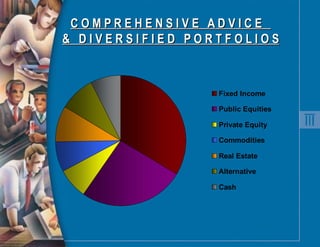

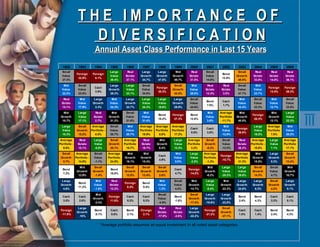

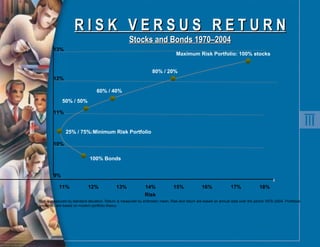

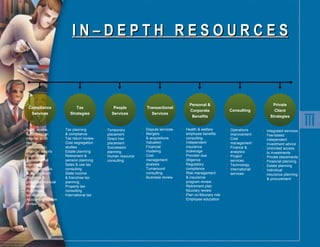

The document is a presentation from Weaver Tidwell Wealth Management that outlines their comprehensive wealth management services. It discusses their focus on independence, integrity and innovation. The presentation covers their services such as estate planning, investment management, financial planning and more. It emphasizes the importance of diversification and their personalized approach to creating customized plans and portfolios for clients.