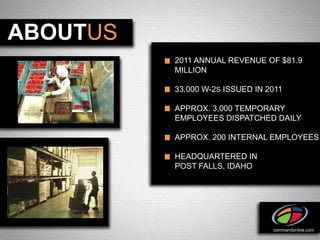

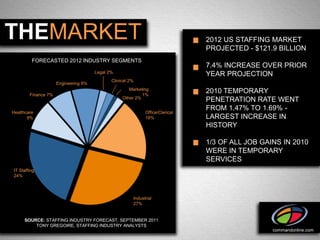

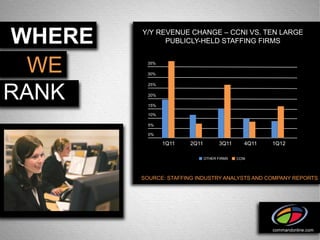

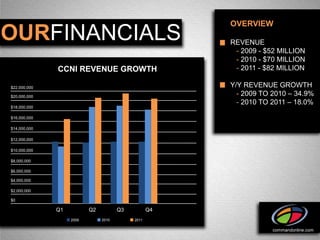

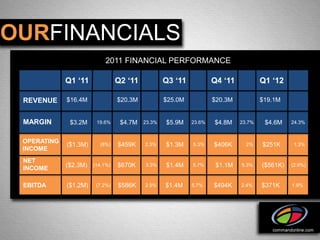

Command Center Inc. is an on-demand staffing company that provides short-term, semi-skilled, and unskilled labor. In 2011, they generated $81.9 million in revenue and issued approximately 33,000 W-2s. They operate 52 branches across 24 states. The presentation discusses Command Center's financial performance, growth outpacing competitors, and seasoned management team as reasons for their continued success in the on-demand staffing industry.