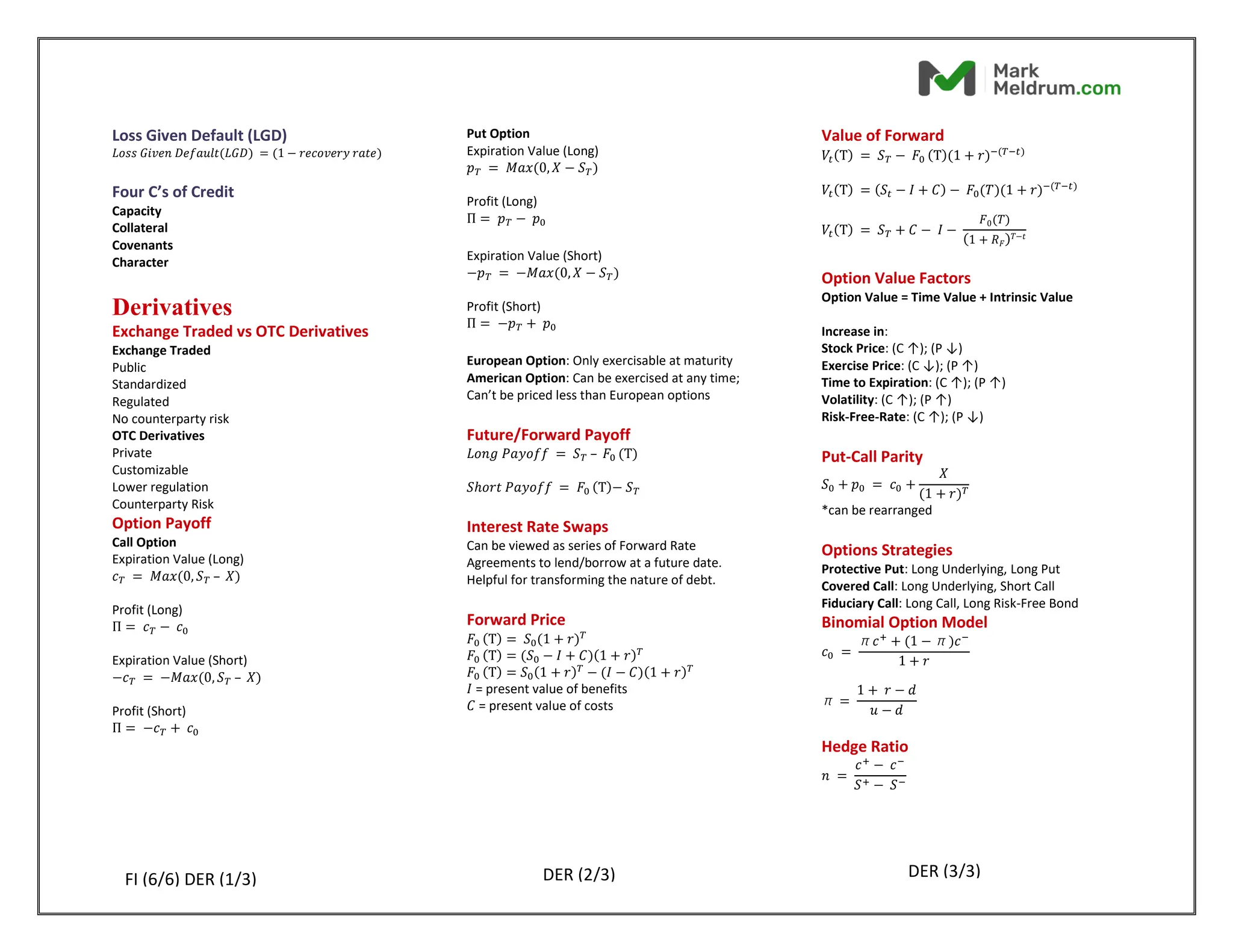

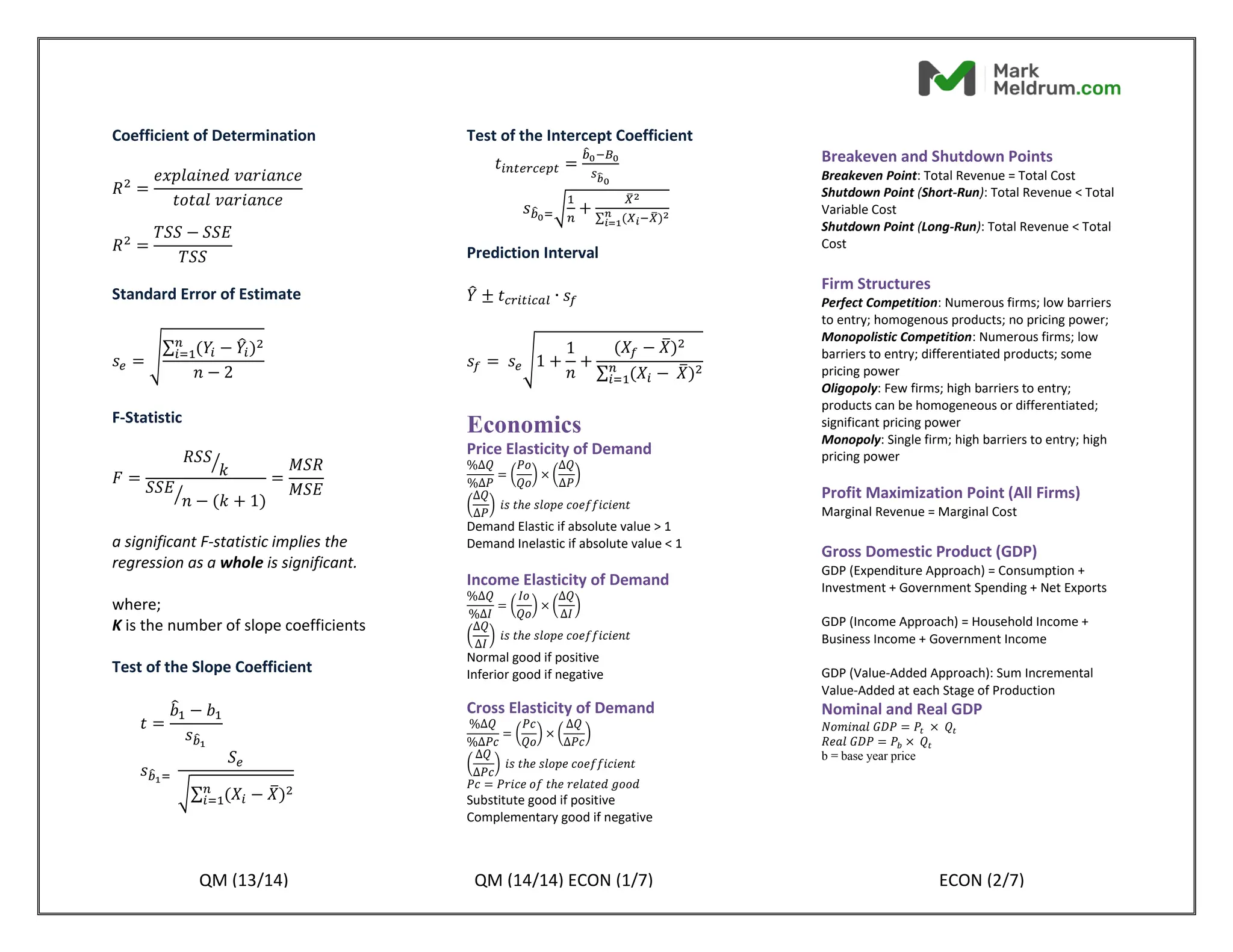

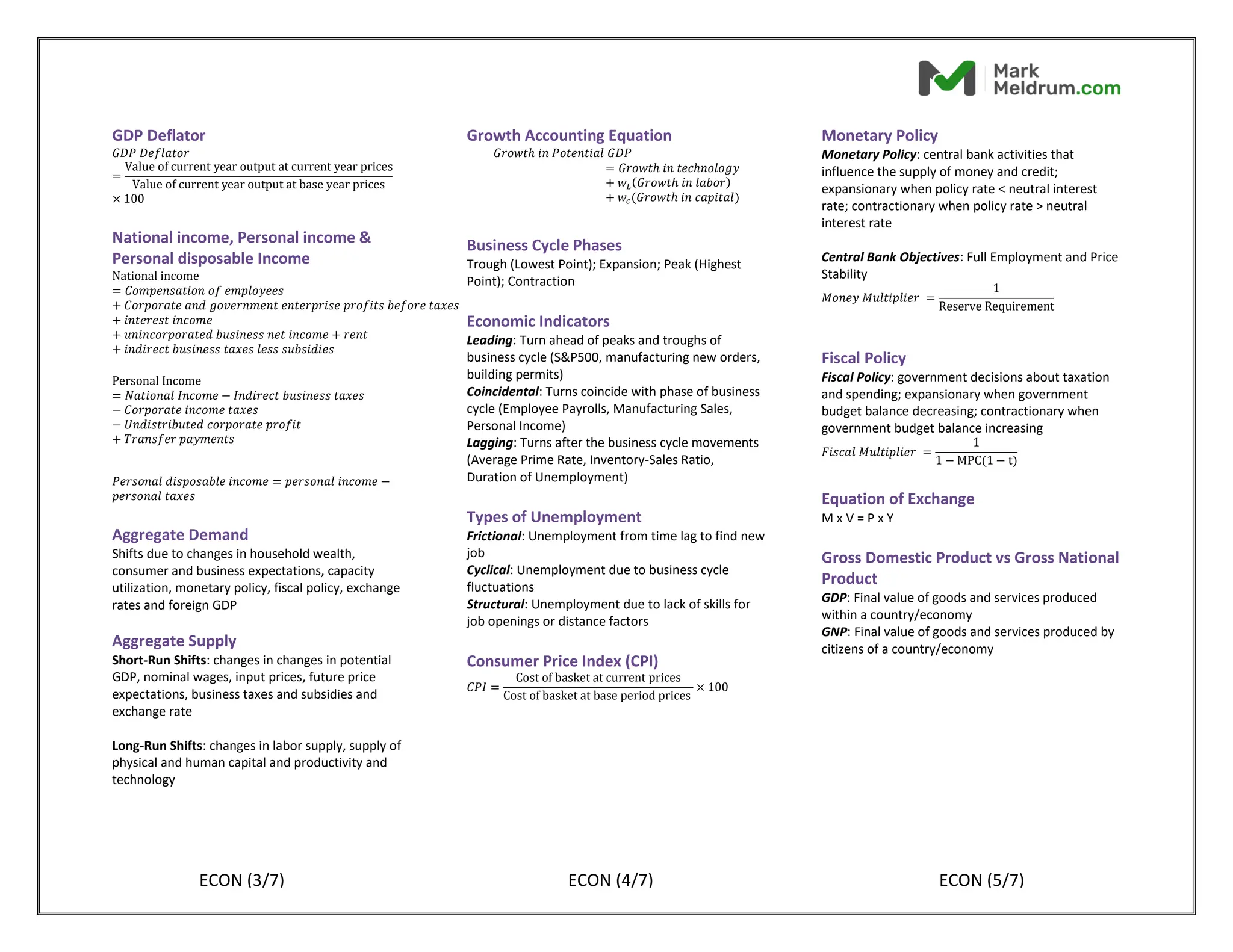

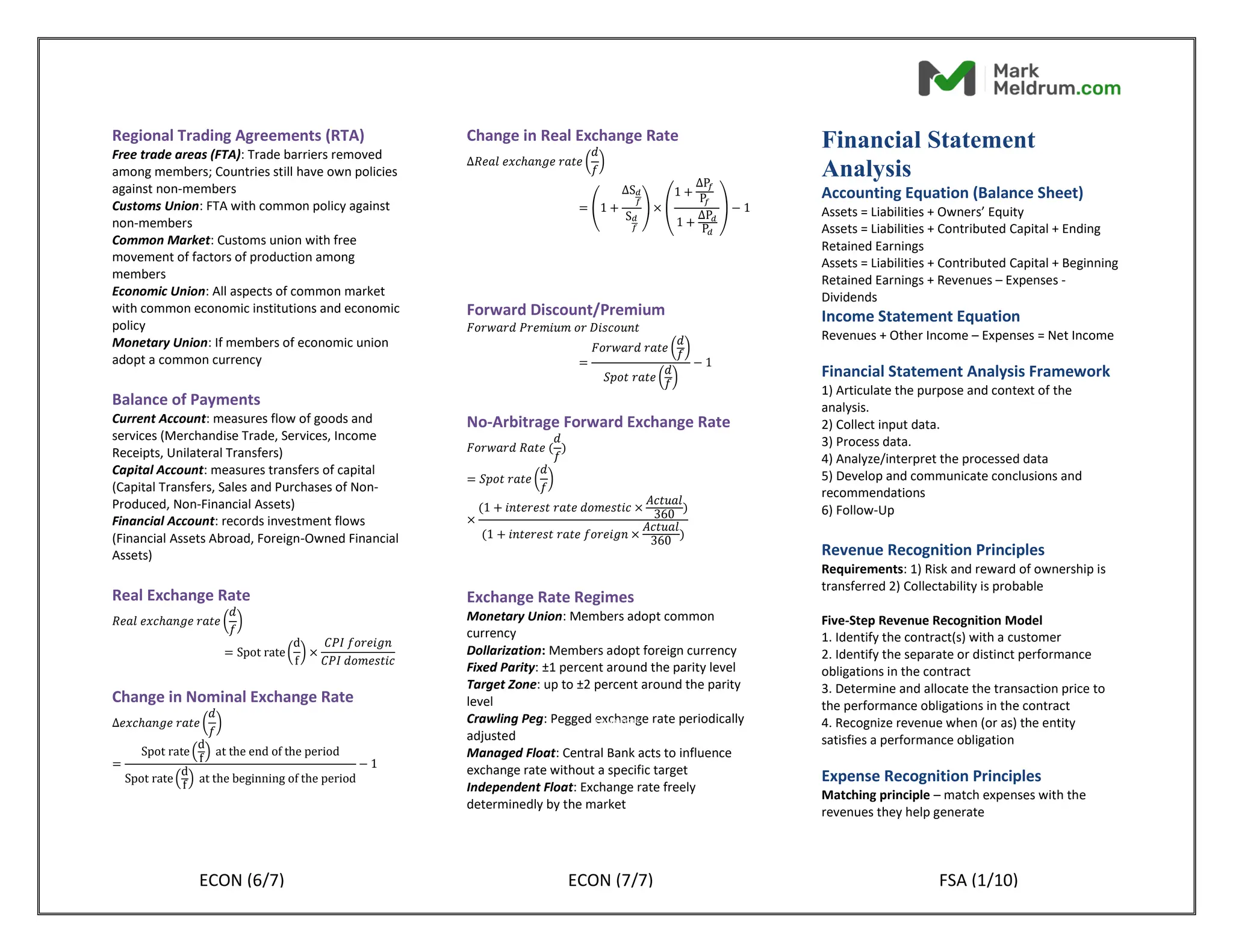

