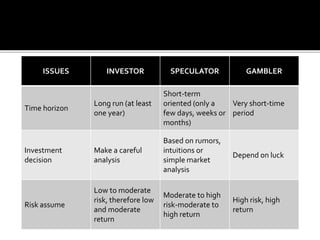

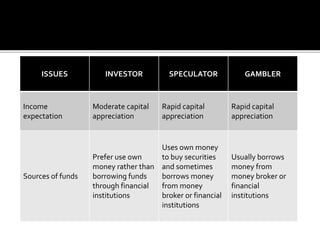

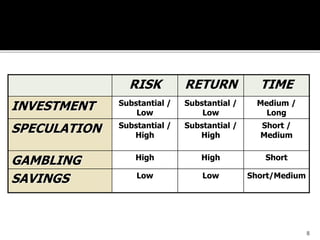

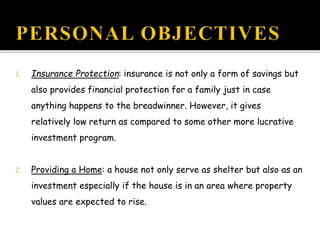

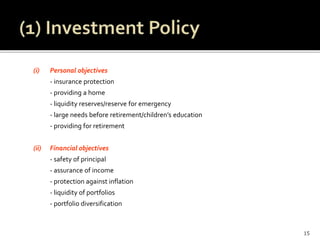

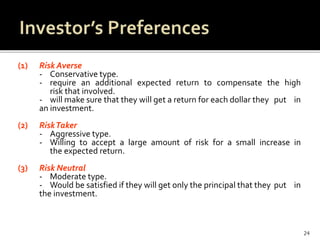

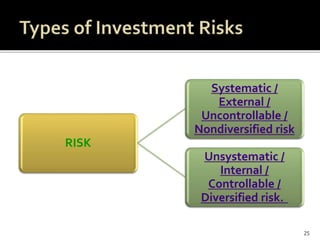

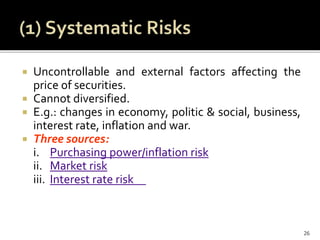

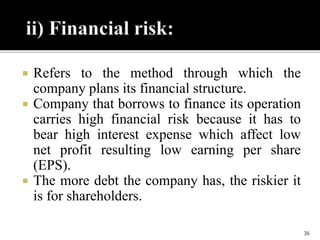

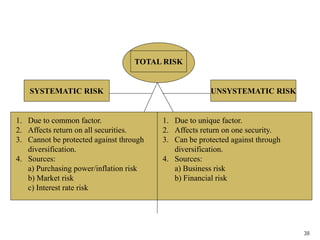

Investment involves sacrificing present consumption to enjoy higher consumption in the future. Investors expect a fair return for the risks they undertake, while speculators assume high risks seeking quick profits. A well-informed investor with clear objectives and an understanding of constraints can make better investment decisions. Risk and return are positively correlated - higher risk means higher expected returns. An investor's attitude to risk is described as risk-averse, risk-tolerant, or risk-neutral. There are two types of risk: systematic/uncontrollable risk like inflation, markets, interest rates and unsystematic/controllable risk like business and financial risks. Diversification can reduce unsystematic risk while purchasing power, market and interest rate risks