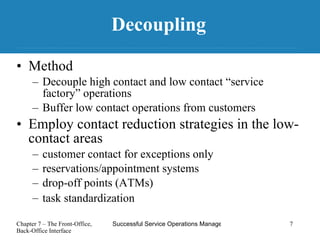

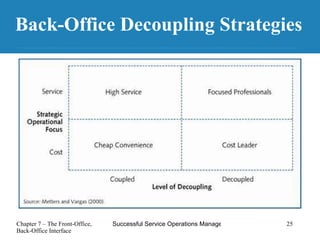

The document discusses the concept of "de-coupling" front-office and back-office operations in service industries to improve efficiency. It analyzes different de-coupling strategies and their impact on costs, quality, speed and flexibility. The strategies range from highly de-coupled "cost leader" models to coupled "high service" models, with trade-offs to consider around each approach based on the organization's strategic focus.