Executive Bonus Arrangement

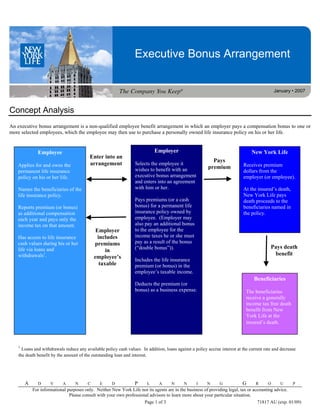

- 1. Executive Bonus Arrangement January • 2007 Concept Analysis An executive bonus arrangement is a non-qualified employee benefit arrangement in which an employer pays a compensation bonus to one or more selected employees, which the employee may then use to purchase a personally owned life insurance policy on his or her life. Employee Employer New York Life Enter into an Pays Applies for and owns the arrangement Selects the employee it Receives premium wishes to benefit with an premium permanent life insurance dollars from the policy on his or her life. executive bonus arrangement employer (or employee). and enters into an agreement Names the beneficiaries of the with him or her. At the insured’s death, life insurance policy. New York Life pays Pays premiums (or a cash death proceeds to the Reports premium (or bonus) bonus) for a permanent life beneficiaries named in as additional compensation insurance policy owned by the policy. each year and pays only the employee. (Employer may income tax on that amount. also pay an additional bonus Employer to the employee for the Has access to life insurance includes income taxes he or she must cash values during his or her premiums pay as a result of the bonus life via loans and (“double bonus”)). Pays death in withdrawals1. benefit employee’s Includes the life insurance taxable premium (or bonus) in the employee’s taxable income. Beneficiaries Deducts the premium (or bonus) as a business expense. The beneficiaries receive a generally income tax free death benefit from New York Life at the insured’s death. 1 Loans and withdrawals reduce any available policy cash values. In addition, loans against a policy accrue interest at the current rate and decrease the death benefit by the amount of the outstanding loan and interest. A D V A N C E D P L A N N I N G G R O U P For informational purposes only. Neither New York Life nor its agents are in the business of providing legal, tax or accounting advice. Please consult with your own professional advisors to learn more about your particular situation. Page 1 of 3 71817 AU (exp. 01/09)

- 2. Executive Bonus Arrangement Concept Analysis What is an Executive Bonus it may bonus the premiums to the insurance policy. However, if the policy Arrangement? employee, so that he or she may write the is owned by an ILIT, each premium check to the insurance company. payment will be considered a gift from Sometimes, the employer will agree to an the employee to the trust and gift tax An executive bonus arrangement, also additional bonus amount to help the issues will need to be addressed. known as a Section 162 bonus plan, is a employee pay the income taxes on the non-qualified employee benefit bonus. This is referred to as a “double arrangement in which an employer pays a Restricted Executive Bonus bonus”. In later years, the cash value of compensation bonus to selected the permanent life insurance policy may employees. It is most easily described as To address concerns from the employer be accessed via policy loans or for an incentive for the employee to employer-funded personal life insurance. withdrawals to pay the income tax on the remain with the employer (often referred bonus amount if sufficient cash value to as “golden handcuffs”), a special The executive bonus arrangement may be exists in the policy 2 . of particular interest to employers who endorsement may be placed on the life want to reward key employees with insurance policy which would require the The cash bonus or premium paid by the employer’s consent to: borrow cash supplemental nonqualified benefits employer will appear as additional without extending these additional values, surrender the policy, assign or compensation on the employee’s W-2 in pledge the policy as collateral for a loan, benefits to all full-time employees. It the year in which the bonus is received. may also be of interest to employers who or change ownership of the policy. This The compensation bonus is deductible by endorsement would not give the have qualified plans in place, but feel the employer in that same year if the they need another benefit with which employer any rights in the life insurance employee’s total compensation is a policy, other than the limited ability to they can reward certain key employees. reasonable amount (I.R.C. §162(a)(1)). participate in decisions that would affect Again, it is important to document the how the policy is used during the time How to Establish an Executive executive bonus arrangement via a specified by the restriction. Bonus Arrangement corporate resolution in order to help establish the expense as a reasonable The employee would still be able to If there are no restrictions placed on the business expense of the company, thus change the beneficiary but could not, executive bonus arrangement, the only helping preserve the tax deduction. without the employer’s consent: required documentation between the withdraw cash value, surrender the employer and the employee is a corporate During the employee’s life, he or she policy, take a loan against the policy, or resolution adopted by the employer’s accrues basis in the life insurance policy assign the policy. board of directors. The resolution should equal to the sum of premiums paid by the establish the purpose for the bonus (for employer. Unless the arrangement has a A “restricted executive bonus agreement” example, to help recruit, retain and restriction on it (discussed later), the between the parties would typically reward key employees). While it is not employee is free to take policy loans, establish when the restrictions were required, it may nevertheless be advisable surrenders or withdrawals from the cash scheduled to expire. Triggering events for an attorney to formally document an value 3 and would be taxed the same as if often include: the executive’s retirement agreement in writing between the he or she had purchased the policy or disability, the attainment of a employer and the employee that clearly individually. designated age, or when the employer defines the terms of the bonus discretionarily releases the restriction. arrangement. At the employee’s death, the life The agreement may also contain a insurance death proceeds are generally vesting schedule, however if it does, the The employee typically both applies for received by the policy owner’s total bonus becomes taxable to the and owns the permanent life insurance beneficiary free of federal income taxes executive and deductible to the employer policy. As the owner of the policy, the (I.R.C. §101(a)). If estate taxes are a when the policy vests in the executive employee has the right to name the concern for the employee, he or she may without risk of forfeiture (I.R.C. §83). beneficiaries of the policy’s death wish to establish an irrevocable life benefit; however, the employee should insurance trust (ILIT) to own the life Once the restriction period is terminated not name the employer as beneficiary of or otherwise expires, a written statement the life insurance policy, otherwise the from the employee stating that the 2. Loans and withdrawals reduce any employee has retired from employment bonus would not be income tax available policy cash values. In addition, deductible to the employer (I.R.C. with the employer is required in order to loans against a policy accrue interest at the §264(a)(1)). current rate and decrease the death benefit by remove the endorsement from the policy. the amount of the outstanding loan and The employer may then either pay the interest. If the executive elects to terminate premiums on the life insurance policy employment before the restriction is directly to the life insurance company or 3 Id. lifted, he or she may be required in a A D V A N C E D P L A N N I N G G R O U P For informational purposes only. Neither New York Life nor its agents are in the business of providing legal, tax or accounting advice. Please consult with your own professional advisors to learn more about your particular situation. Page 2 of 3

