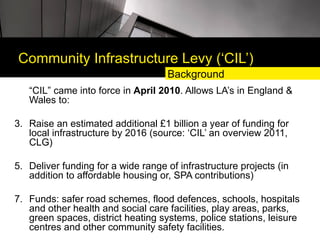

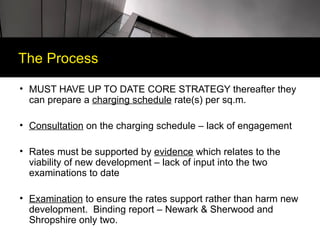

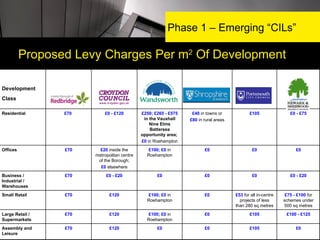

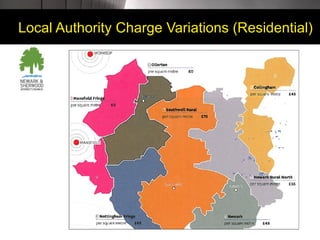

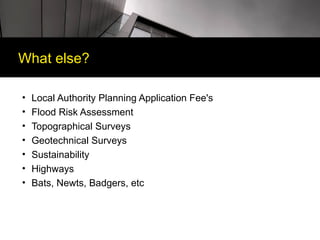

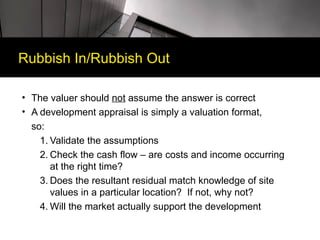

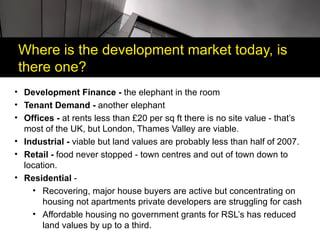

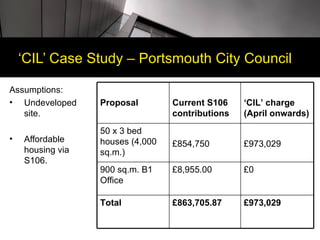

Vail Williams LLP presented on the Community Infrastructure Levy (CIL) and development appraisals. CIL allows local authorities to charge developers per square meter to fund infrastructure. Rates vary significantly between authorities. CIL aims to provide a fairer system than section 106 agreements but adds costs. Development appraisals assess scheme viability considering values, costs, and market conditions to determine profitability and ability to pay CIL/section 106. Current market conditions make many types of development unviable outside of select areas like London.