- Banks still hold advantages over fintechs in terms of existing customers, compliance experience, and low cost of capital. However, banks must improve their user experience to retain customers.

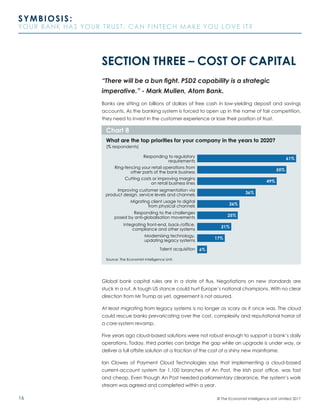

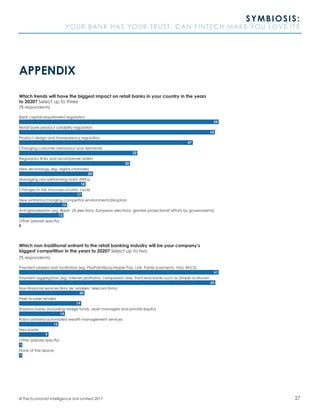

- Regional regulatory trends are diverging, with US banks most worried about potential deregulation under Trump while European rules on disclosure are tightening.

- Fears of disruption from fintech competitors have receded as banks realize collaboration is necessary, and new entrants face challenges in gaining traction due to customer inertia, compliance costs, and falling margins.