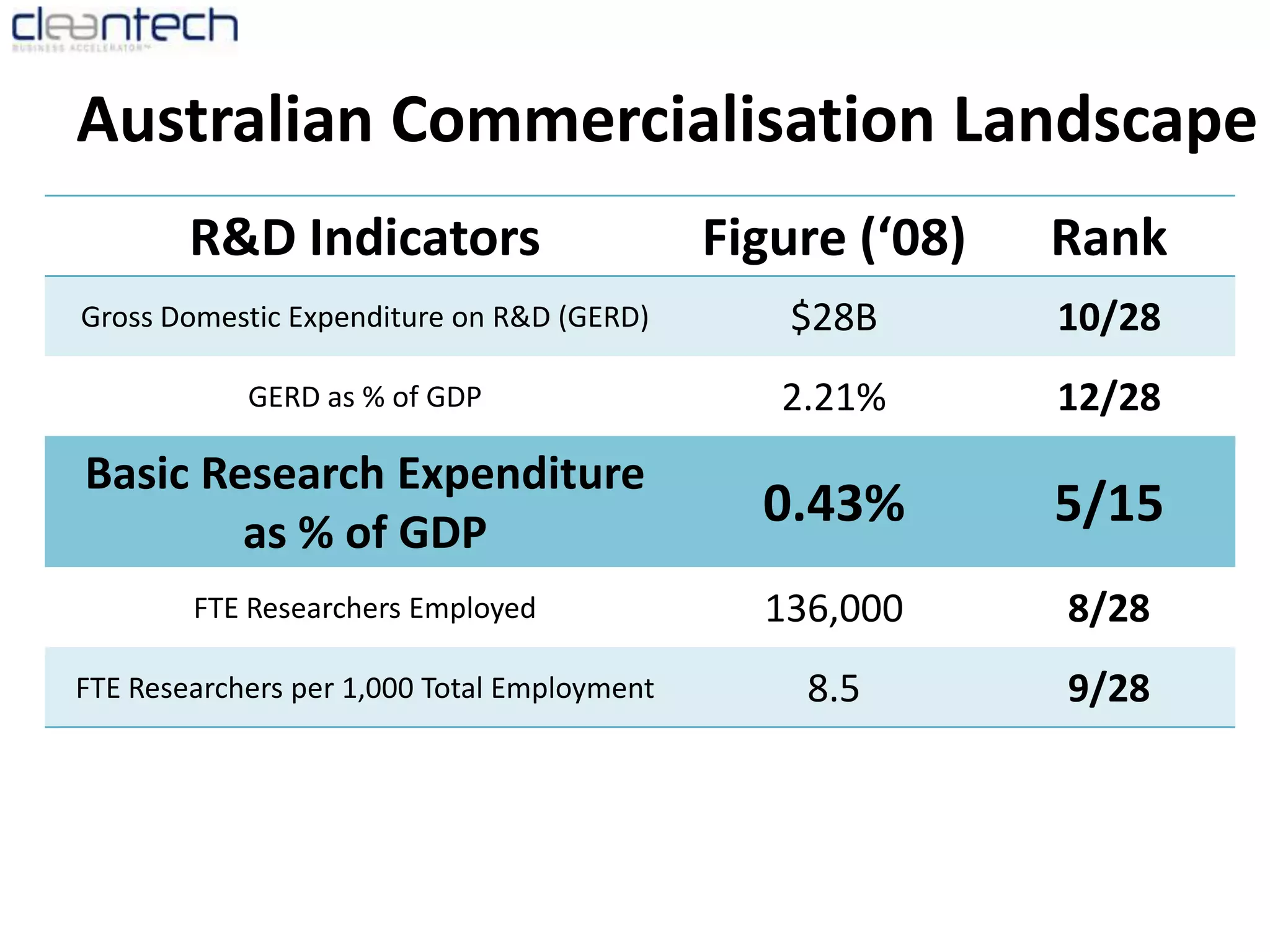

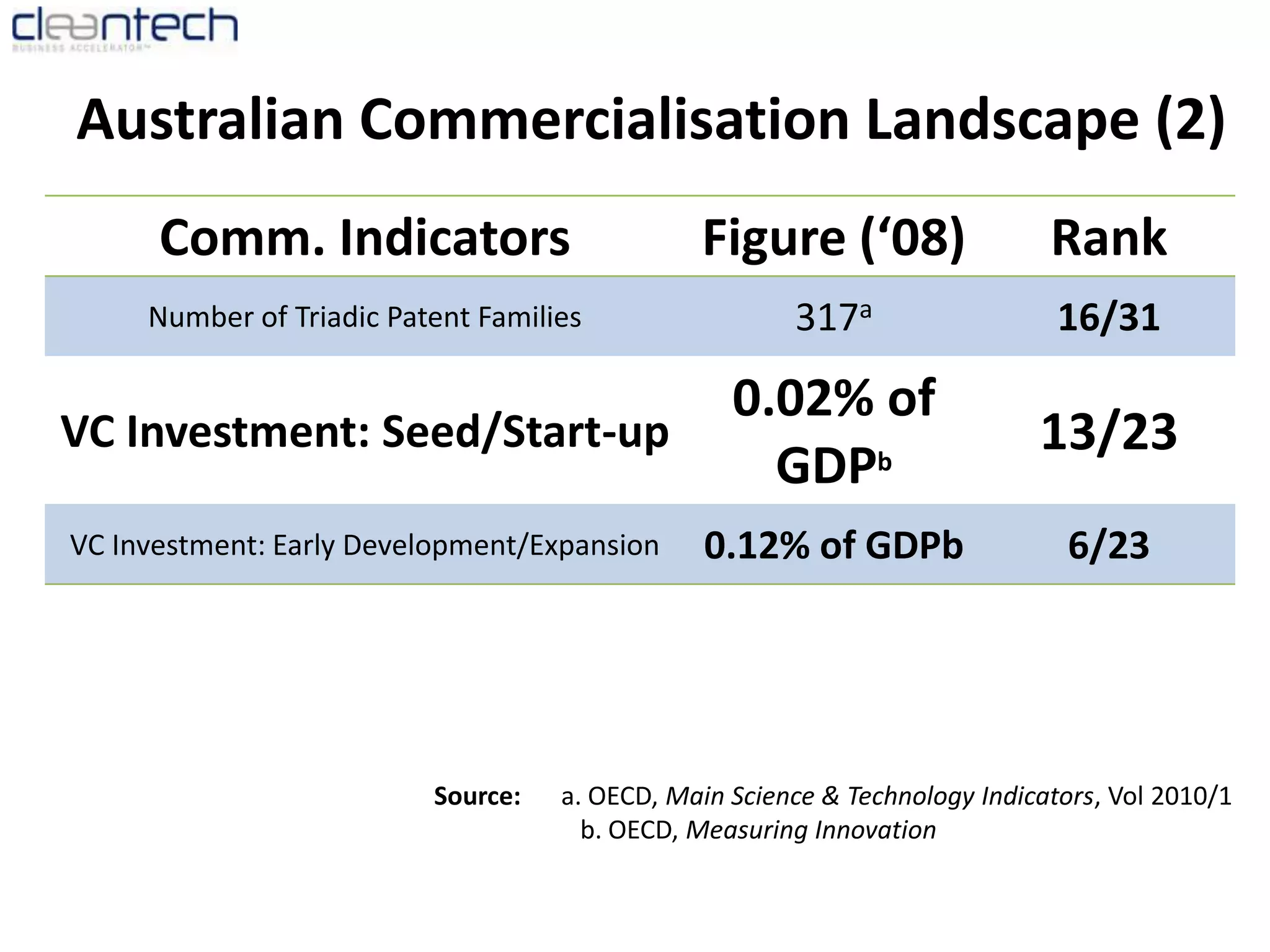

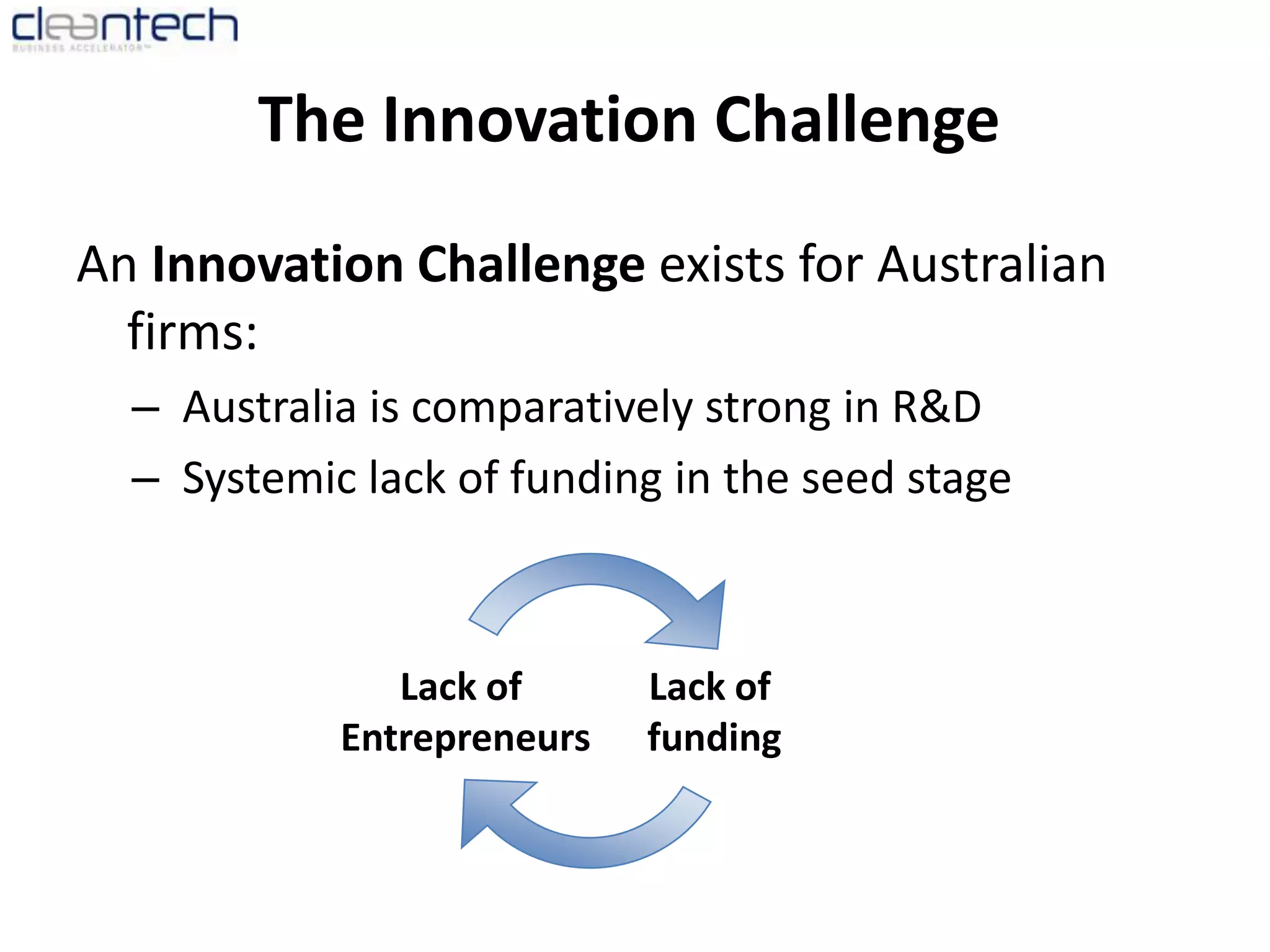

