Embed presentation

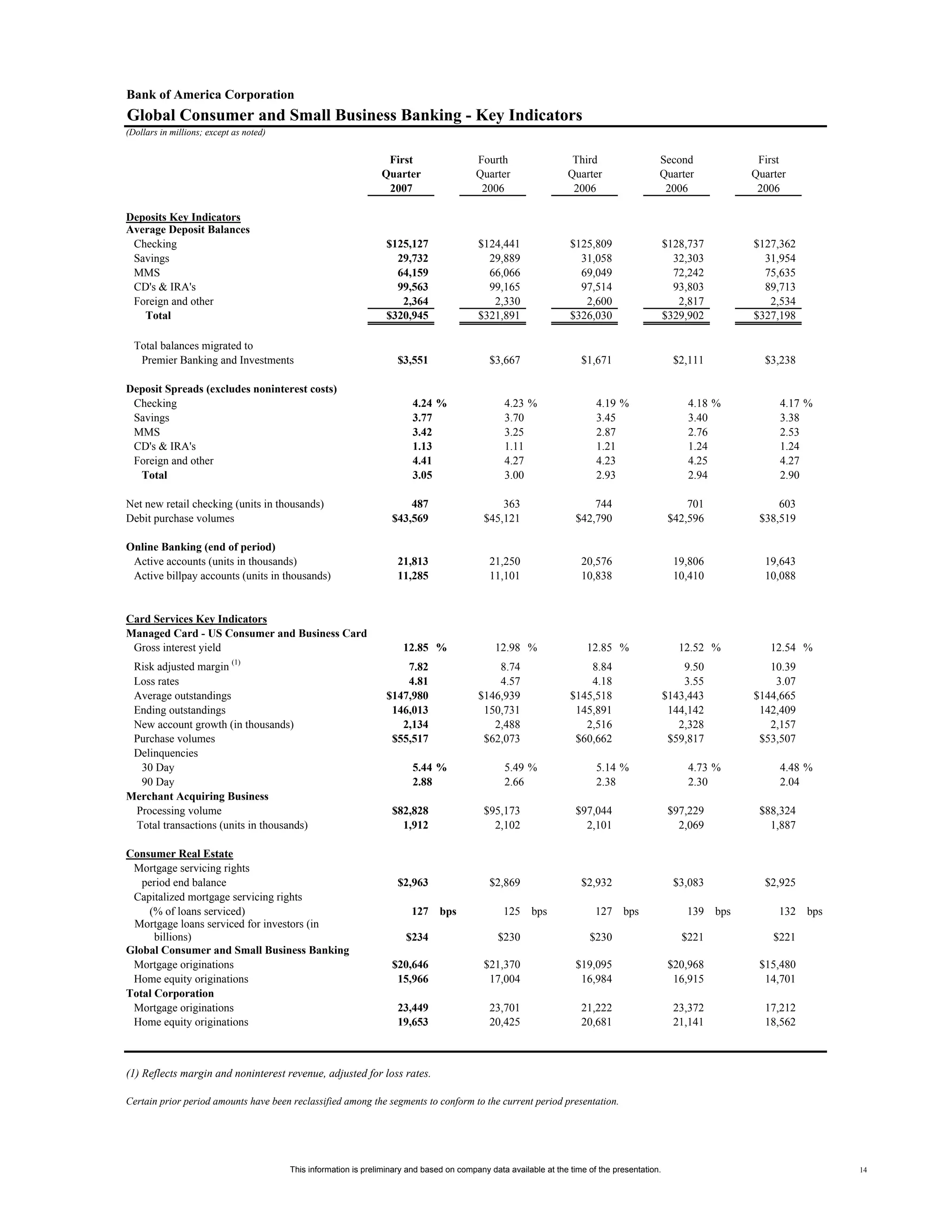

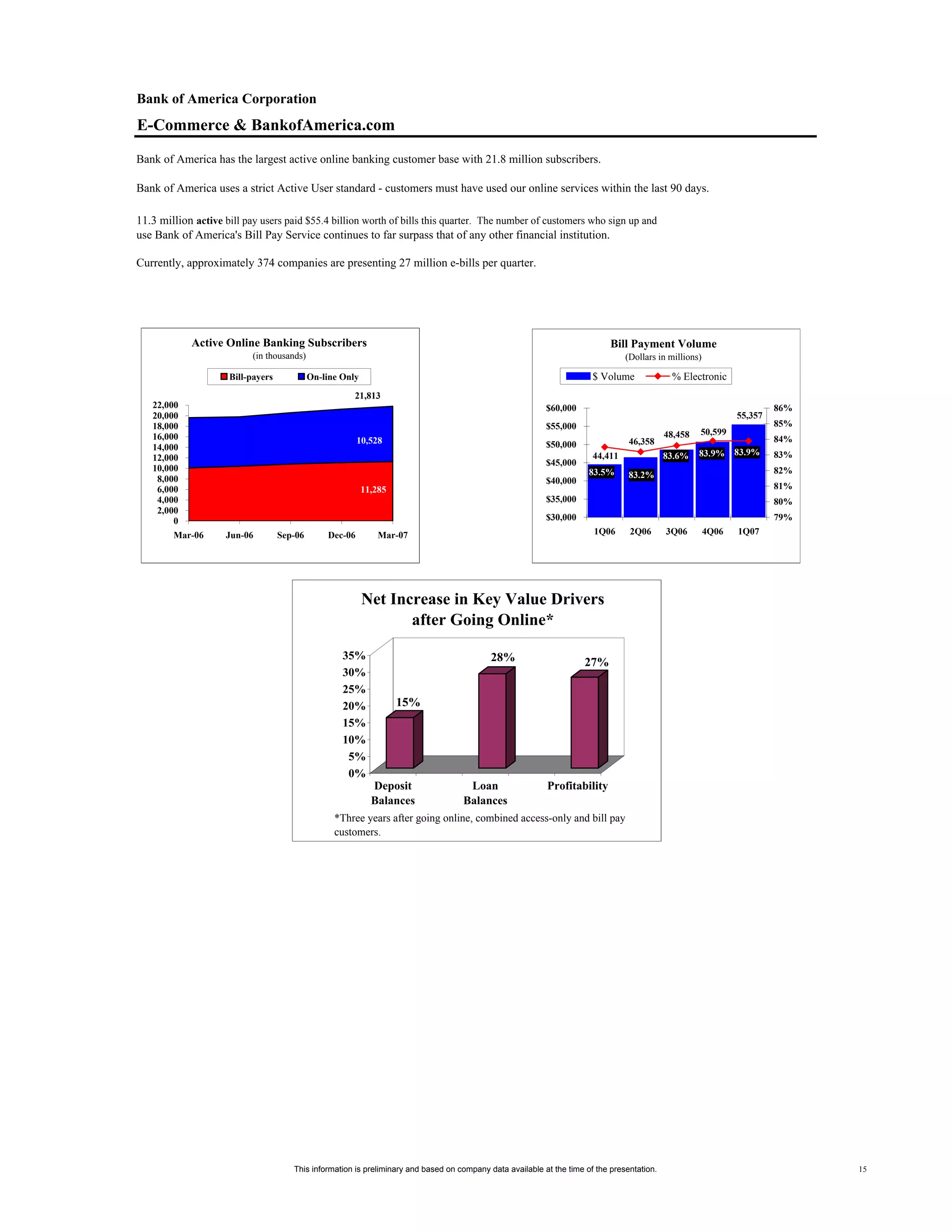

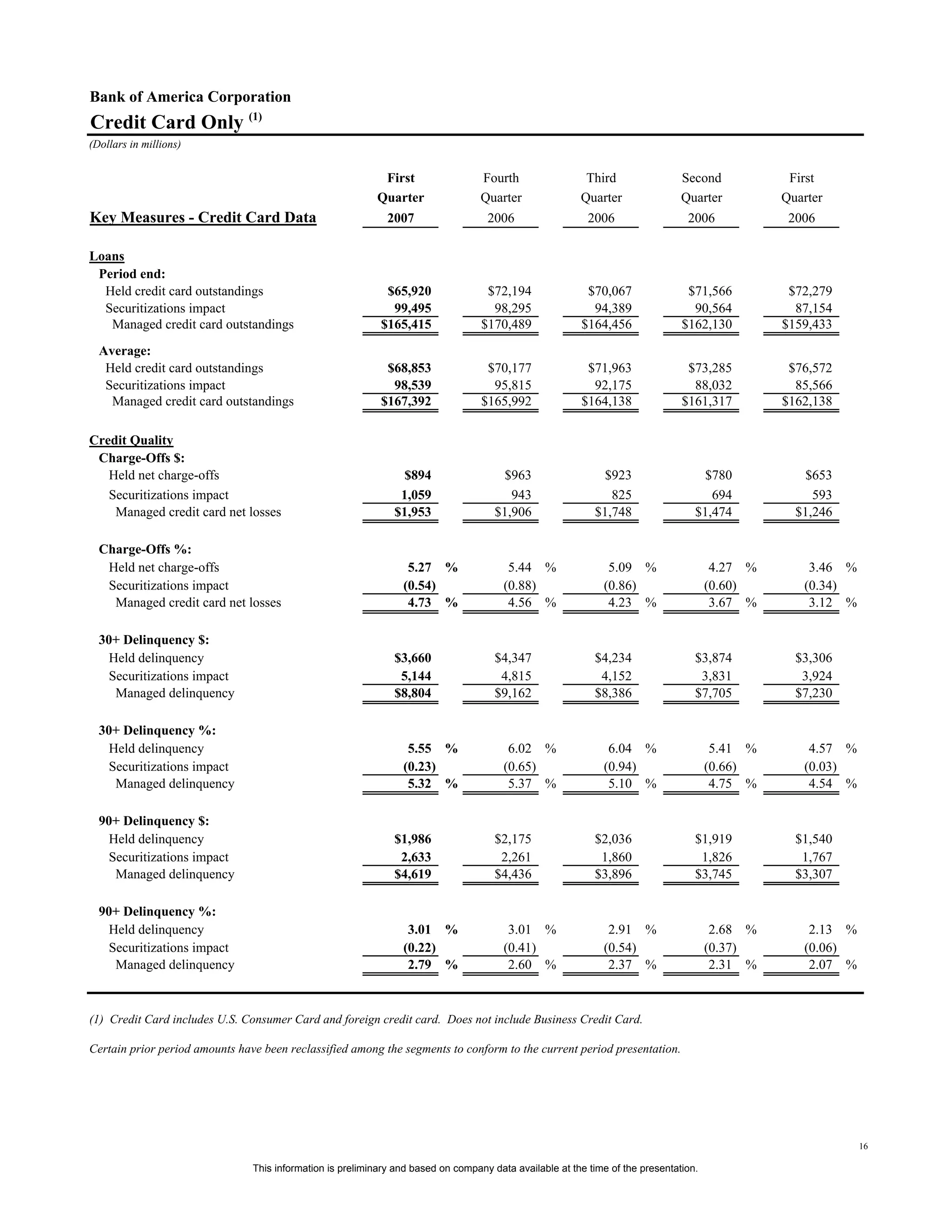

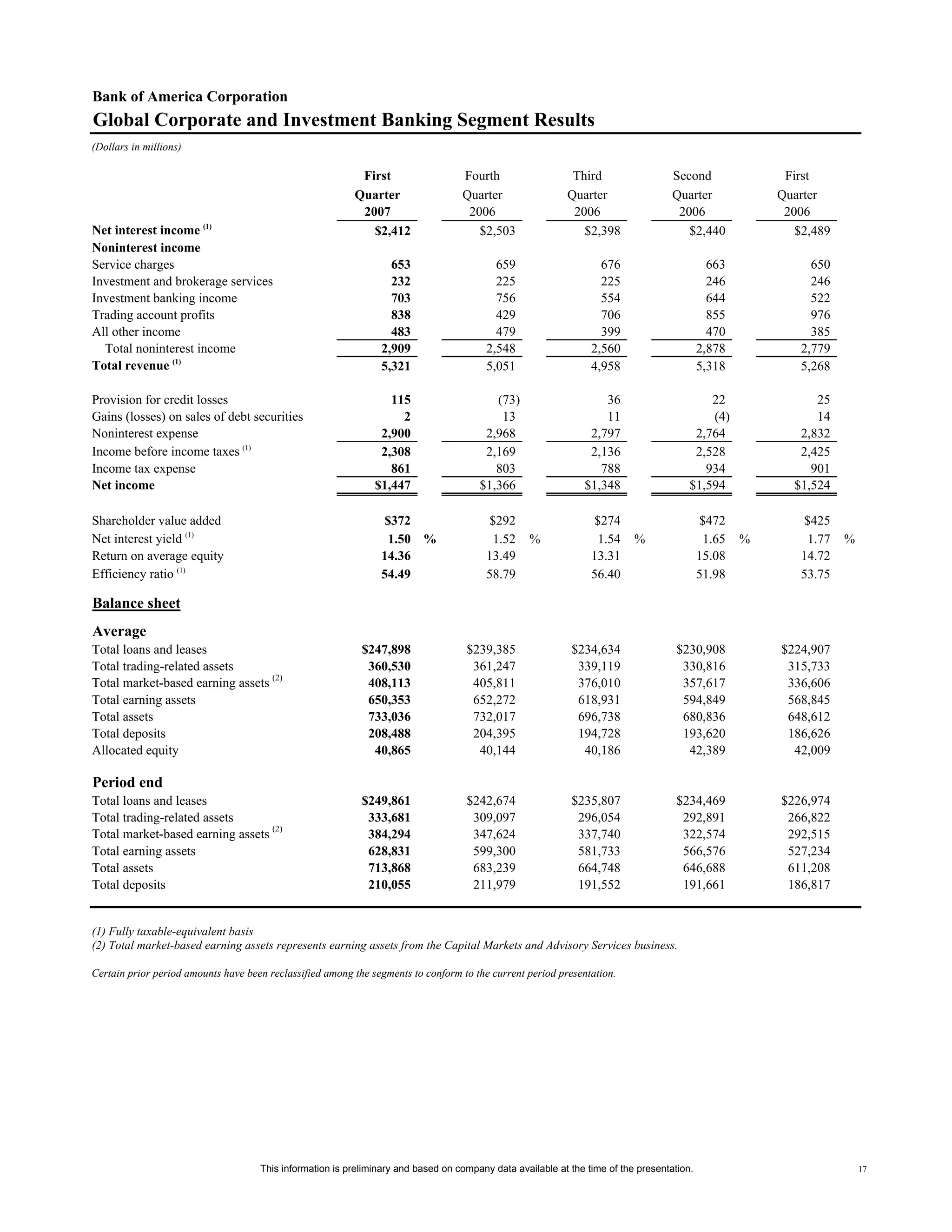

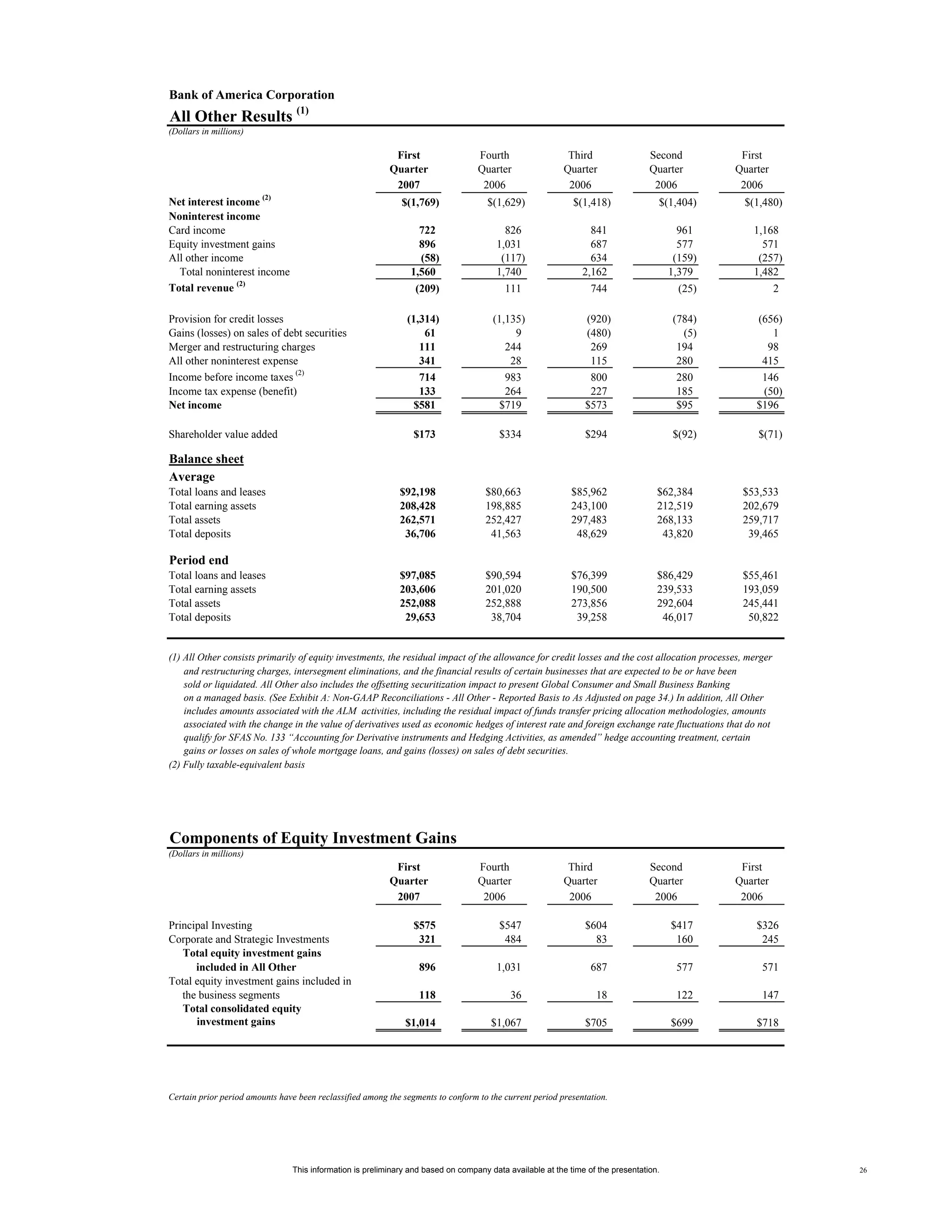

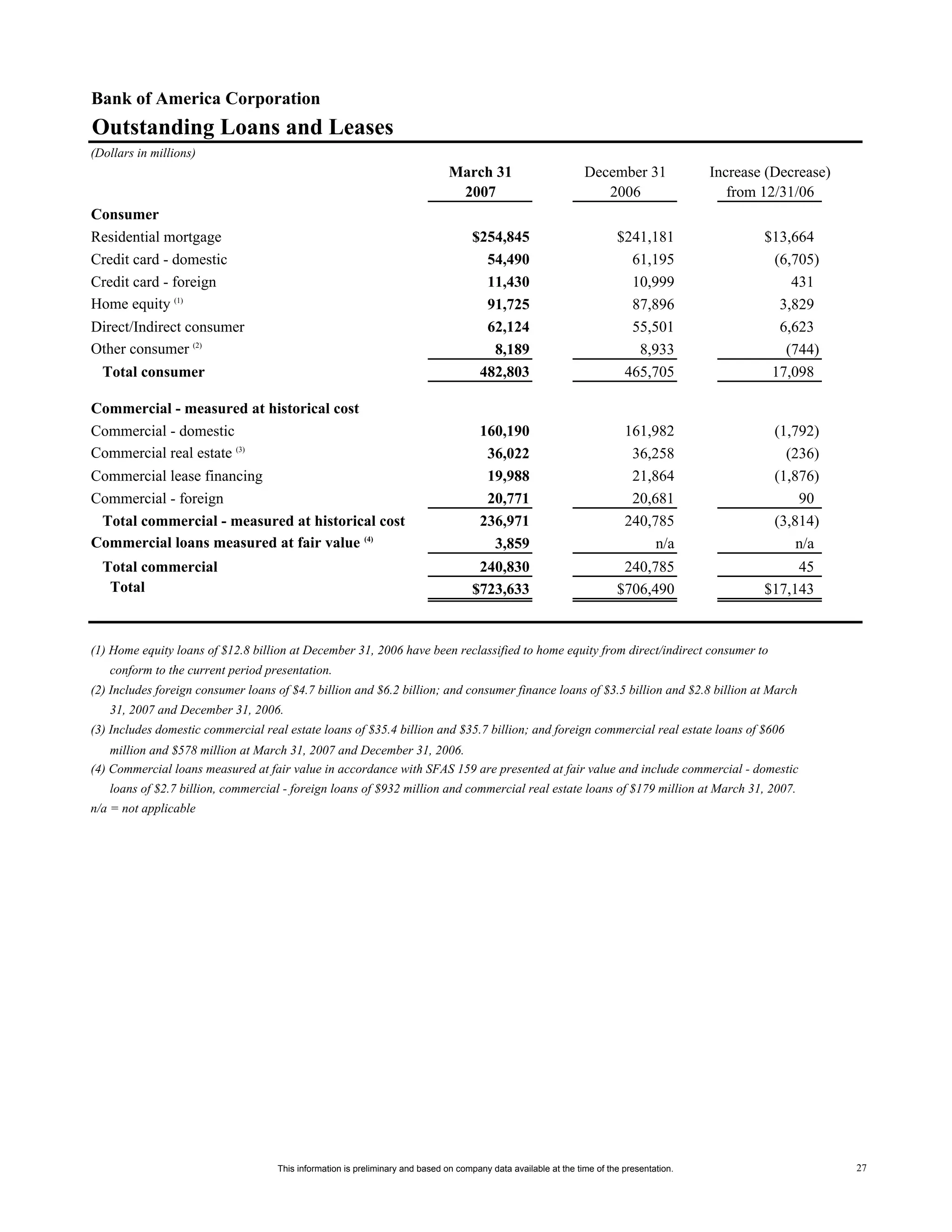

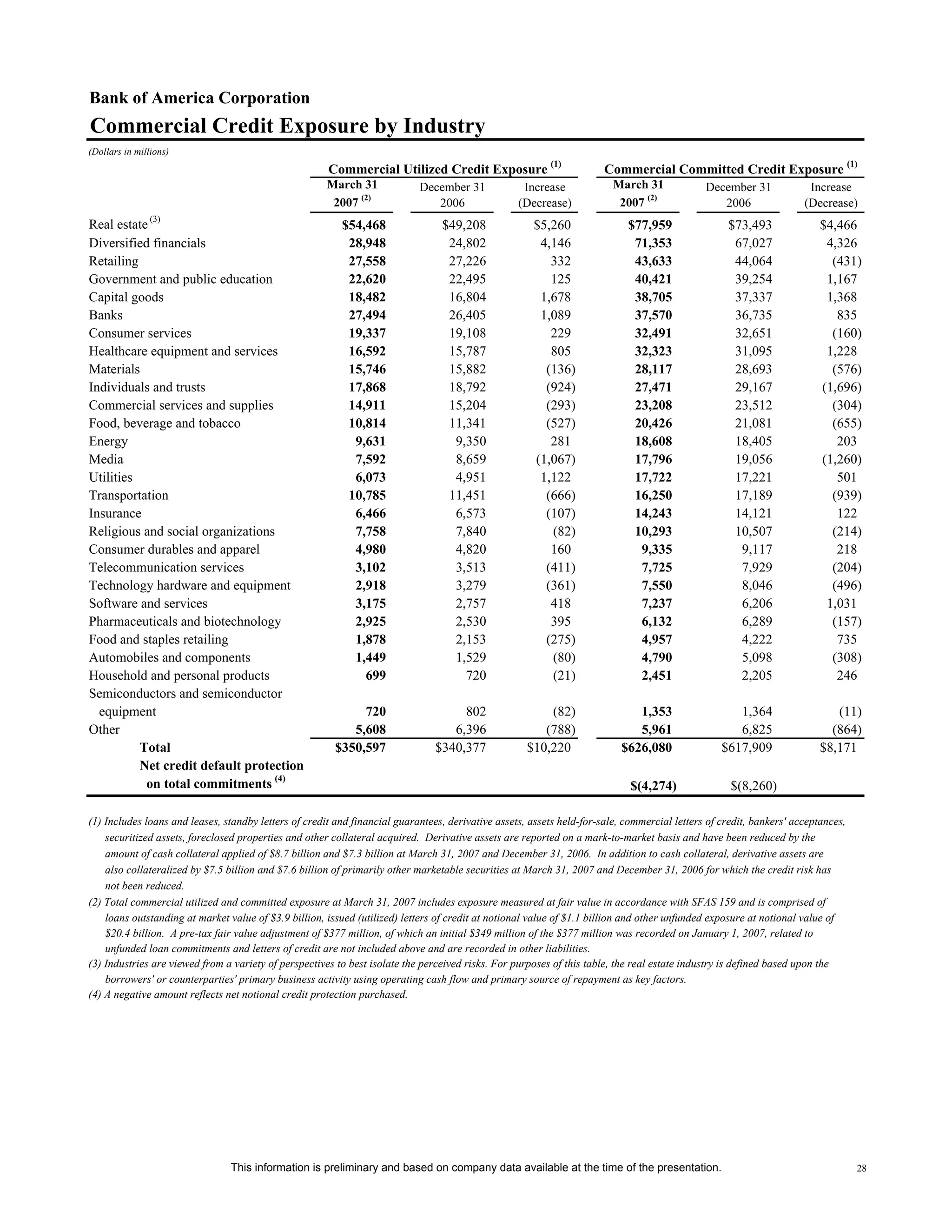

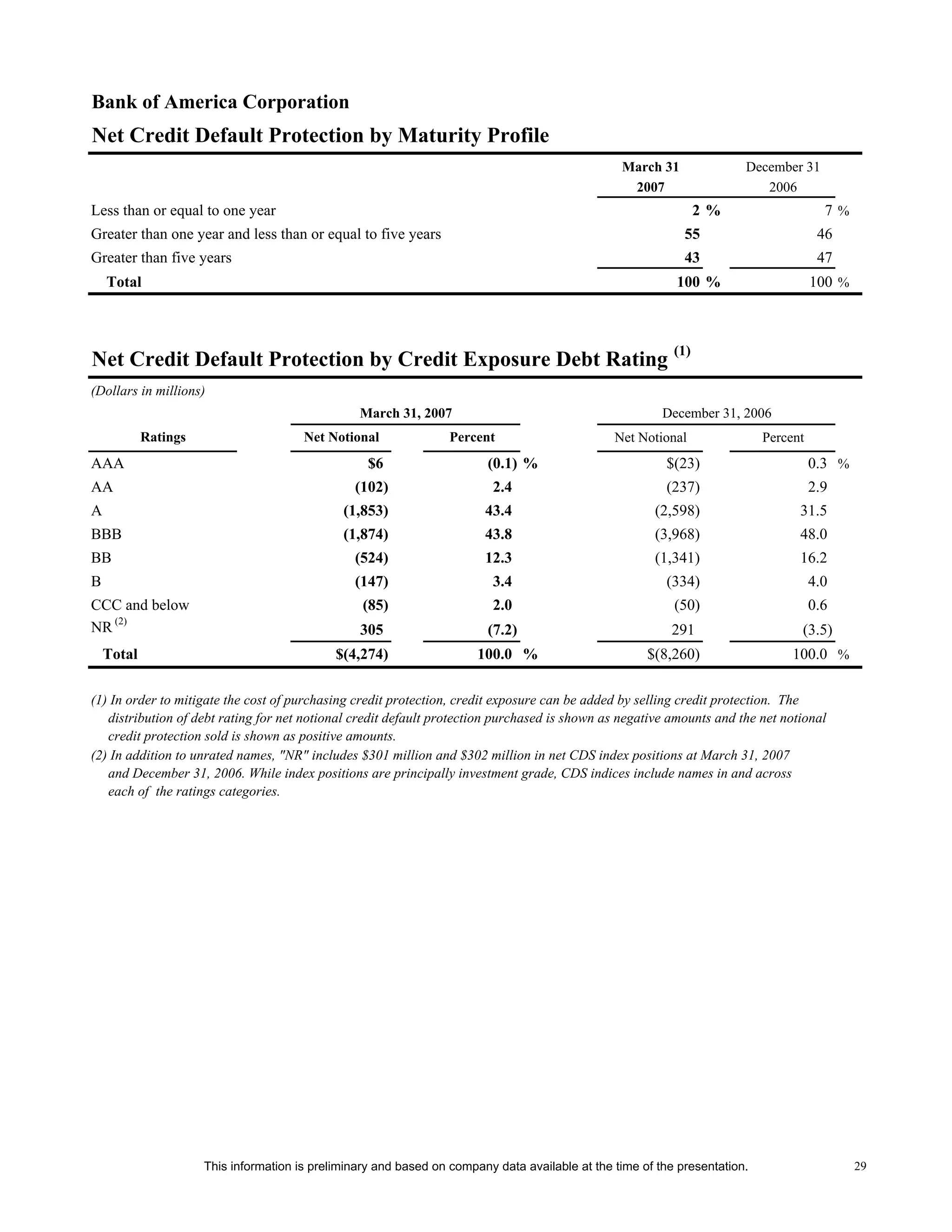

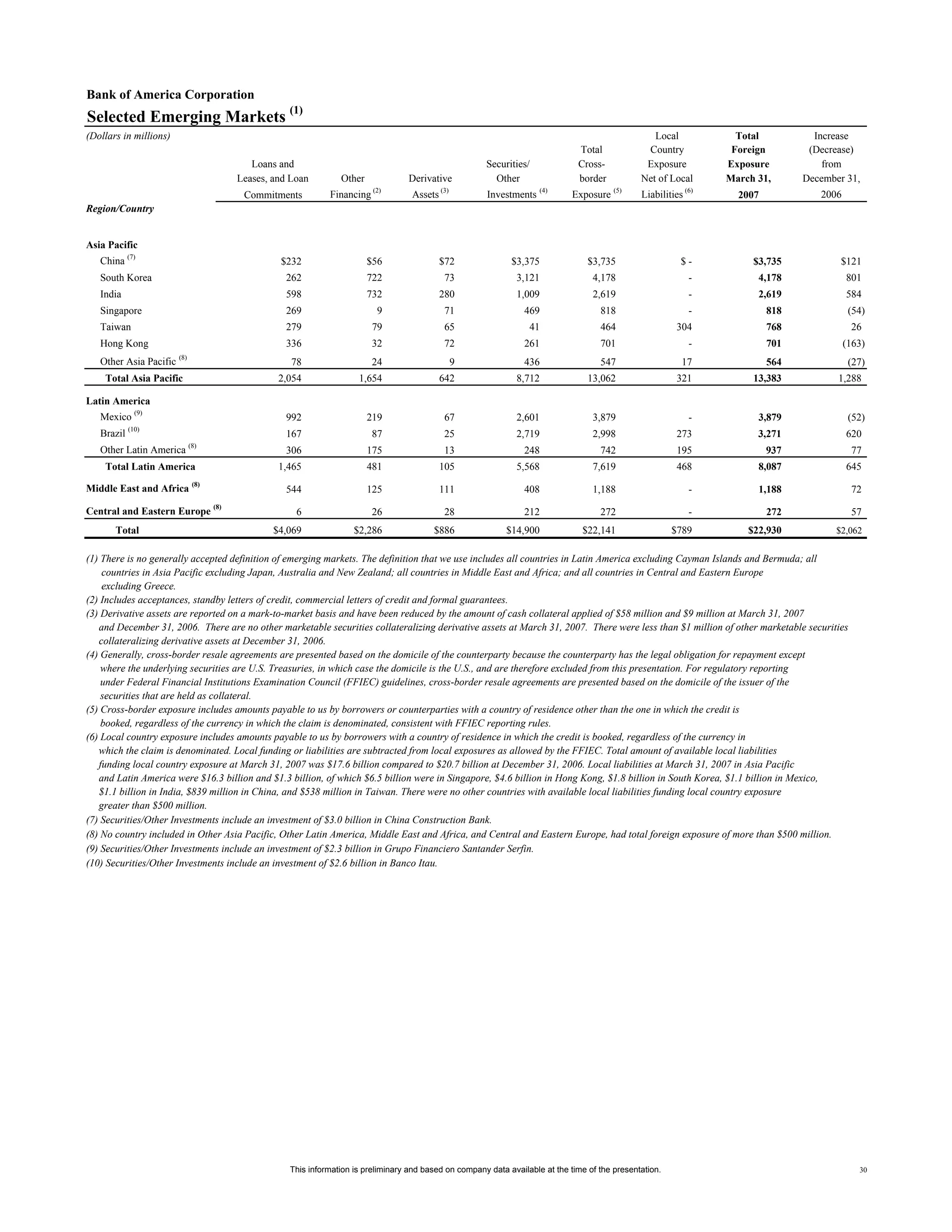

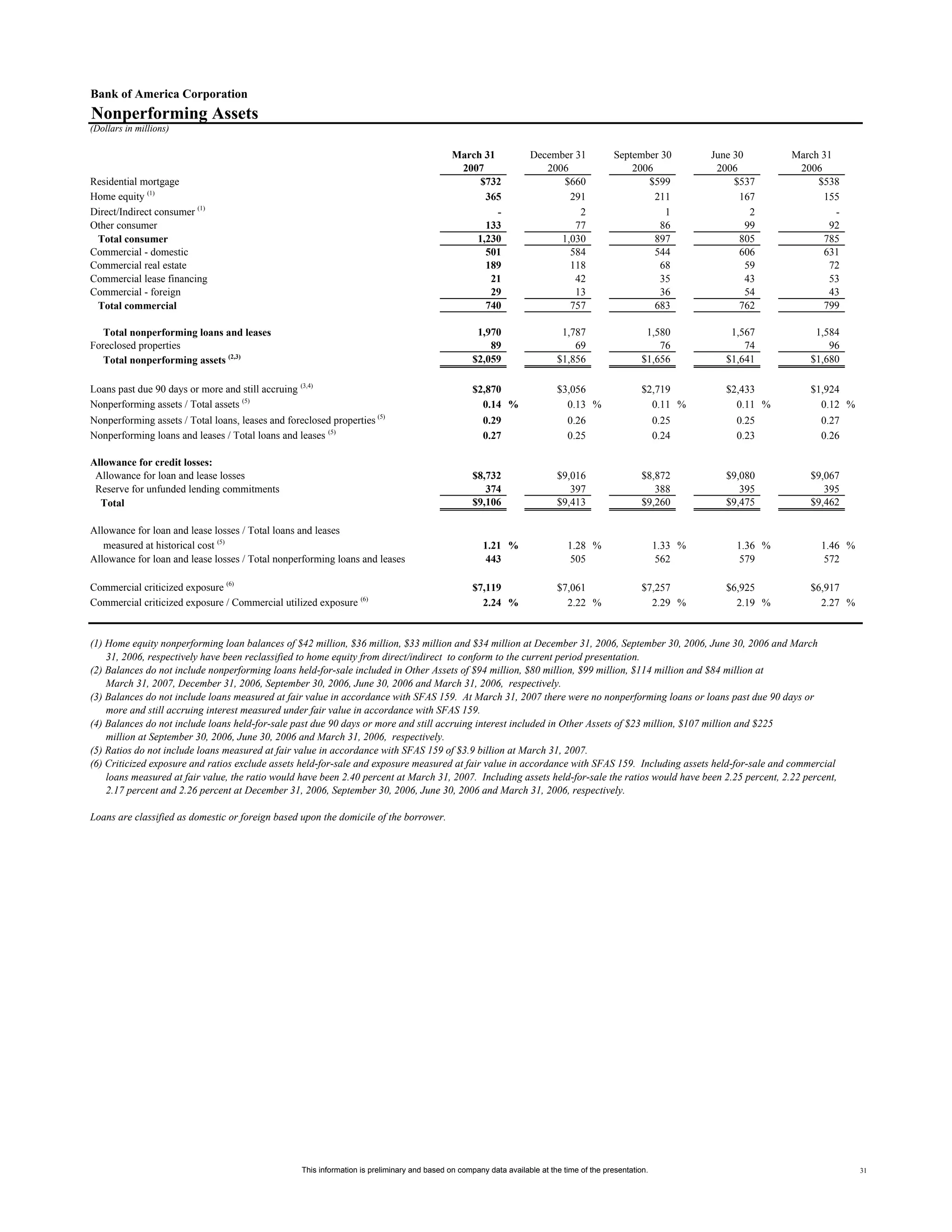

