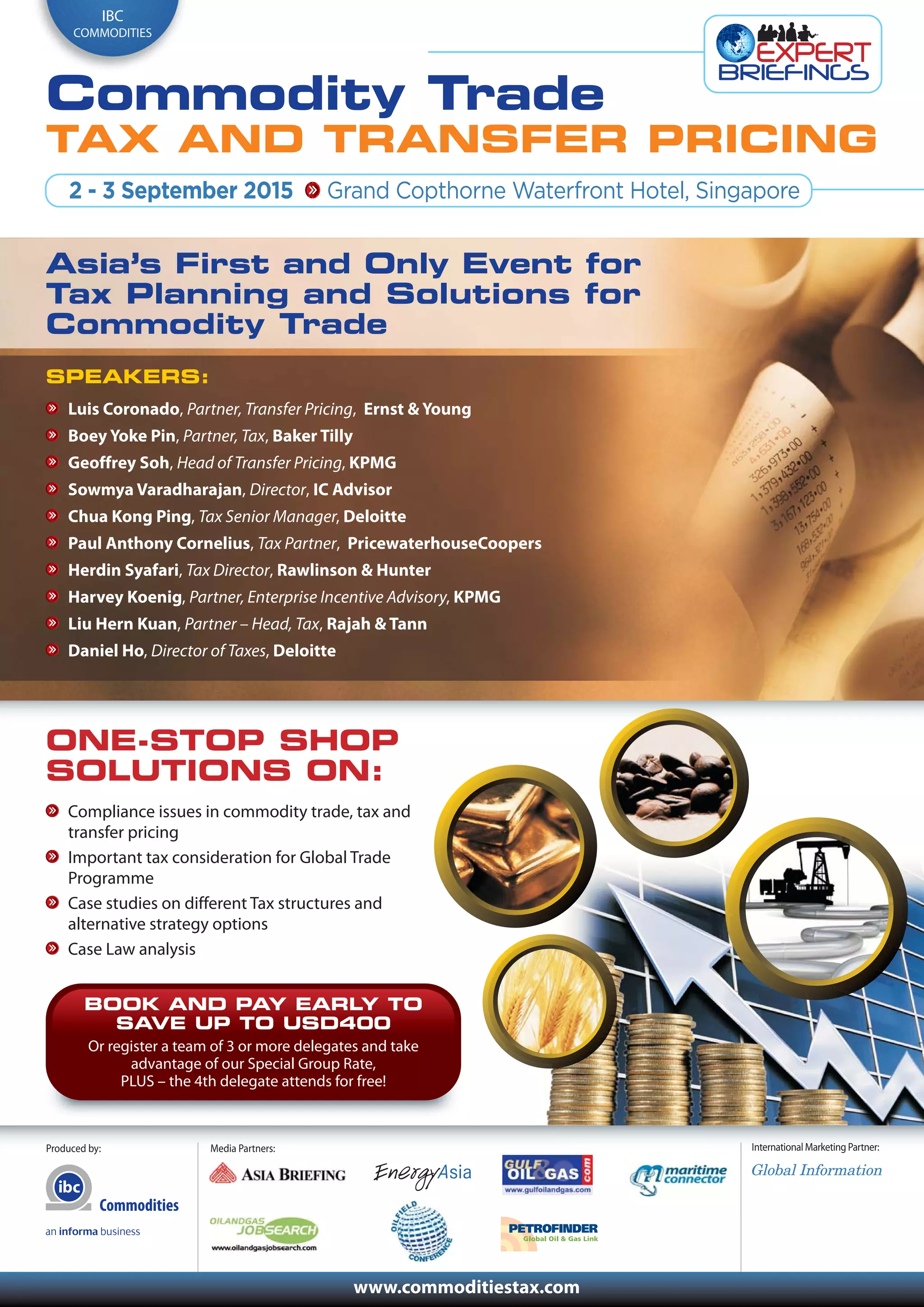

The document details a conference on commodity trade, tax, and transfer pricing held on September 2-3, 2015, in Singapore, featuring expert speakers from various renowned firms. It emphasizes the importance of tax compliance and transfer pricing strategies in global trade, presenting key topics, case studies, and networking opportunities for industry professionals. Registration information and payment instructions are also provided, along with special rates for group bookings.