline

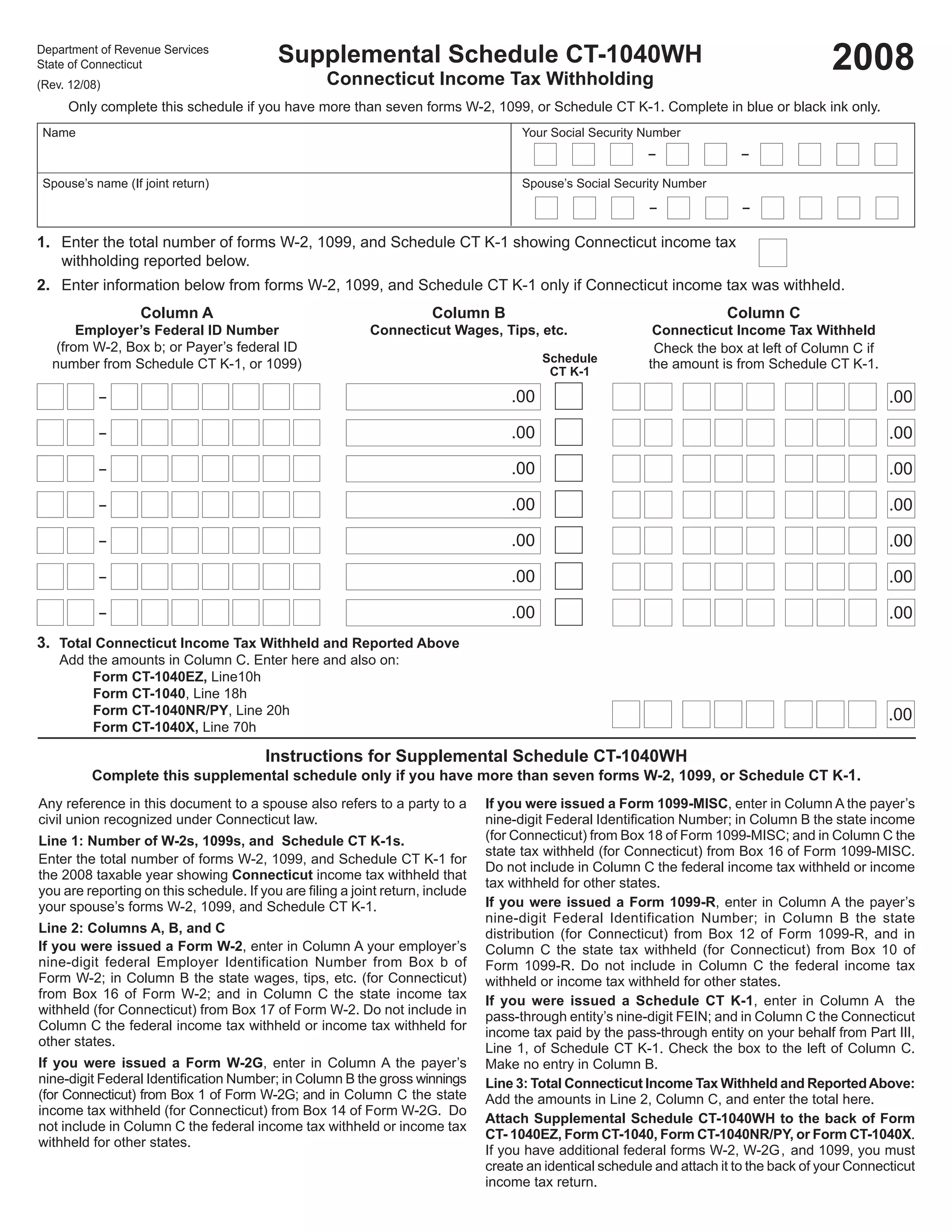

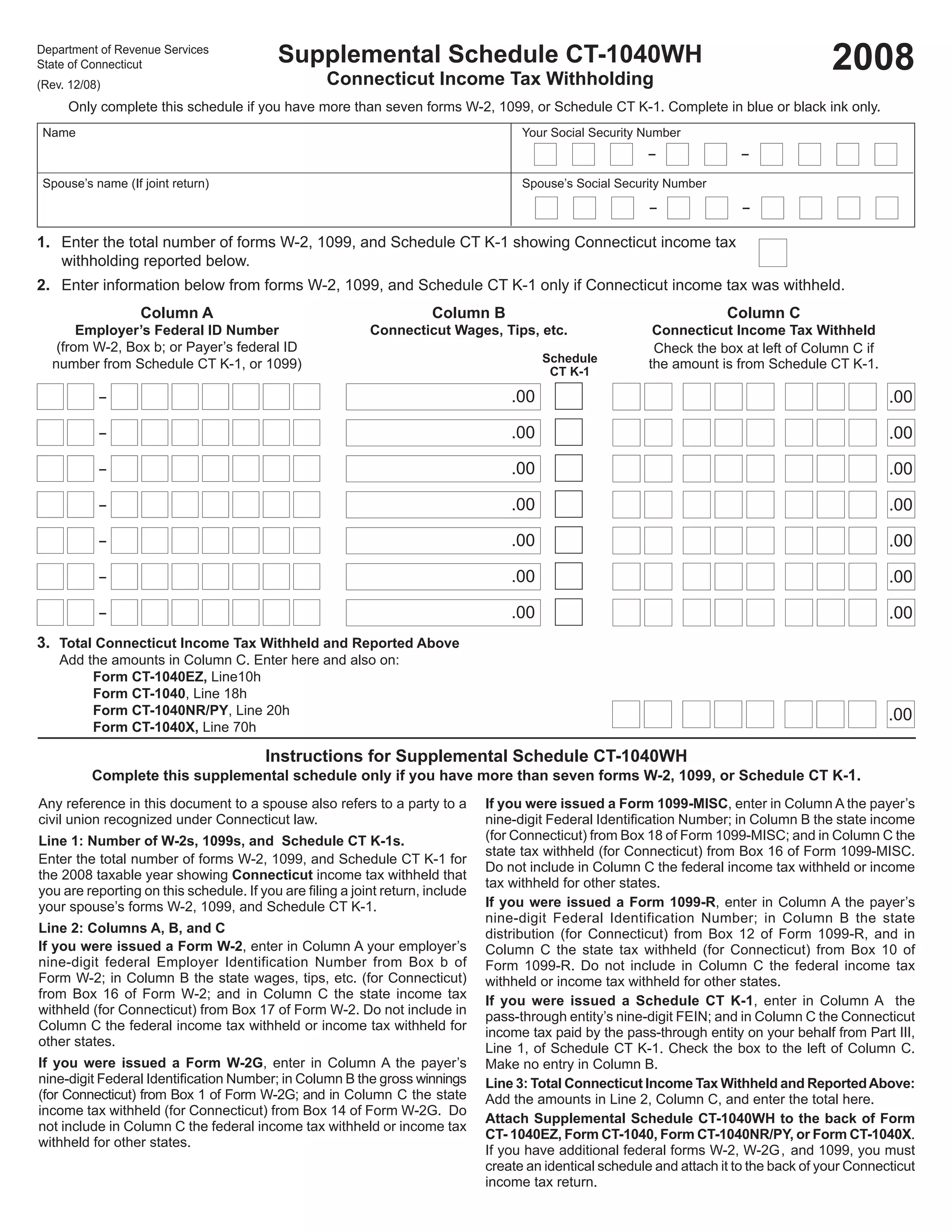

This document is the Connecticut Supplemental Schedule CT-1040WH for reporting Connecticut income tax withholding from more than seven W-2, 1099, or Schedule CT K-1 forms. It instructs filers to enter identifying information from each form in Columns A, B, and C, including employer ID numbers, income amounts, and withholding amounts. Filers are directed to total the Column C withholding amounts and carry that total to their Connecticut income tax return. The schedule is to be attached to Form CT-1040EZ, CT-1040, CT-1040NR/PY, or CT-1040X if more than seven withholding forms are being reported.