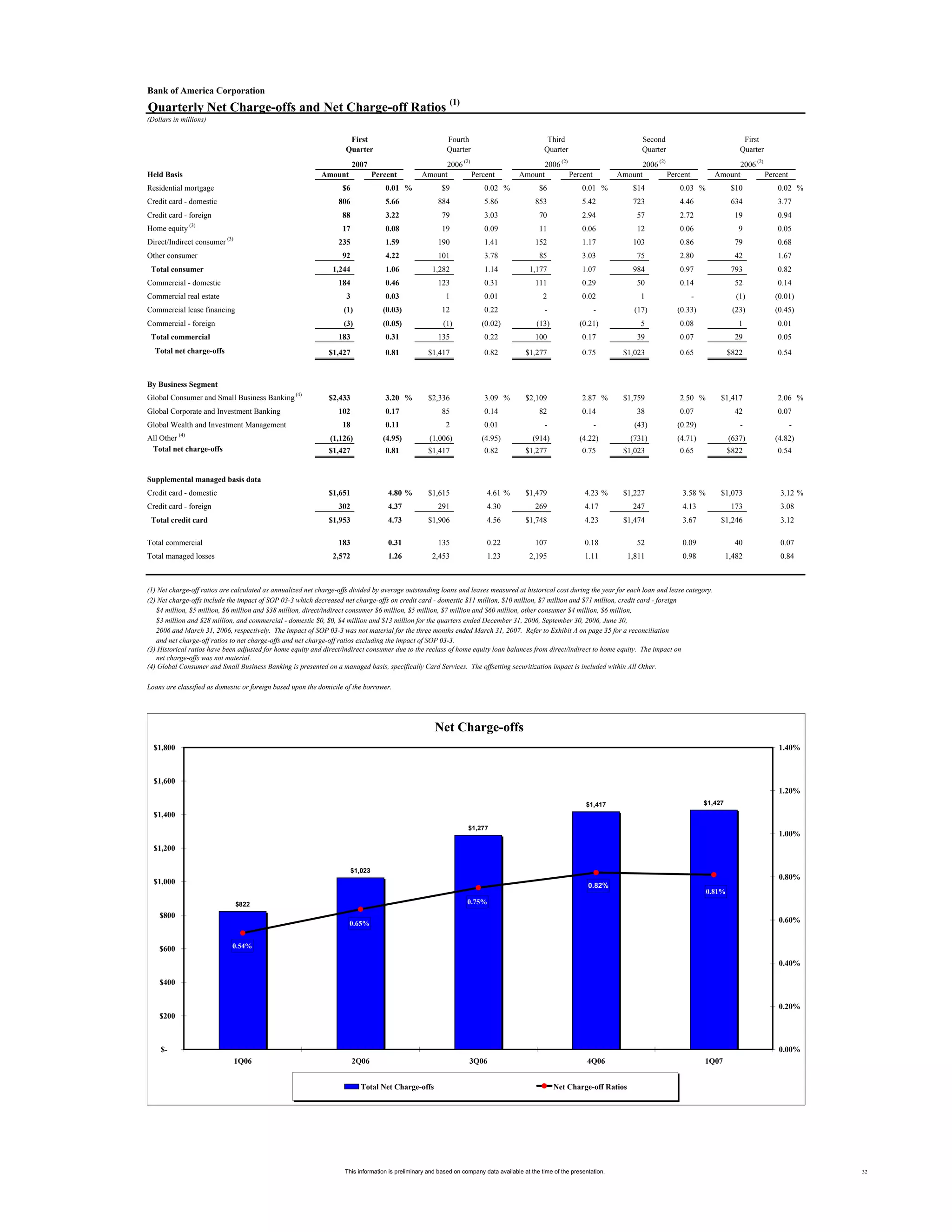

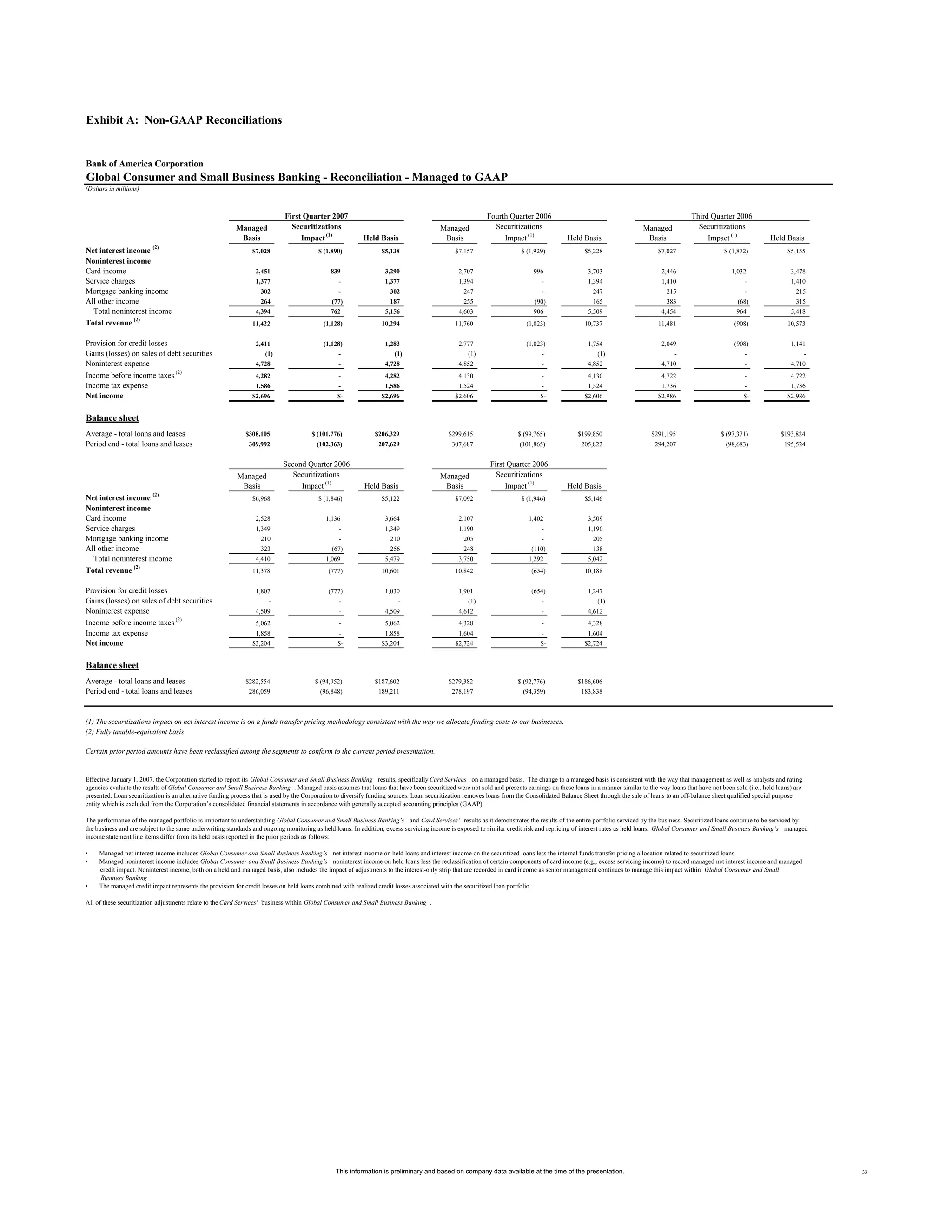

Download to read offline

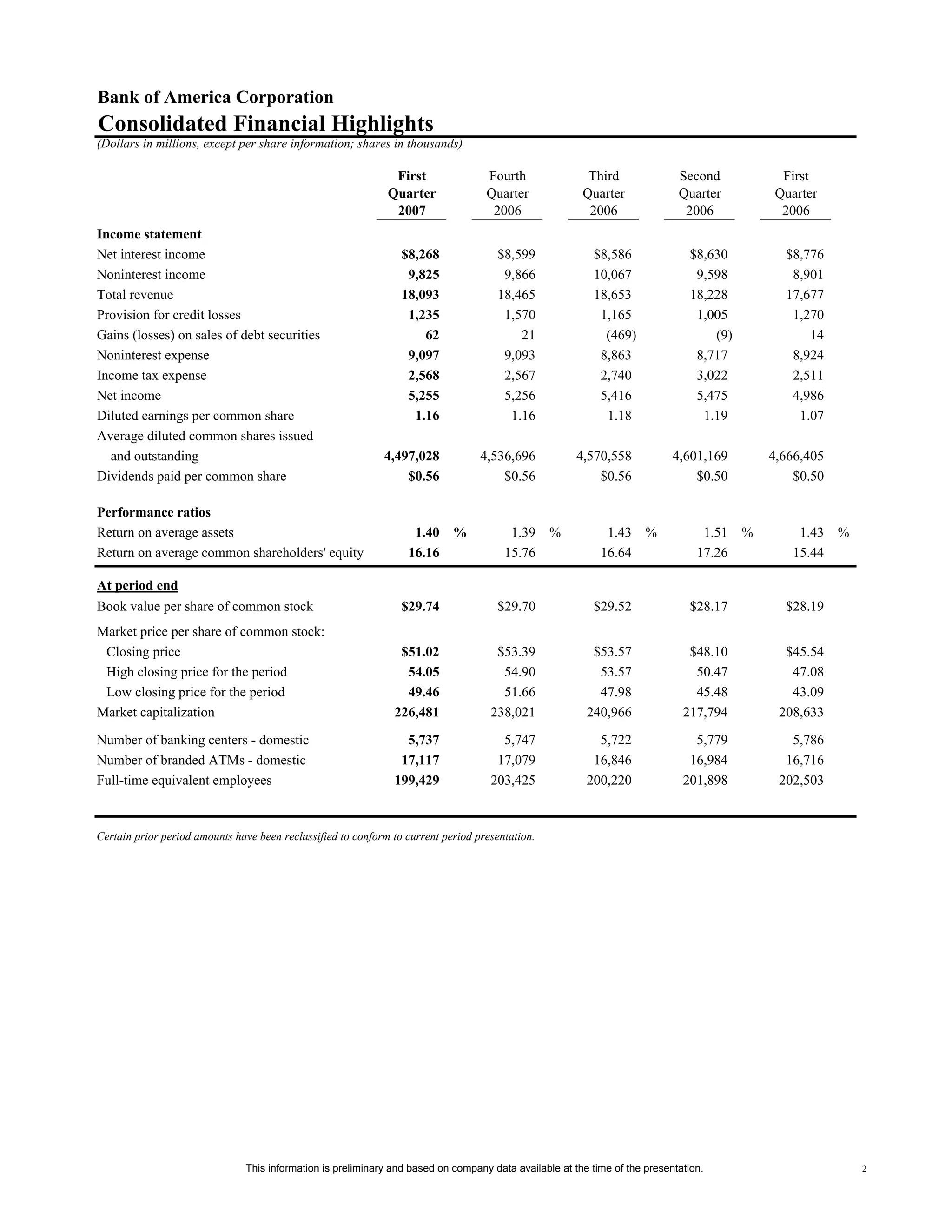

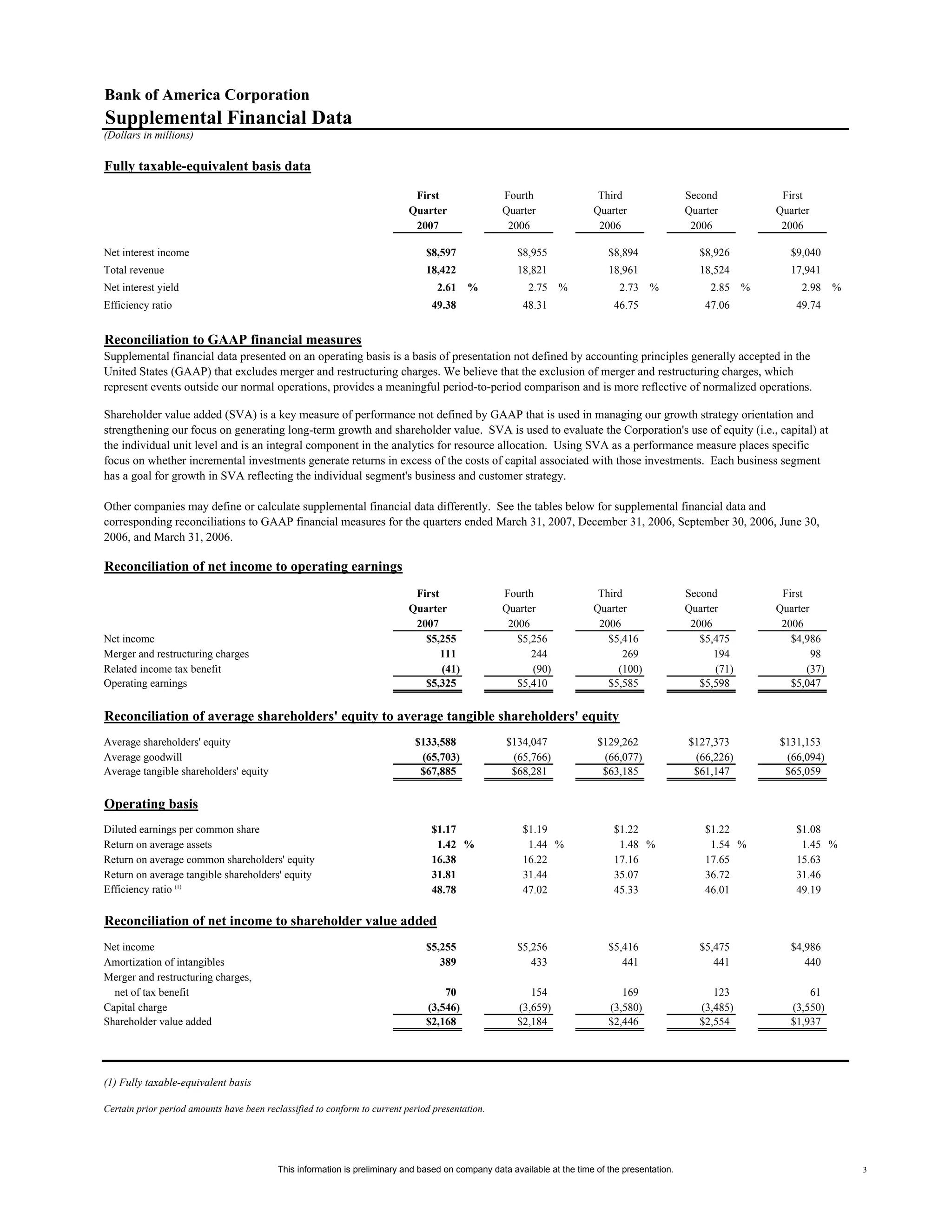

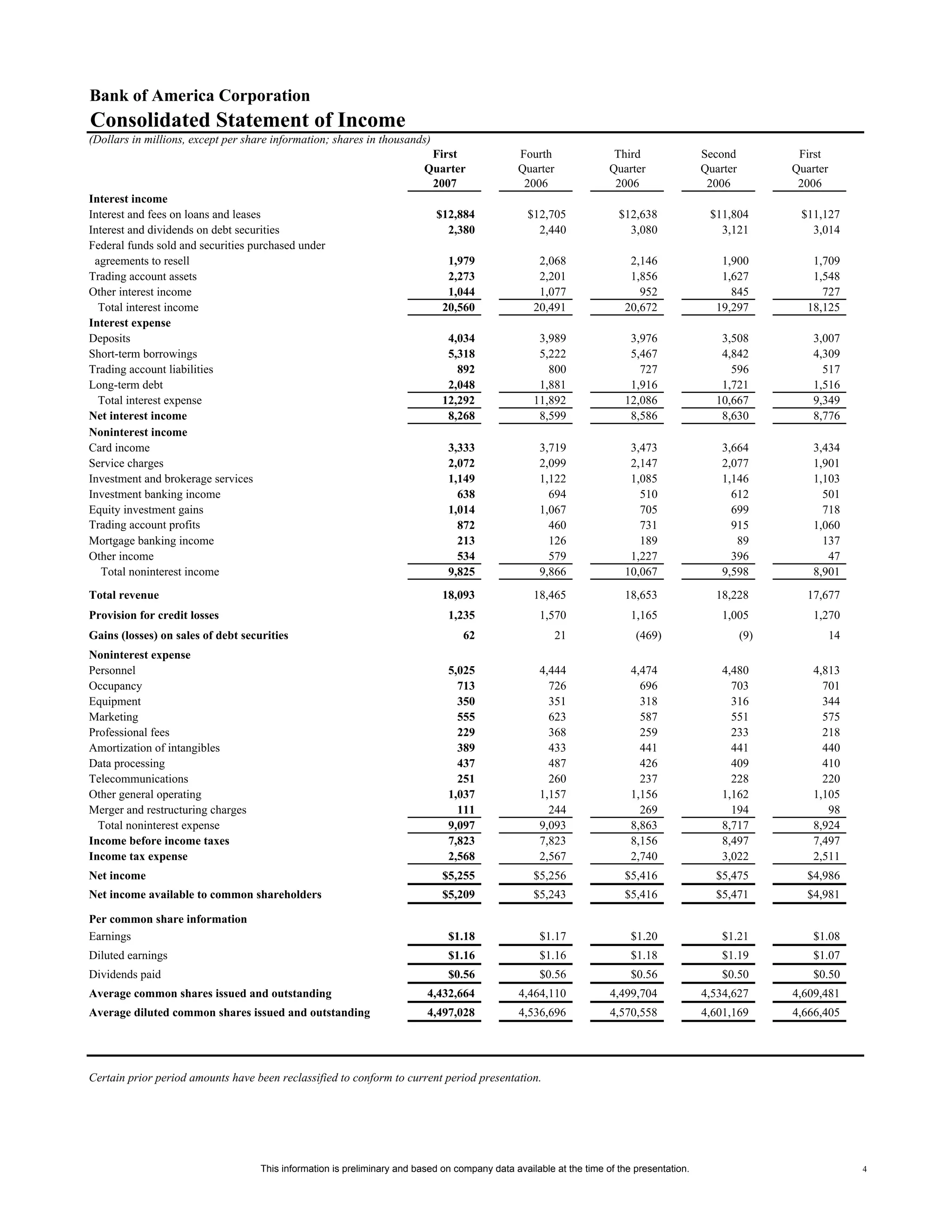

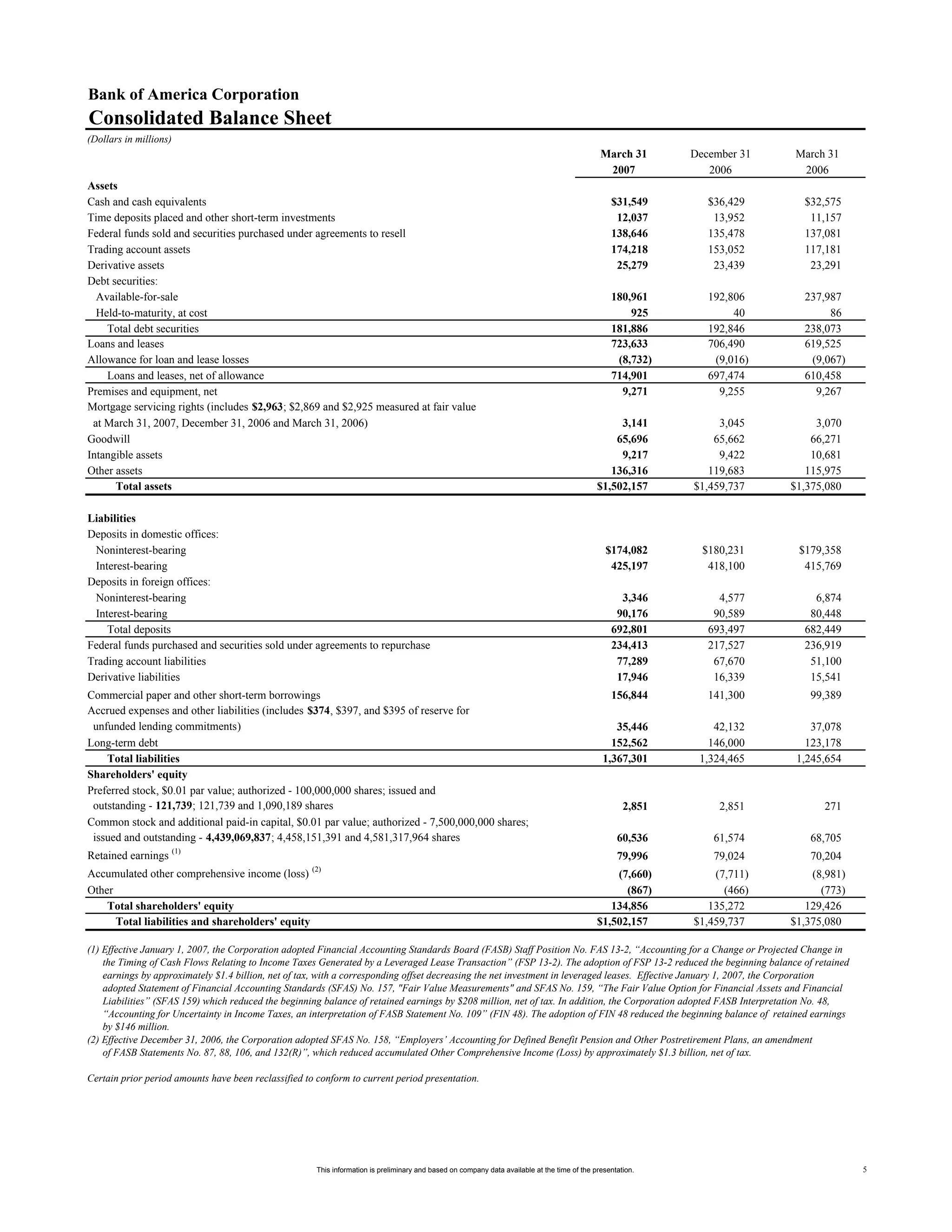

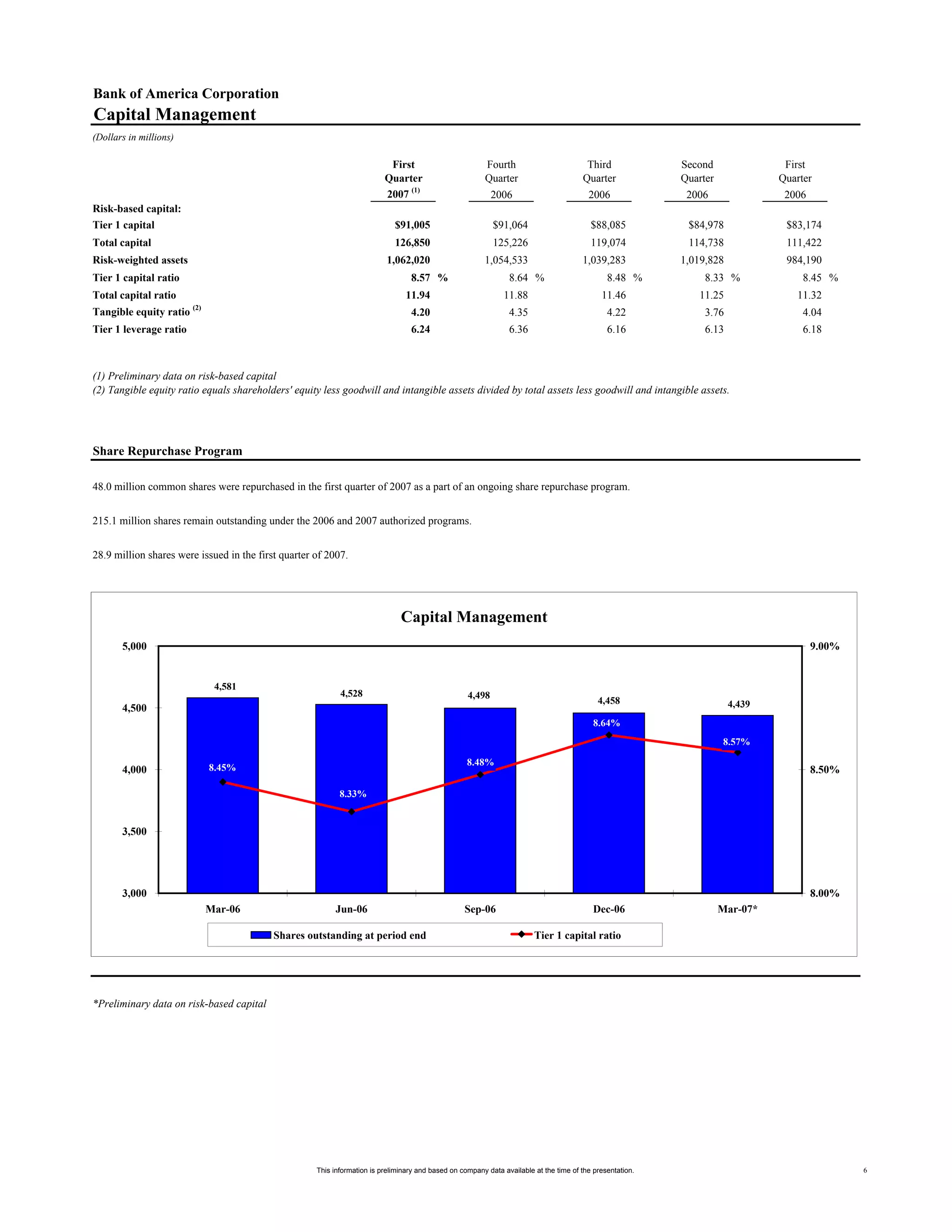

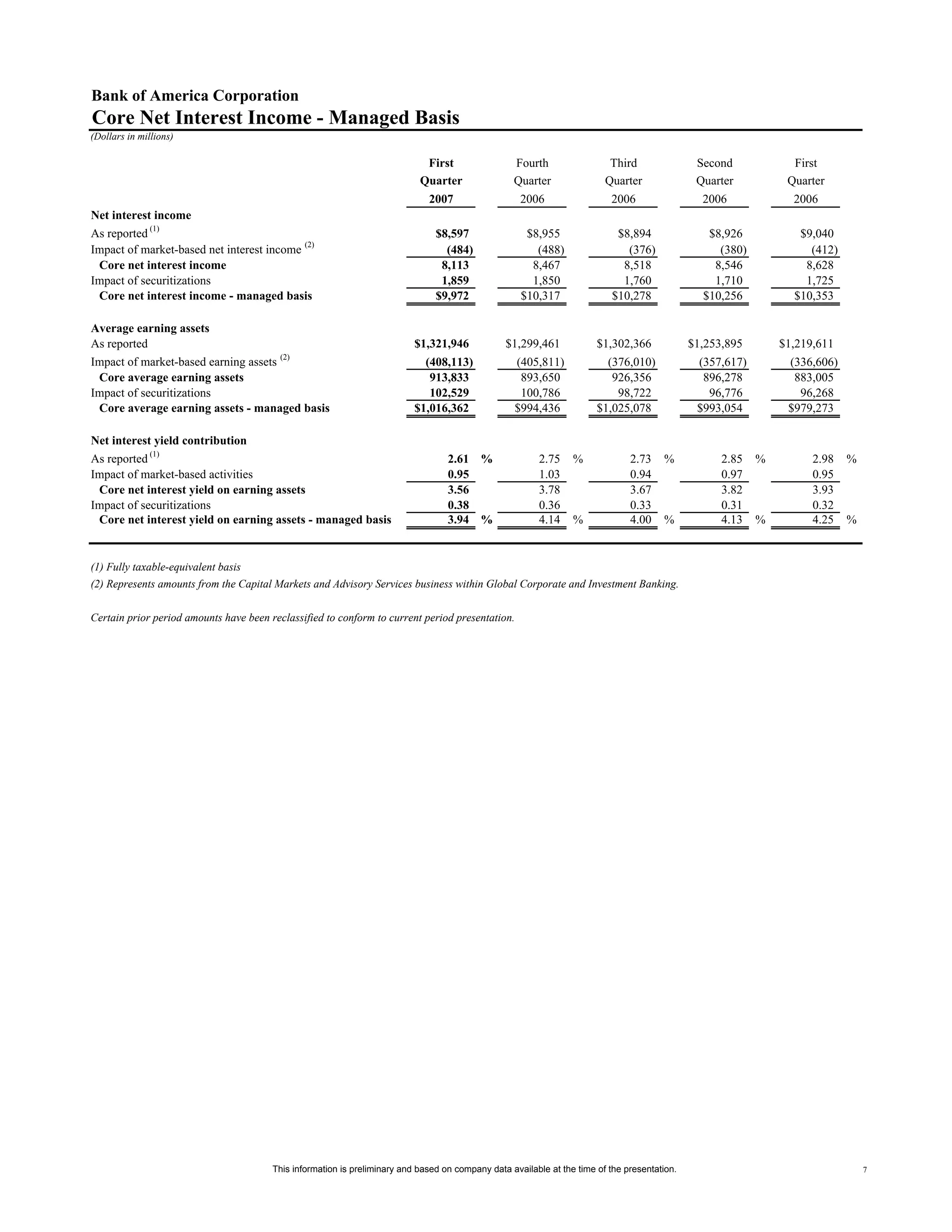

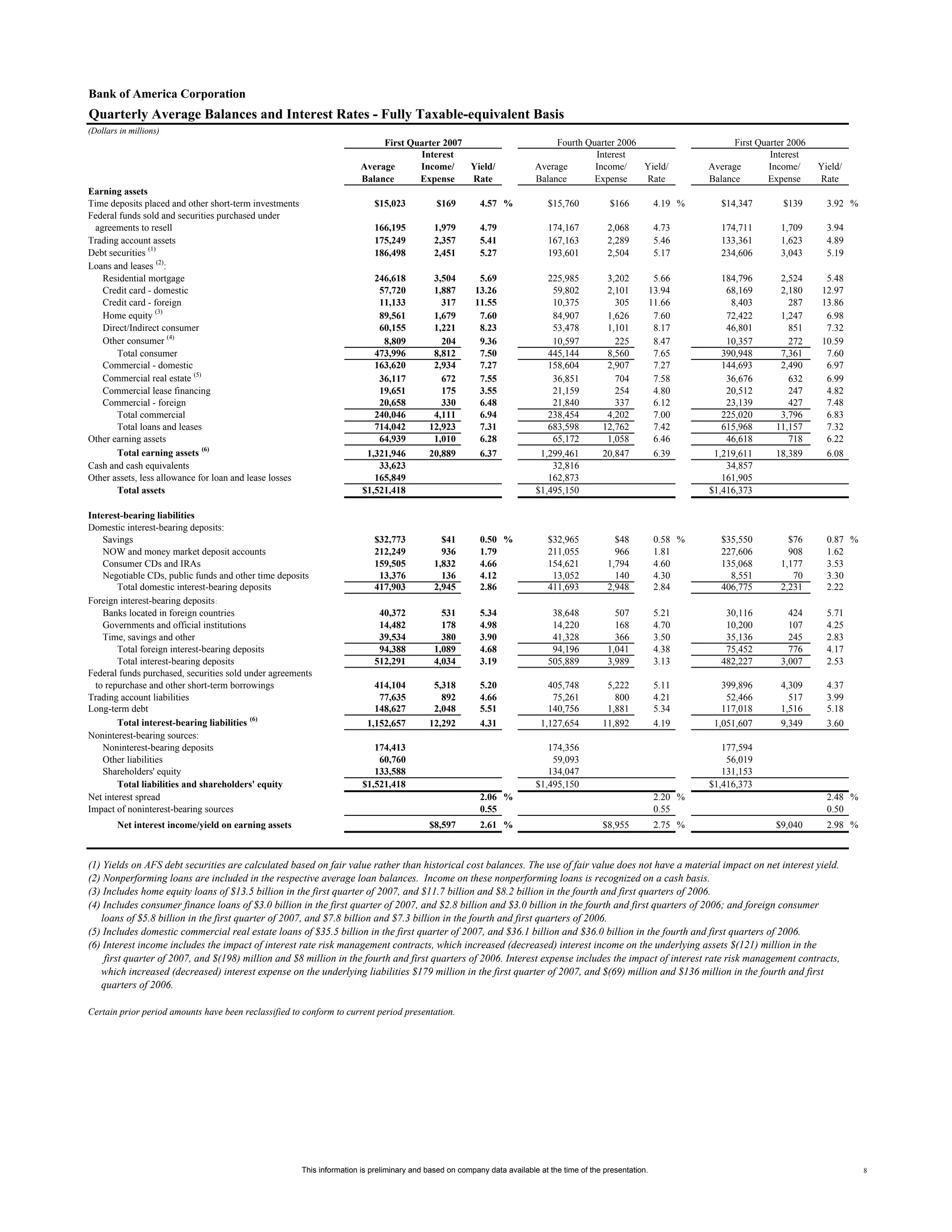

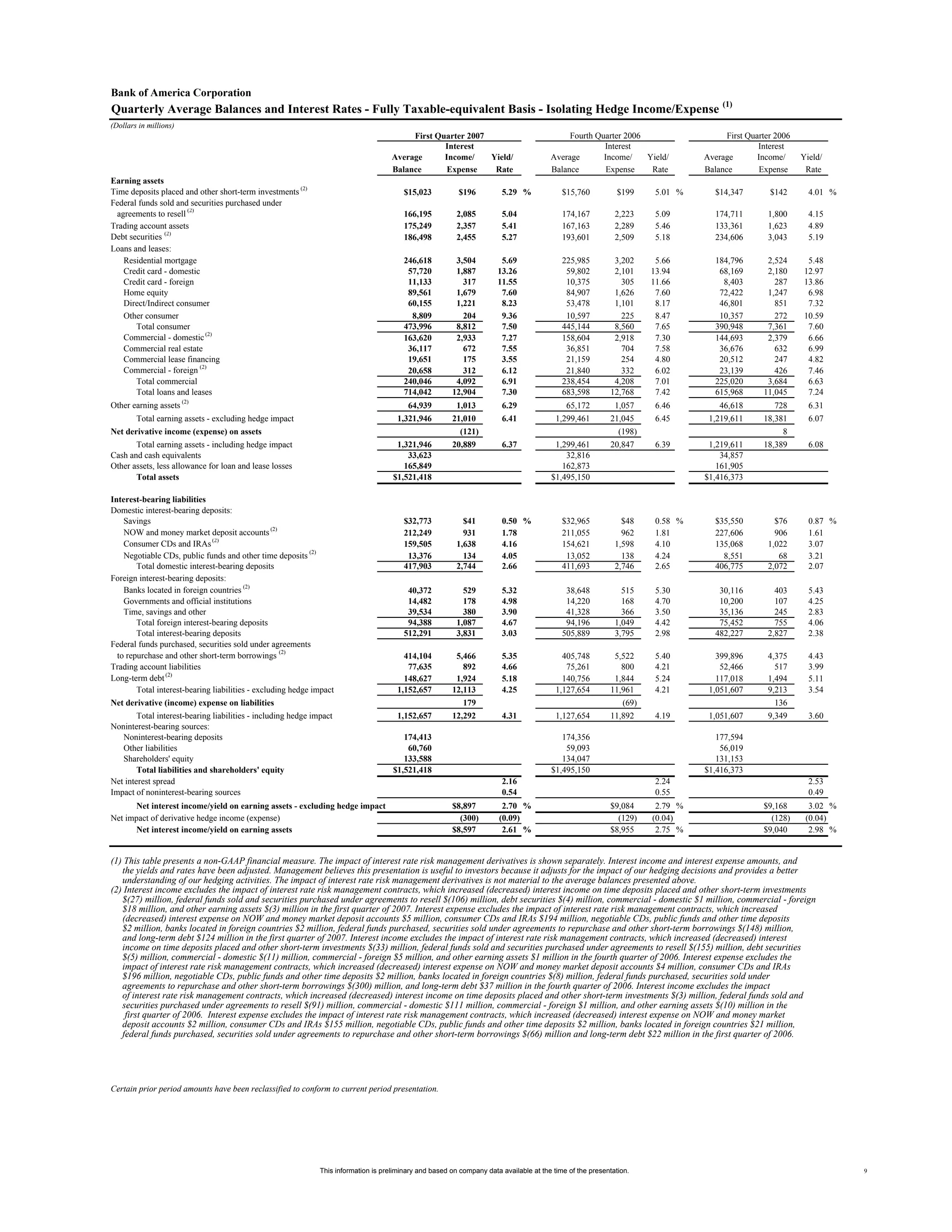

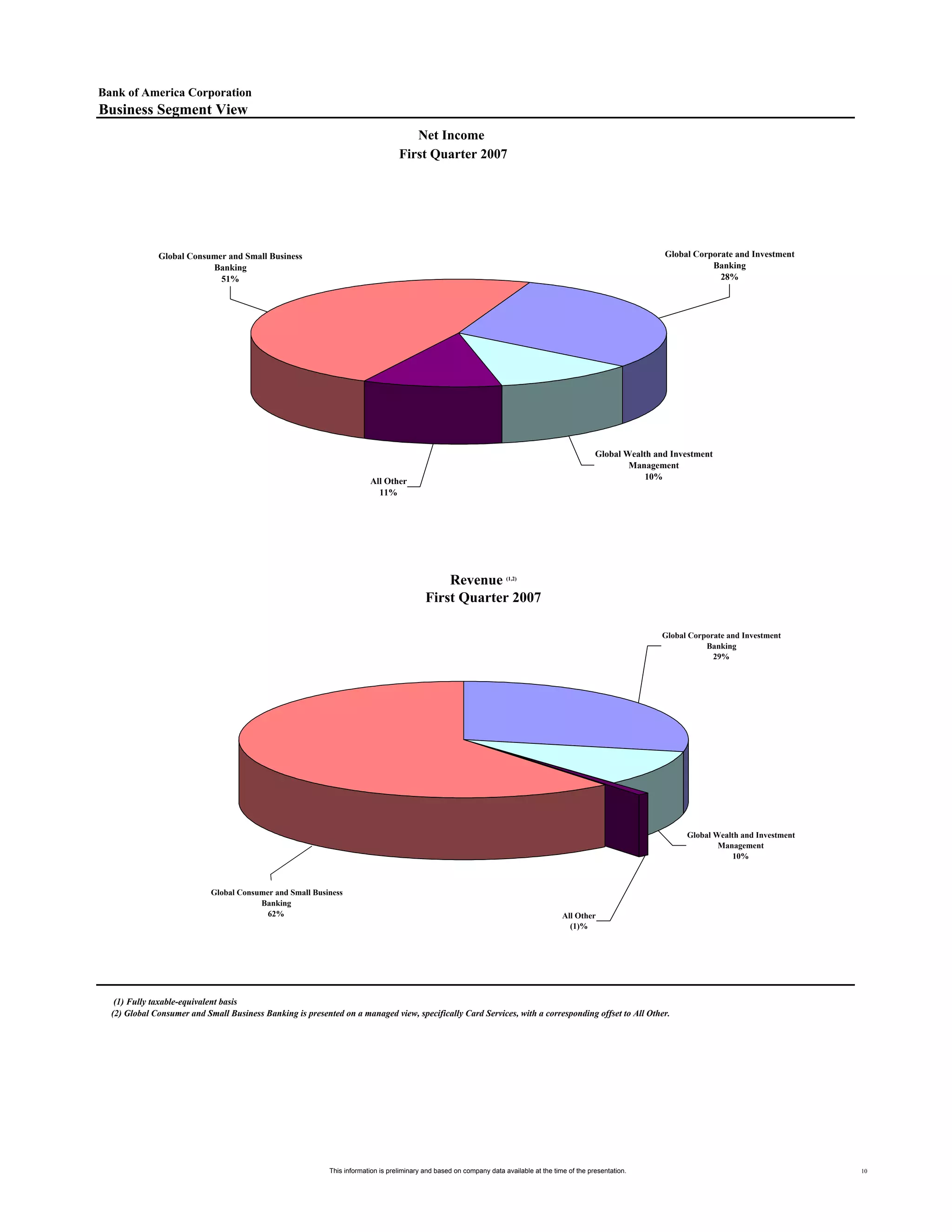

