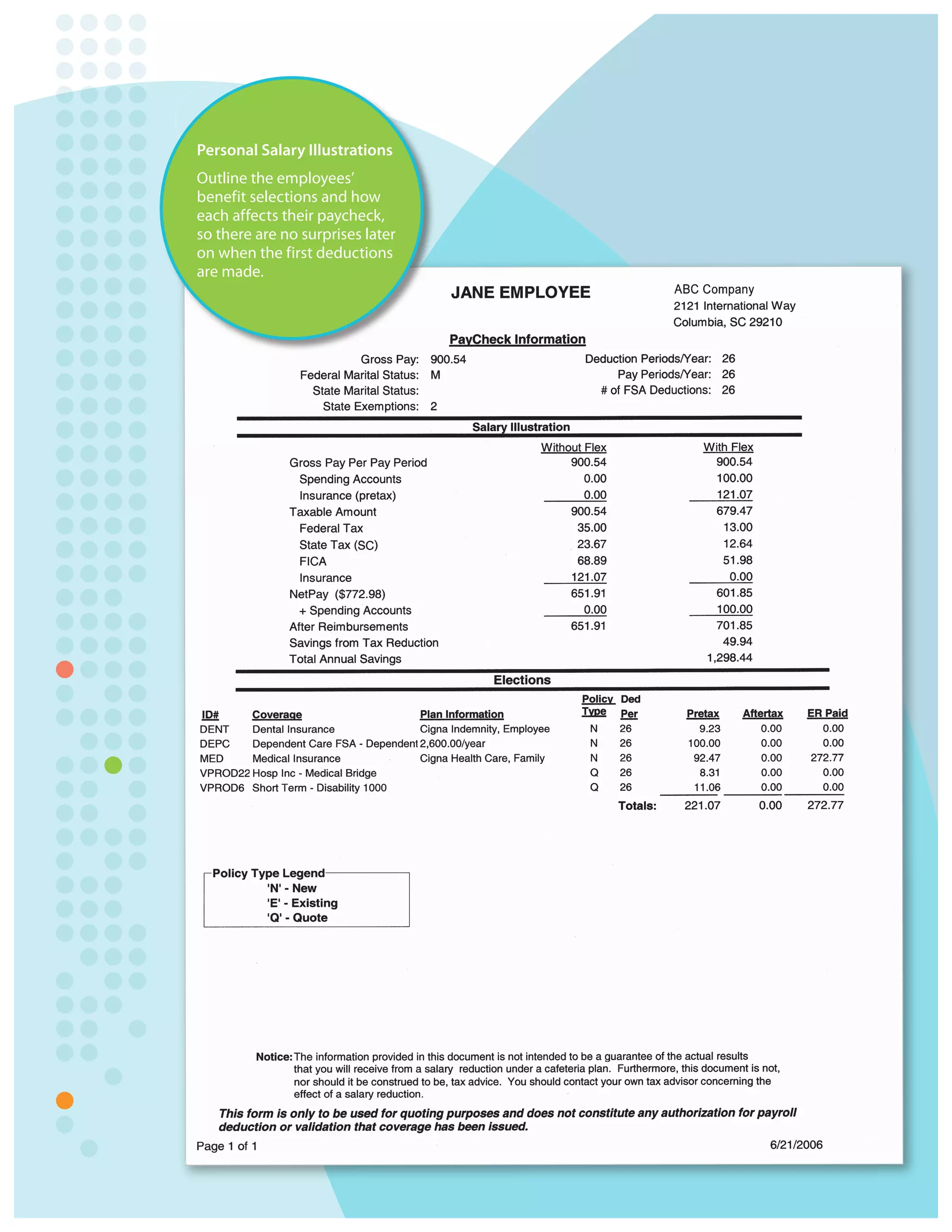

This document discusses the benefits of professional benefits counseling and communication services provided by Colonial Life. They can provide customized pre-enrollment communications to educate employees on upcoming benefits enrollment. Services also include group meetings to overview the benefits program and one-on-one meetings for employees to privately review their options. Colonial Life uses an online enrollment system that allows for individual, group, and self-enrollment along with updating employee records and providing personalized illustrations of benefit selections and costs. The goal is to ensure employees understand their benefits through consistent, clear communication tailored to each employer's needs.