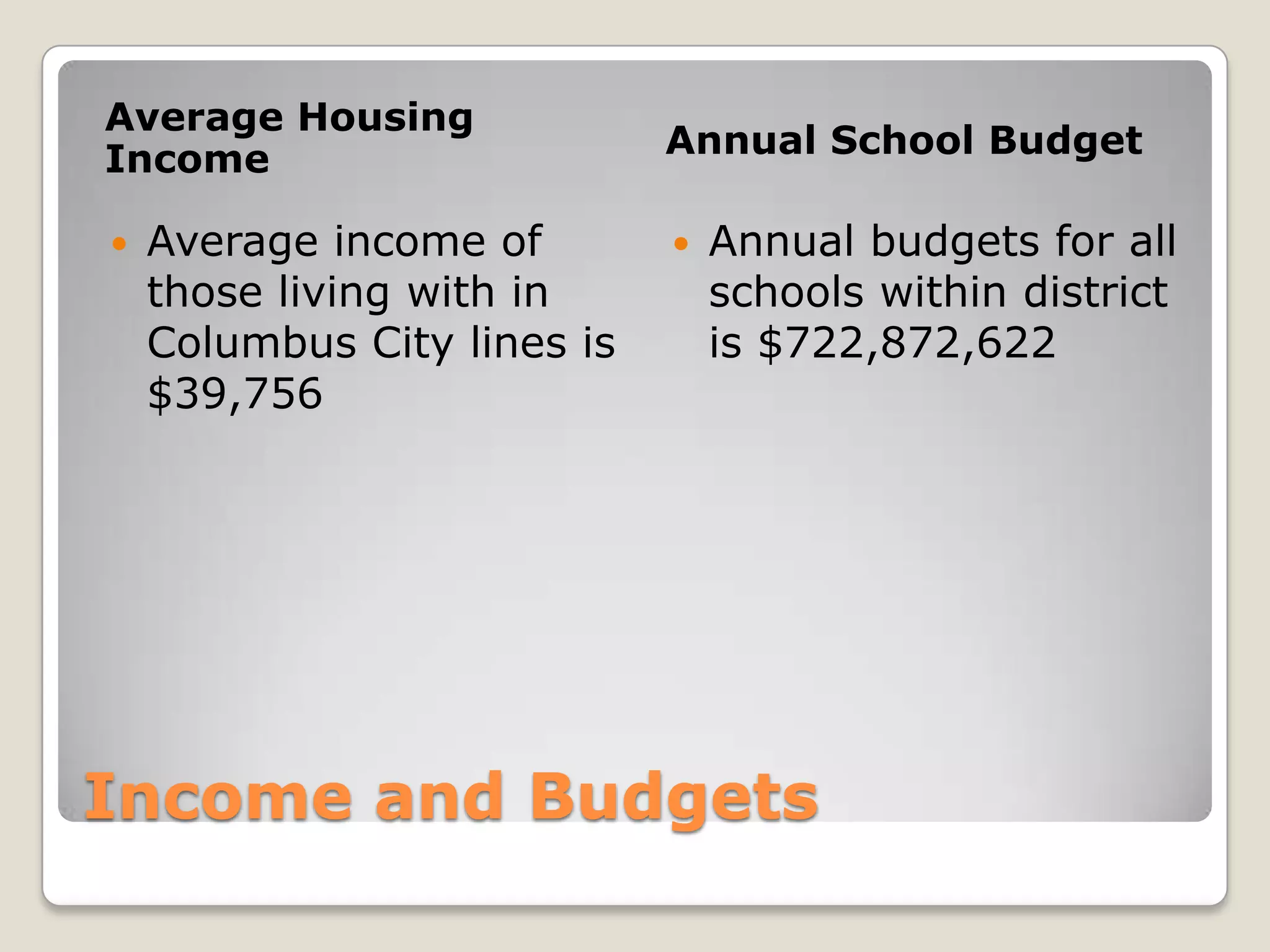

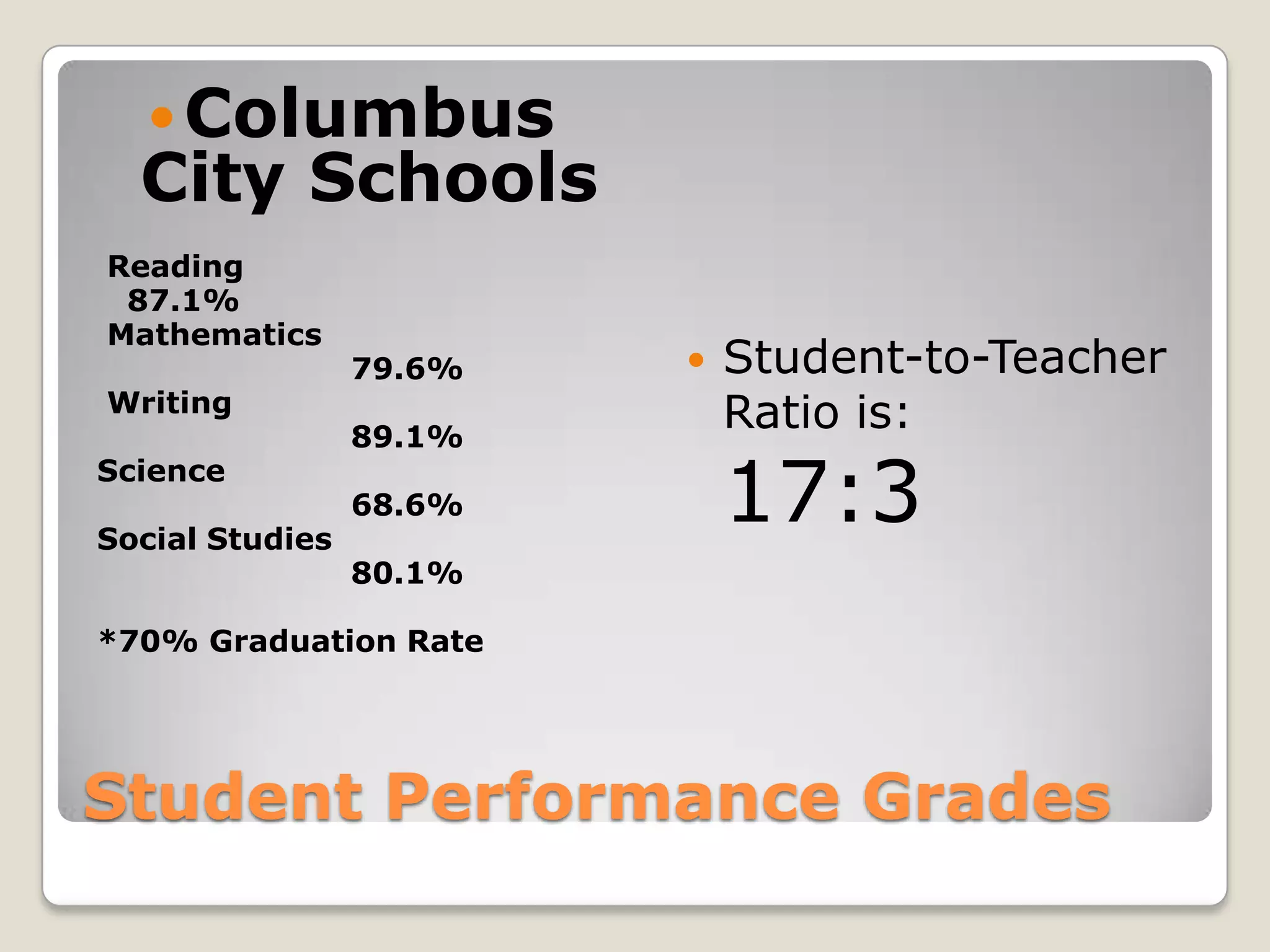

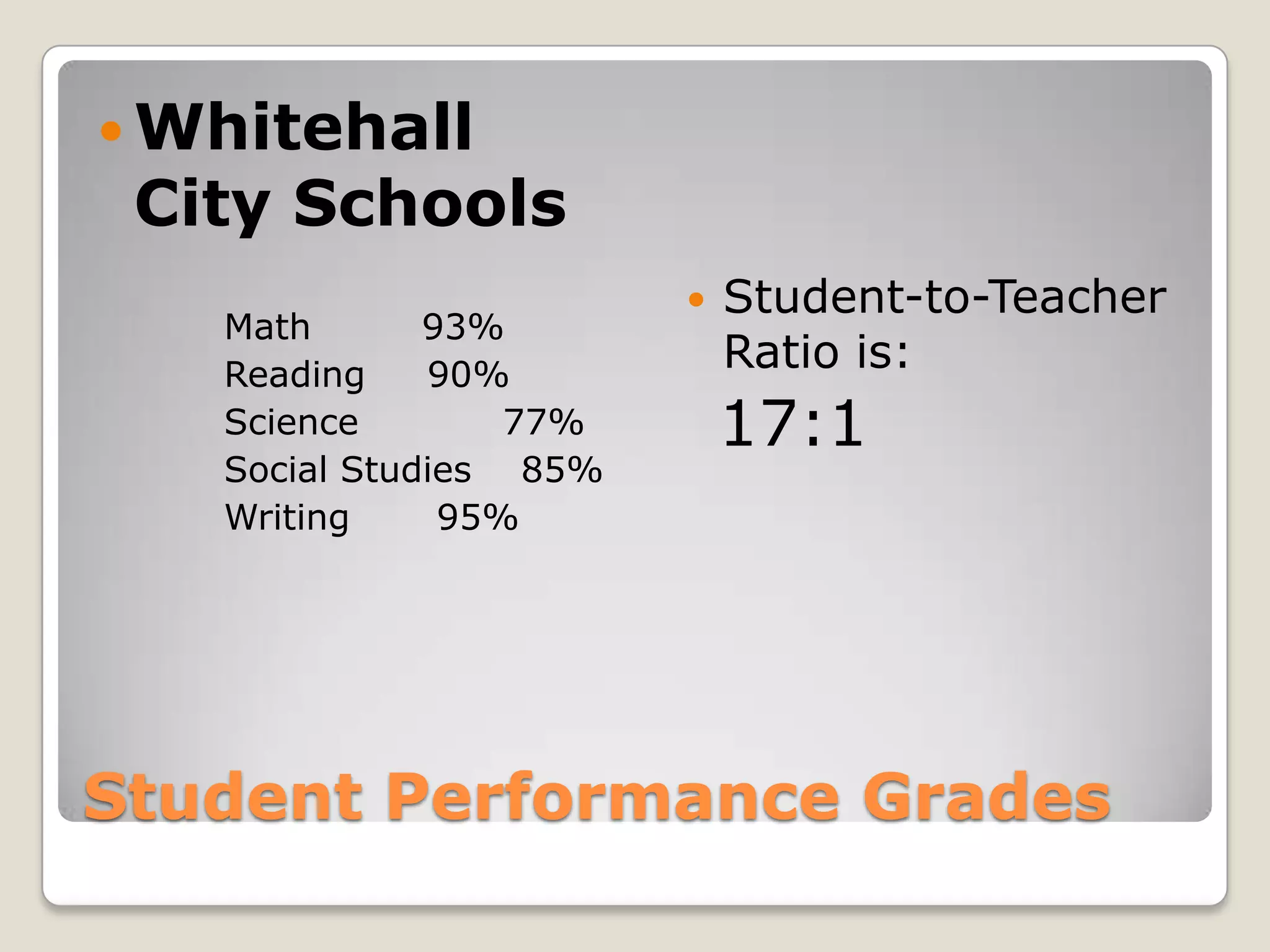