- 3. Executive Bonus Arrangement Concept Analysis separate employment agreement to repay Summary What are the Benefits of an the employer part or all of the premiums Executive Bonus Arrangement bonused. This employment agreement would not be tied in any way to the life What are the Benefits of an to the Employee? insurance policy itself. If the employee Executive Bonus Arrangement left prior to vesting and failed to repay to the Employer? • The employee (or a designated third the employer, the employer would have party) owns the permanent life insurance policy and the cash values. the right to seek enforcement of the • May reward key employees. contract in a court of law. The employer If the employee changes employers, the employee will be able to retain would not, however, have any rights to • Selective participation is permissible. the life insurance cash values absent the policy (although any future judgment from the court. premiums due will have to be self- • Bonus is tax-deductible, subject to funded by the employee). reasonable compensation limits. It is also important to note that if repayment to the employer were required, • Non-restricted executive bonus • Creation of plan is simple, generally arrangements avoid the risk of it is possible that the IRS might deem the requiring only a corporate resolution. employer to have a “beneficial interest” forfeiture associated with deferred in the life insurance policy that could compensation plans. • No formal administration is jeopardize the income tax deduction it necessary. would otherwise be entitled to without • Accumulating cash values may be such a requirement. The client should borrowed against or withdrawn 4 to • The amount of bonuses and life help in emergencies, at retirement, or consult his or her own professional insurance coverage on various for personal investments. advisors regarding their own tax situation employees can differ. if a repayment agreement is contemplated. • Premium bonuses are not subject to • The plan is not subject to IRS qualified plan contribution limits. approval or restrictions. In most other aspects, the restricted executive bonus functions identically to • Distributions from a life insurance the executive bonus arrangement. policy that is not classified as a Modified Endowment Contract are not subject to the 10% premature distribution penalty for distributions prior to age 59 ½ (I.R.C. §72(t)). • The death benefit may be received income tax free (I.R.C. §101). • Life insurance death proceeds may be used for estate settlement costs. New York Life Insurance Company New York Life Insurance and Annuity Corporation (A Delaware Corporation) 51 Madison Avenue New York, NY 10010 www.newyorklife.com The Company You Keep® 4. Id. A D V A N C E D P L A N N I N G G R O U P For informational purposes only. Neither New York Life nor its agents are in the business of providing legal, tax or accounting advice. Please consult with your own professional advisors to learn more about your particular situation. Page 3 of 3