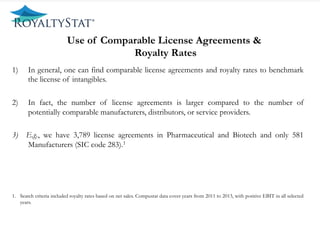

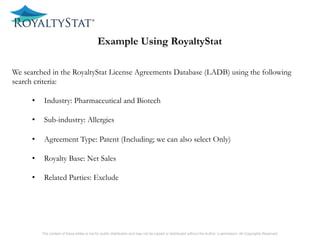

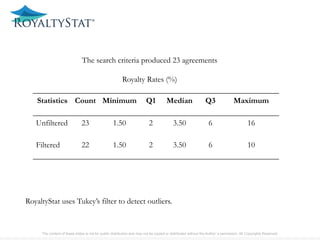

The document discusses using royalty rates from comparable license agreements to analyze the comparability of intangible property transactions. It notes the OECD guidelines for determining comparability and factors that can affect royalty rates like exclusivity, territory, and payment structures. An example analysis of pharmaceutical allergy patent licenses is provided, finding tiered rates are generally higher and that rates did not vary significantly across other factors in this dataset. The document concludes that RoyaltyStat's database contains many agreements useful for comparability analyses of contractual terms.