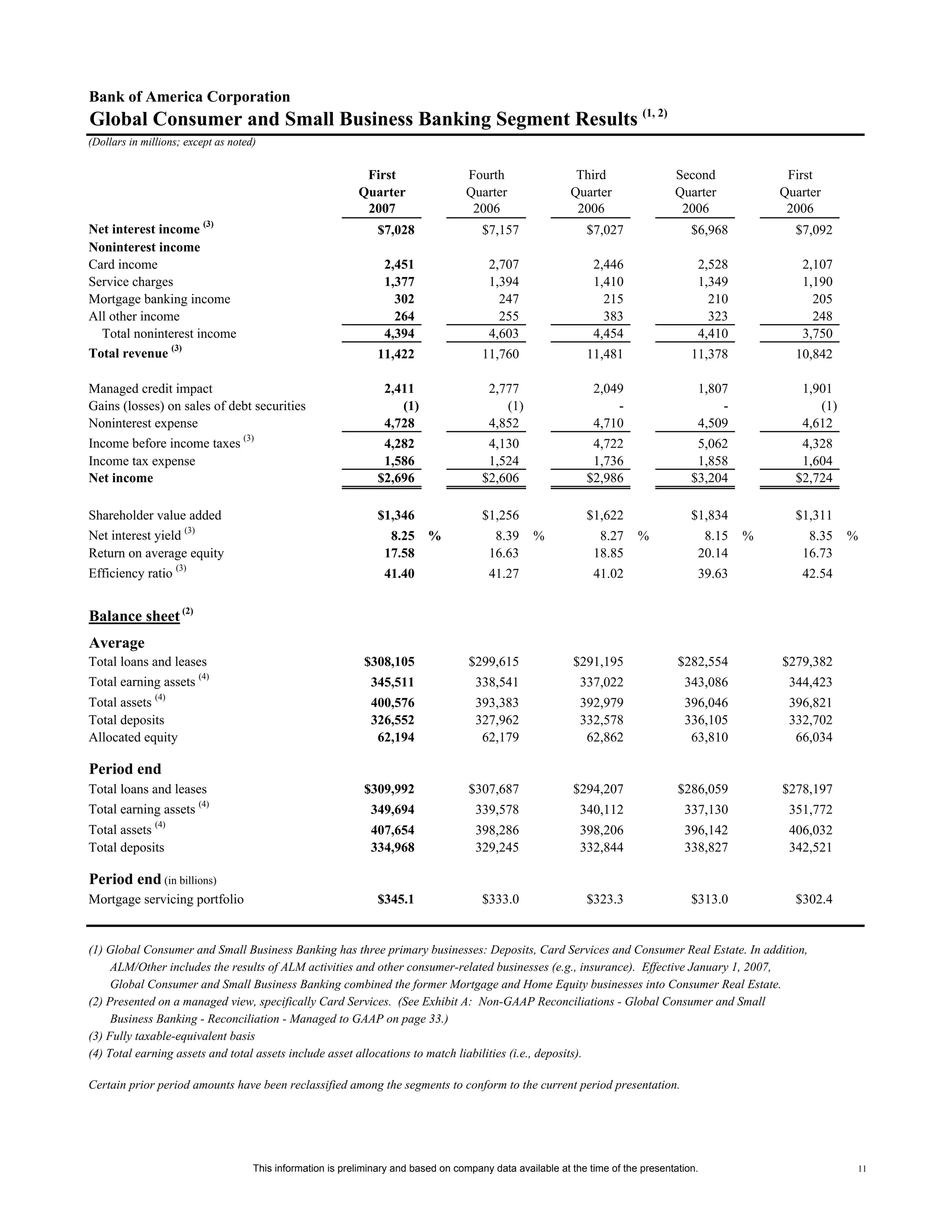

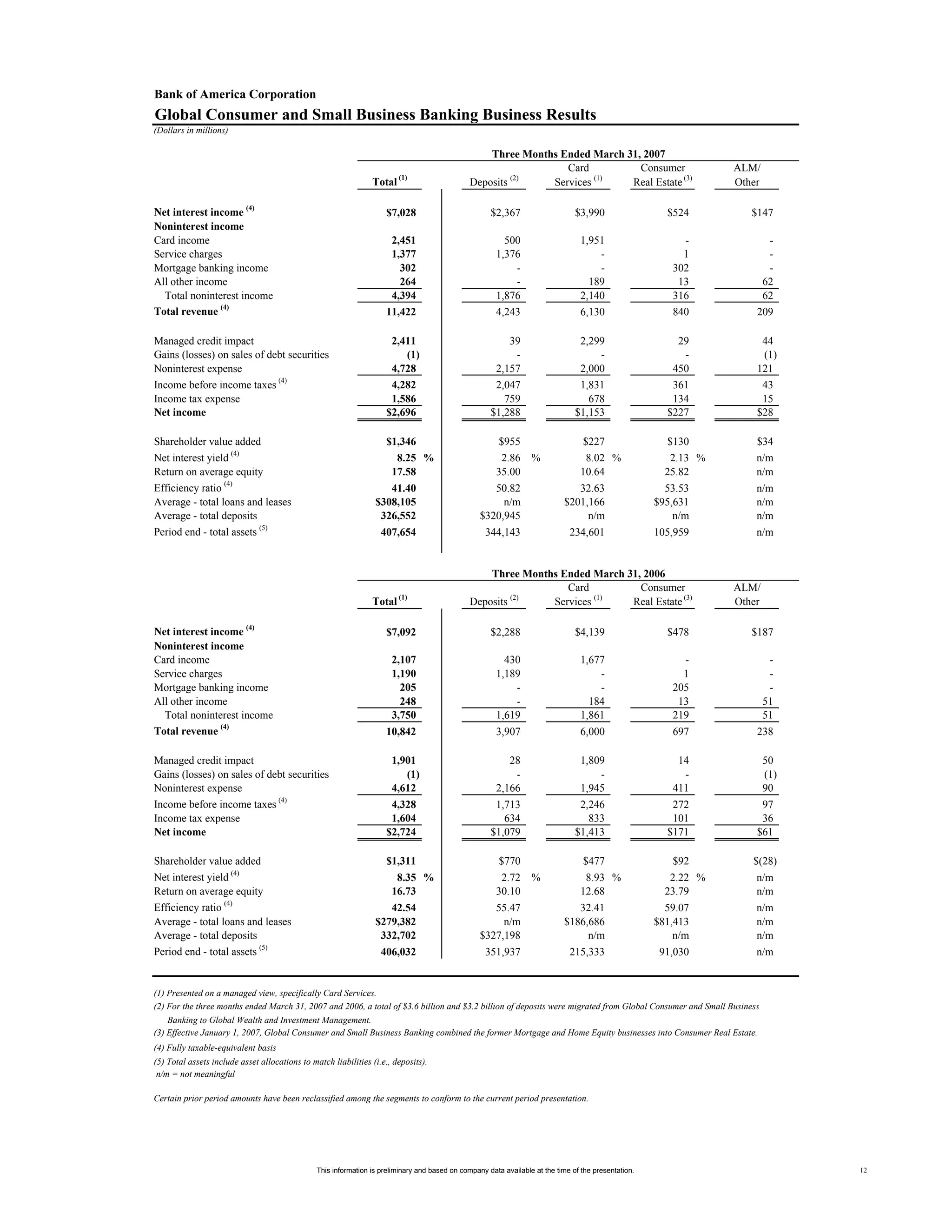

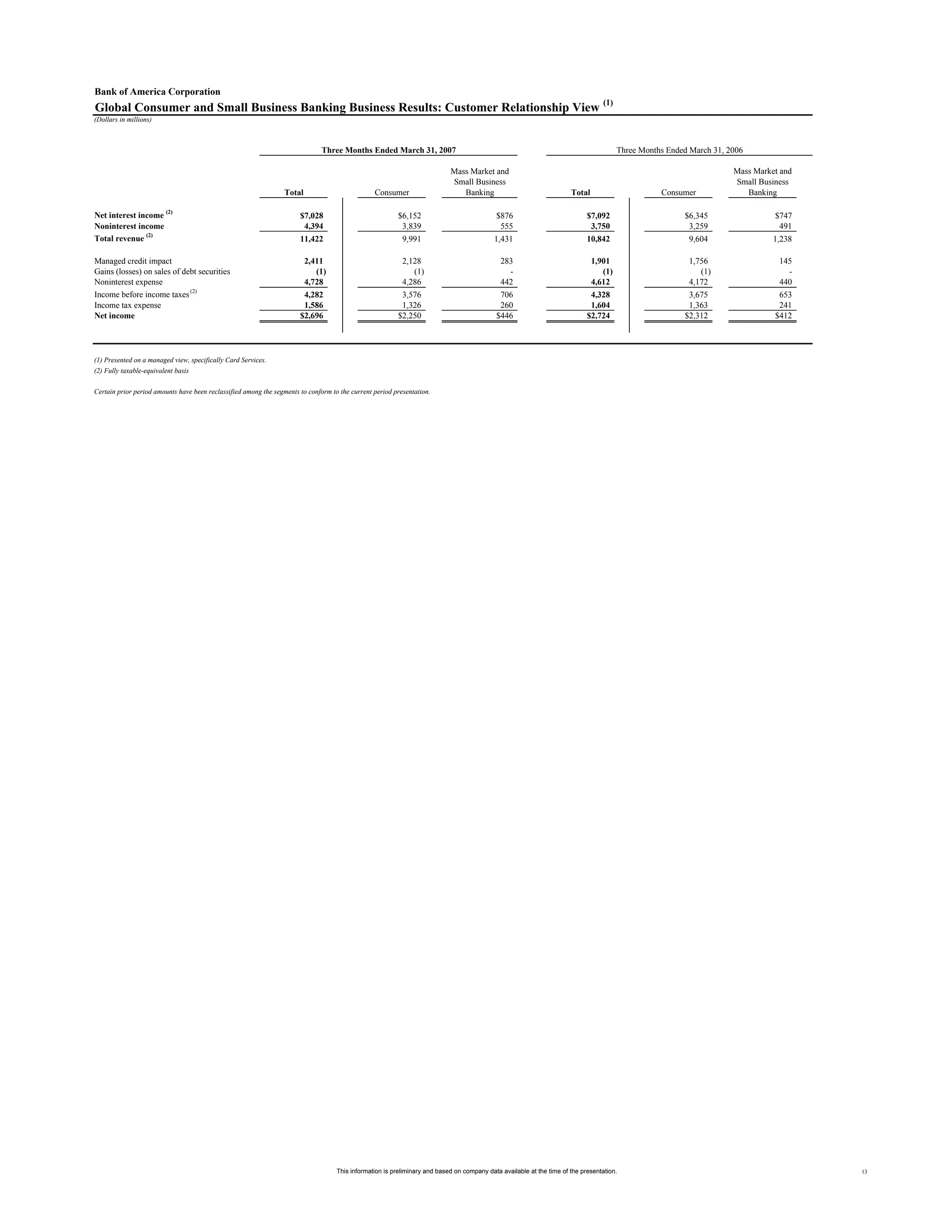

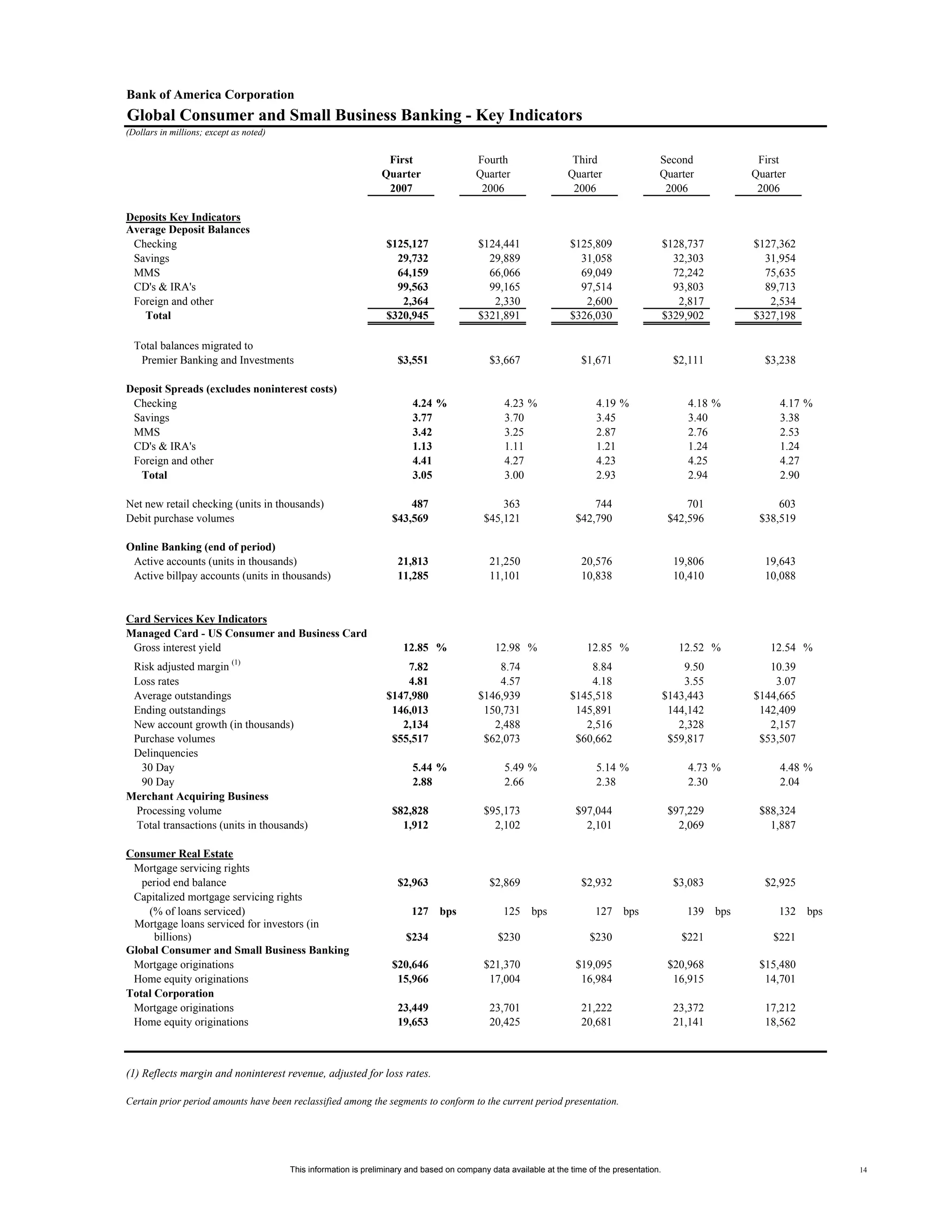

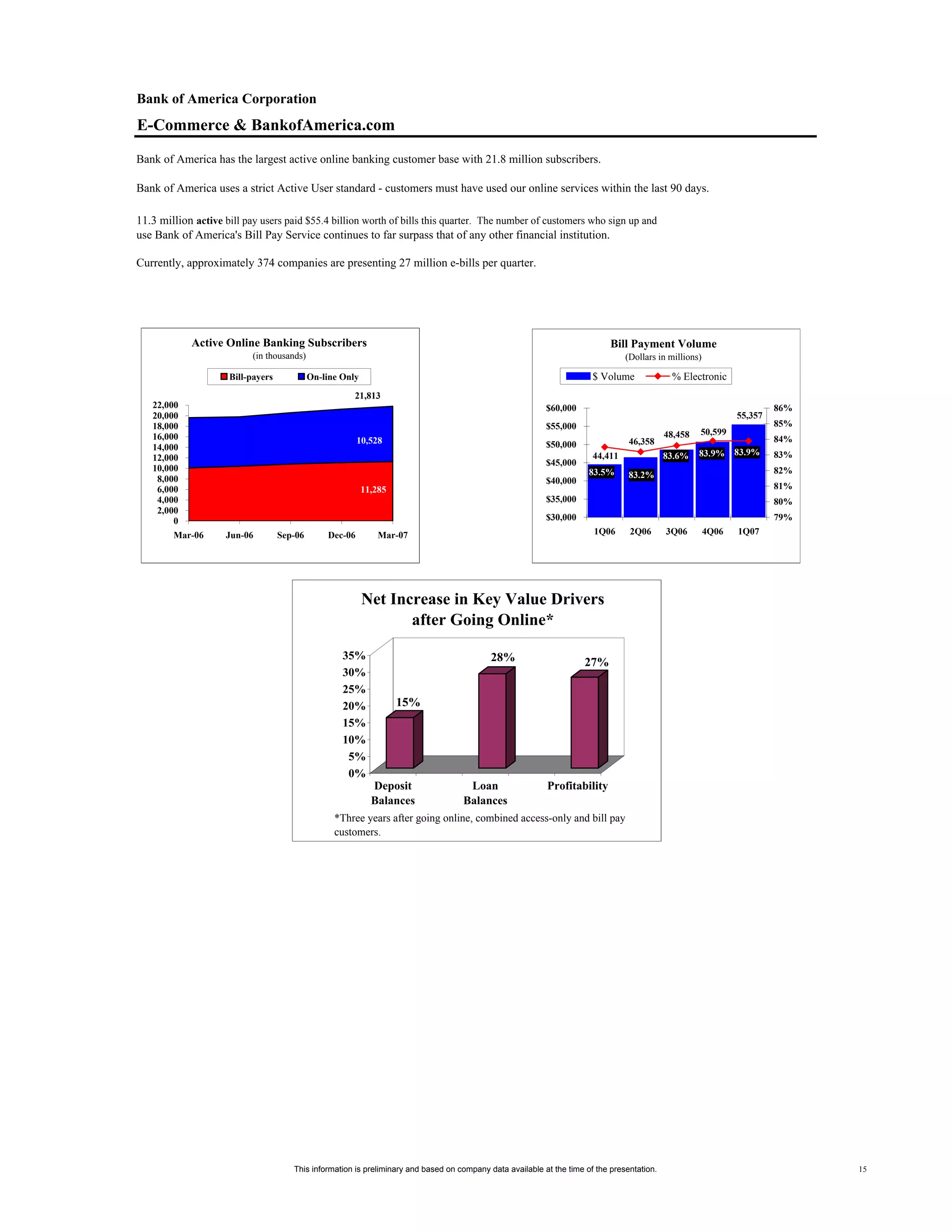

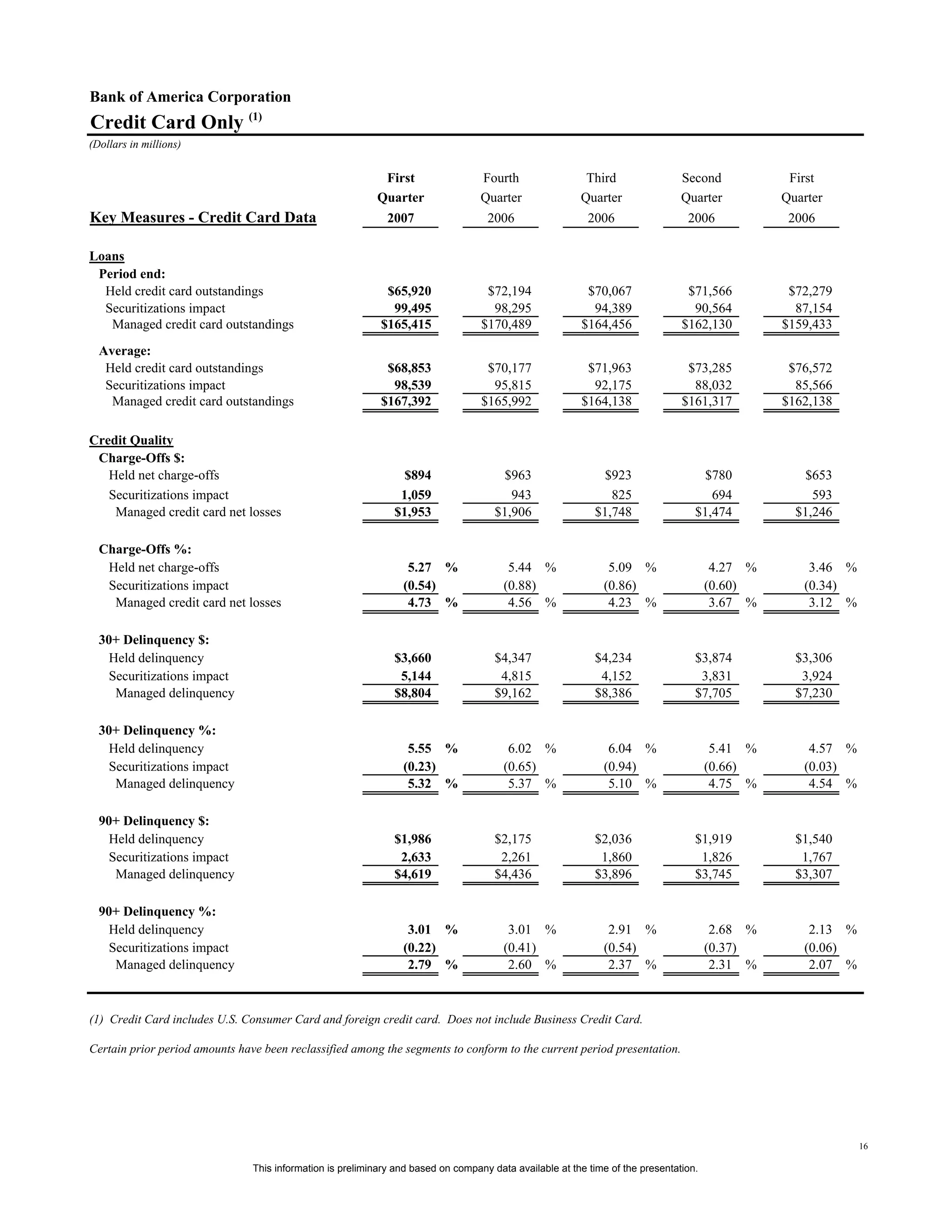

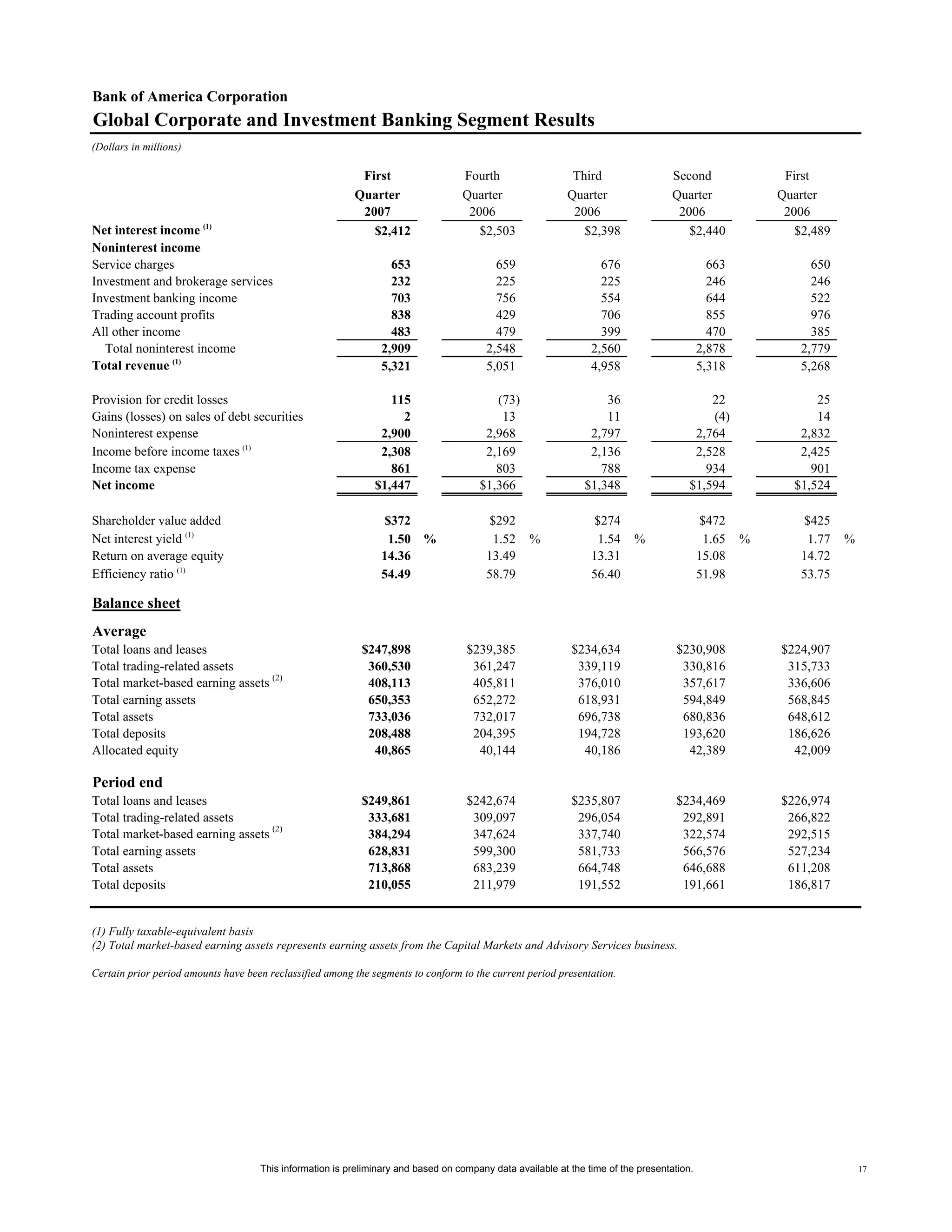

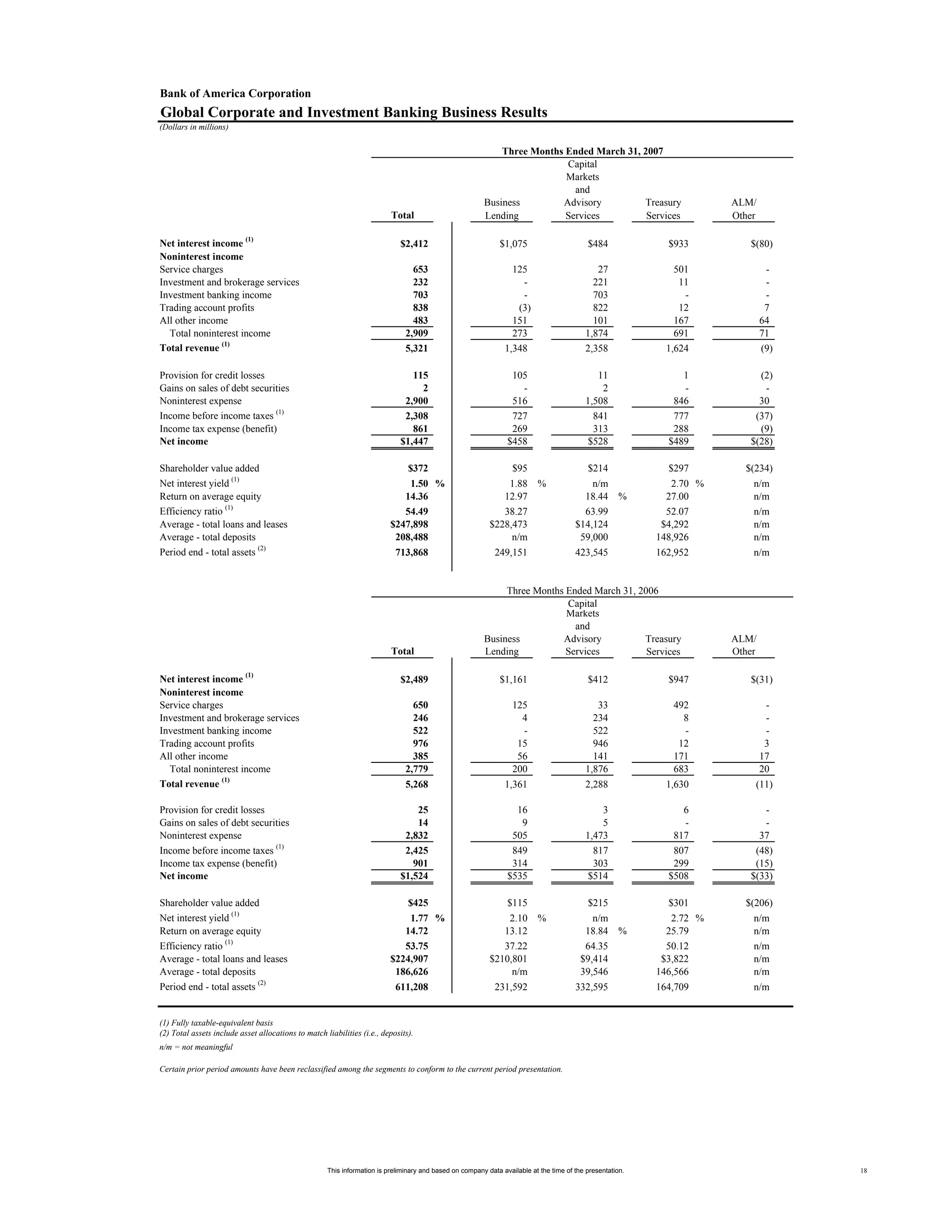

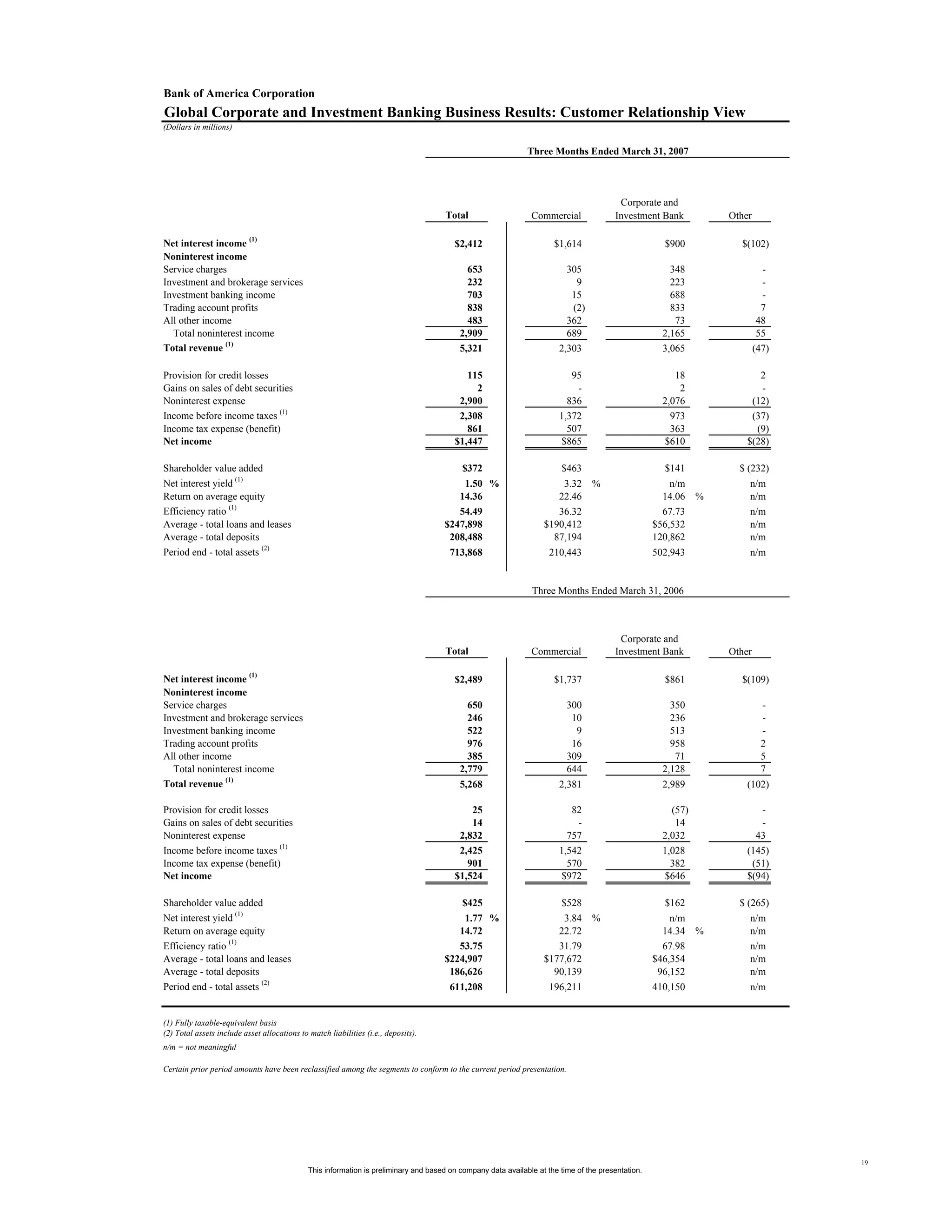

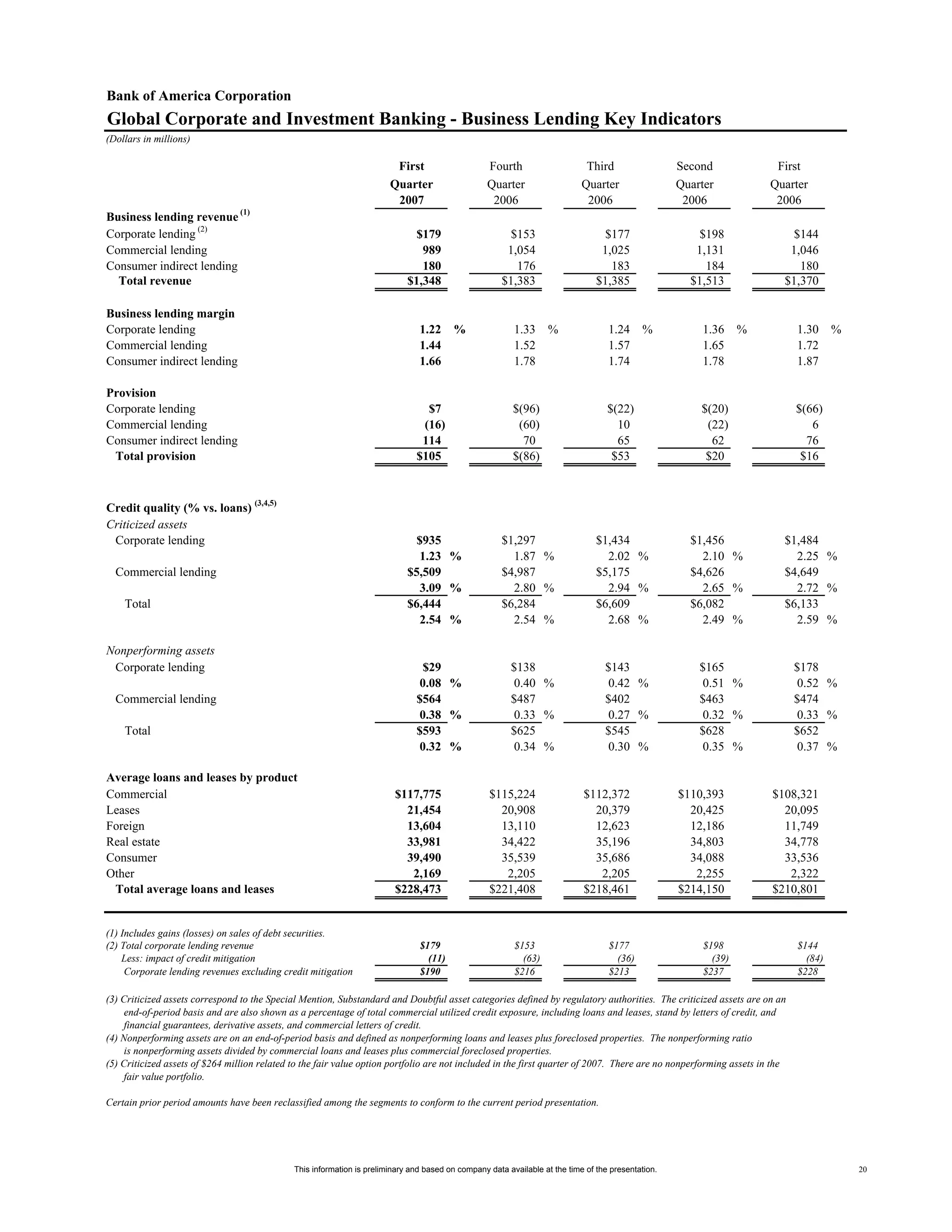

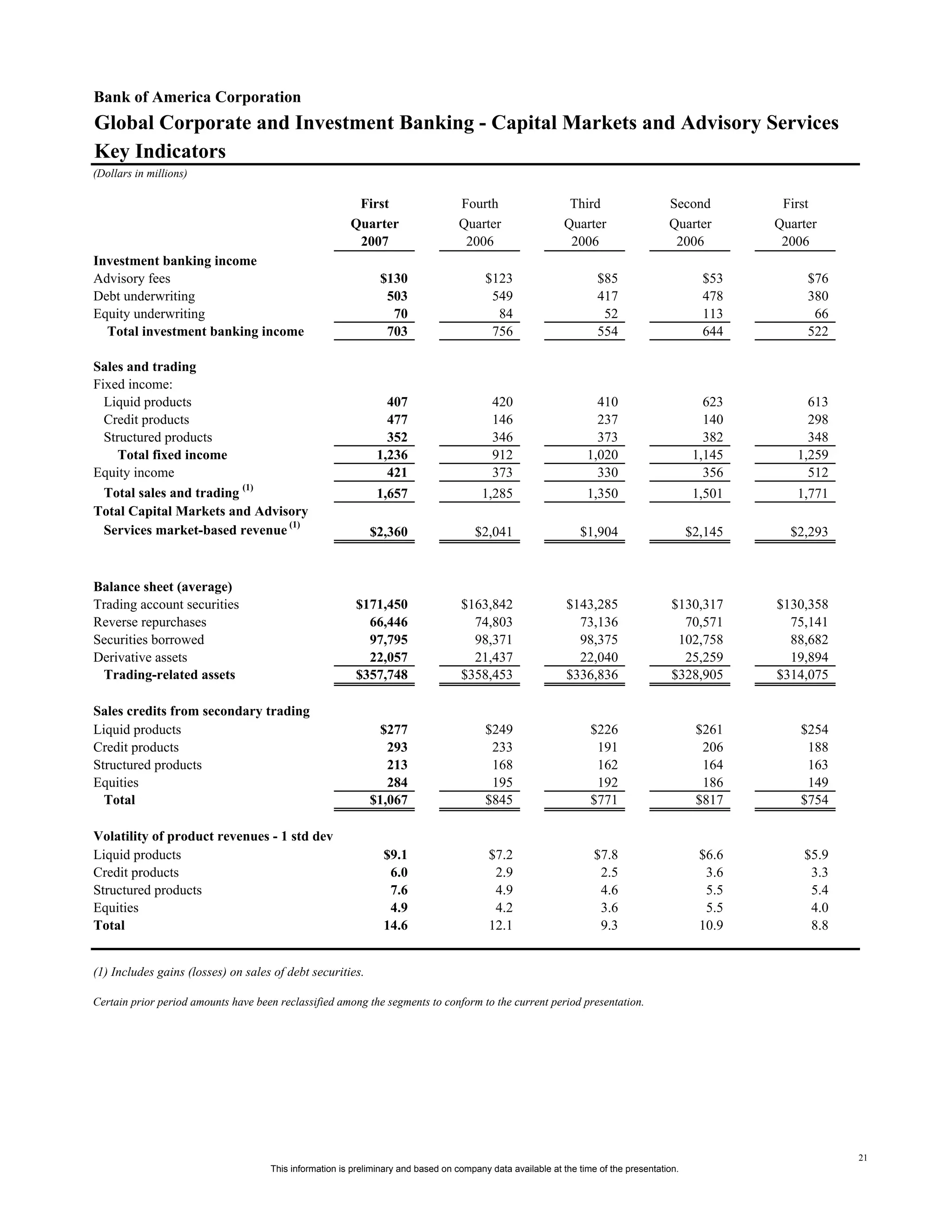

