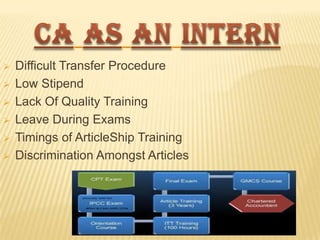

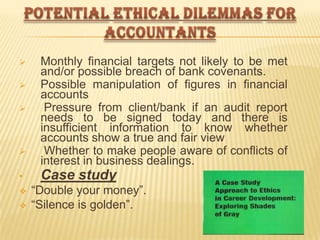

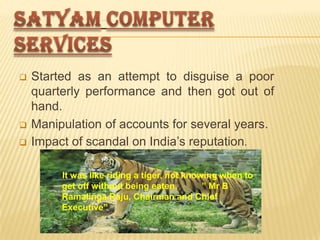

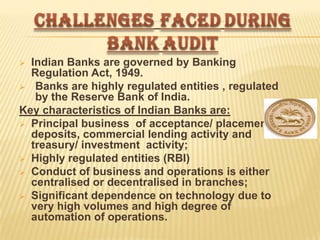

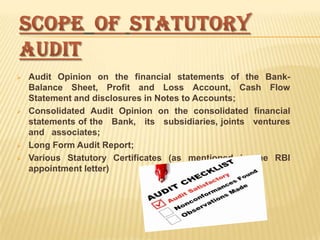

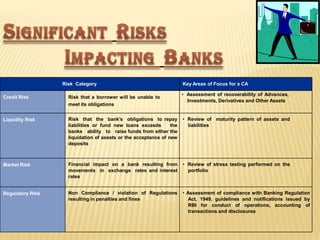

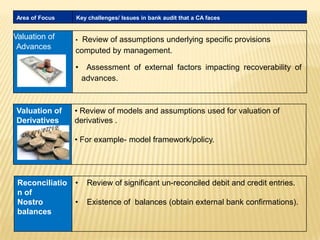

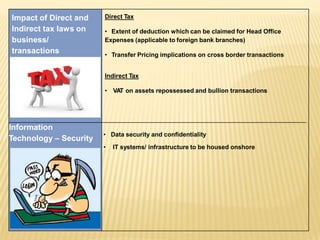

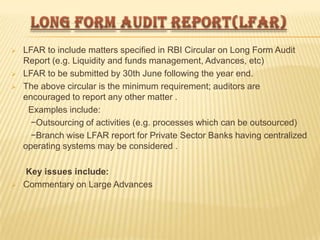

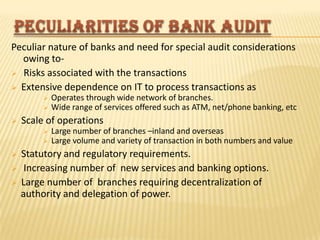

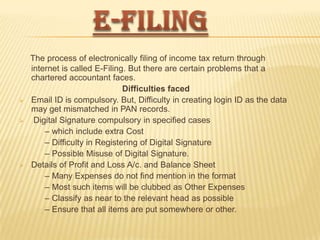

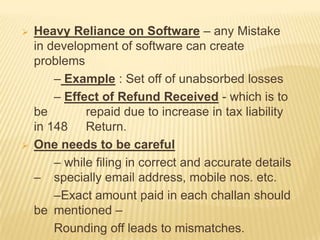

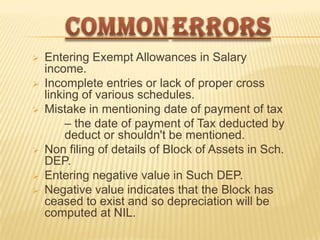

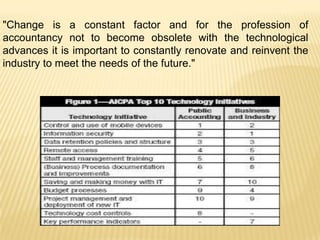

The document highlights the challenges faced by Chartered Accountants (CAs) in various sectors such as banking, insurance, and technology, emphasizing the need for CAs to continuously upgrade their skills in a competitive job market. It discusses the ethical dilemmas CAs encounter, particularly in bank audits and e-filing processes, detailing issues like compliance and technological reliance. Moreover, the text underscores the importance of CAs adapting to the changing landscape of the accounting profession to remain relevant and successful.