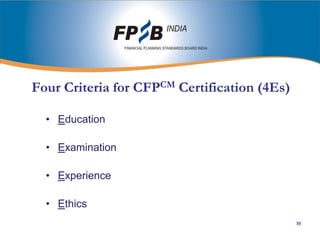

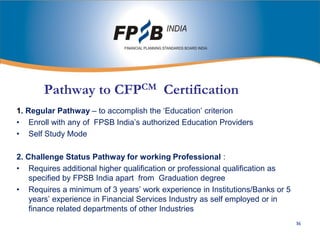

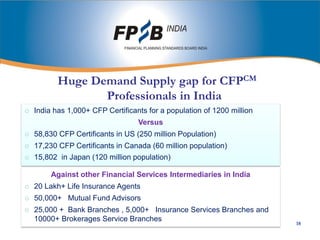

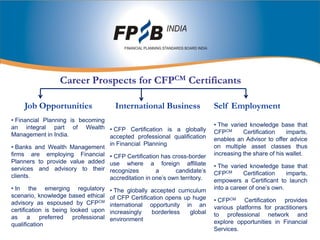

The document discusses financial planning and the CERTIFIED FINANCIAL PLANNERCM (CFPCM) certification in India. It covers what financial planning is, the benefits of CFPCM certification, the requirements to obtain certification, and career prospects for those who earn the certification. CFPCM certification is considered the gold standard in financial planning and there is a large gap between the demand for certified financial planners and the current supply in India, indicating strong career opportunities for individuals who pursue this certification.