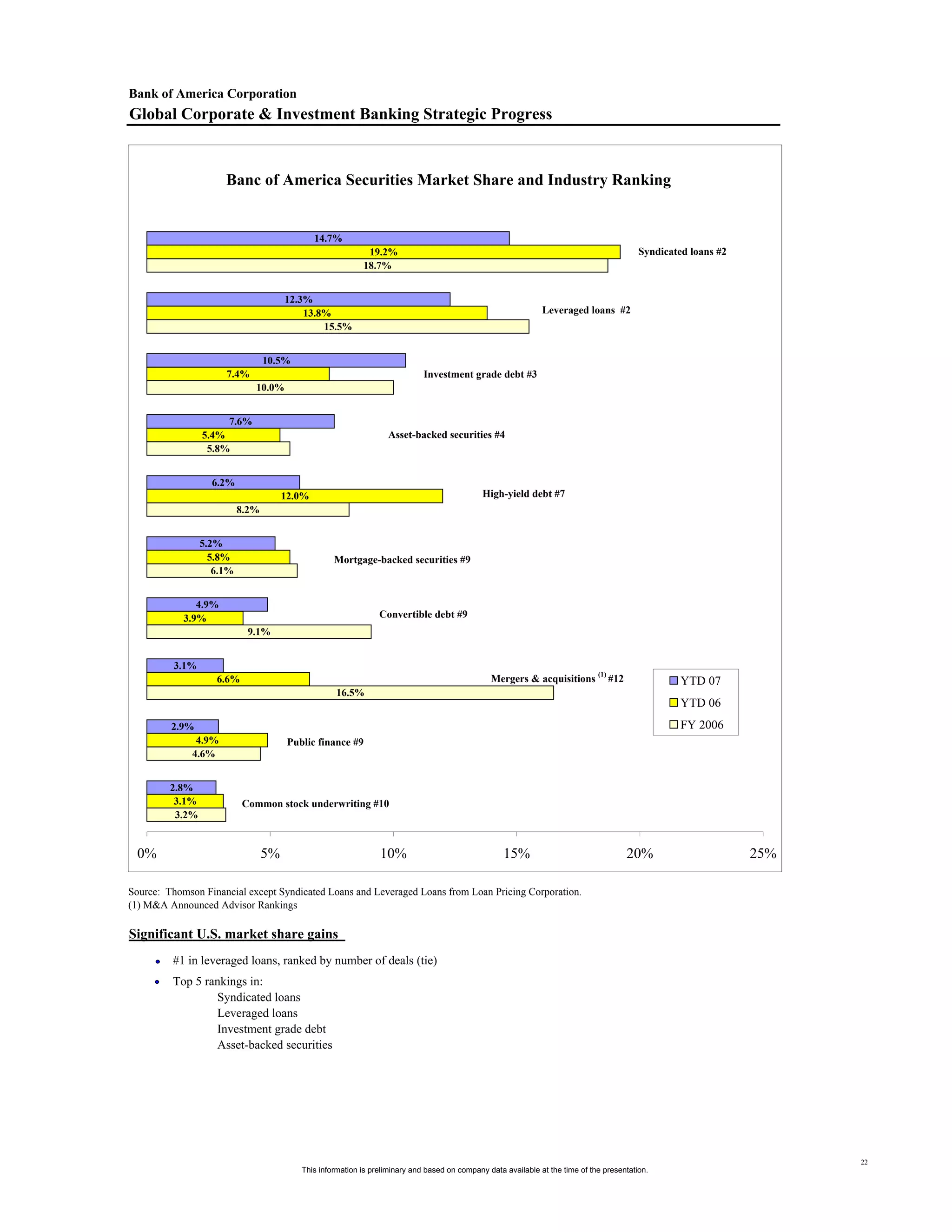

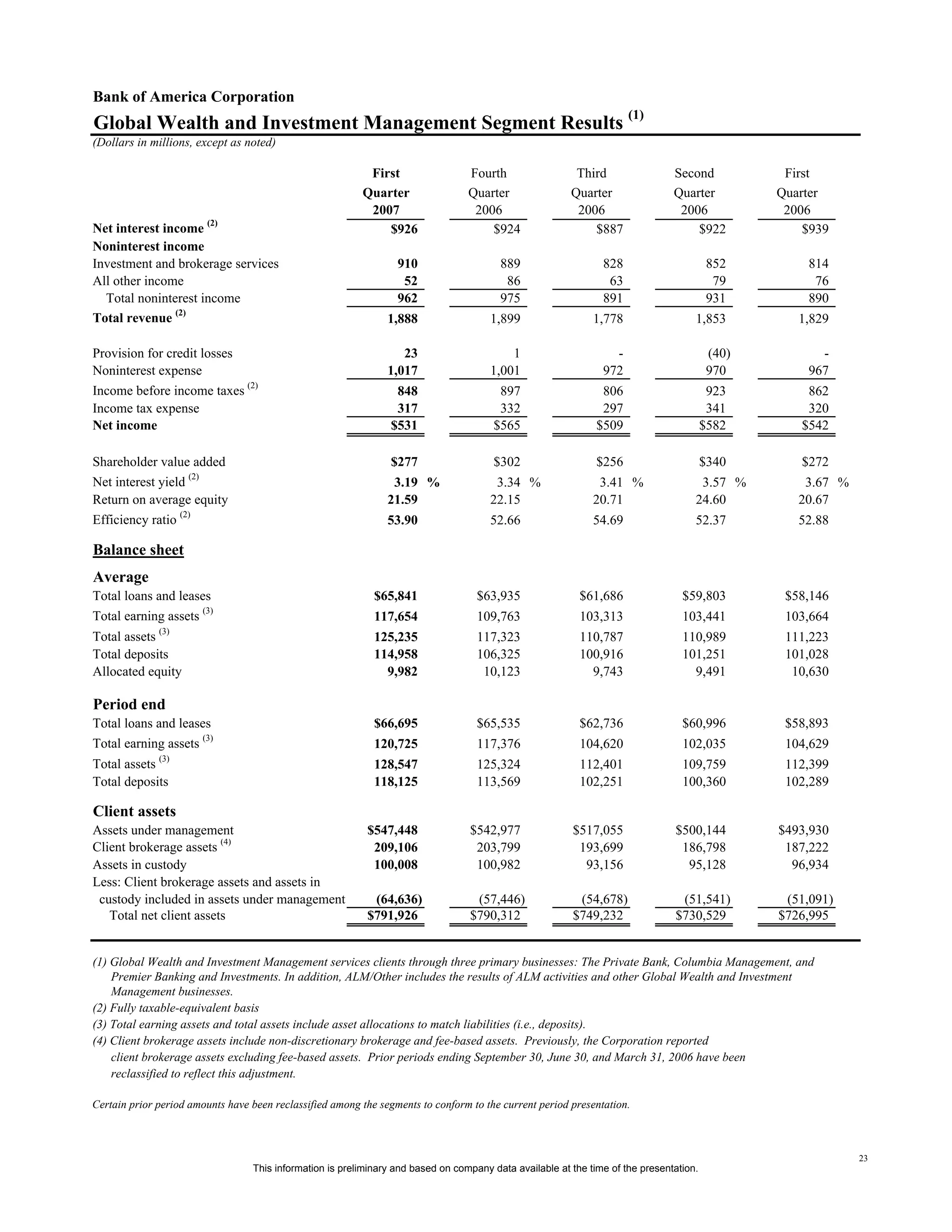

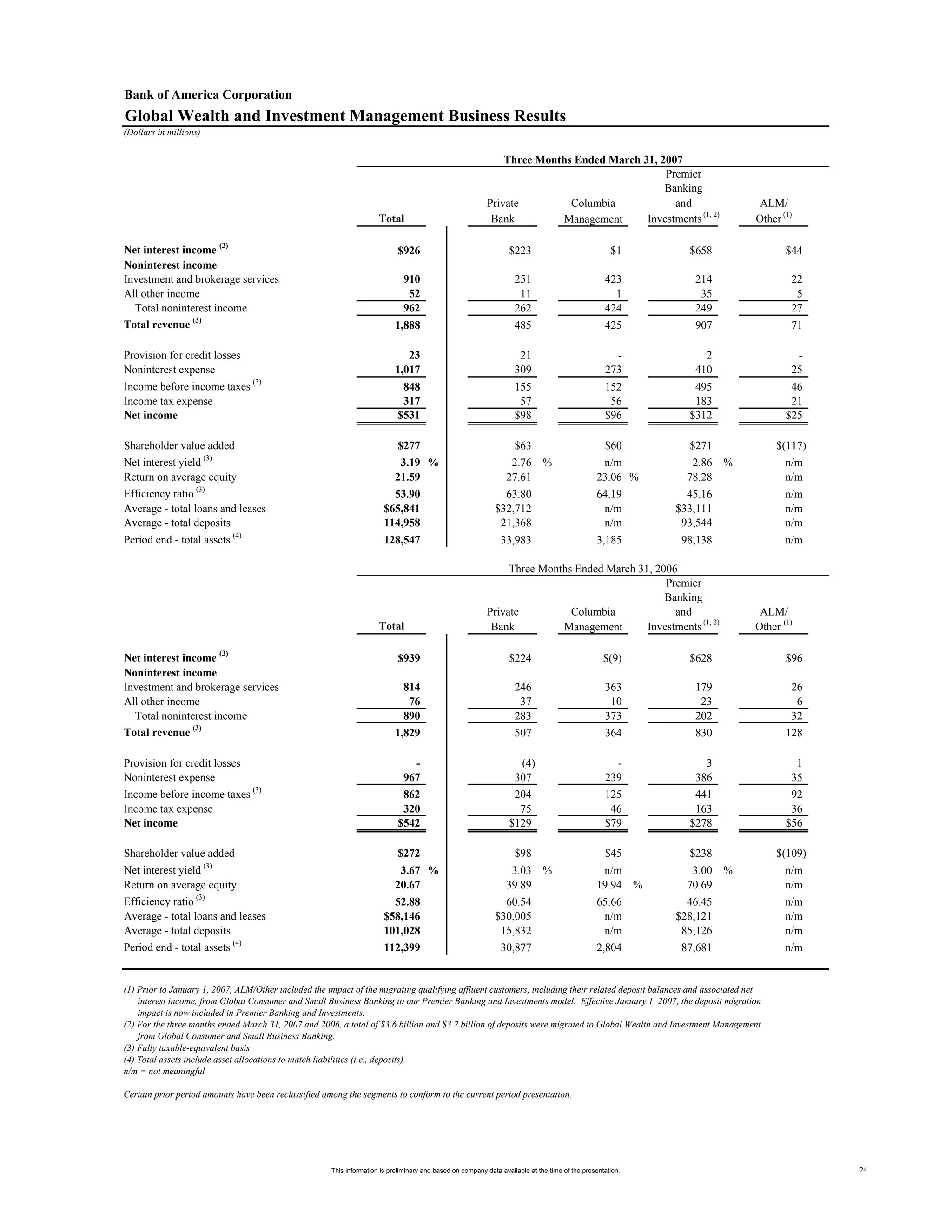

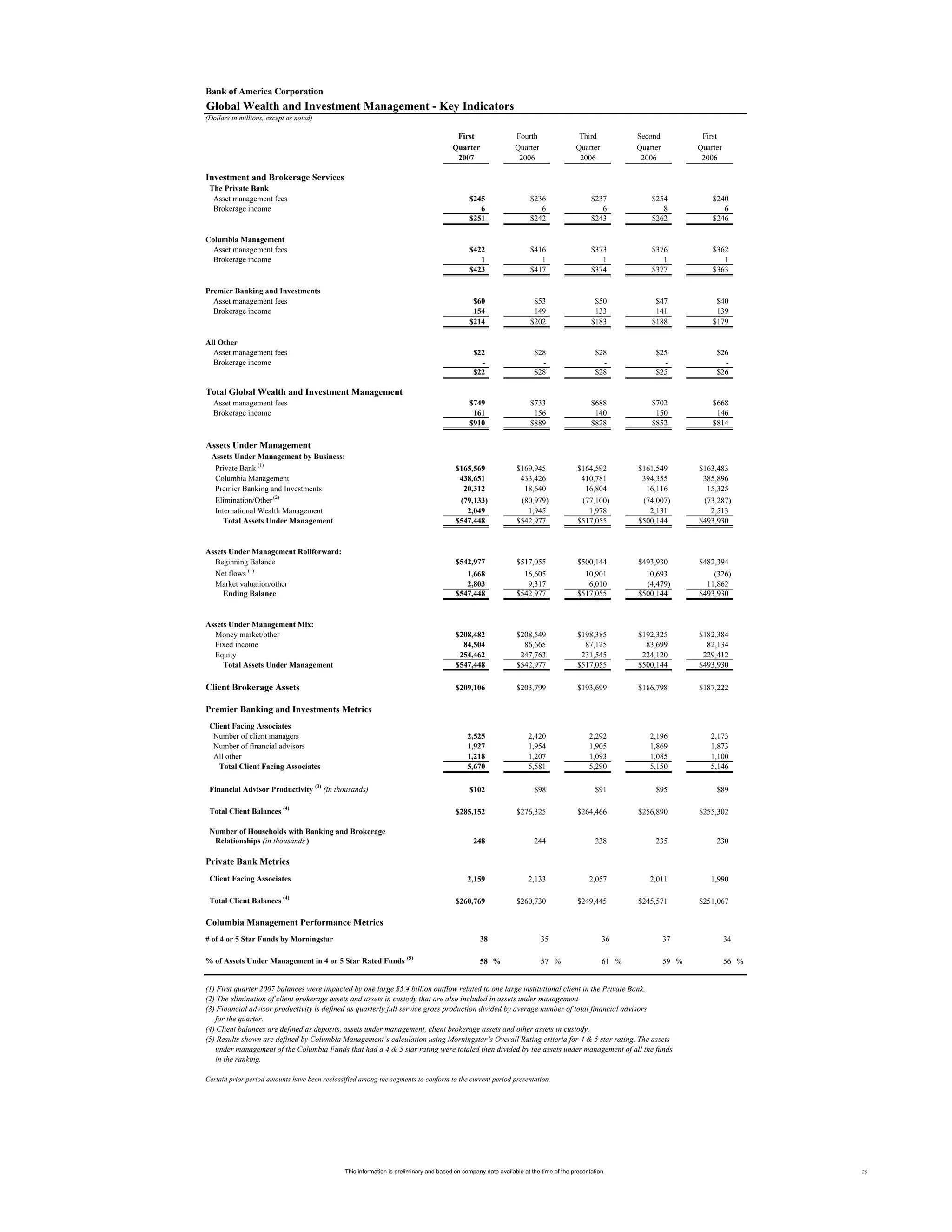

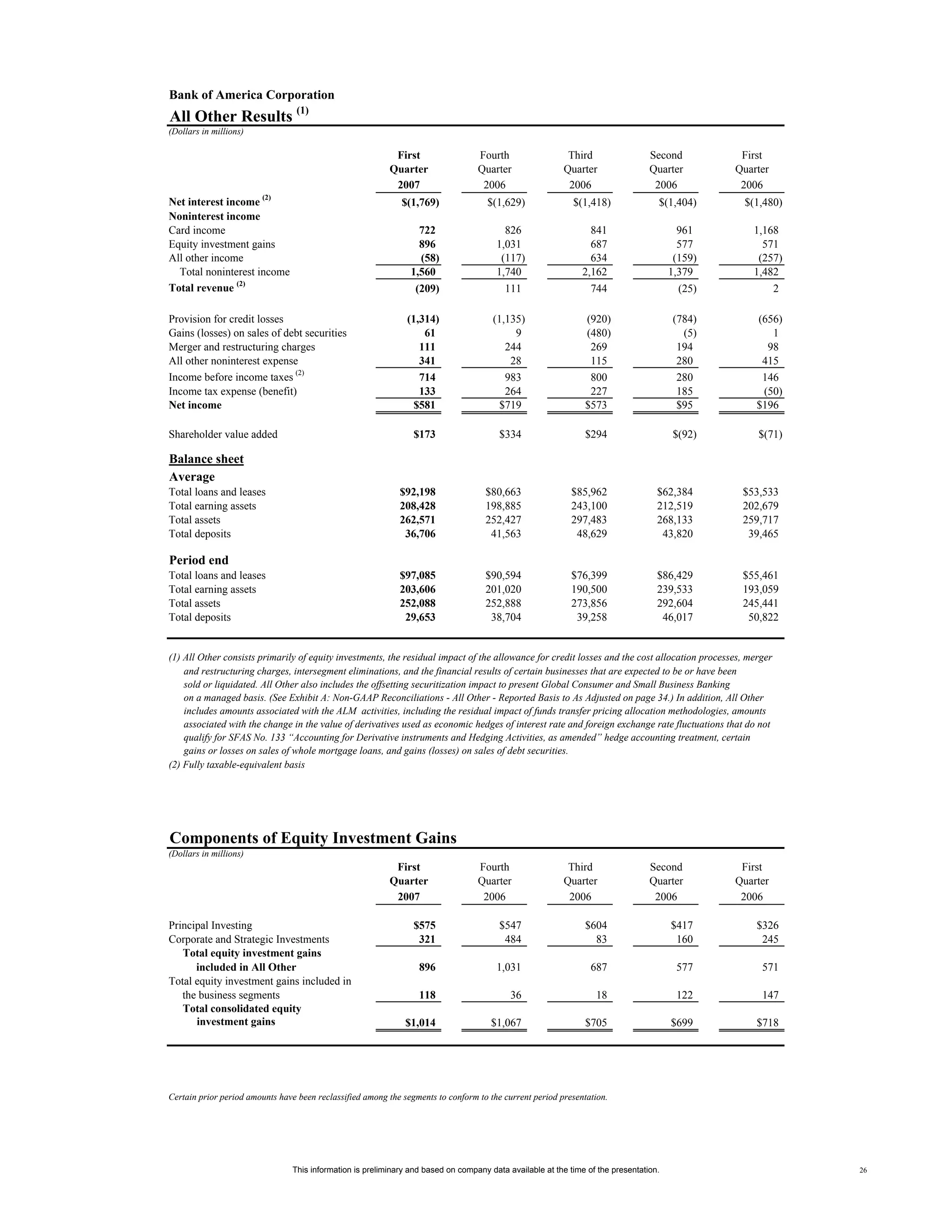

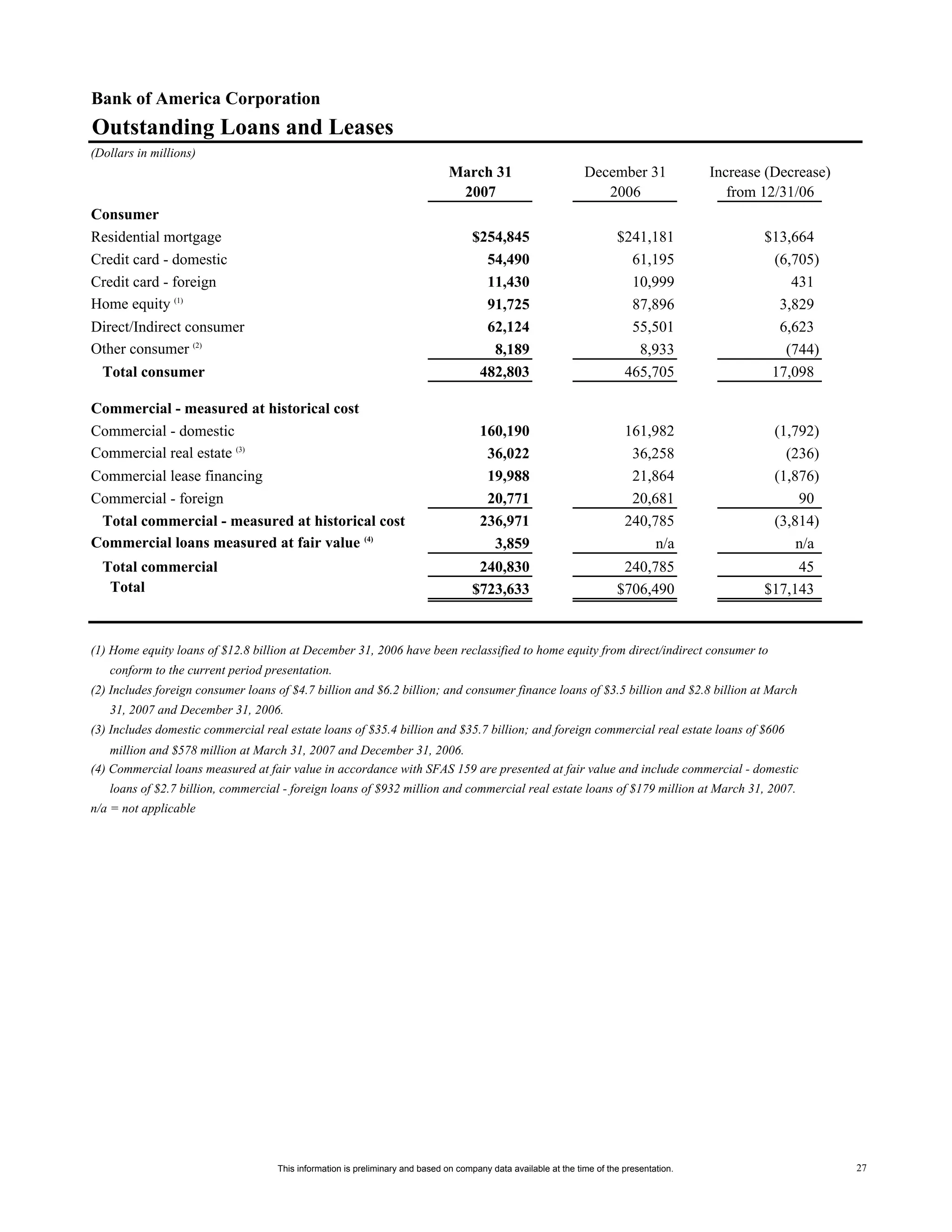

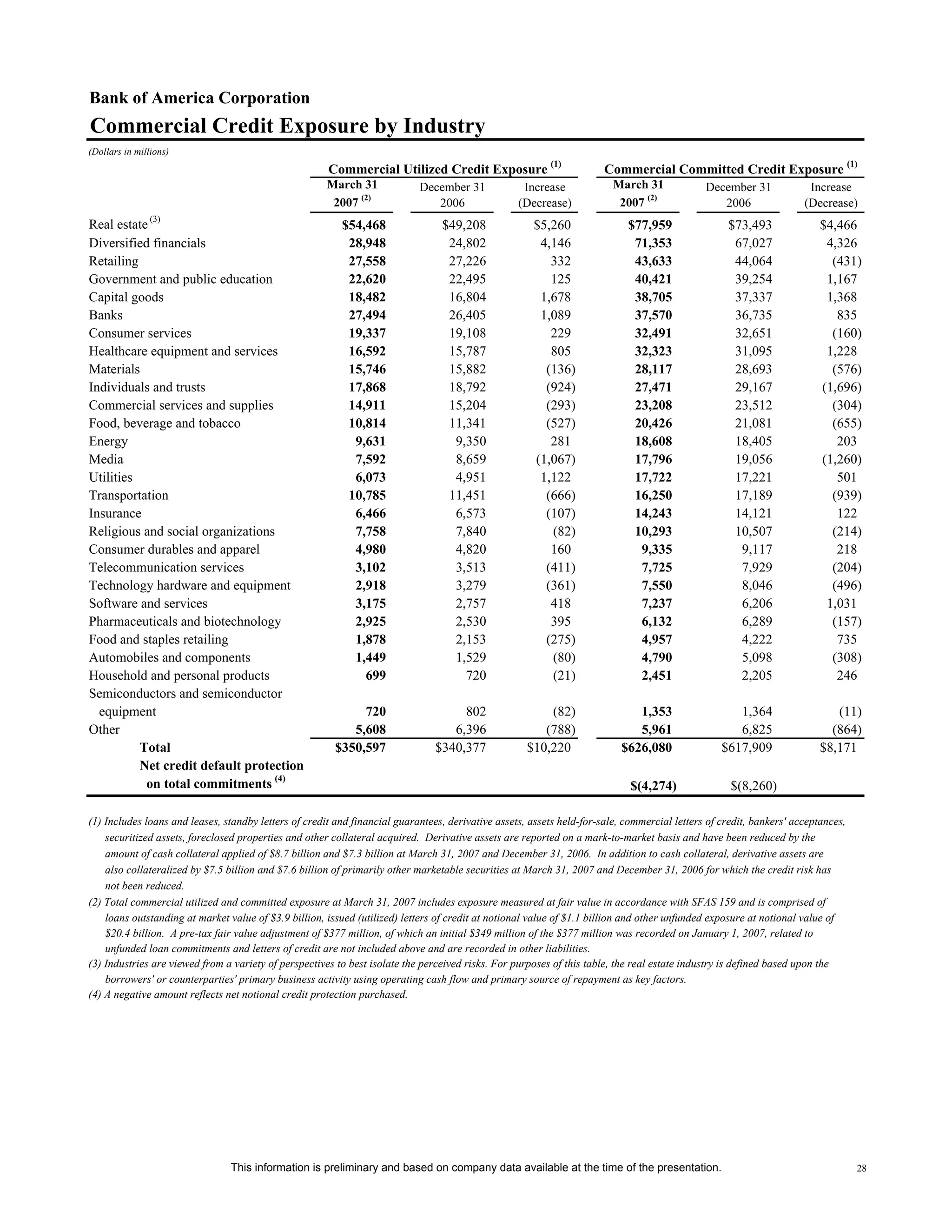

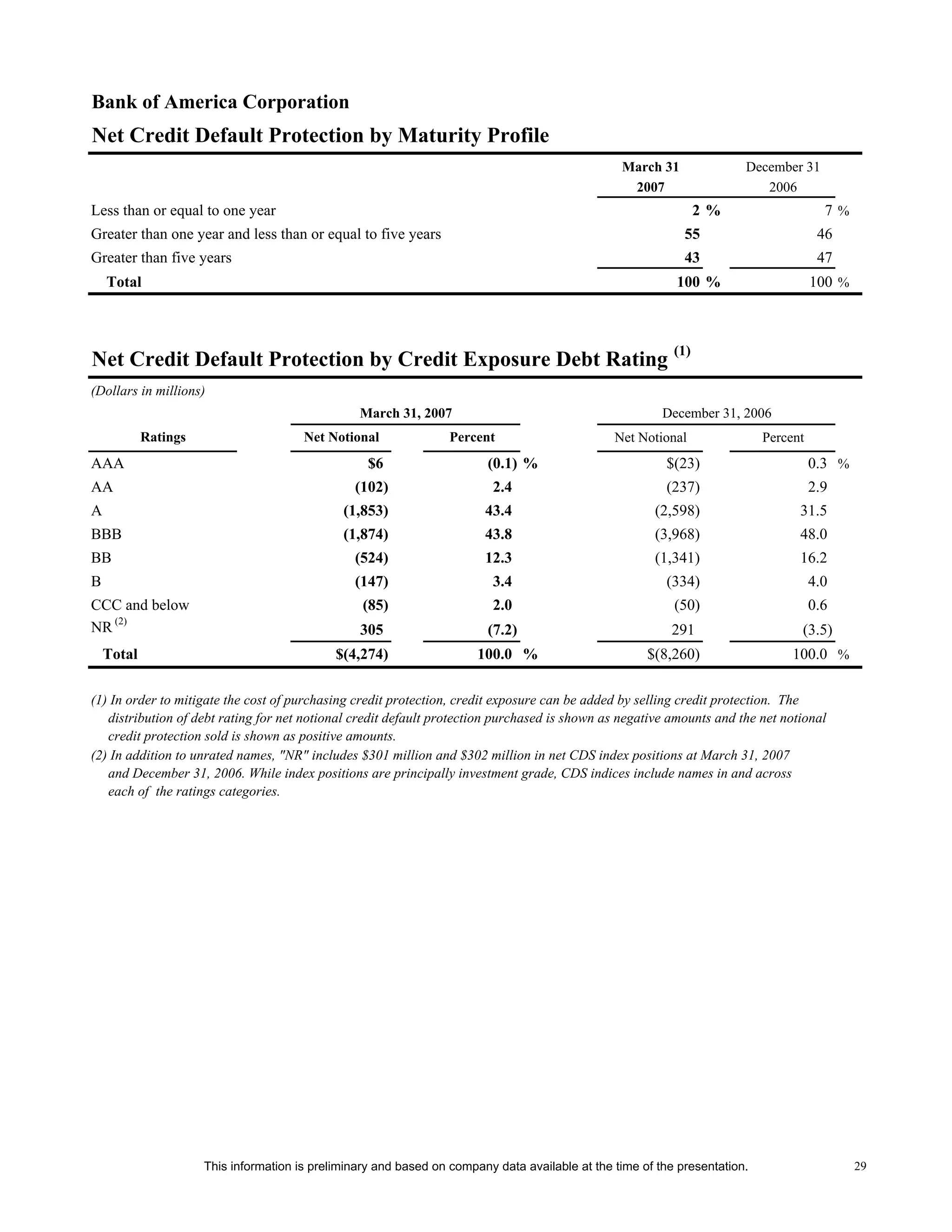

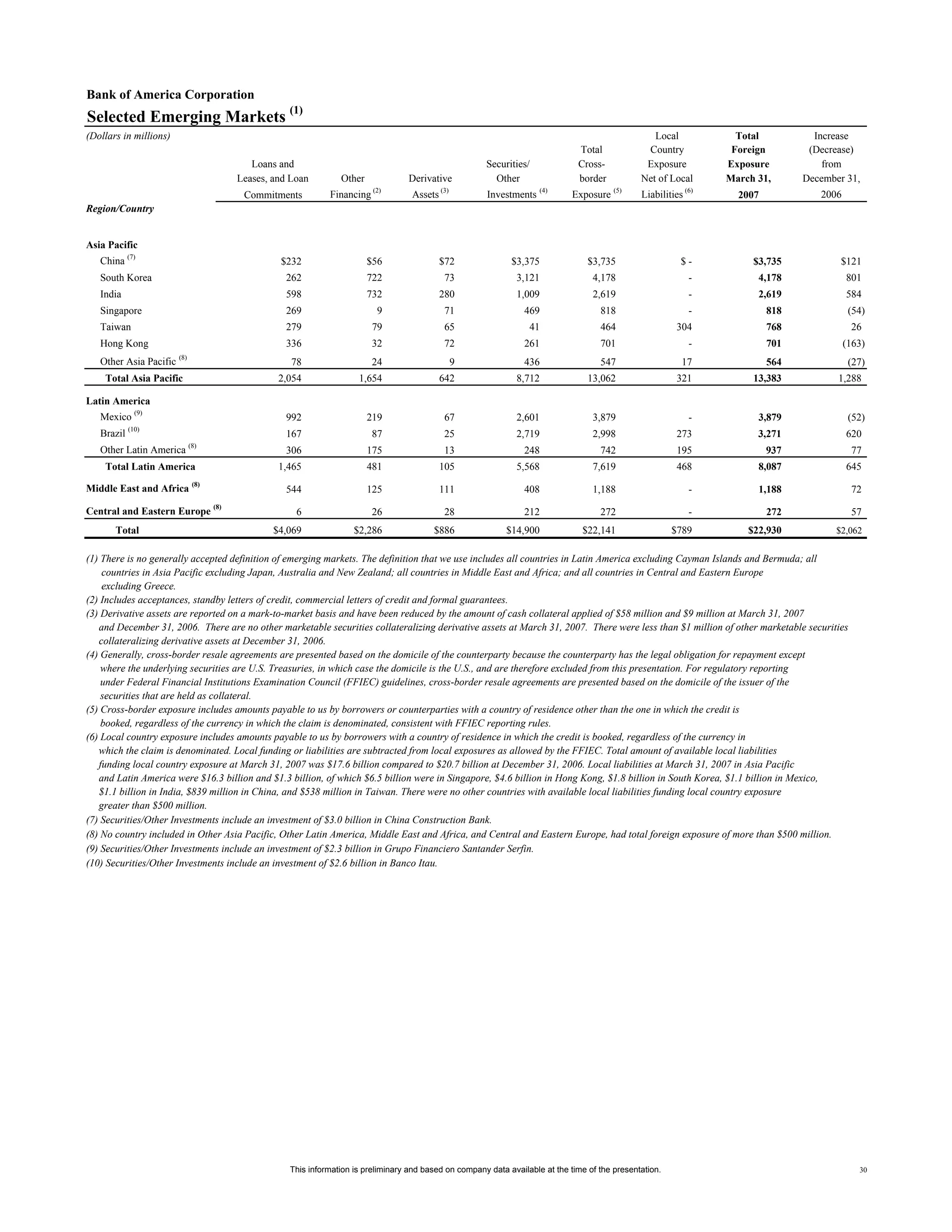

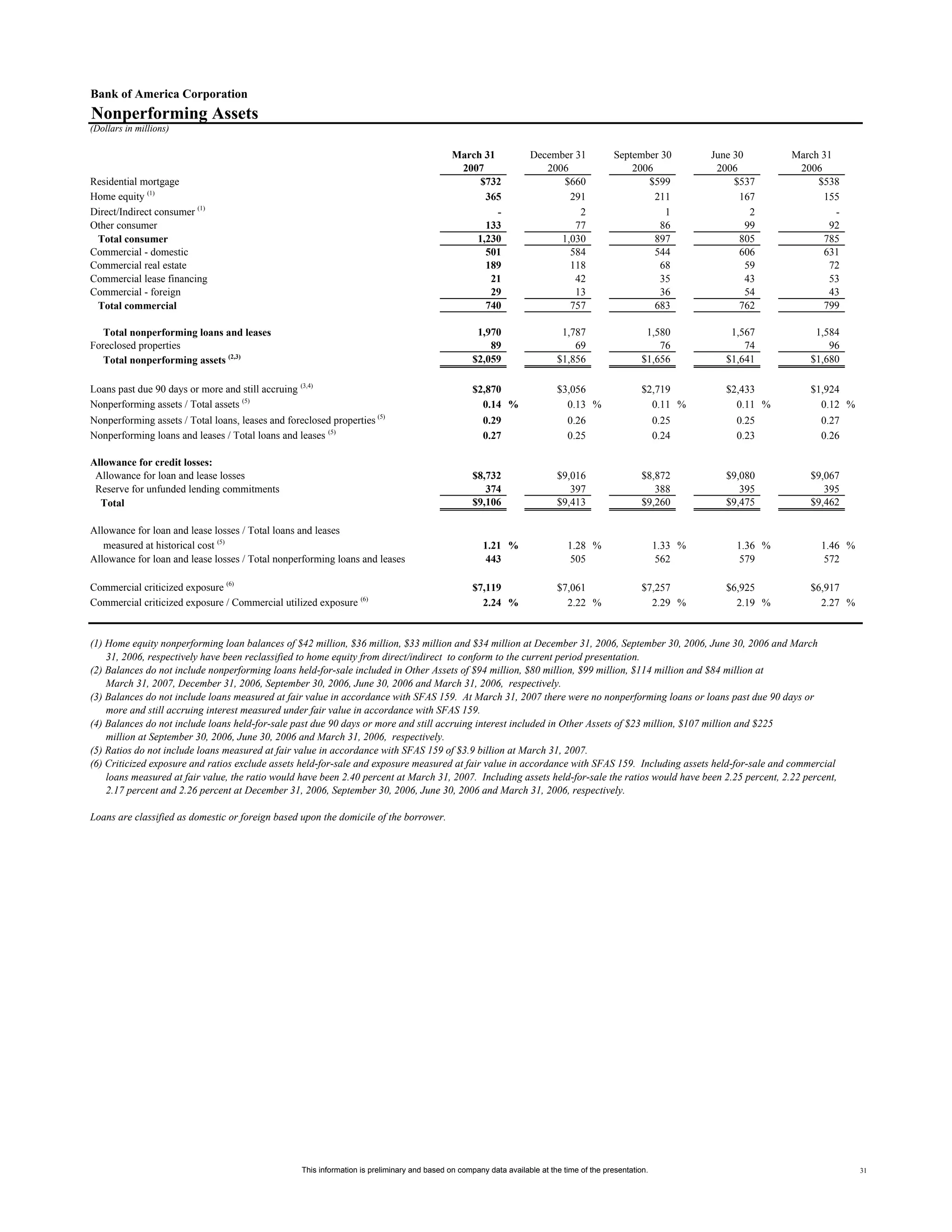

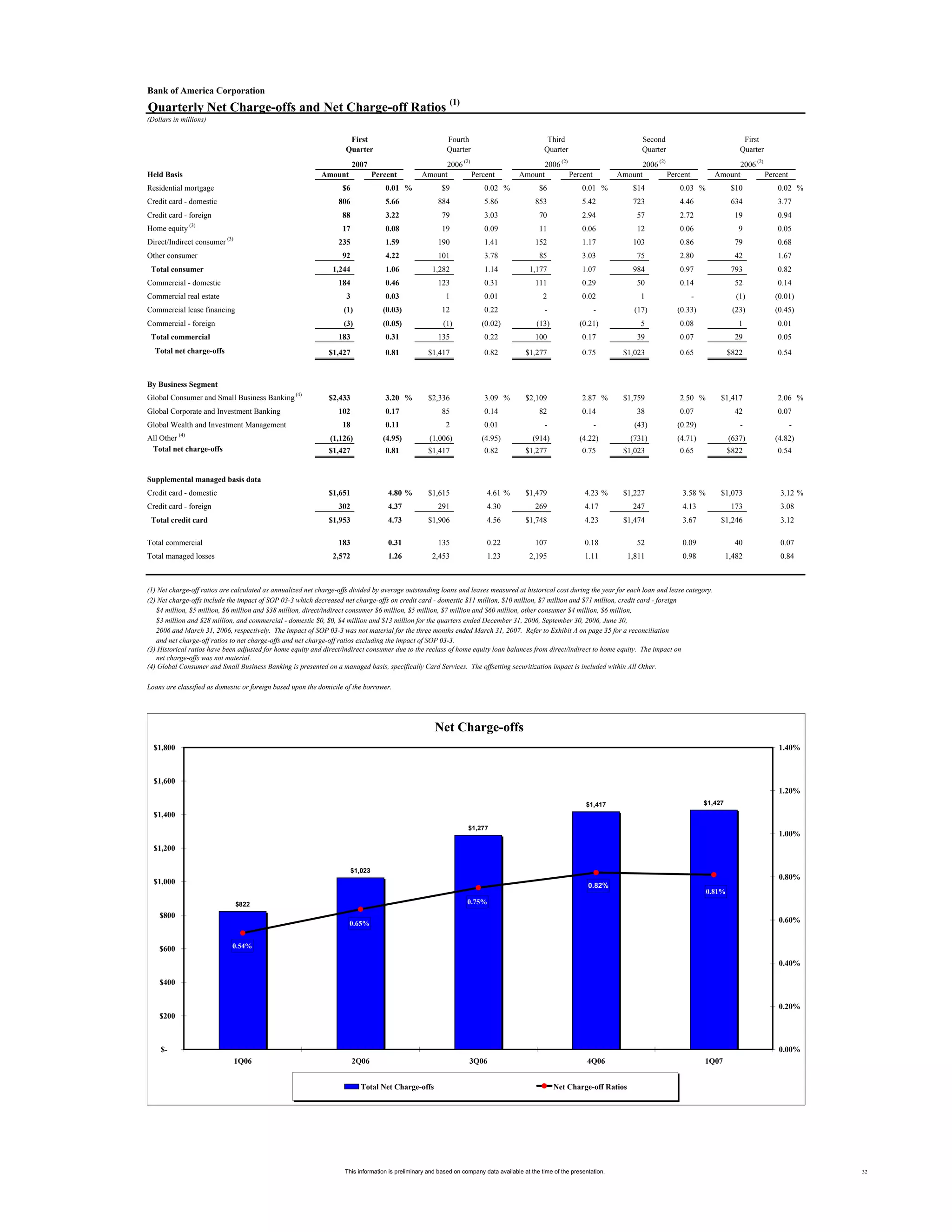

