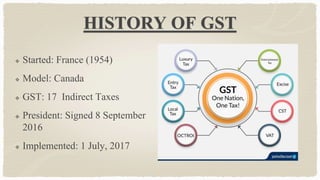

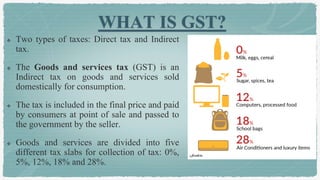

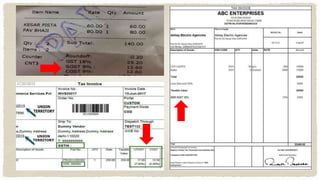

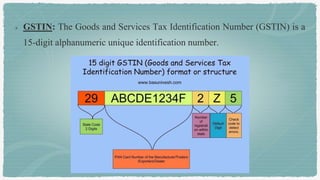

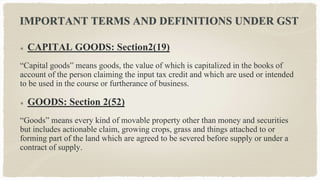

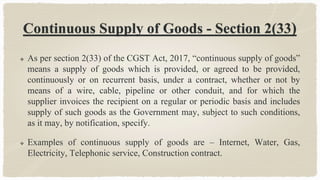

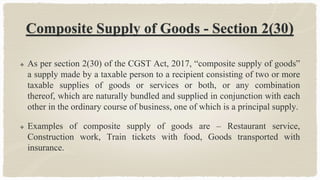

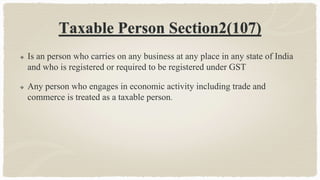

GST is an indirect tax introduced in India in 2017 that combines multiple taxes into one. It is collected on goods and services at the point of sale. There are different tax rates of 0%, 5%, 12%, 18%, and 28% applied to different goods and services. GST is composed of CGST collected by the central government, SGST by state governments, and IGST on inter-state sales. Key terms defined include taxable person, non-resident taxable person, input tax credit, reverse charge, and definitions of goods, services, capital goods, continuous supply of goods, and composite supply of goods. The GSTN manages the IT system for GST.