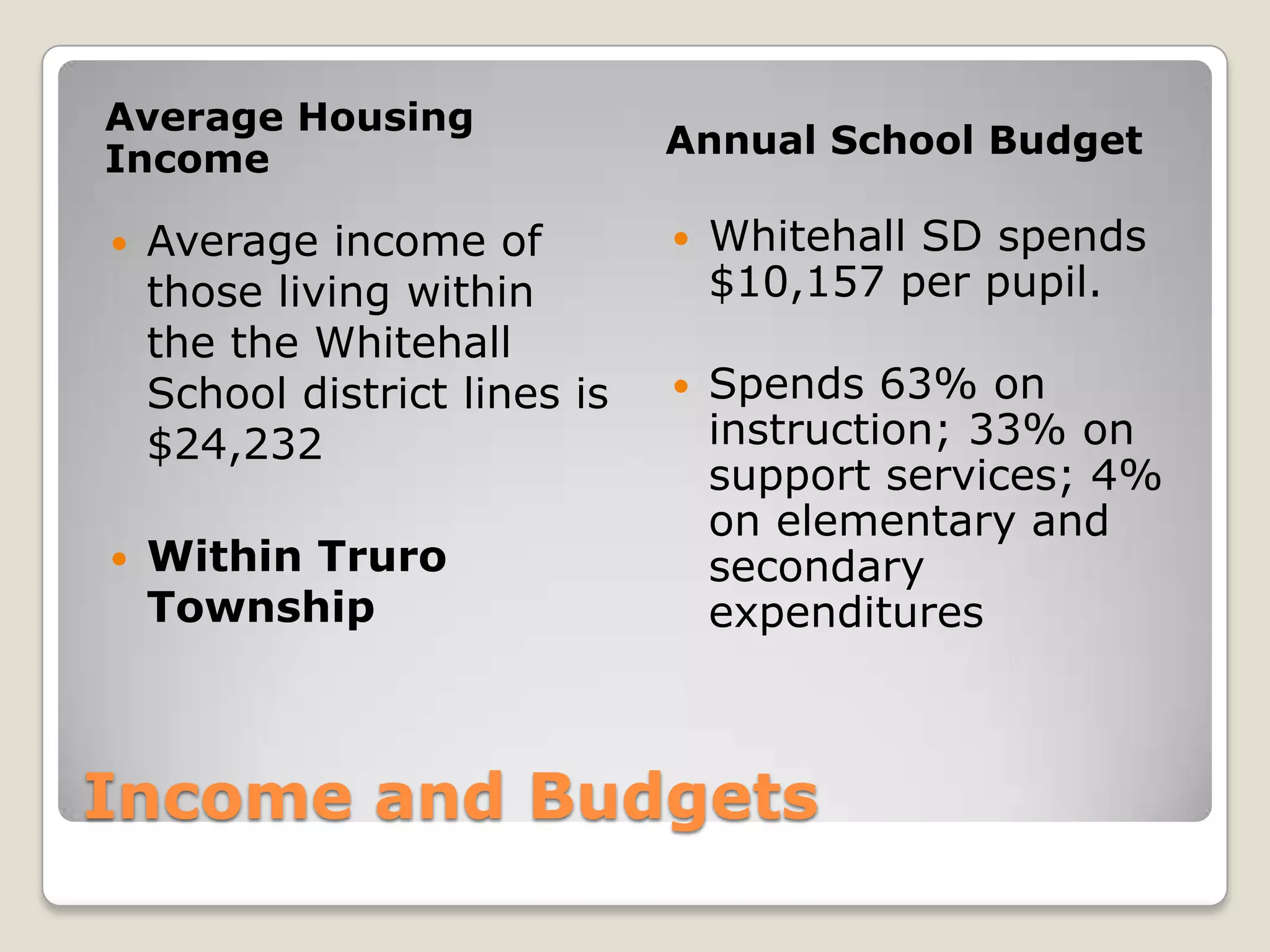

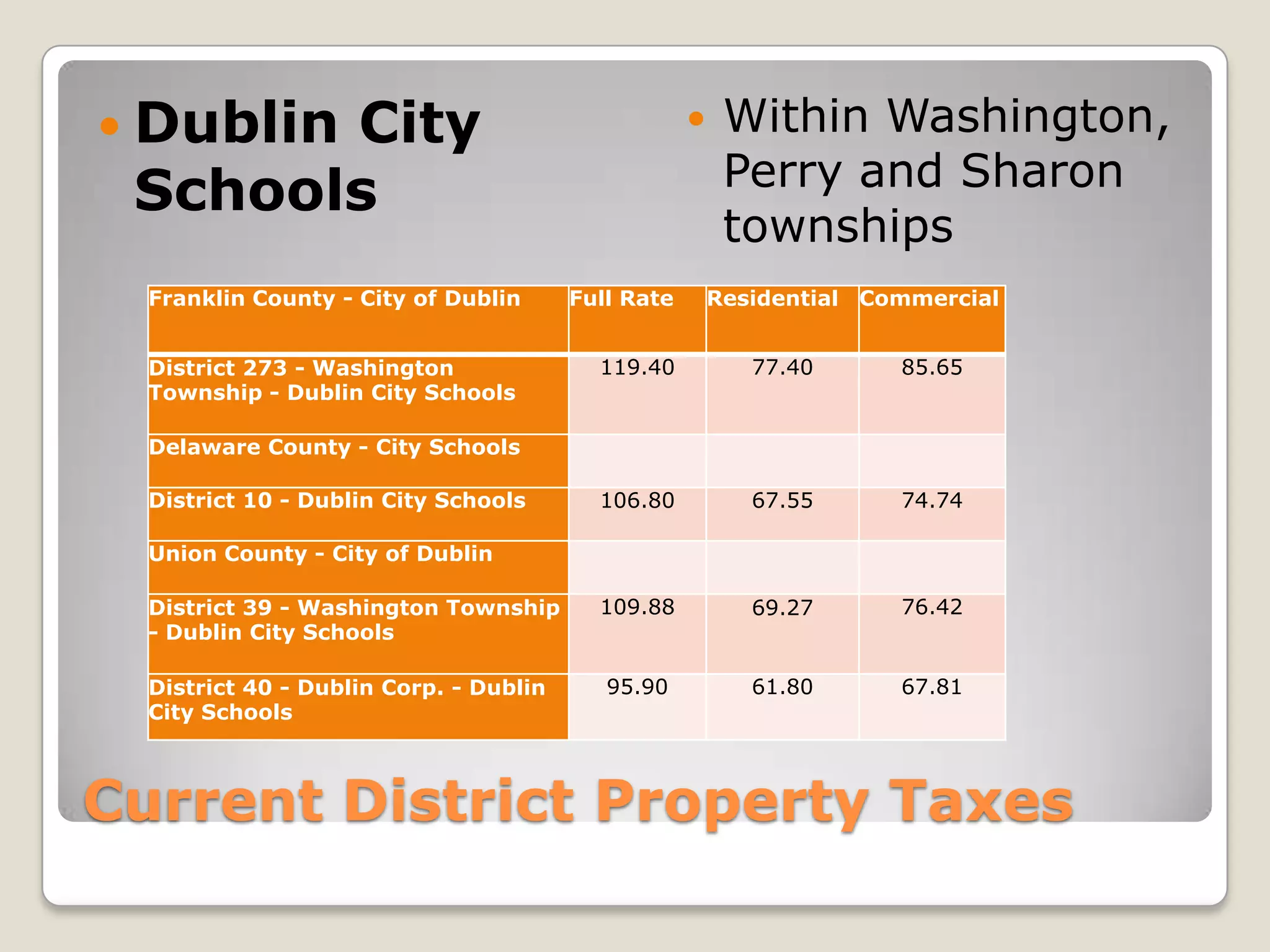

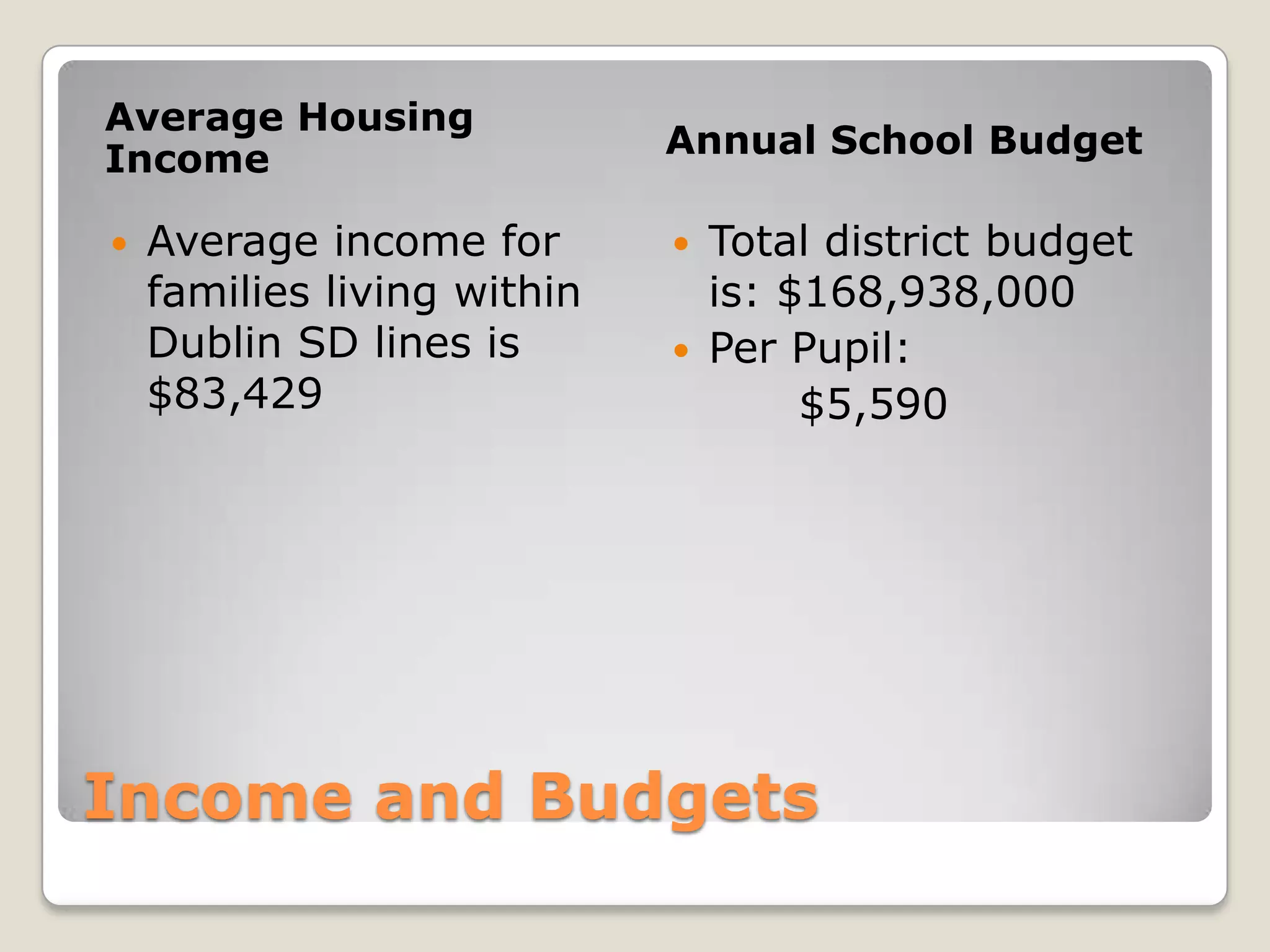