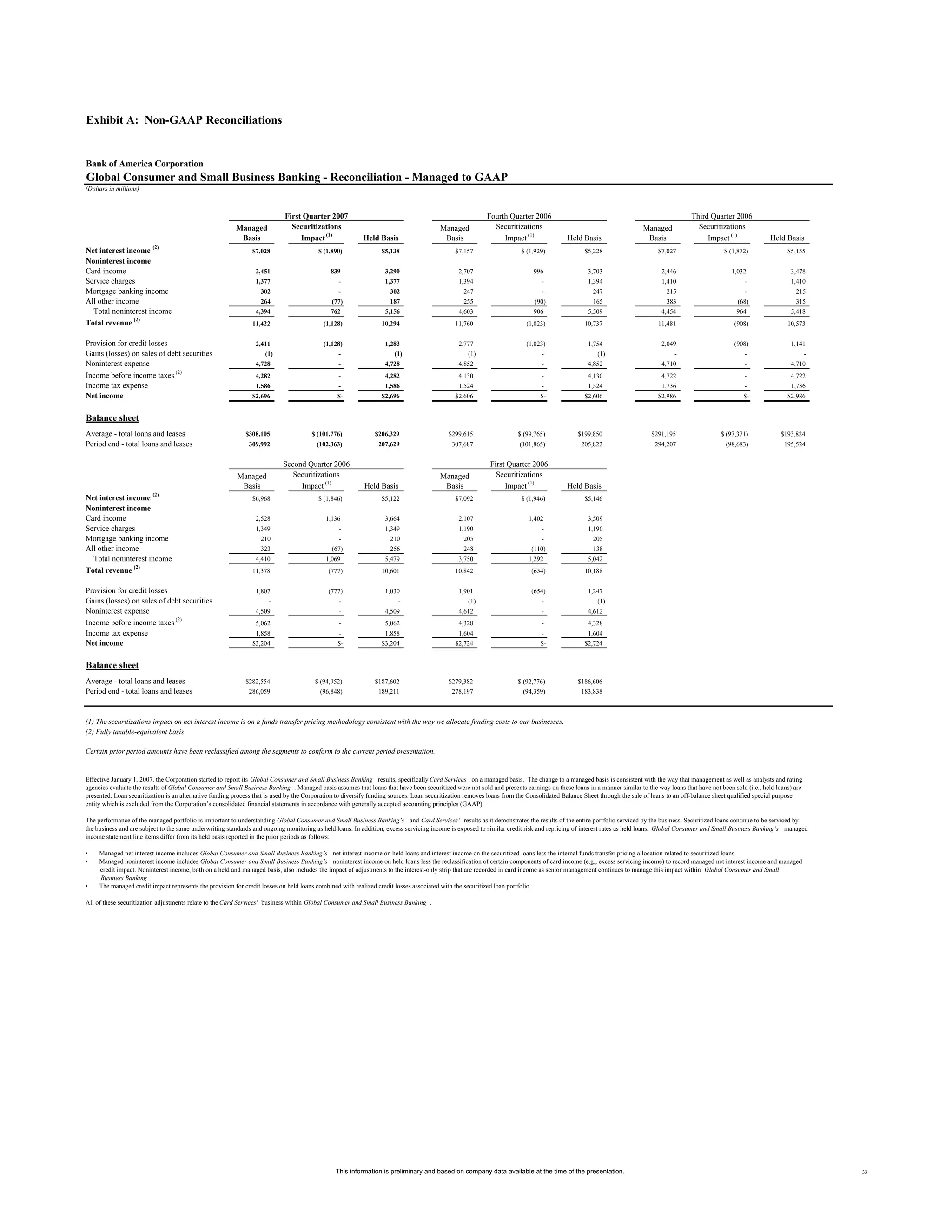

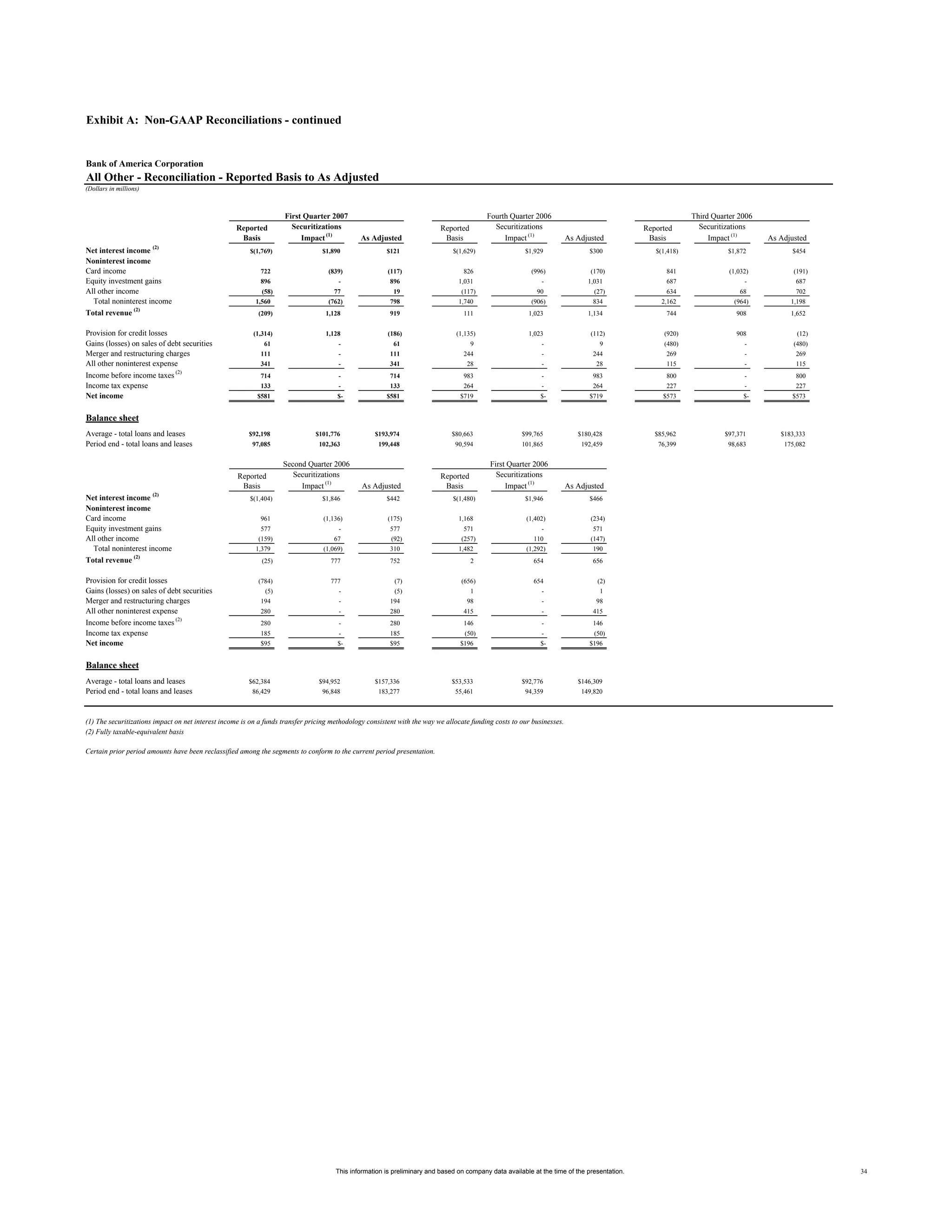

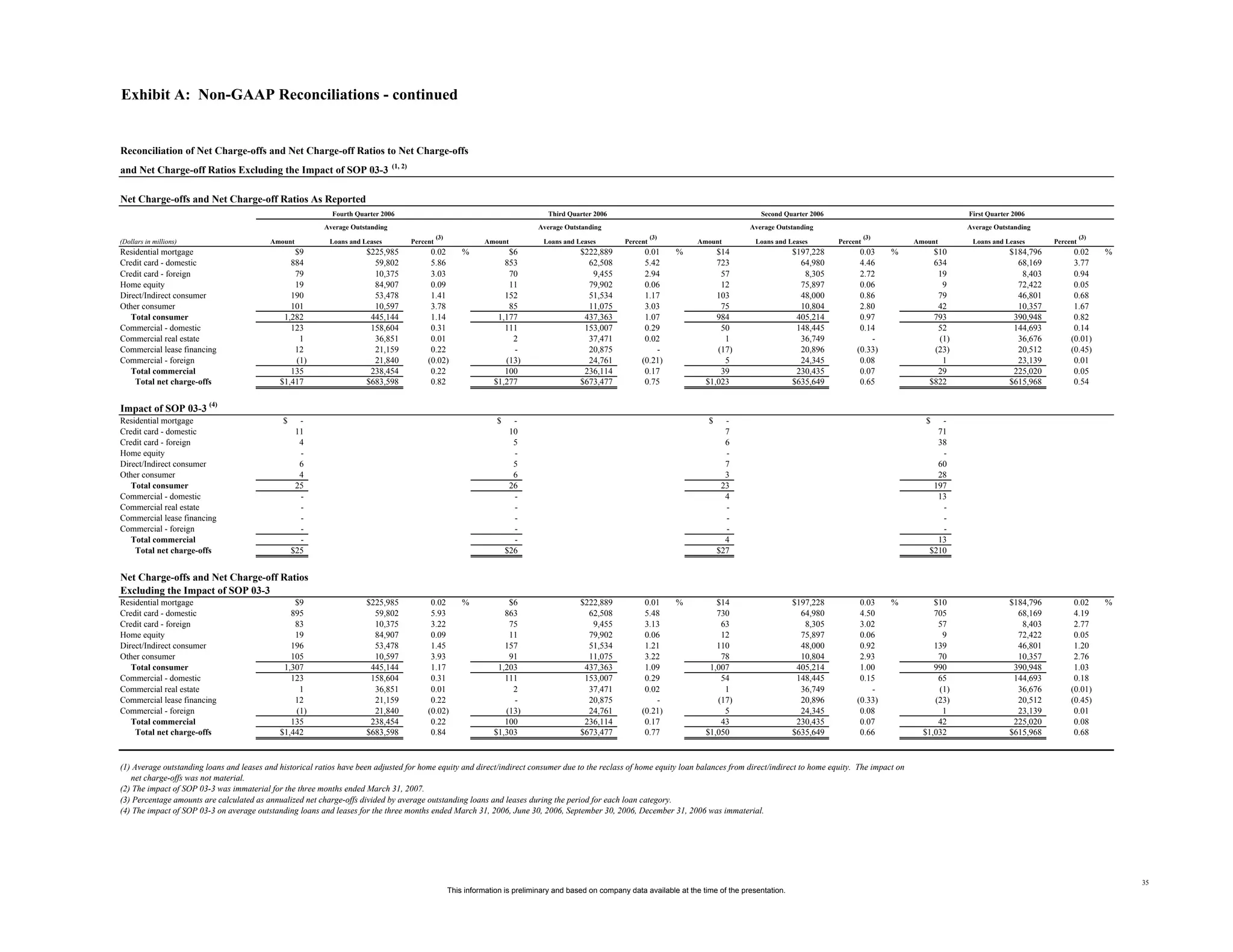

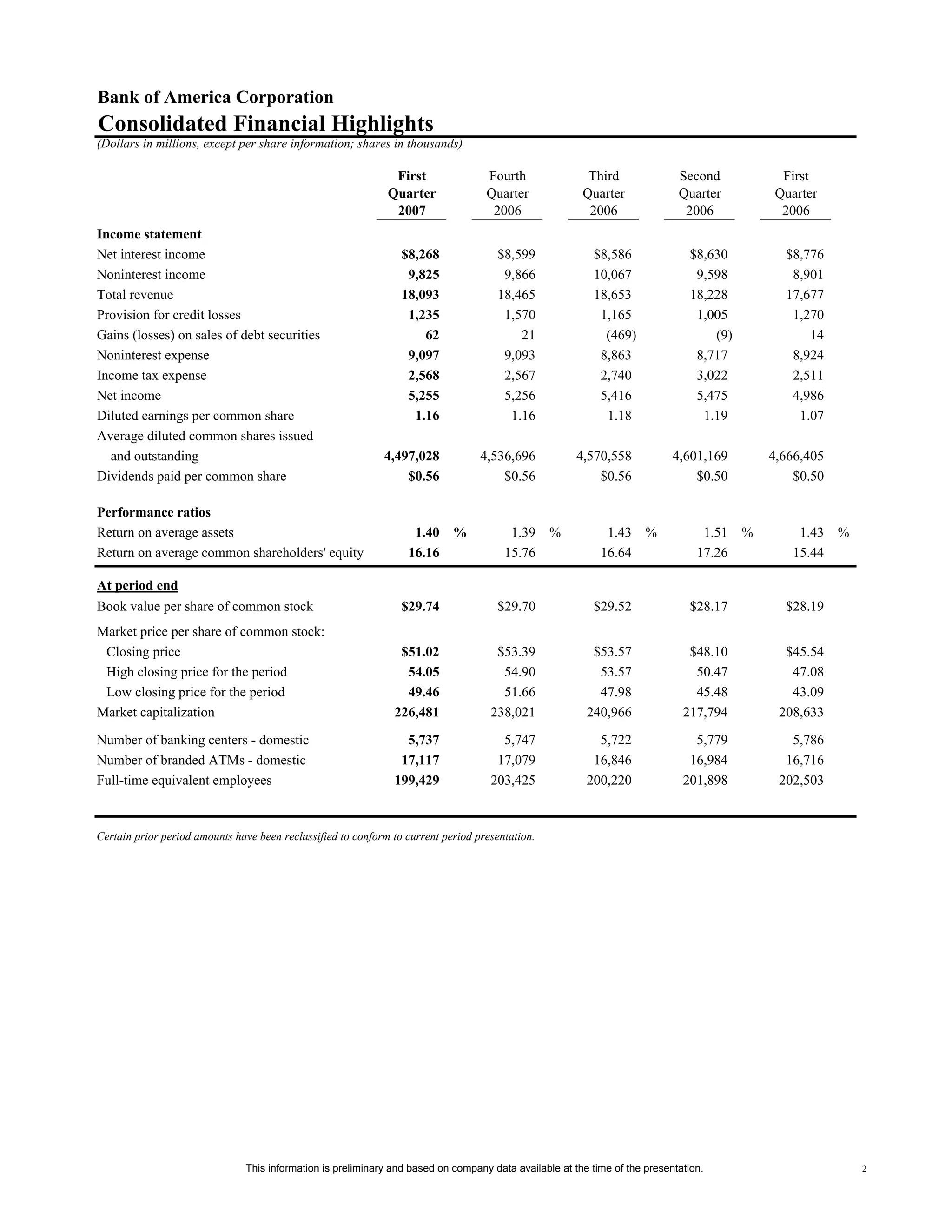

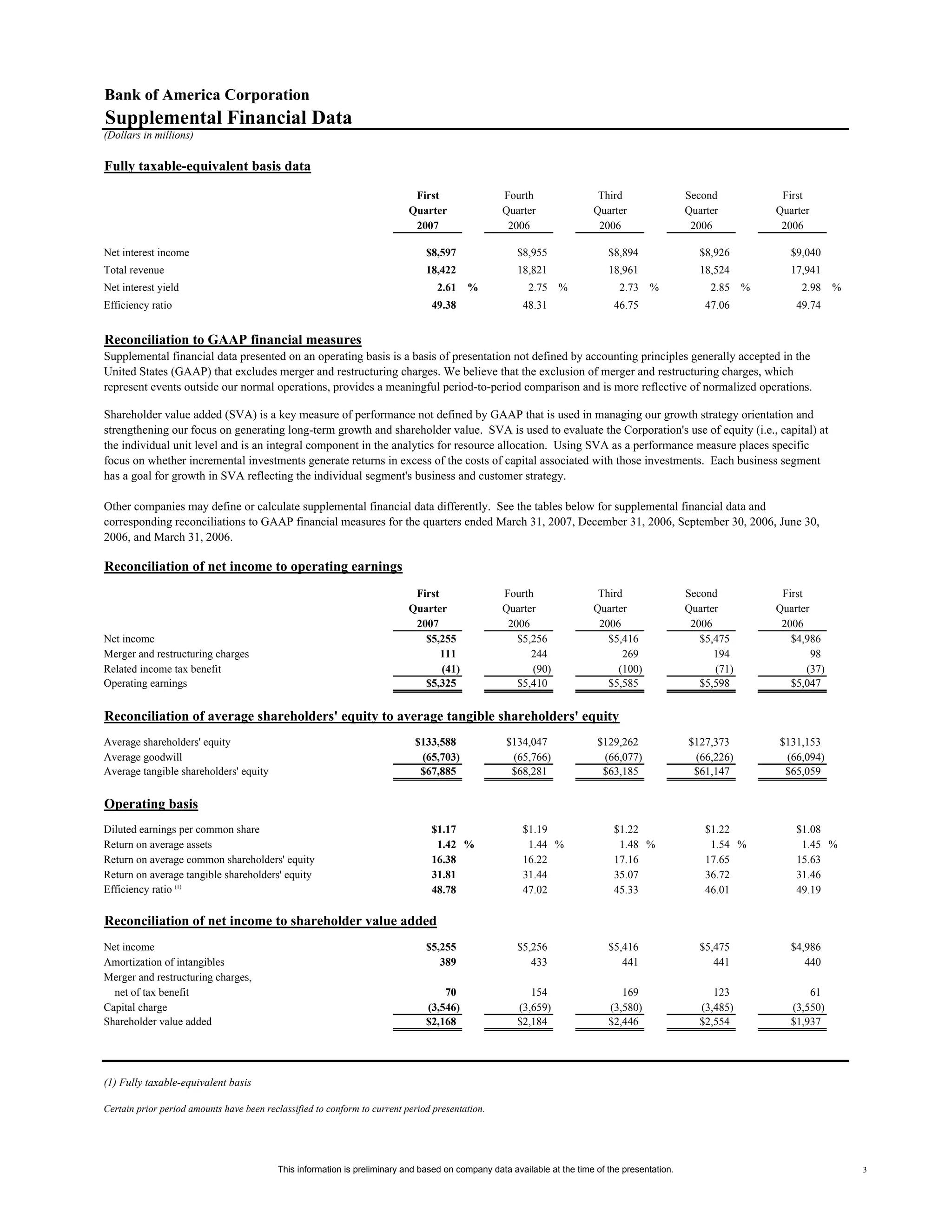

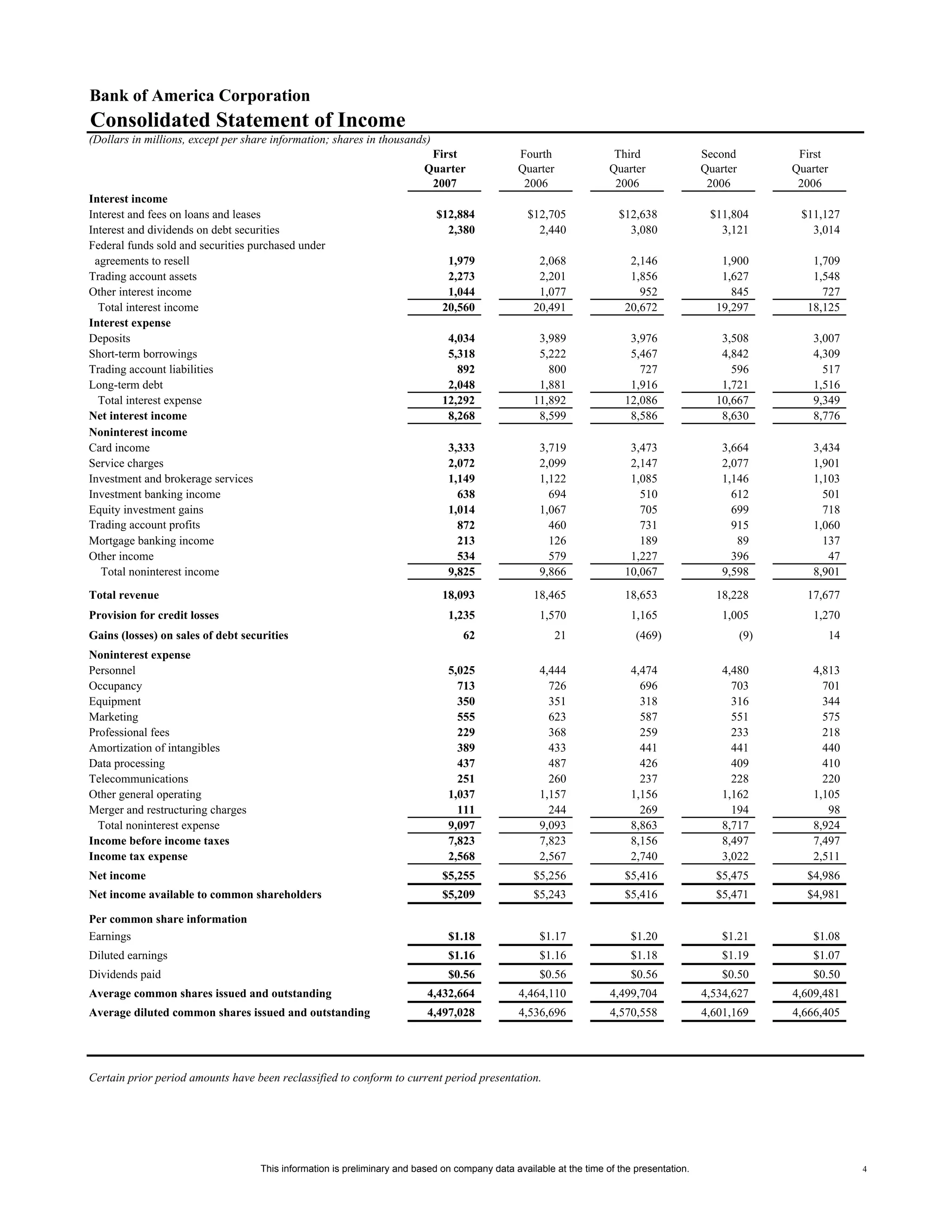

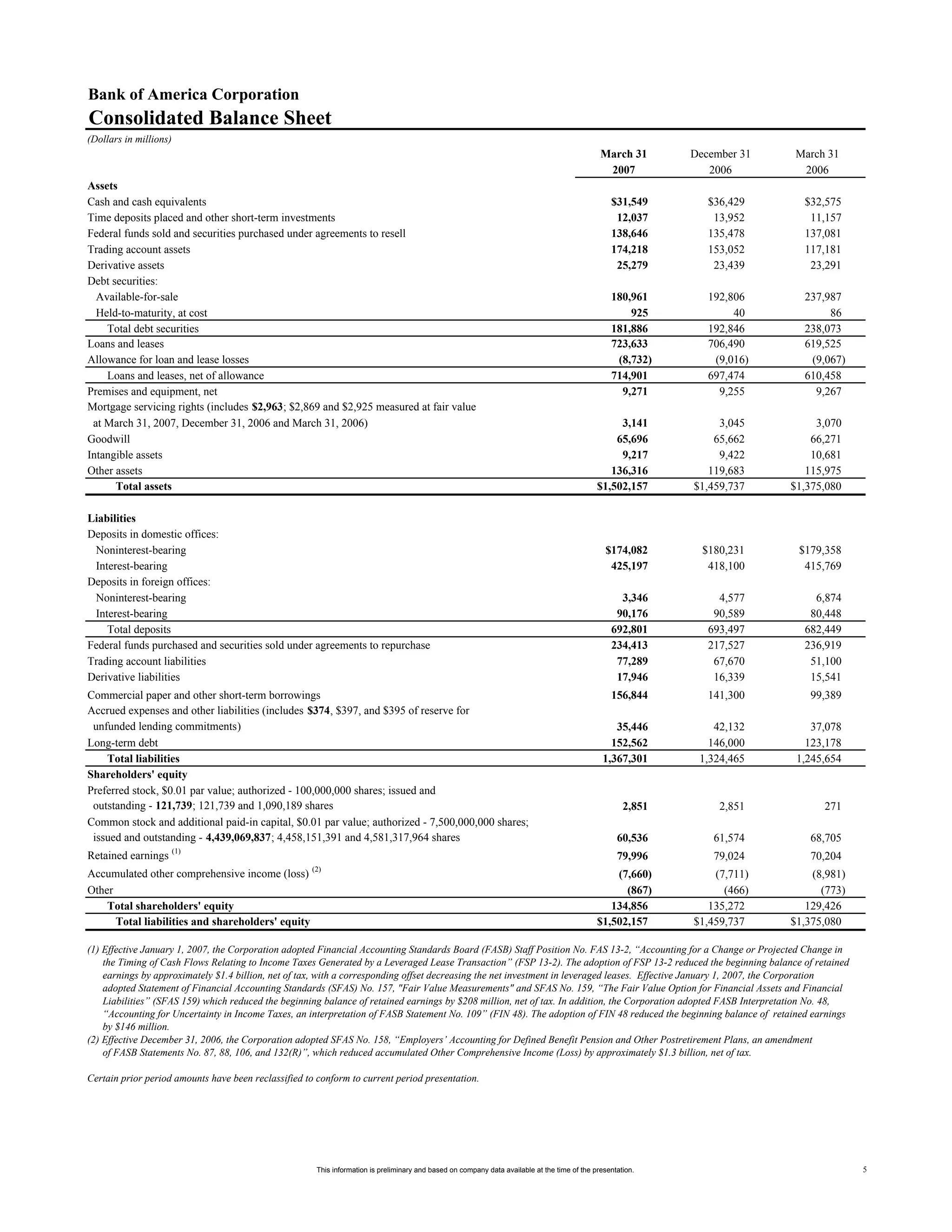

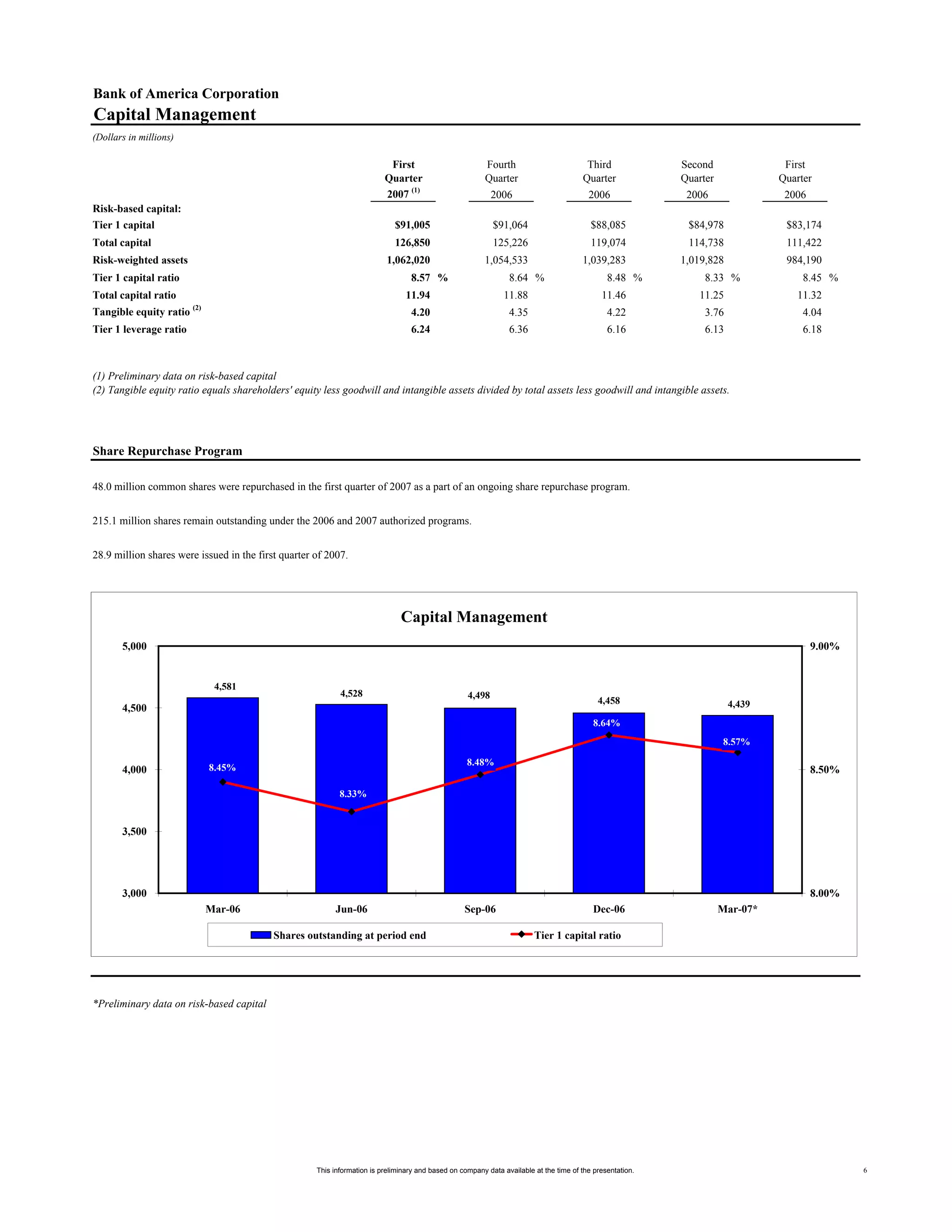

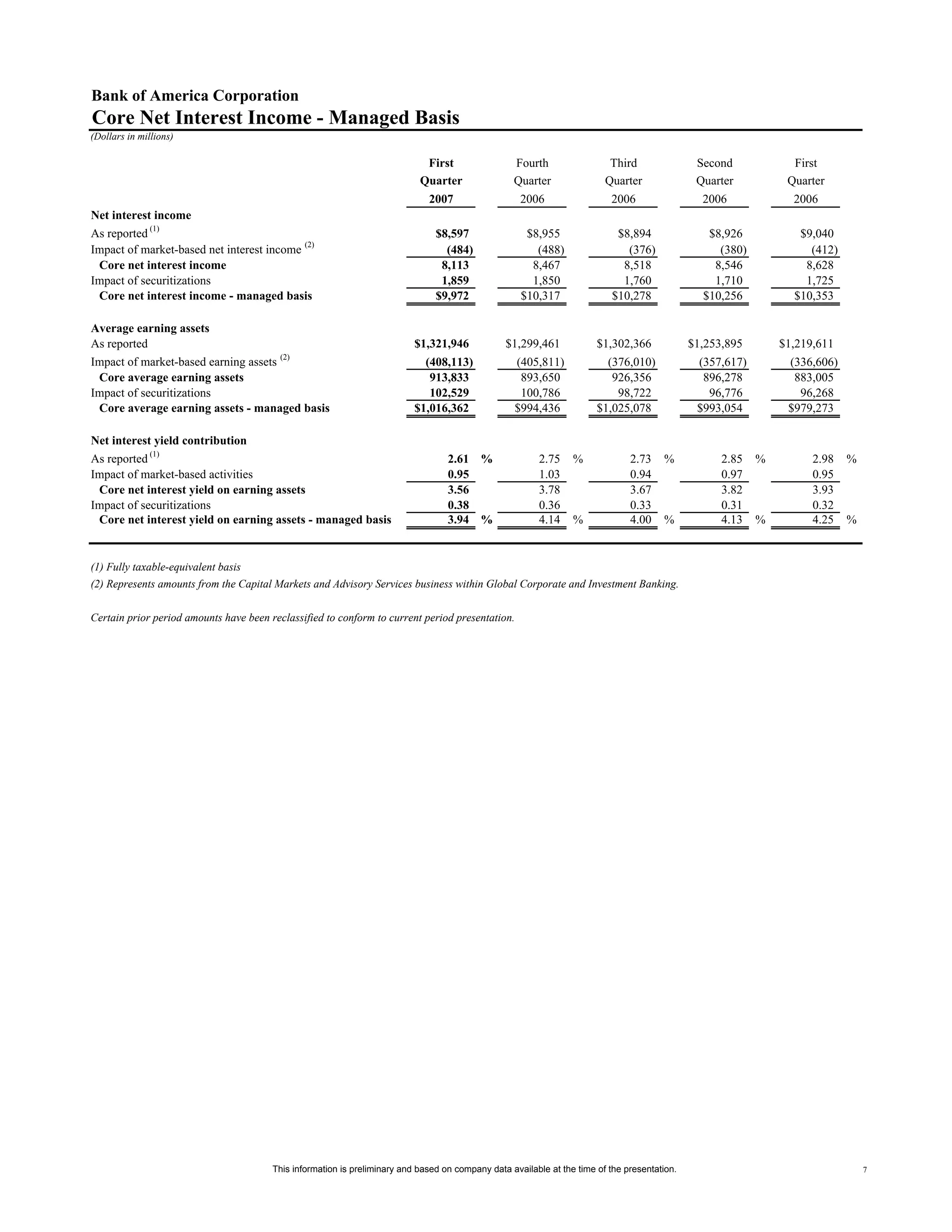

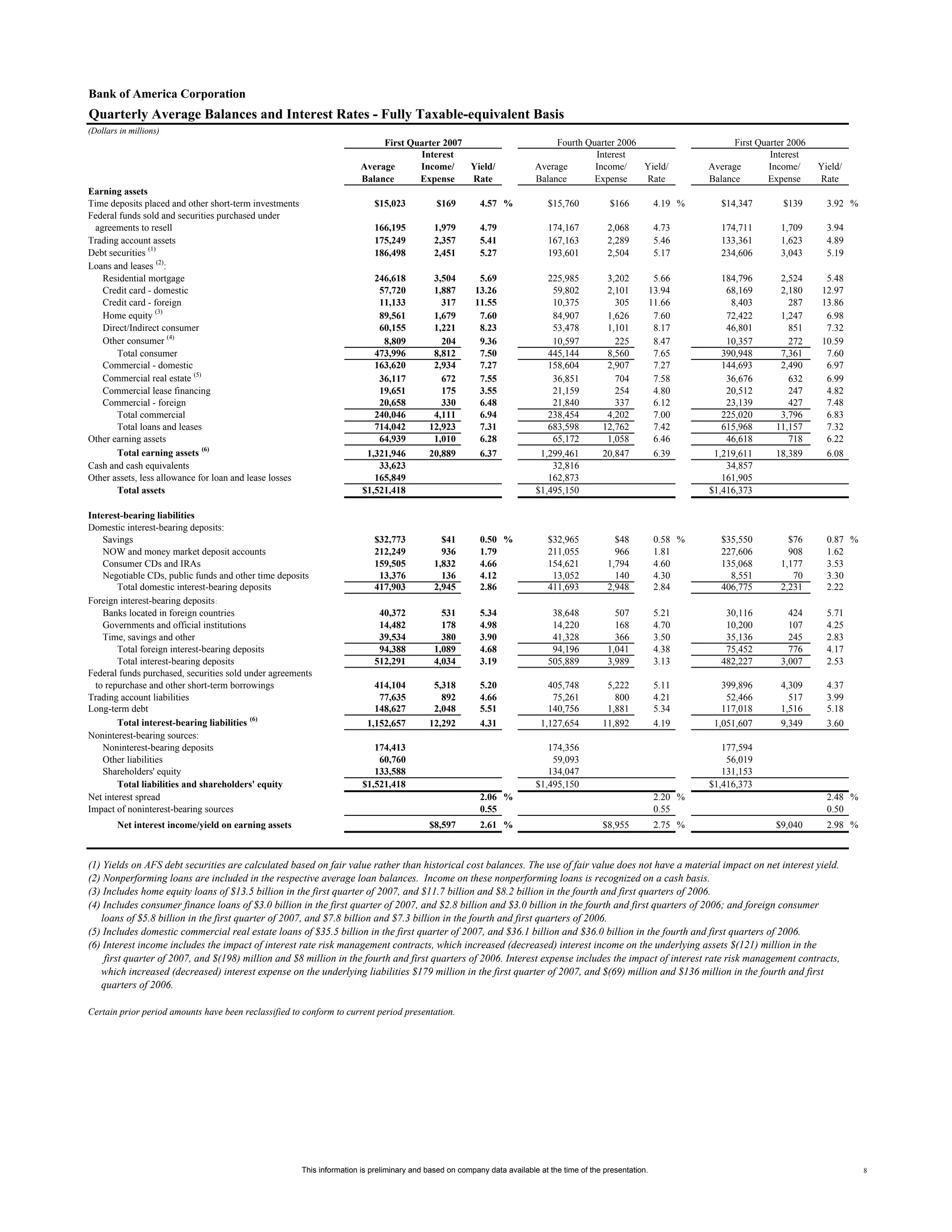

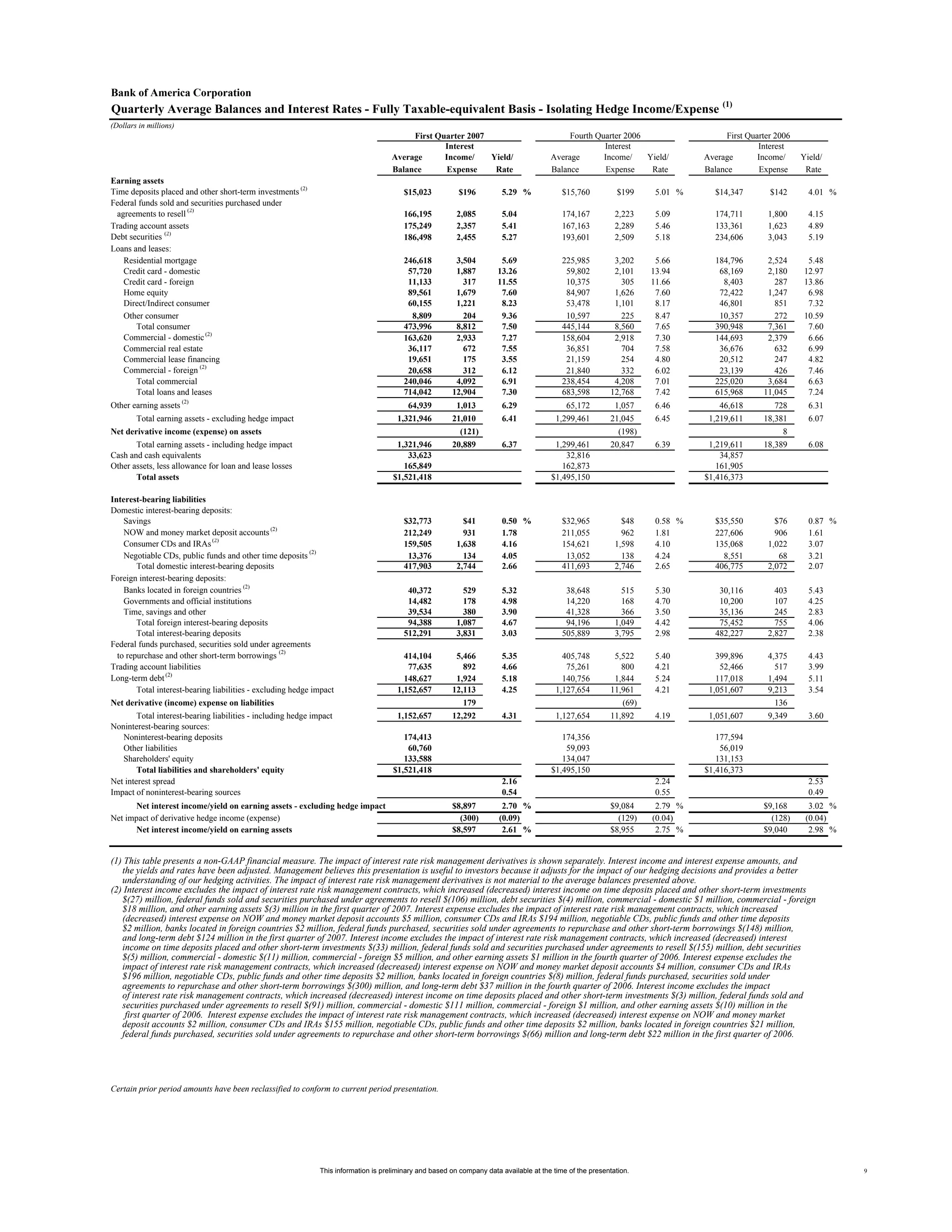

