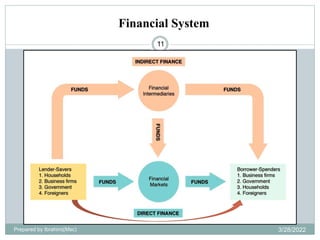

The document provides an overview of the financial system. It defines a financial system as consisting of financial markets, financial assets, and financial institutions. The financial system plays several key roles in the economy, including channeling funds from savers to borrowers, creating liquidity and money, providing payment mechanisms, and allowing for risk diversification. It discusses the components of the financial system, including financial assets/instruments, markets, and institutions. Financial assets are defined as providing expected cash flows rather than physical services, and having characteristics like fungibility and divisibility.