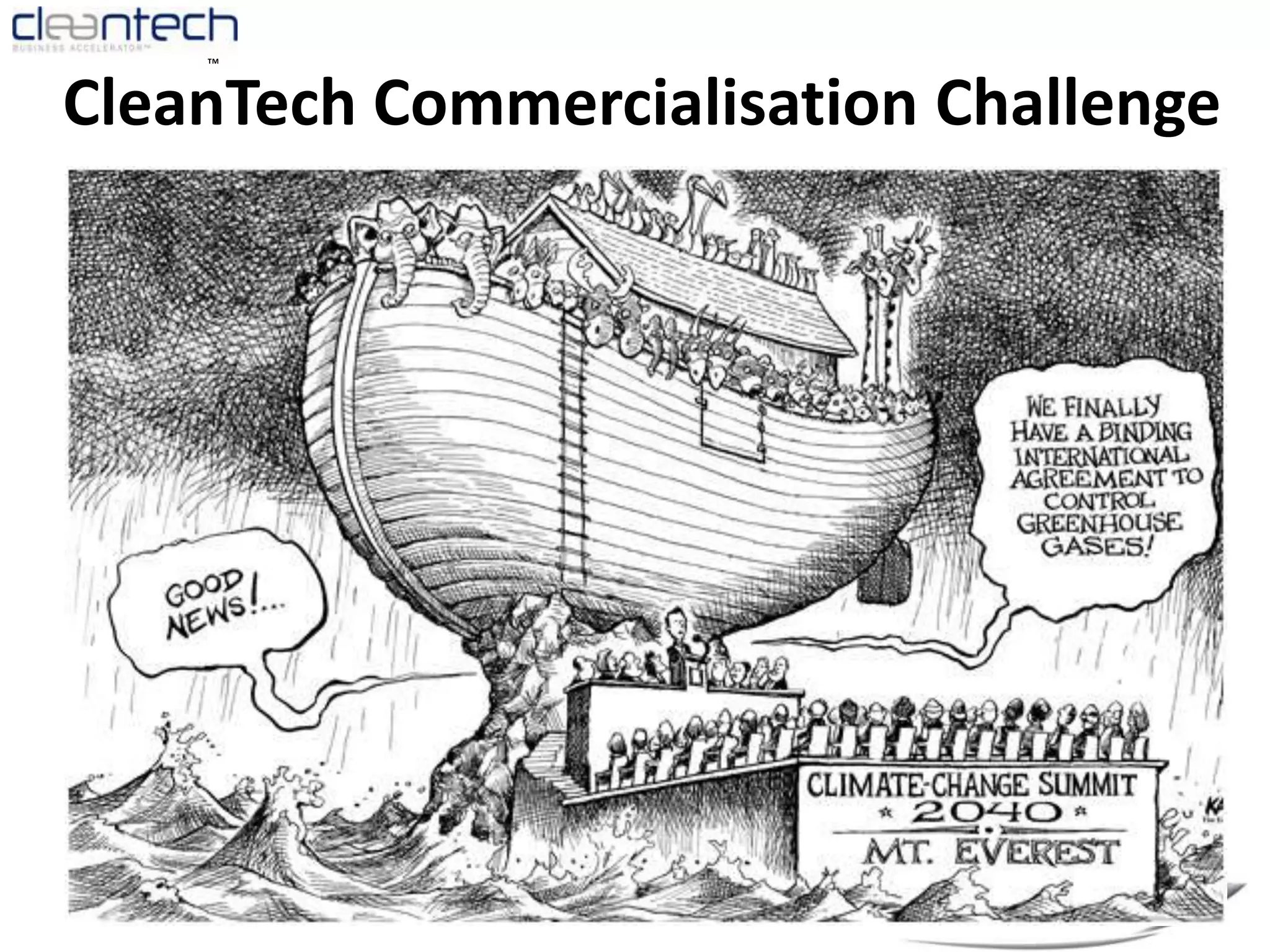

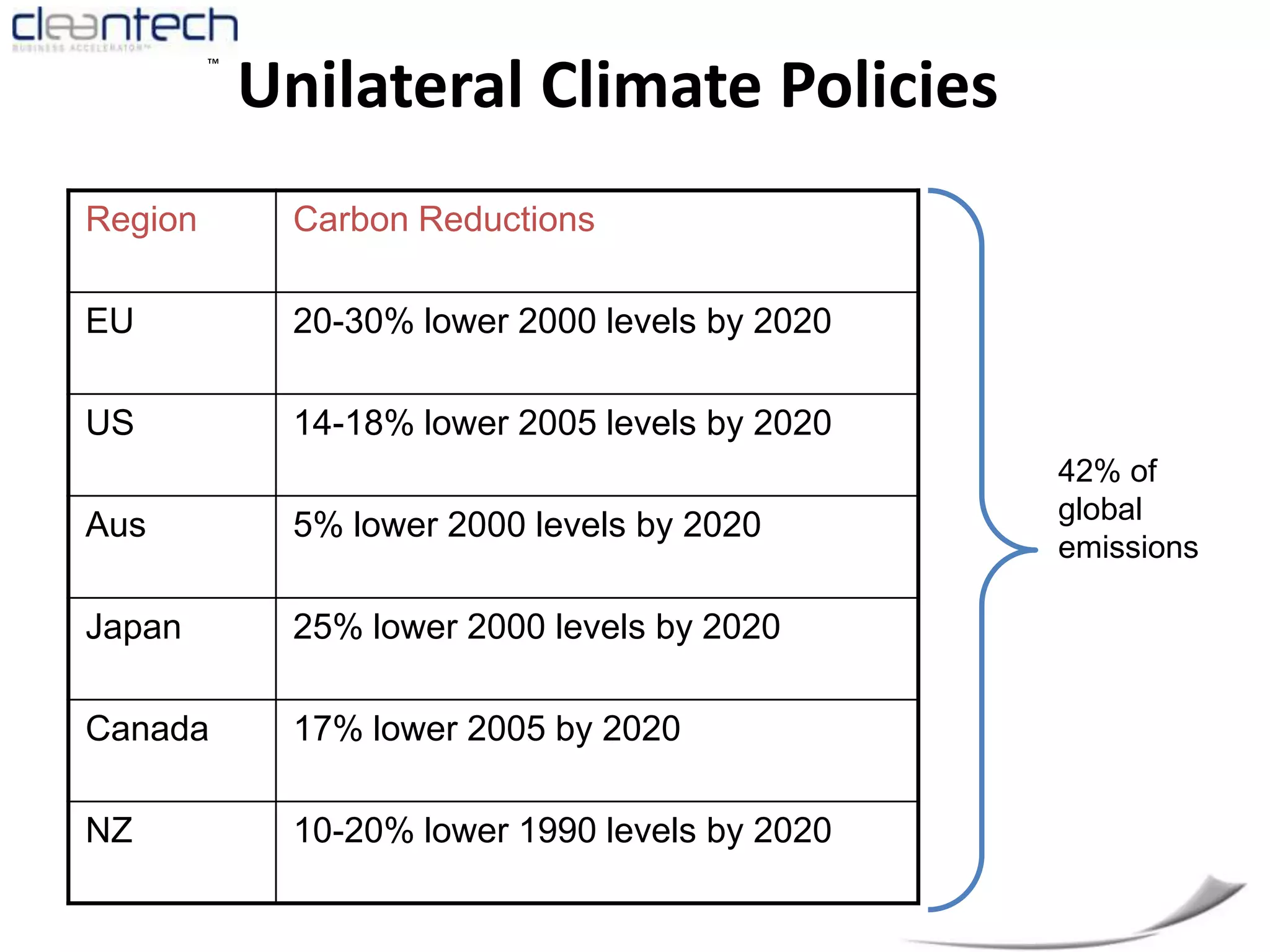

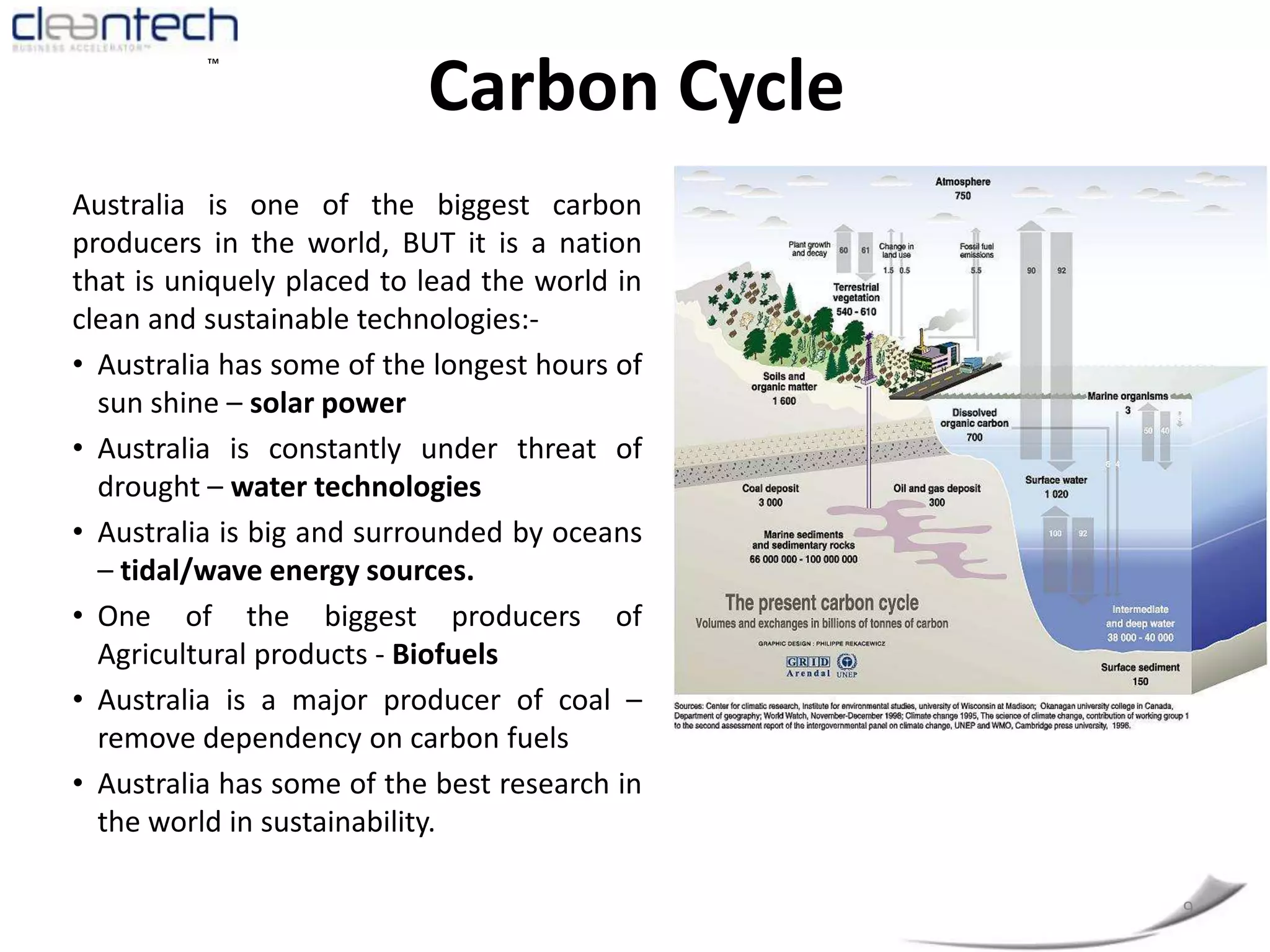

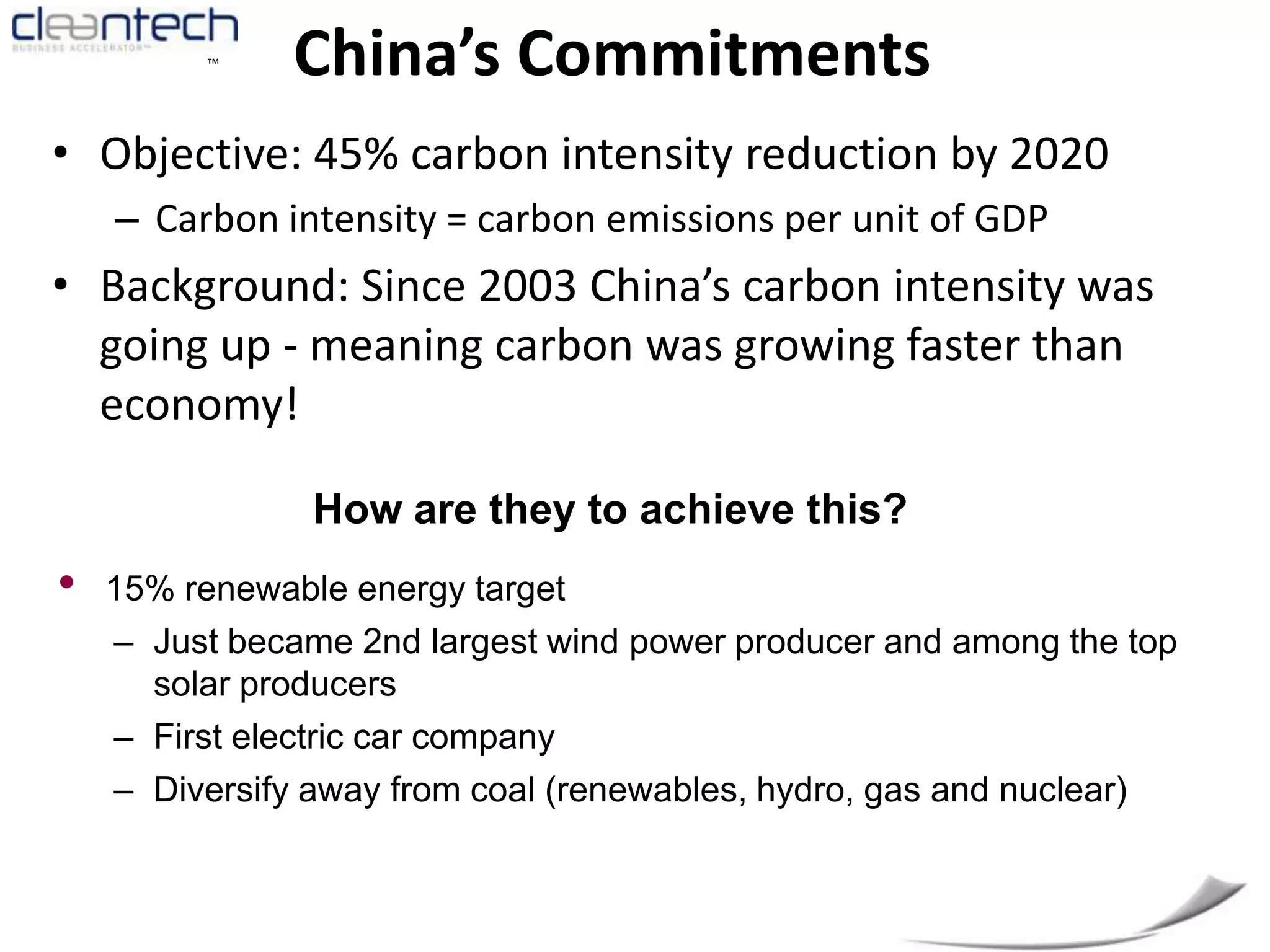