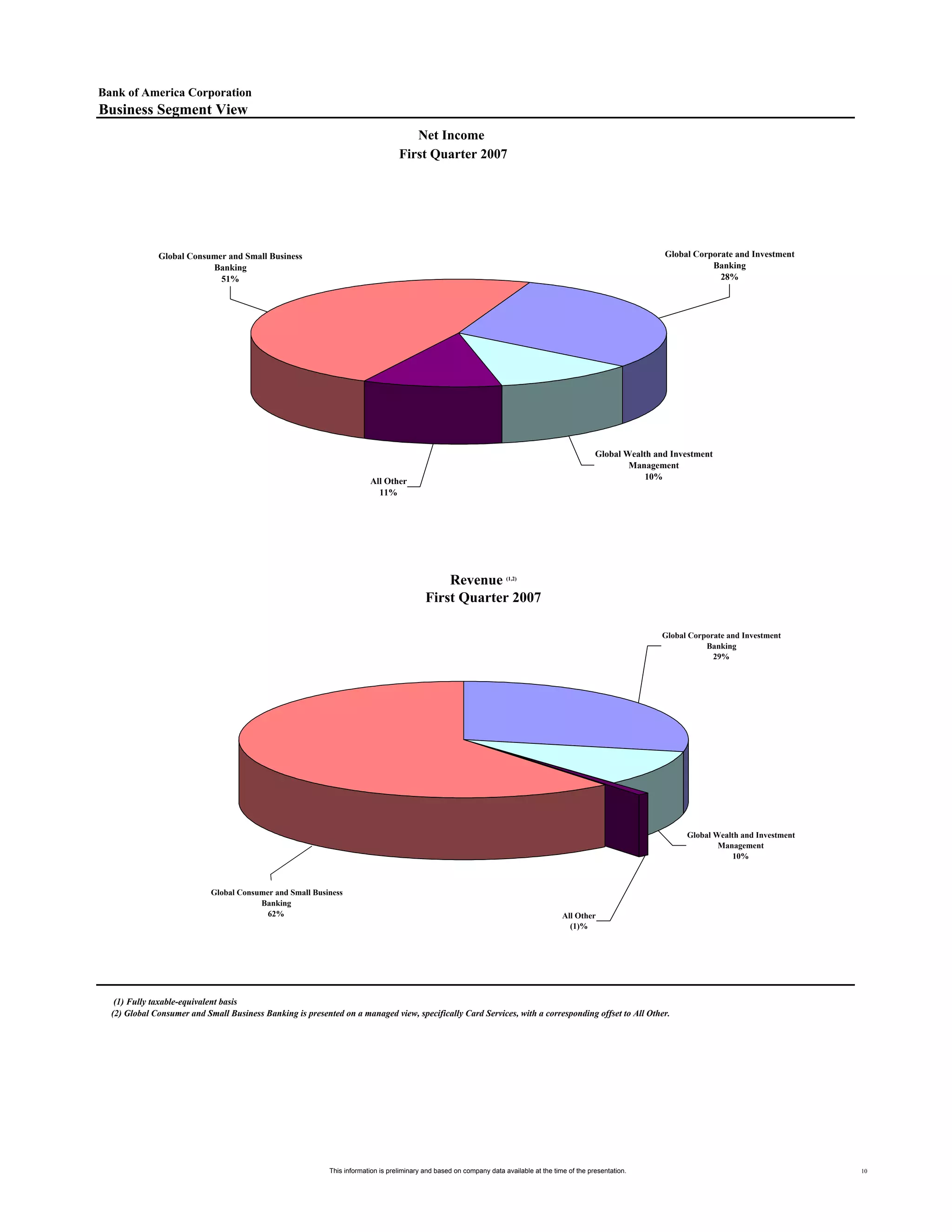

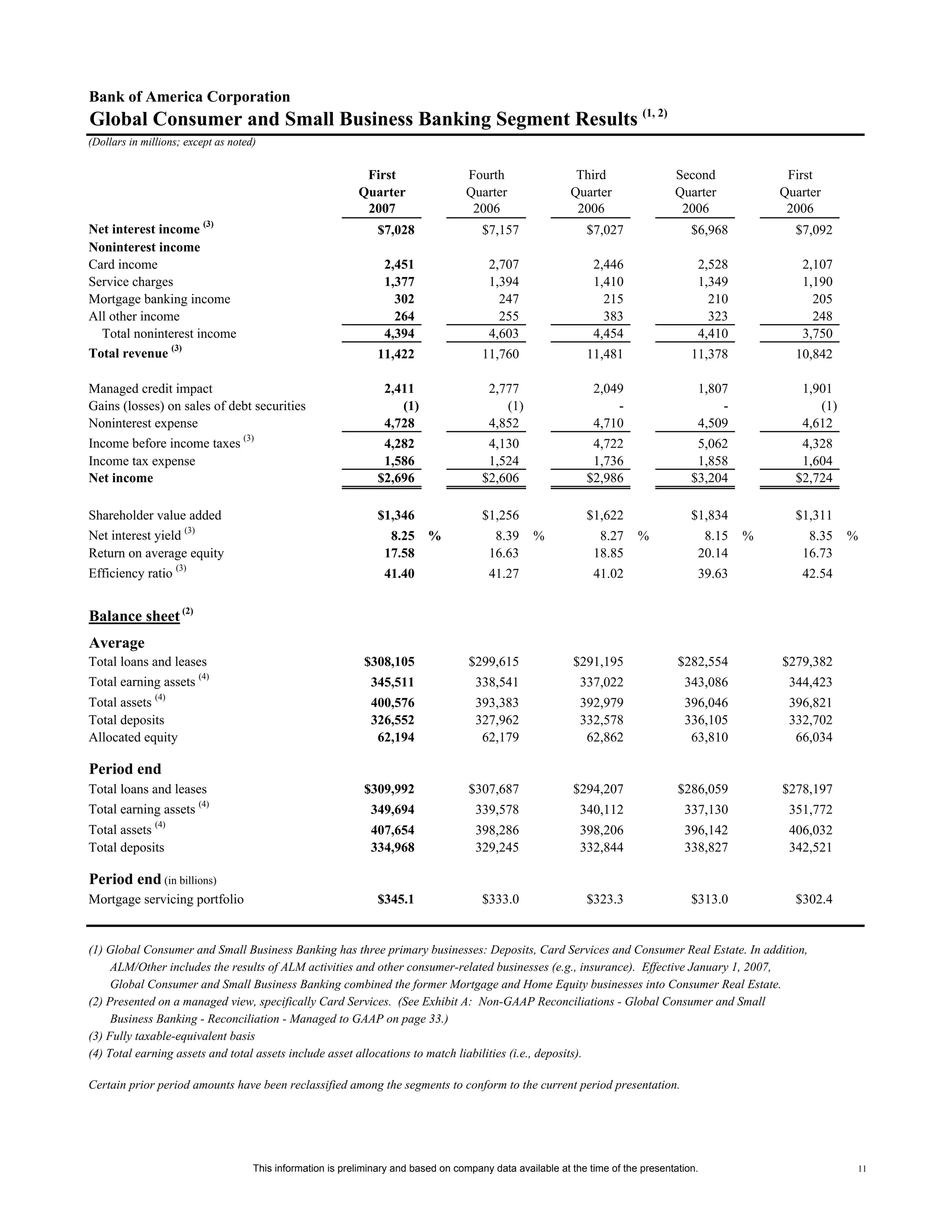

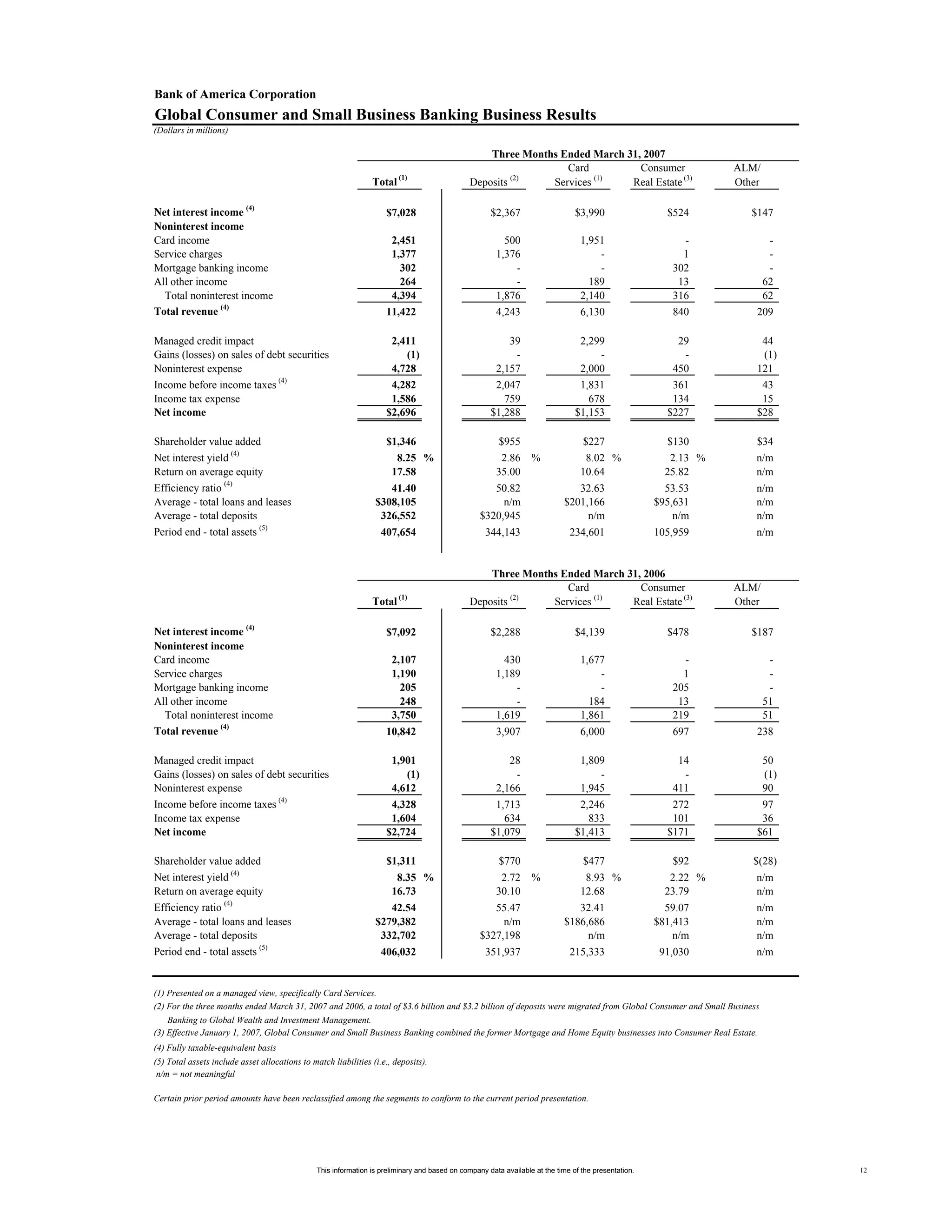

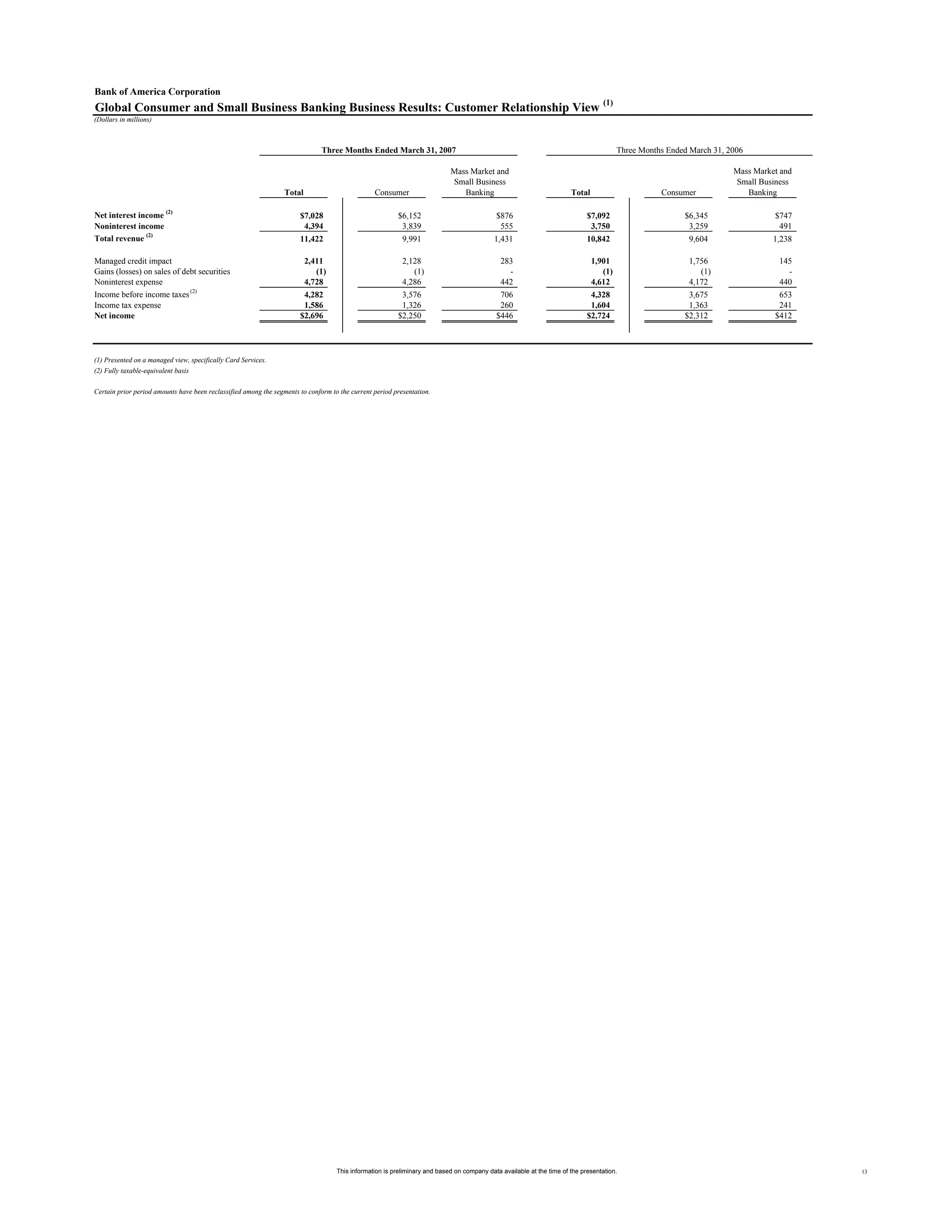

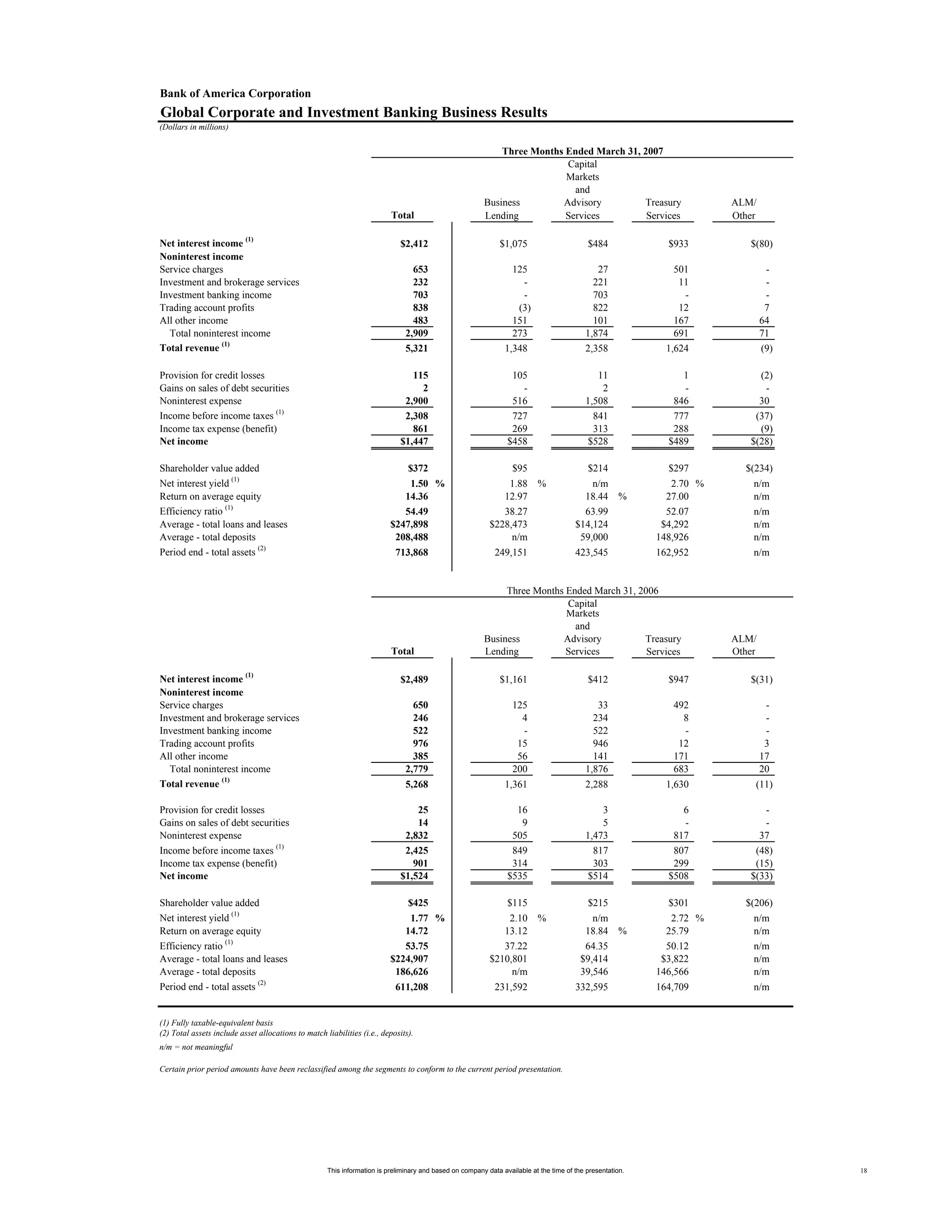

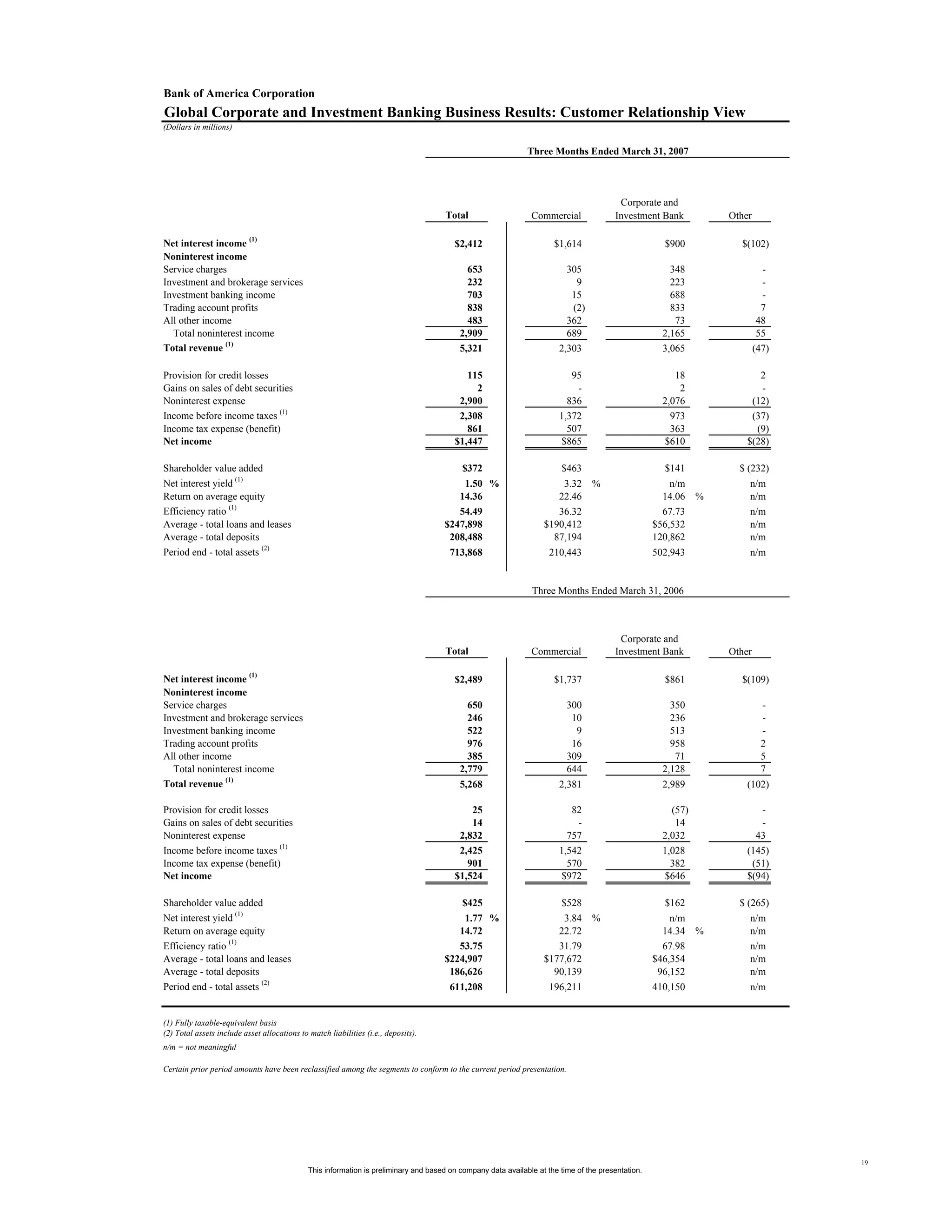

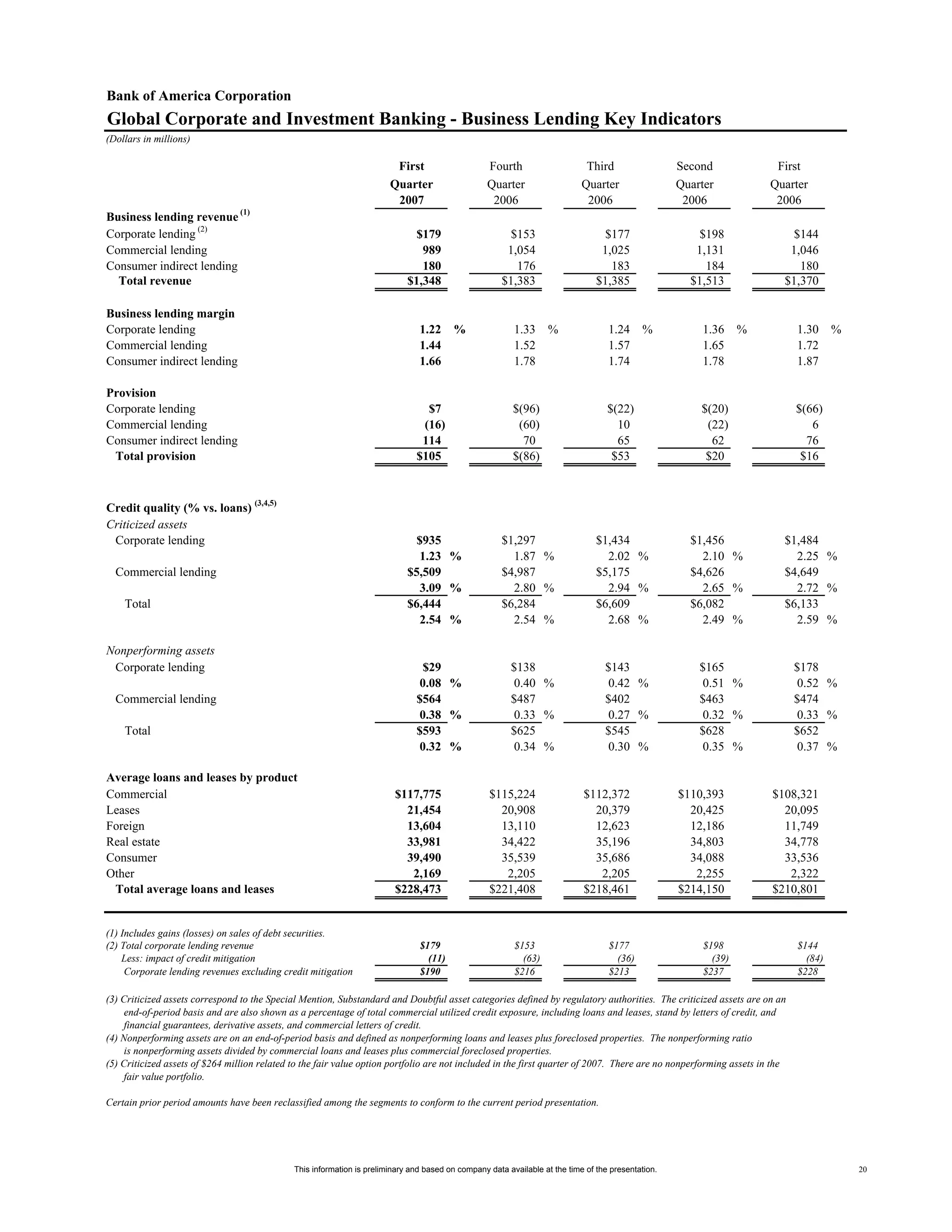

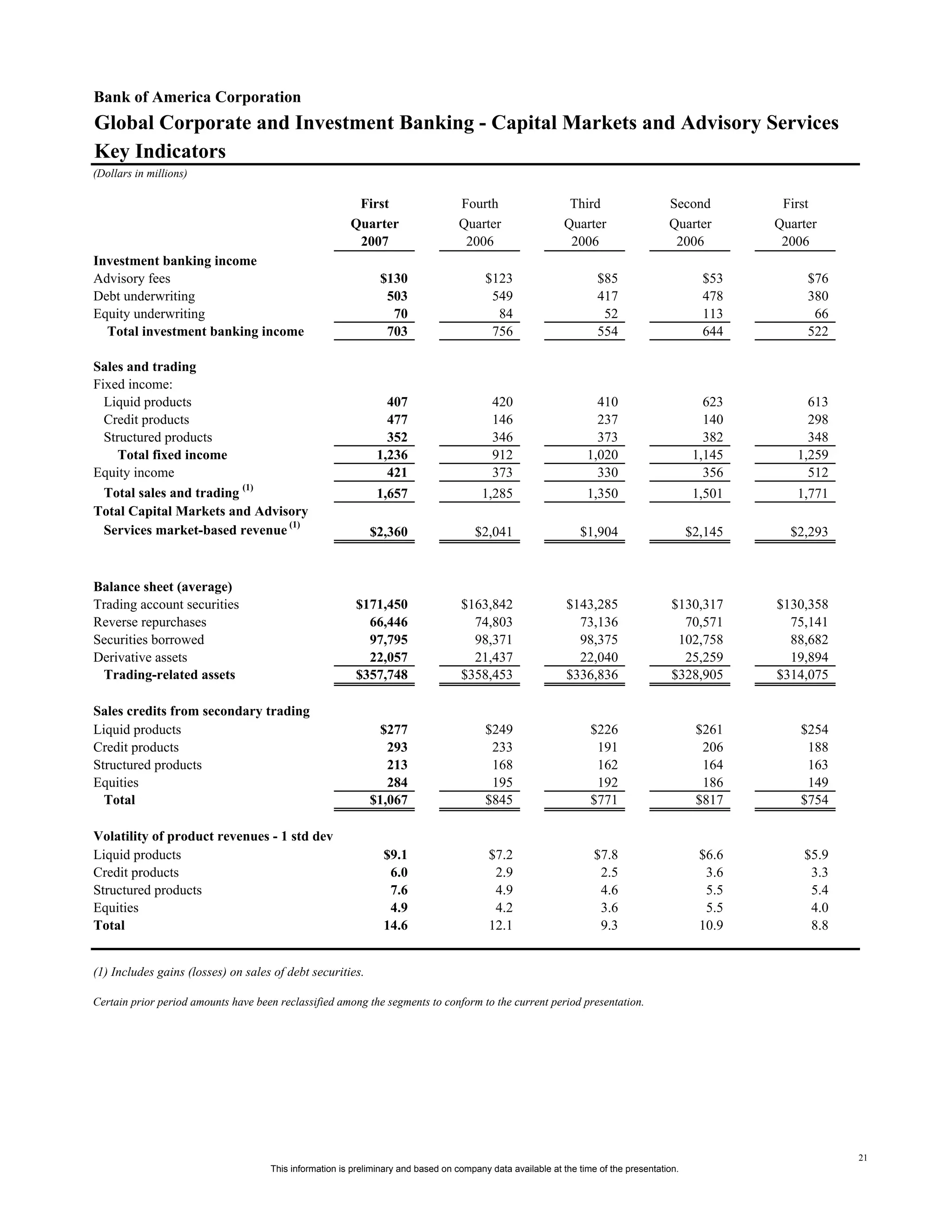

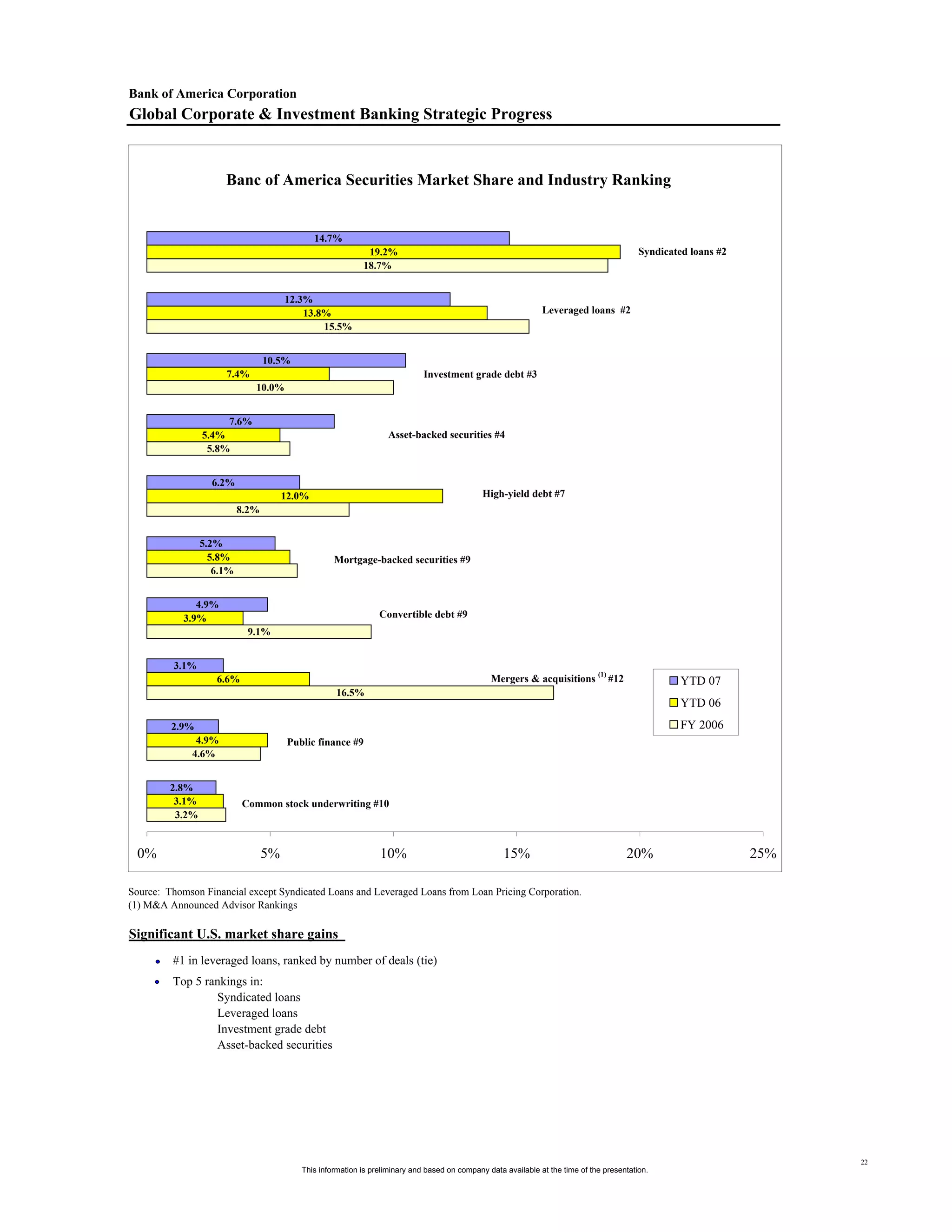

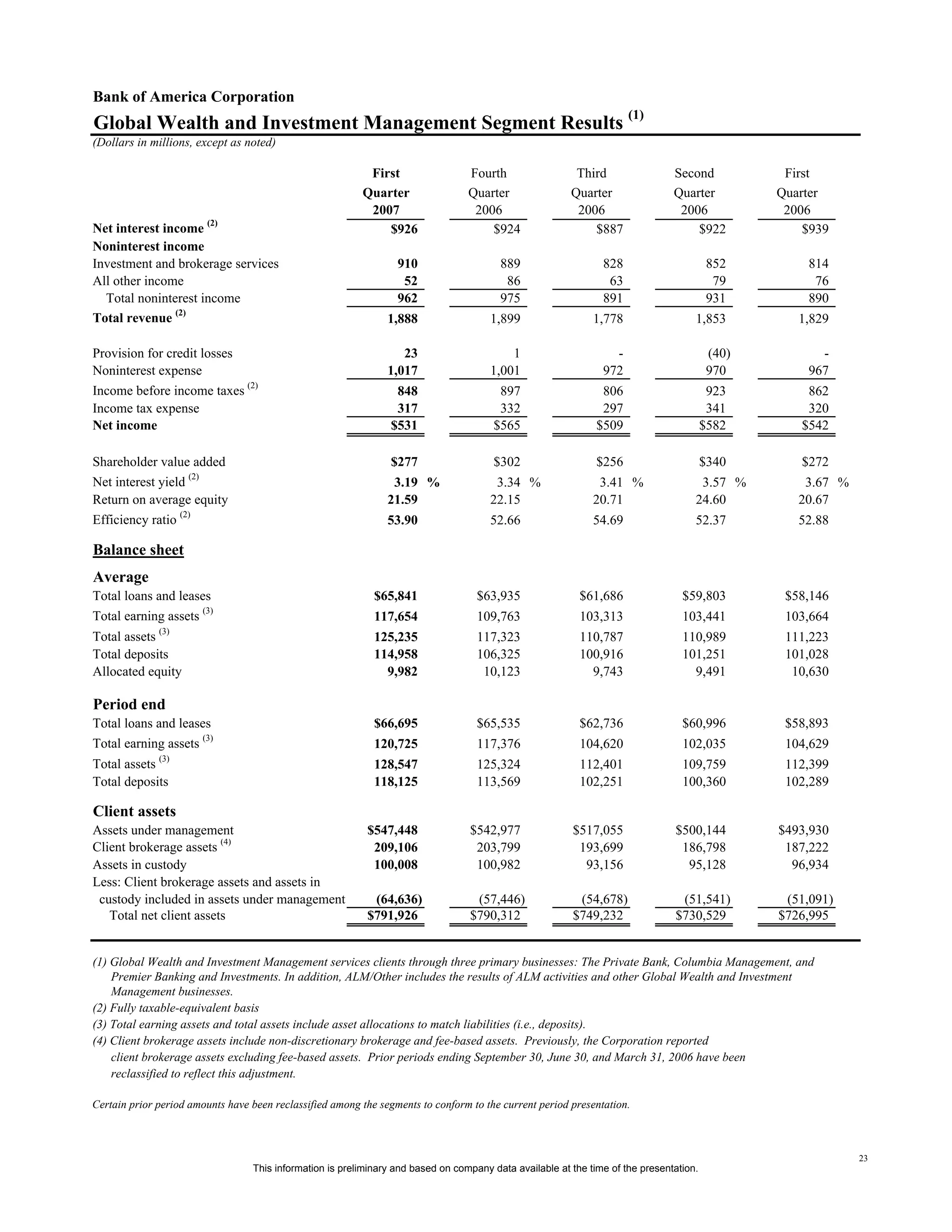

