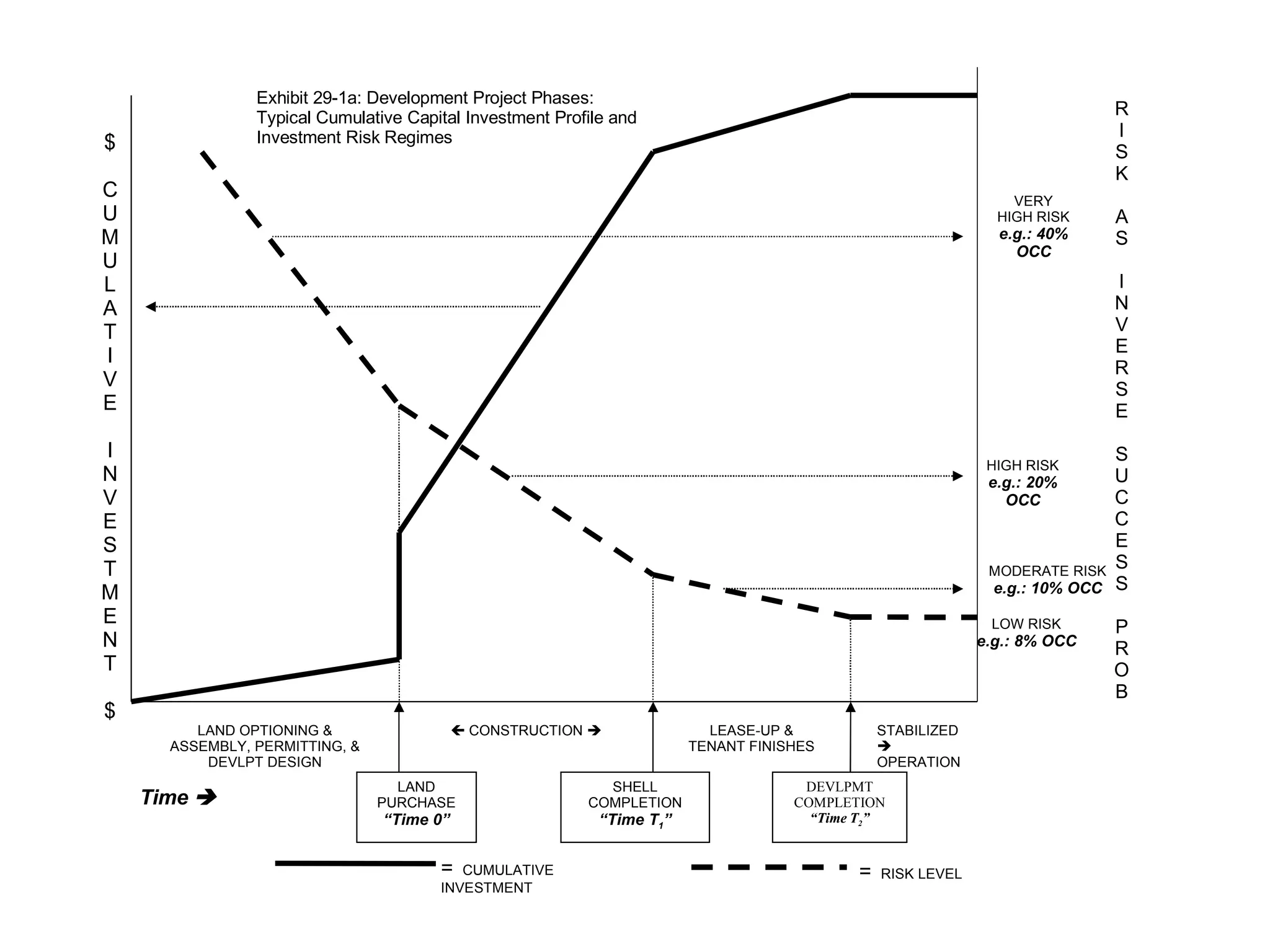

The document describes the typical phases and capital investment profile of a real estate development project. It shows that risk is highest in early phases like land acquisition and construction and decreases over time. The cumulative investment is lowest at the beginning and increases over the phases of shell completion, lease-up, stabilization and operation. It also outlines the common sources of capital at different phases, from entrepreneurial equity to construction loans to permanent financing.