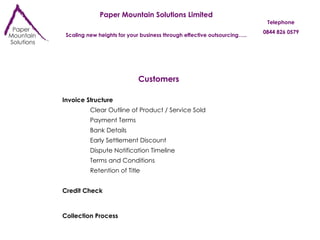

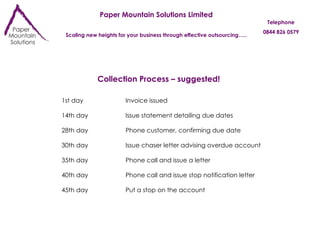

This document discusses credit control and outsourcing credit control to specialist companies. It defines credit control as the process of controlling payments incoming and outgoing from a firm to manage creditors and debtors. It then discusses areas to consider for effective credit control, including customers, suppliers, and what can go wrong if a debtor cannot pay. It provides suggestions for a collection process and emphasizes maintaining contact if a debtor cannot pay.