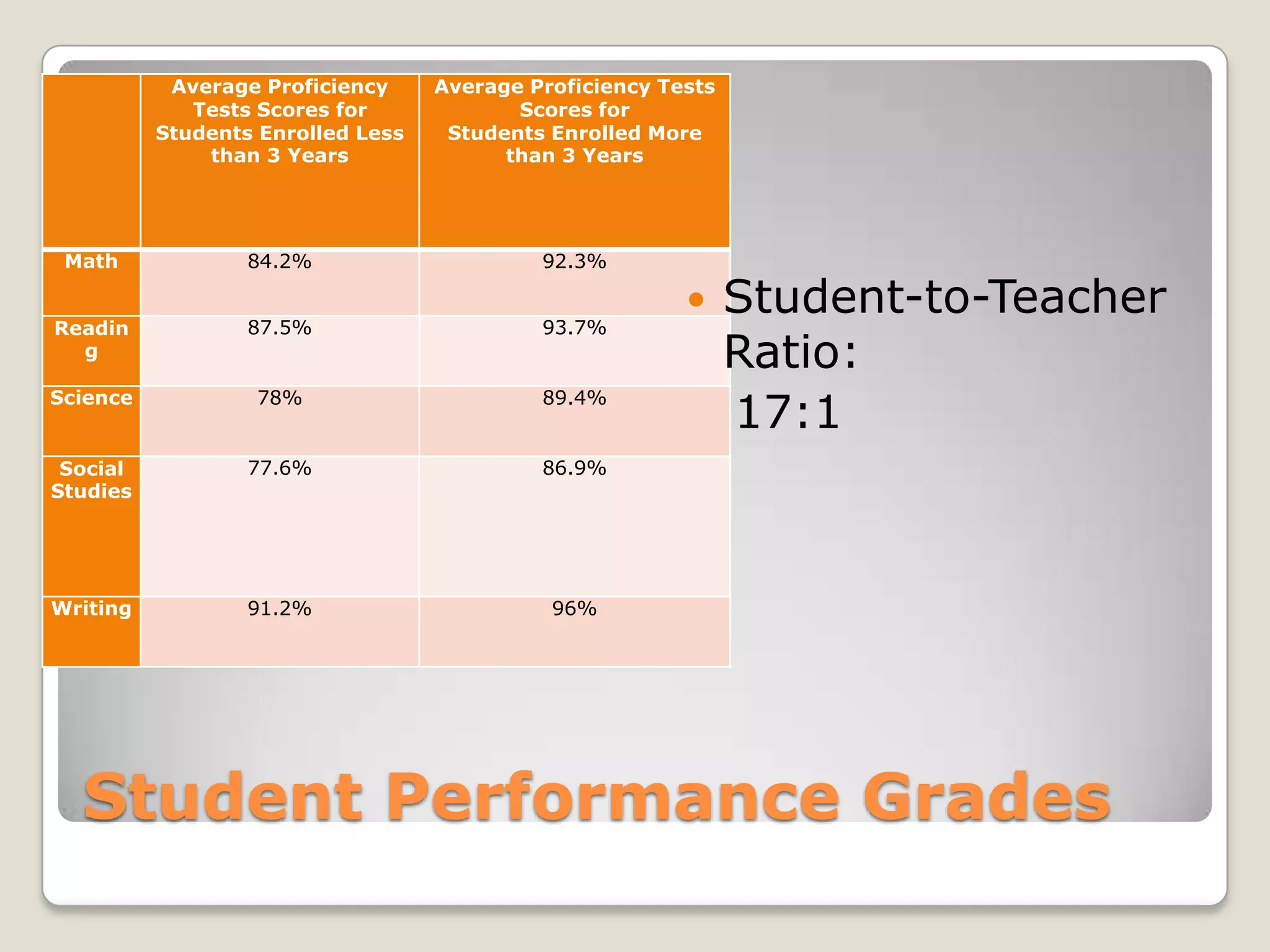

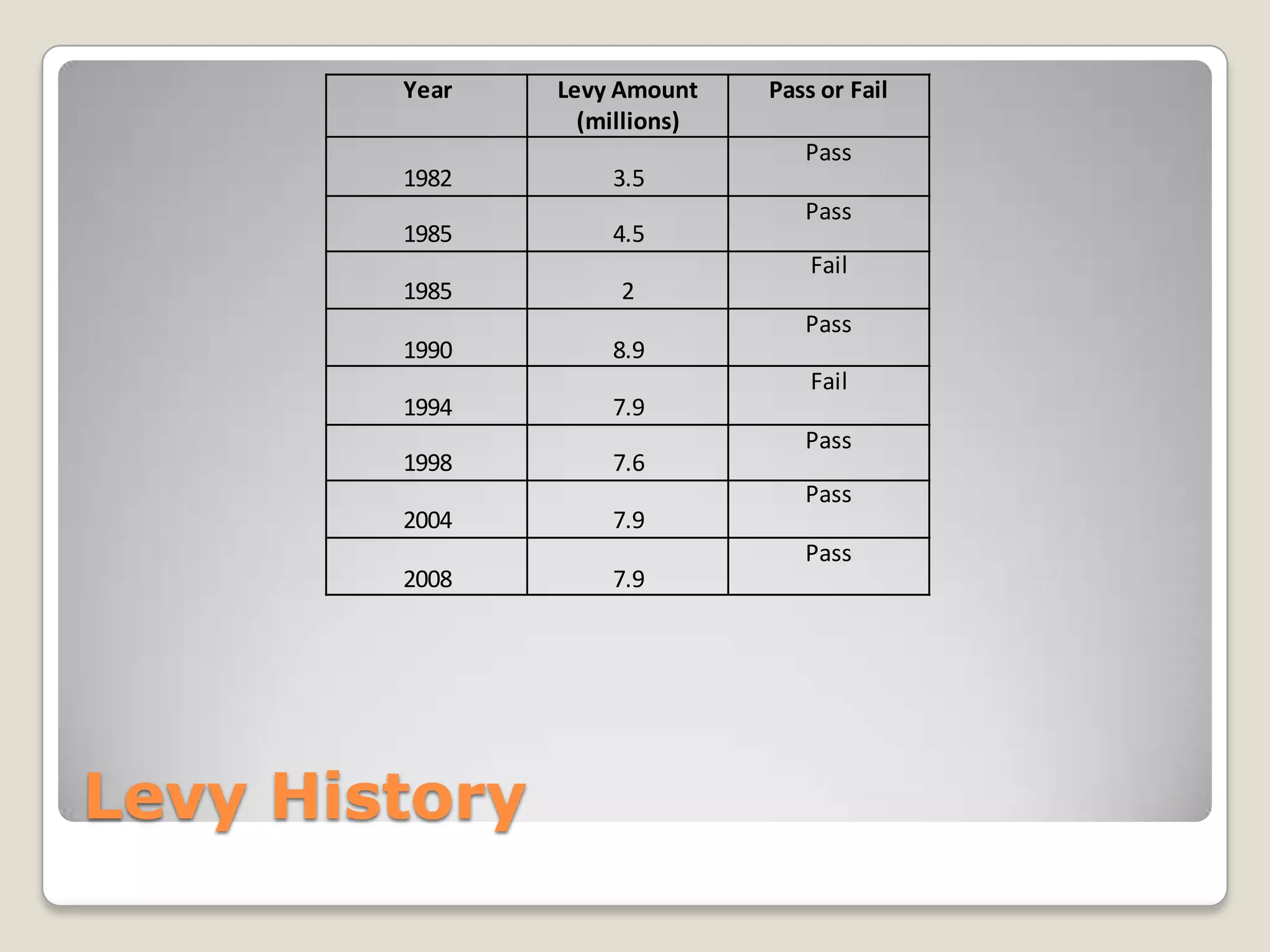

The document examines how four Ohio school districts - Columbus, Whitehall, Dublin, and Olentangy - are funded through property taxes. It finds that districts with high-income housing collect more money from property taxes and pass school levies more easily, while low-income districts struggle financially. This leads to inequities in resources and student performance between rich and poor districts. The document recommends eliminating school funding from state property taxes. Instead, it proposes a flat "school tax" statewide where money is distributed equally based on student population, not local property values. This would make school funding more equitable across districts.