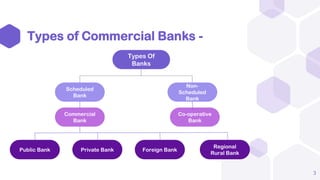

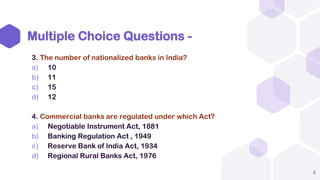

Commercial banks are profit-seeking institutions that accept deposits from the public and lend money to individuals and businesses. They are regulated under the Banking Regulation Act of 1949 and their operations are overseen by the Reserve Bank of India. Commercial banks play an important role in the economic development of India by generating employment, promoting capital formation and business, and channeling funds, including financing to the government. Their primary functions are accepting deposits and advancing loans, while secondary functions include locker facilities, overdraft facilities, discounting bills, and transferring funds.