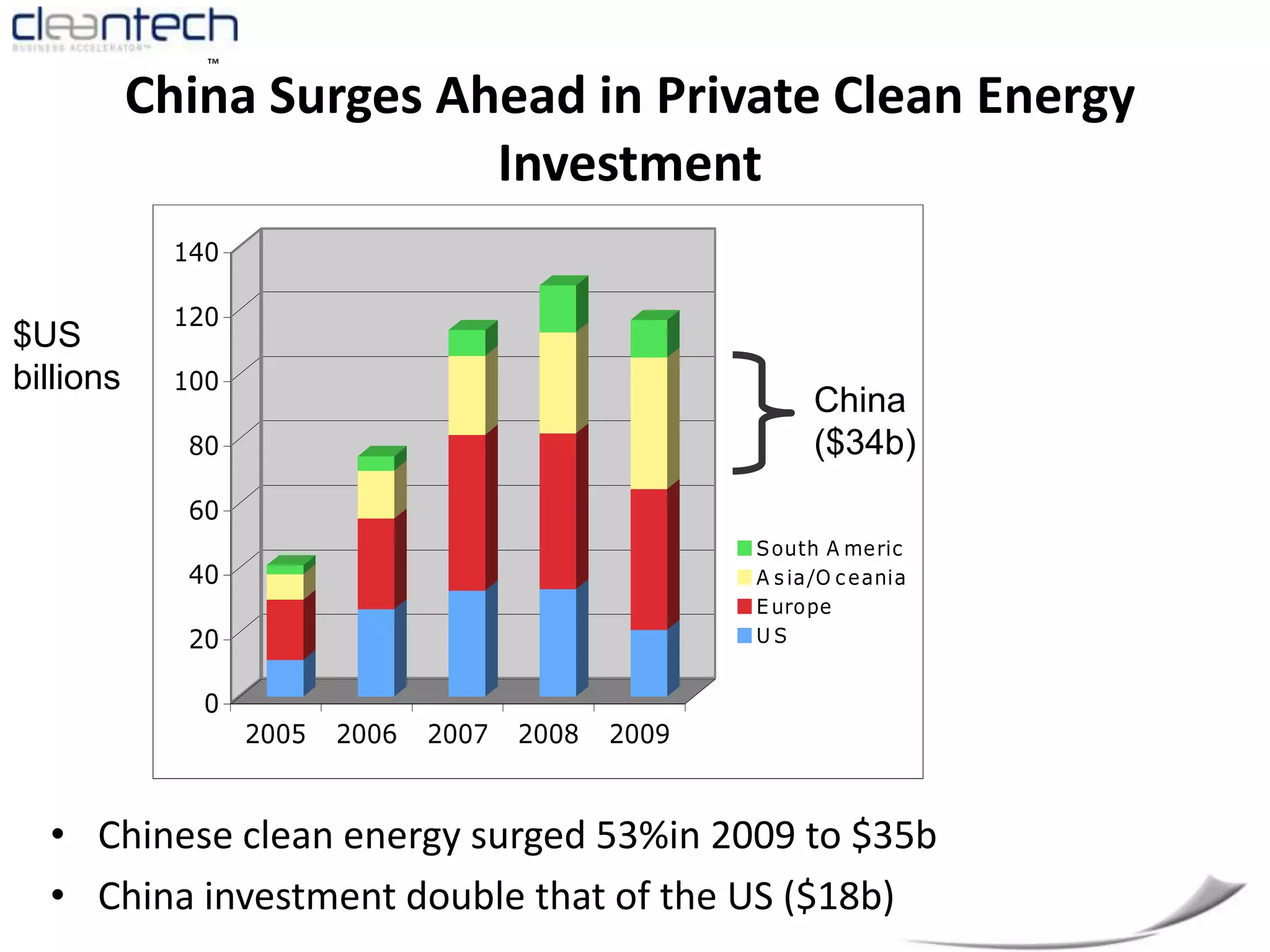

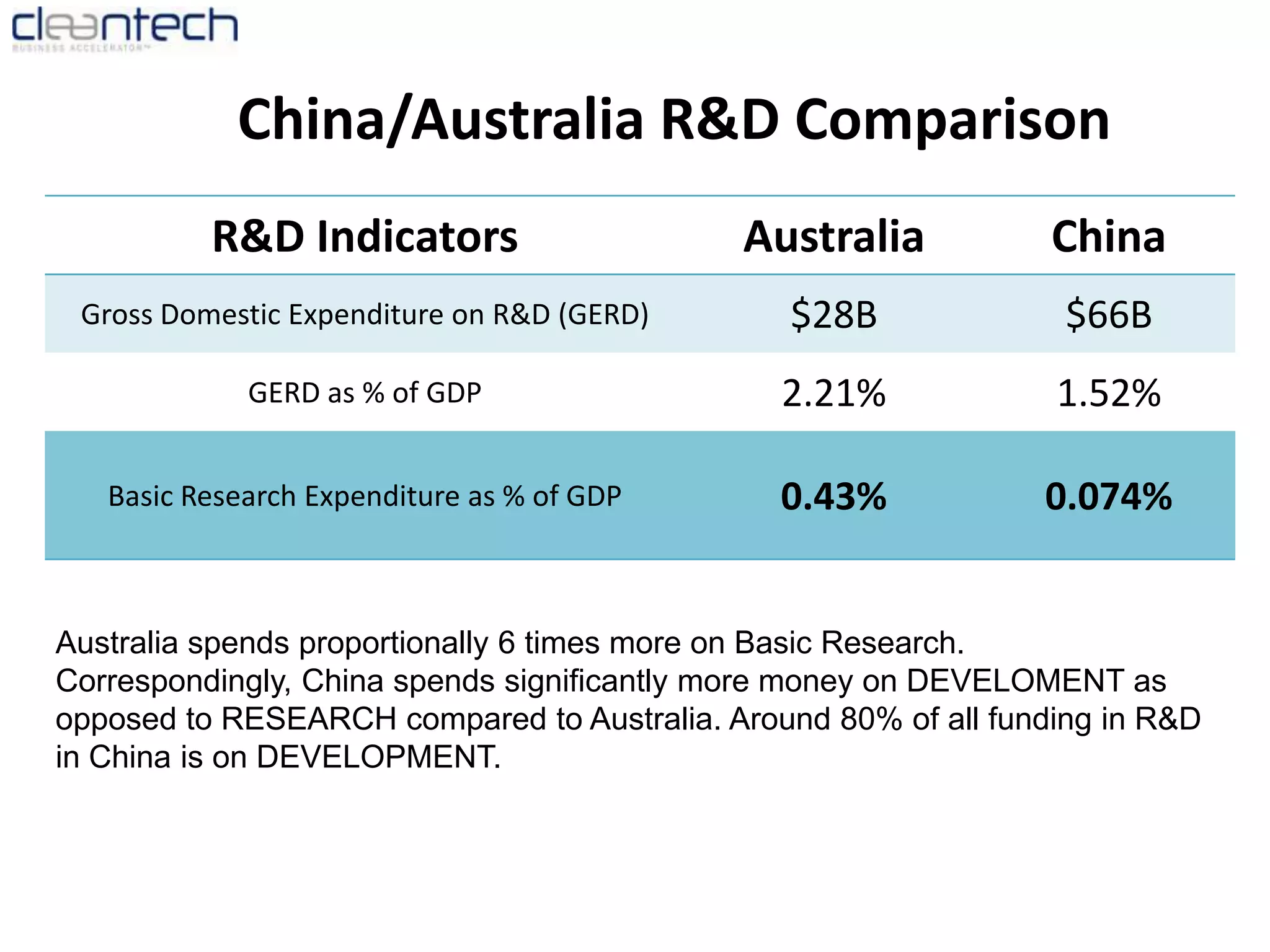

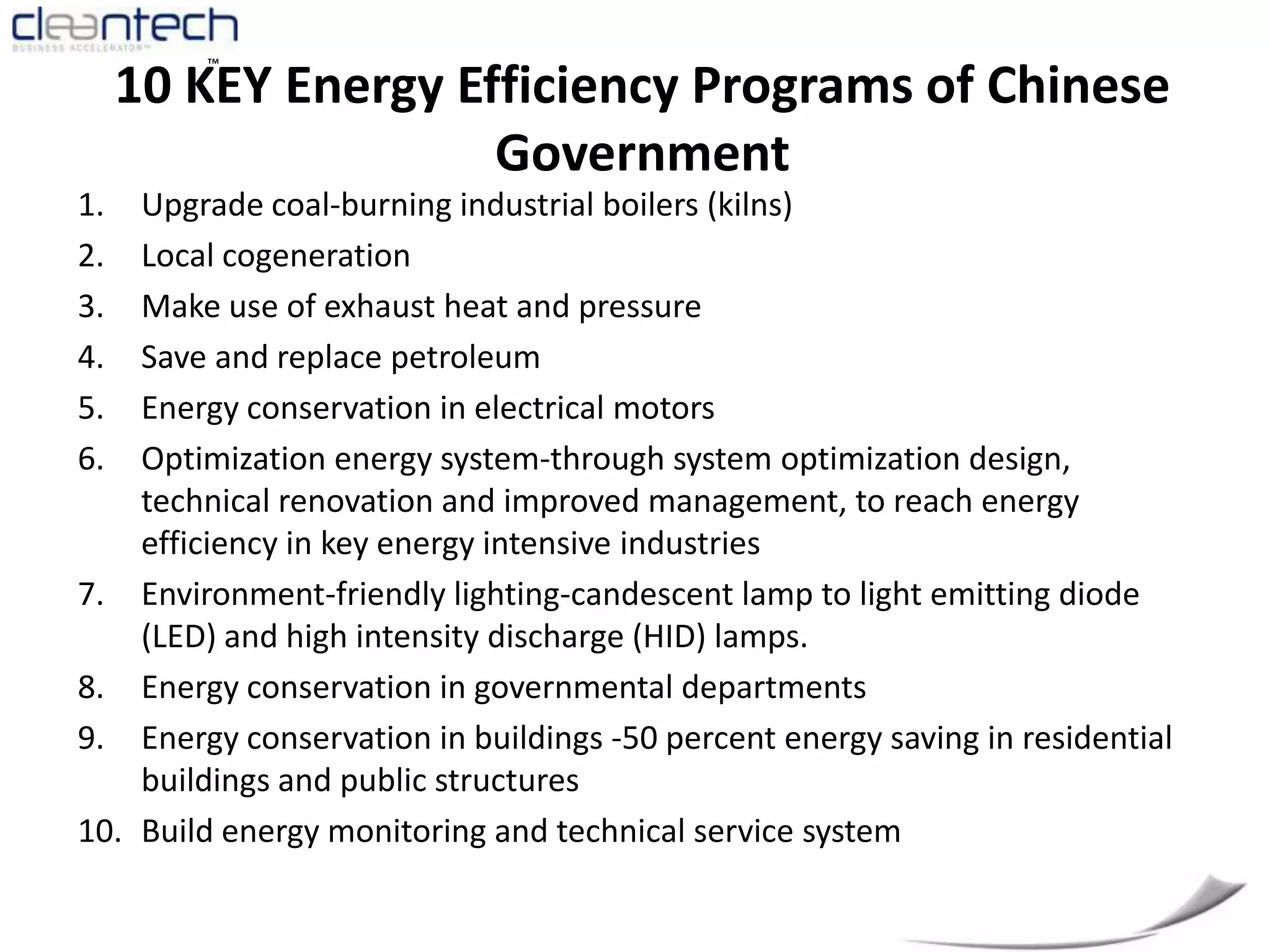

