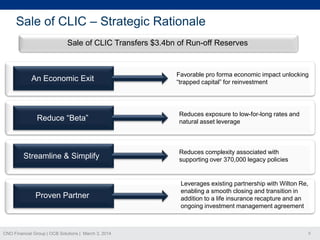

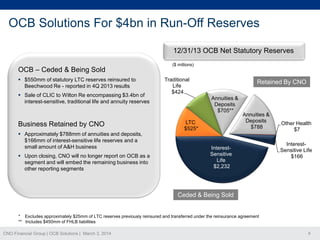

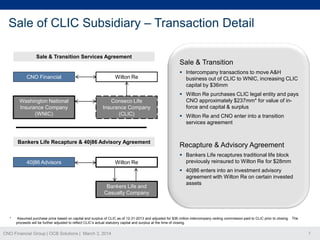

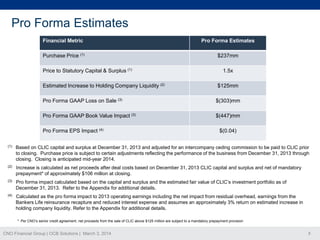

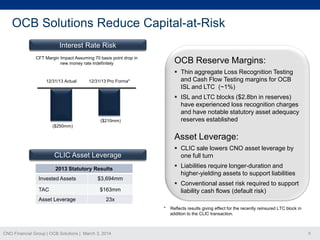

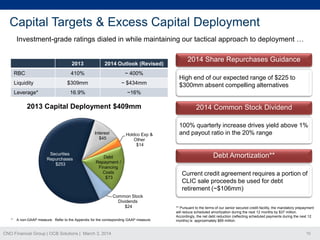

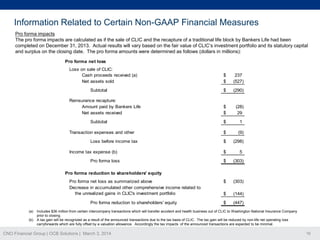

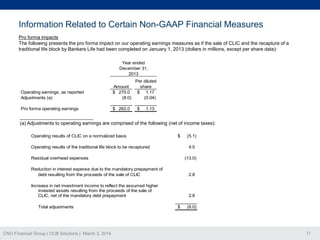

CNO announced the sale of its subsidiary Conseco Life Insurance Company (CLIC) to Wilton Re for approximately $237 million. The sale transfers $3.4 billion in traditional life, interest-sensitive life, and annuity reserves and is expected to close in mid-2014. Additionally, Bankers Life will recapture $160 million of traditional life reserves previously reinsured to Wilton Re for $28 million. The transactions are expected to increase CNO's holding company liquidity by $125 million and reduce exposure to interest rate risk while simplifying operations.