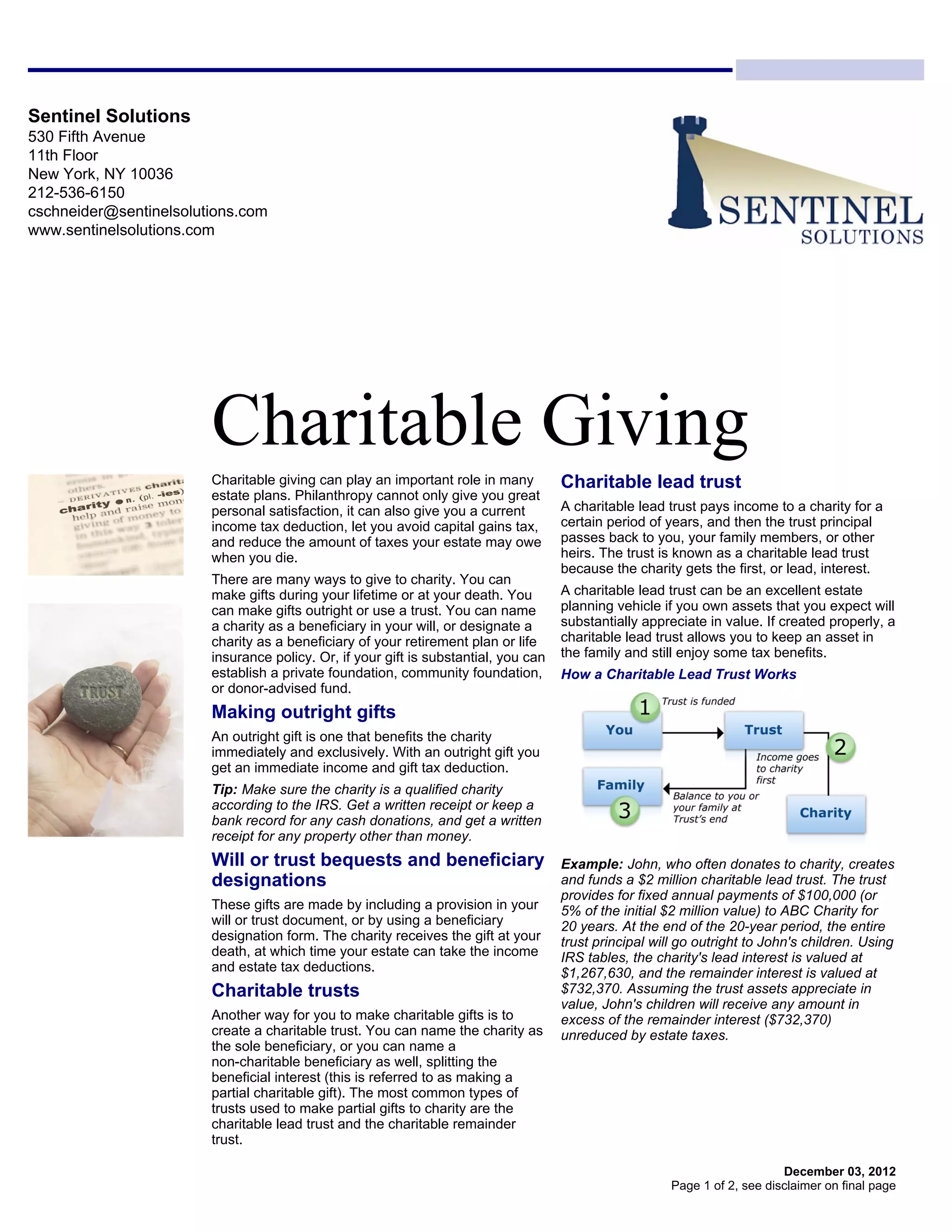

This document provides information about different ways to make charitable gifts through estate planning. It discusses outright gifts, will or trust bequests, charitable trusts including charitable lead trusts and charitable remainder trusts, private foundations, community foundations, and donor-advised funds. It provides an example of how a charitable lead trust can benefit both a charity and family members by reducing estate taxes.