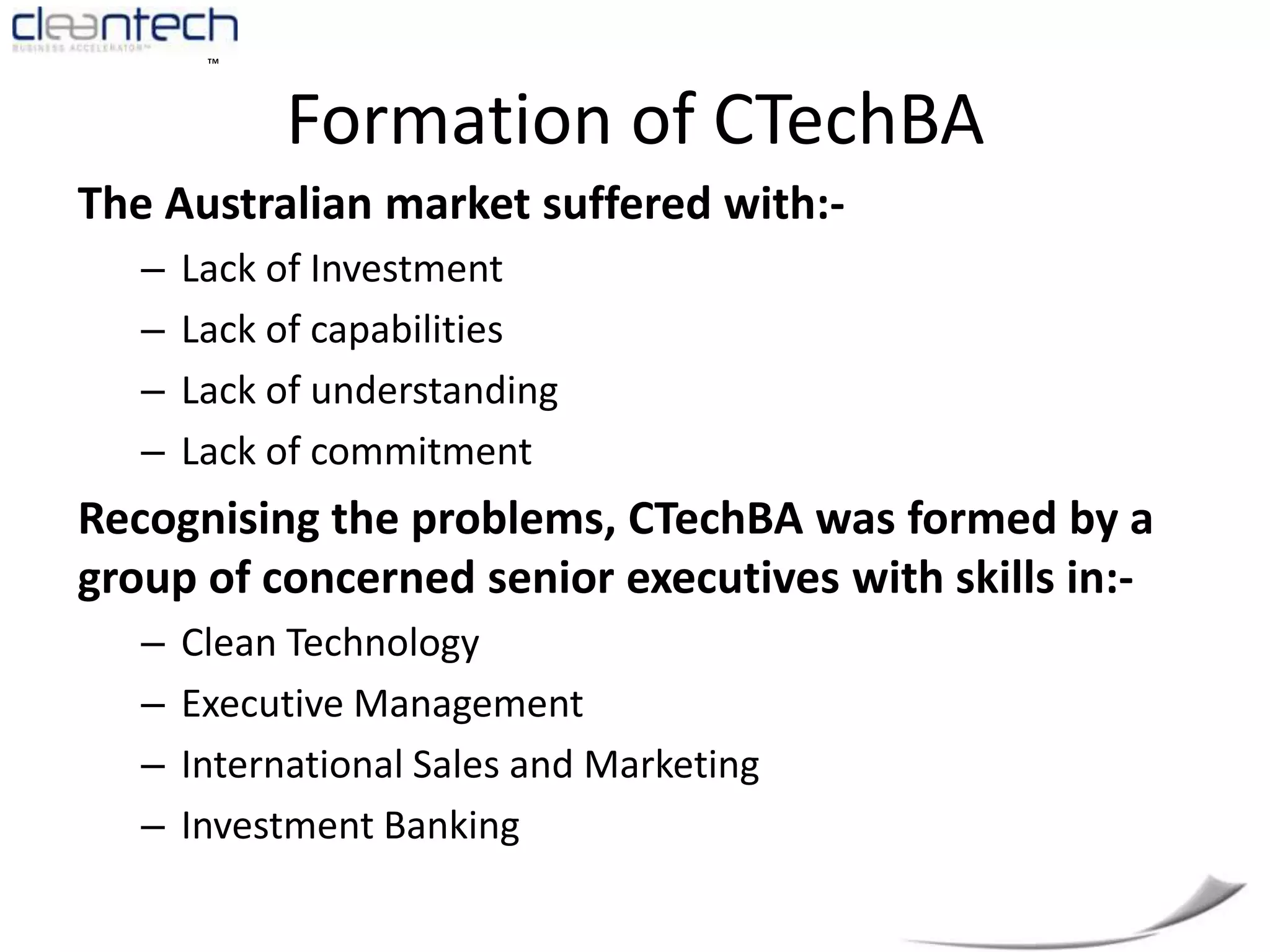

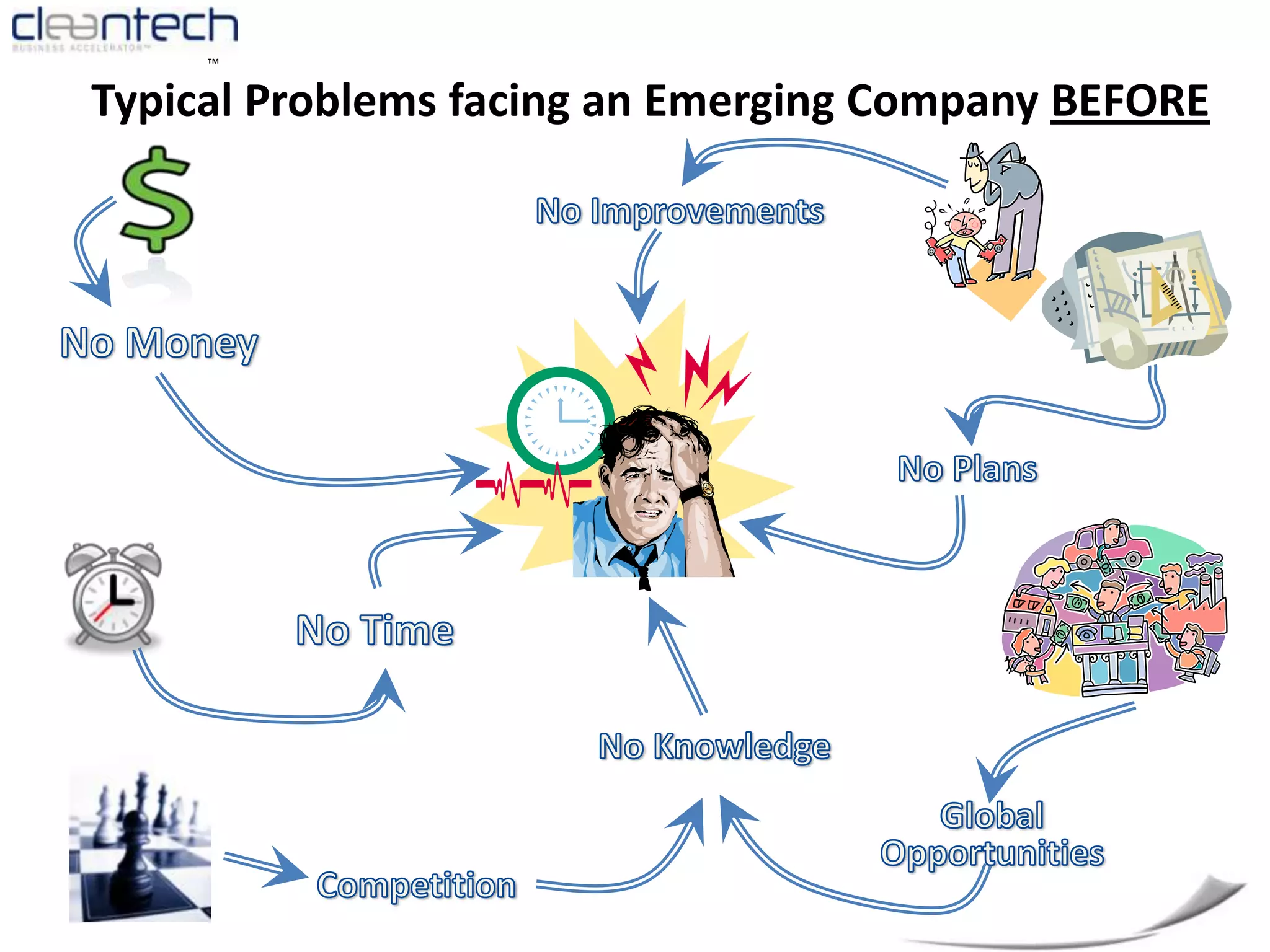

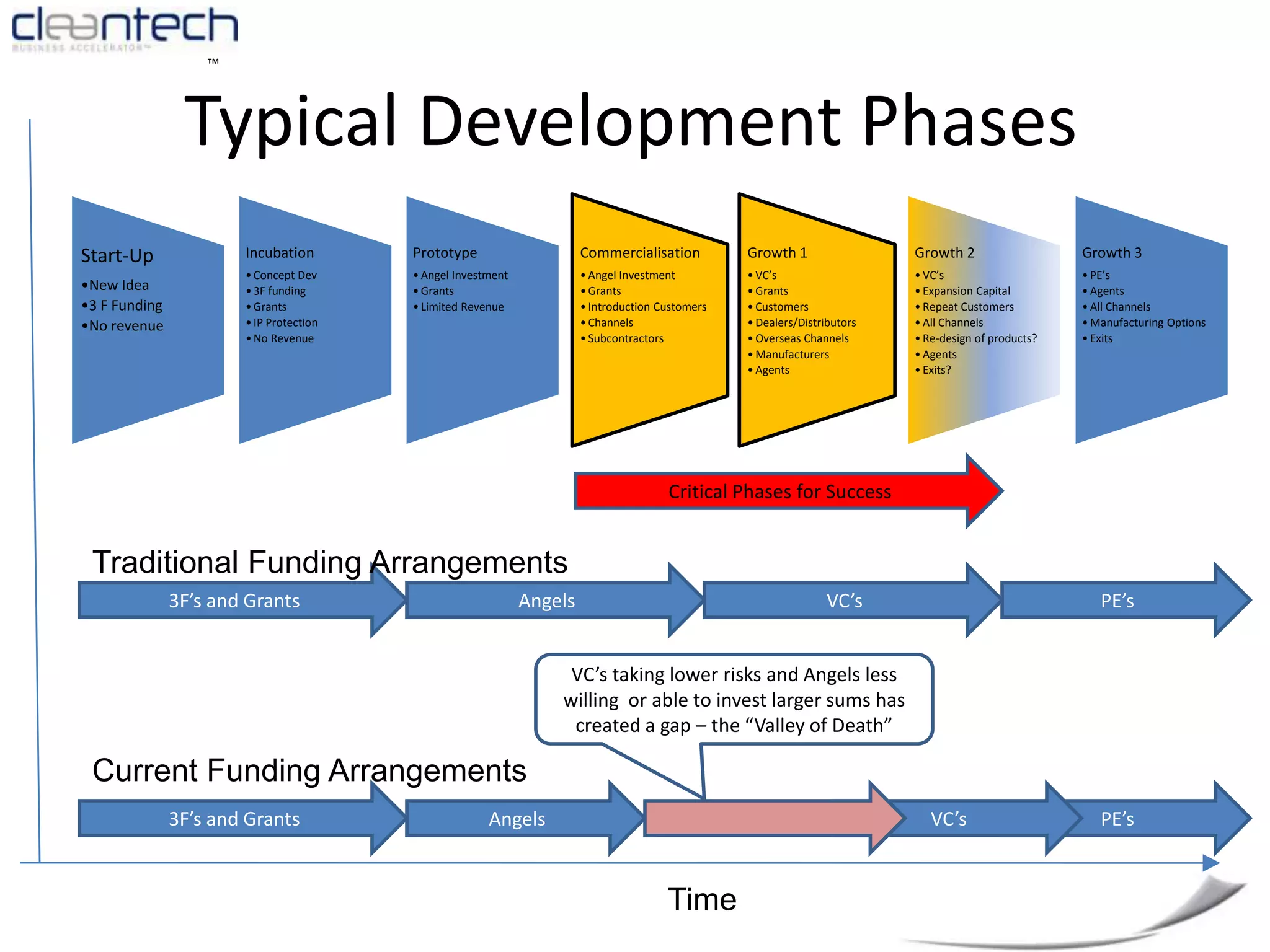

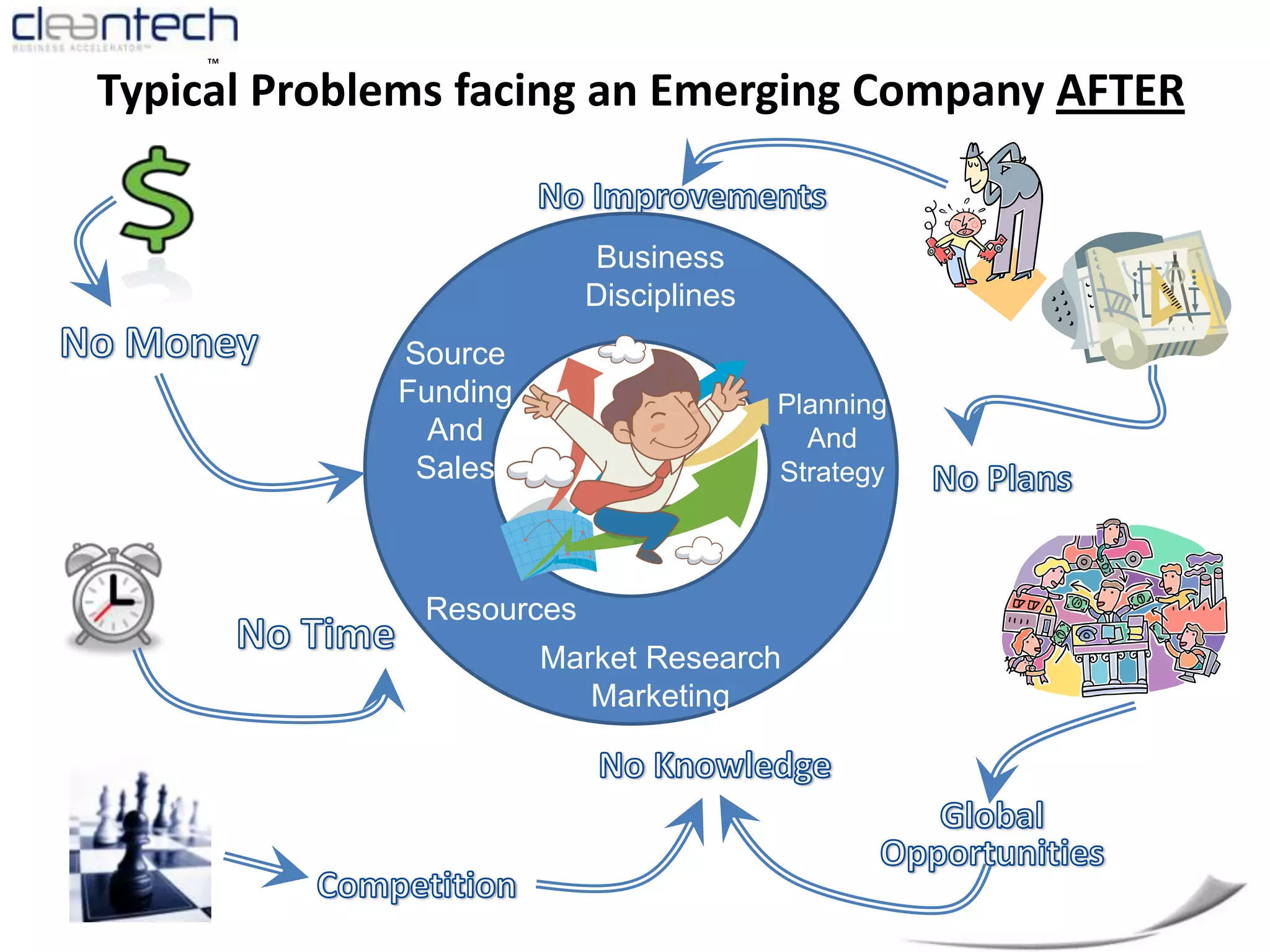

Australia has a strong foundation in clean technology research but faces challenges in commercialization, leading to reliance on investment from other countries like China, which dominates the clean energy market. Key opportunities for Australian firms include solar, biofuels, and water technologies, despite a historical lack of funding and entrepreneurial activity. Collaborative efforts and initiatives like the Clean Tech Business Accelerator (CTECHBA) aim to bridge these gaps and harness synergies within the clean tech sector for growth in both local and international markets.