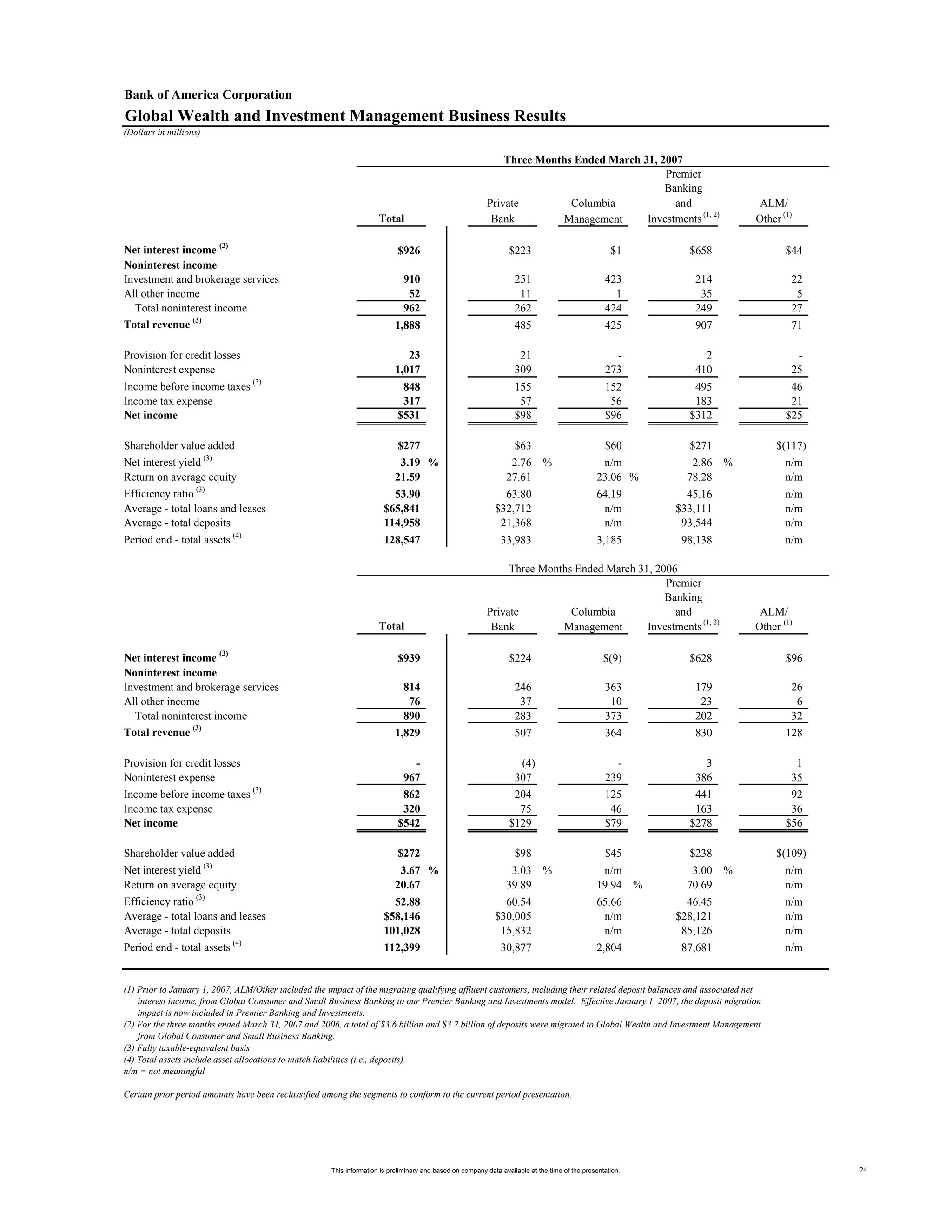

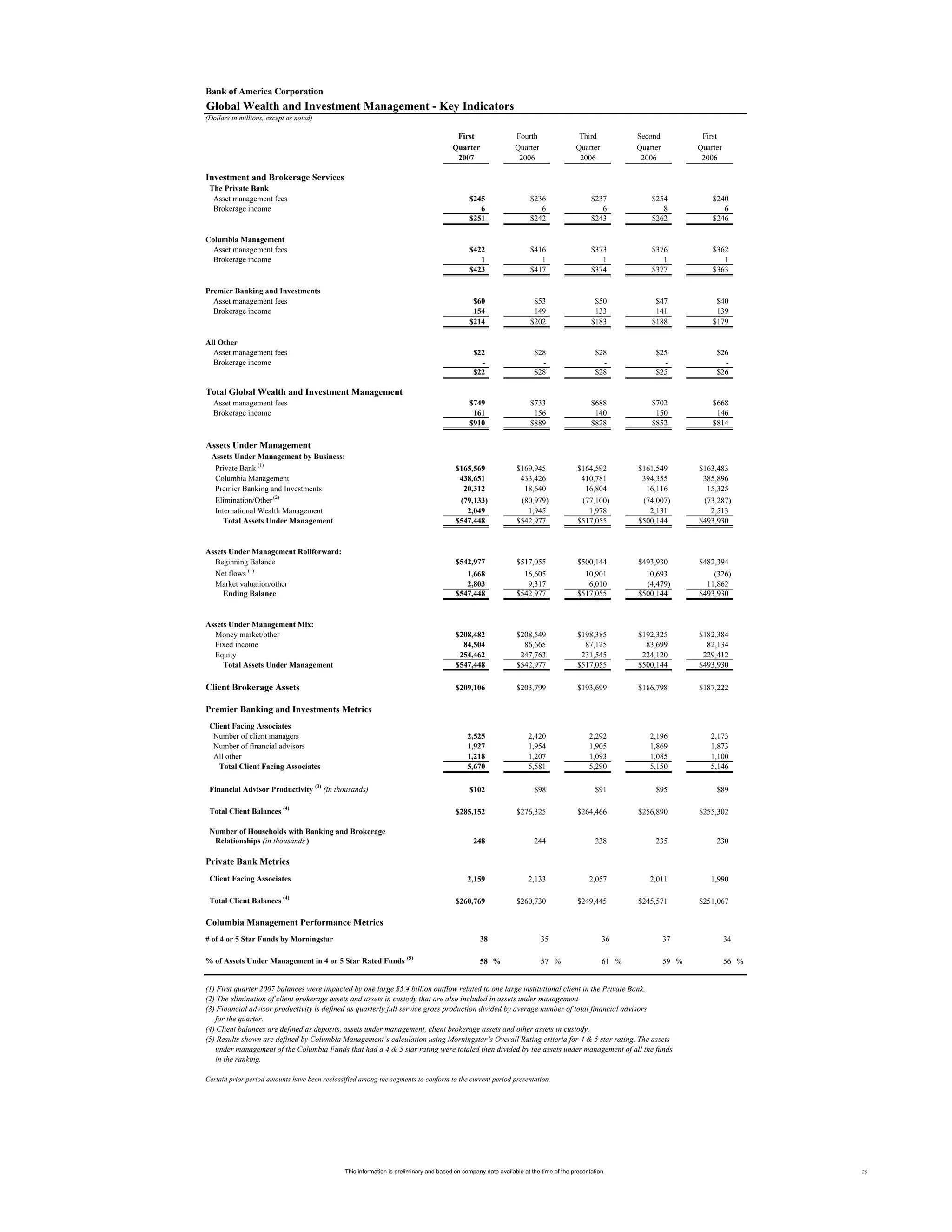

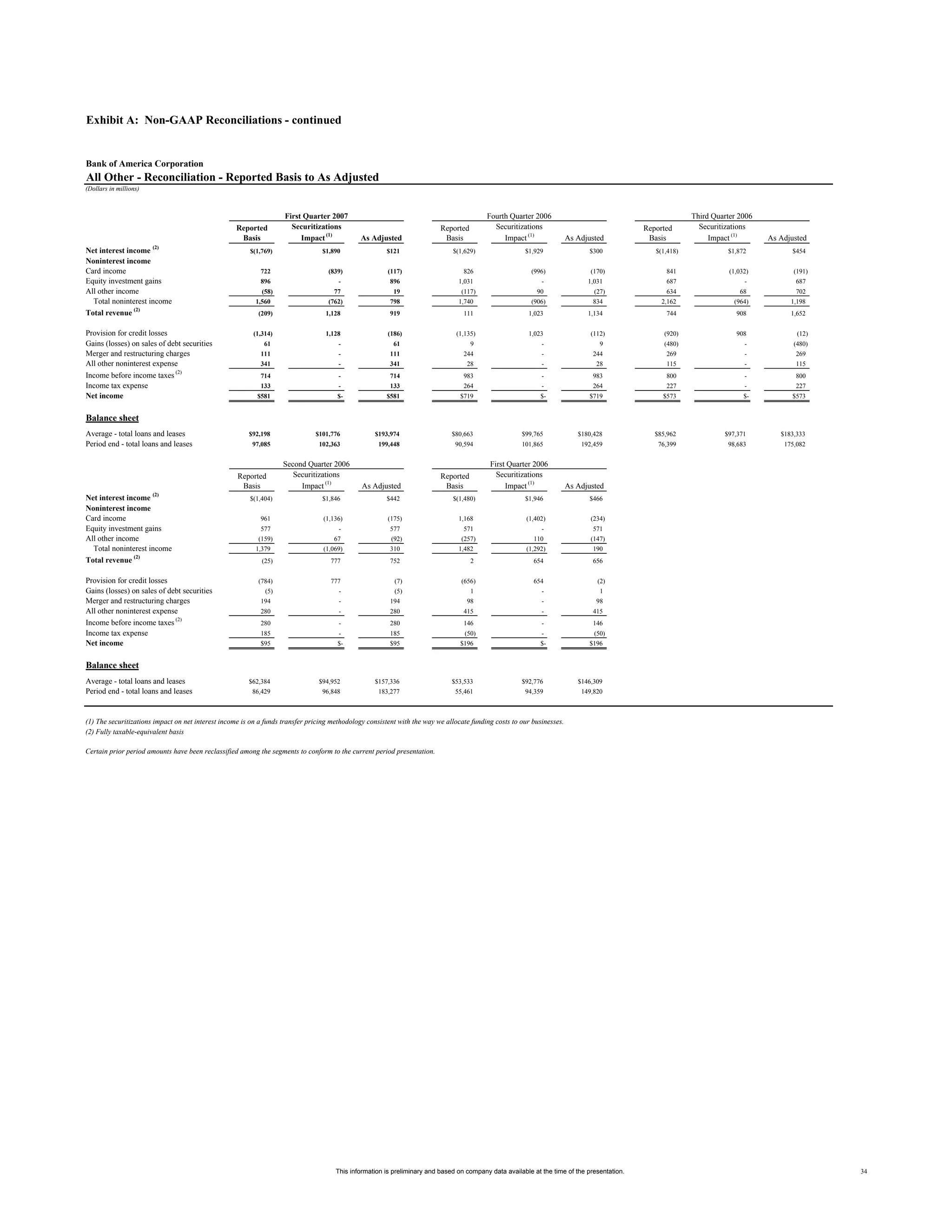

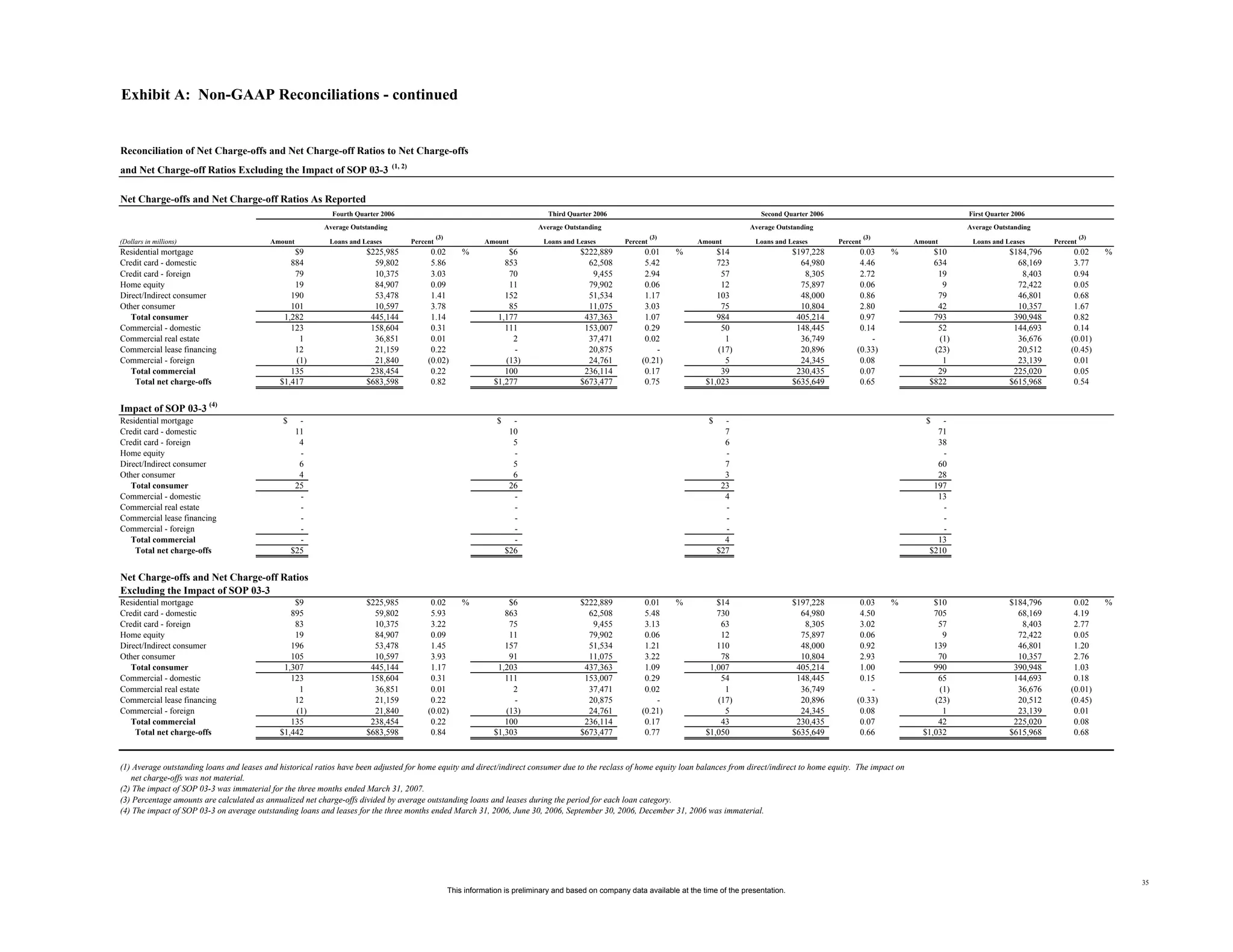

This document provides supplemental financial information for Bank of America for the first quarter of 2007, including: - Consolidated financial highlights such as net income, revenue, assets and equity. - Segment results and key metrics for the Global Consumer and Small Business Banking, Global Corporate and Investment Banking, and Global Wealth and Investment Management segments. - Additional financial details like loans and leases, credit quality, and net interest income. - Financial statements including the consolidated statement of income and consolidated balance sheet for the quarter. The information is preliminary and based on company data available at the time. Forward-looking statements are subject to risks described in Bank of America's SEC filings.