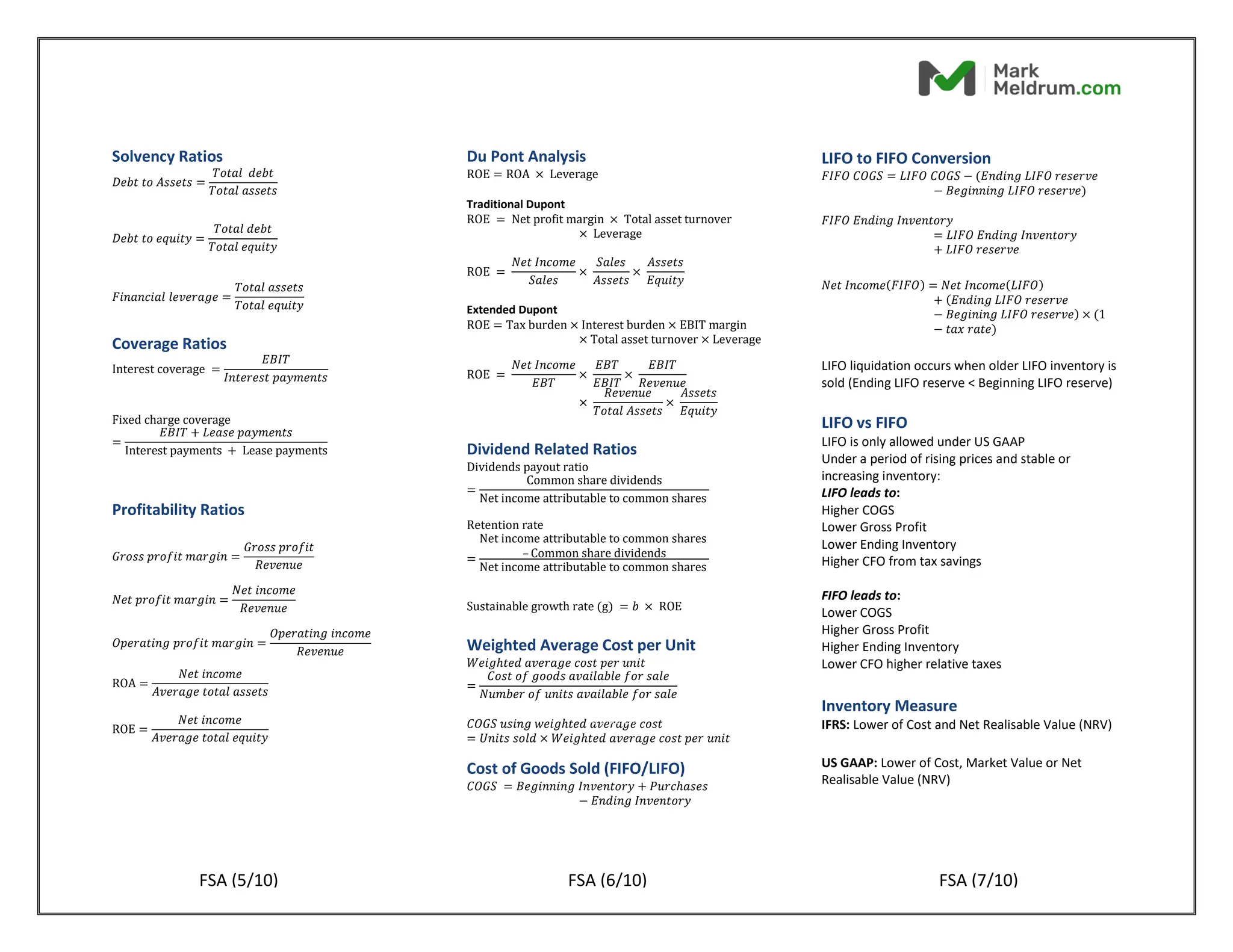

The 2024 Level 1 formula sheet provides essential formulas and calculations necessary for the CFA program curriculum, including financial calculator keys and various mathematical concepts such as present and future value, probability, and regression analysis. It includes information on economic indicators, monetary and fiscal policy, and key financial ratios, while emphasizing the importance of using this document alongside the core readings. This document is copyrighted material from the CFA Institute and should be utilized for educational purposes only.

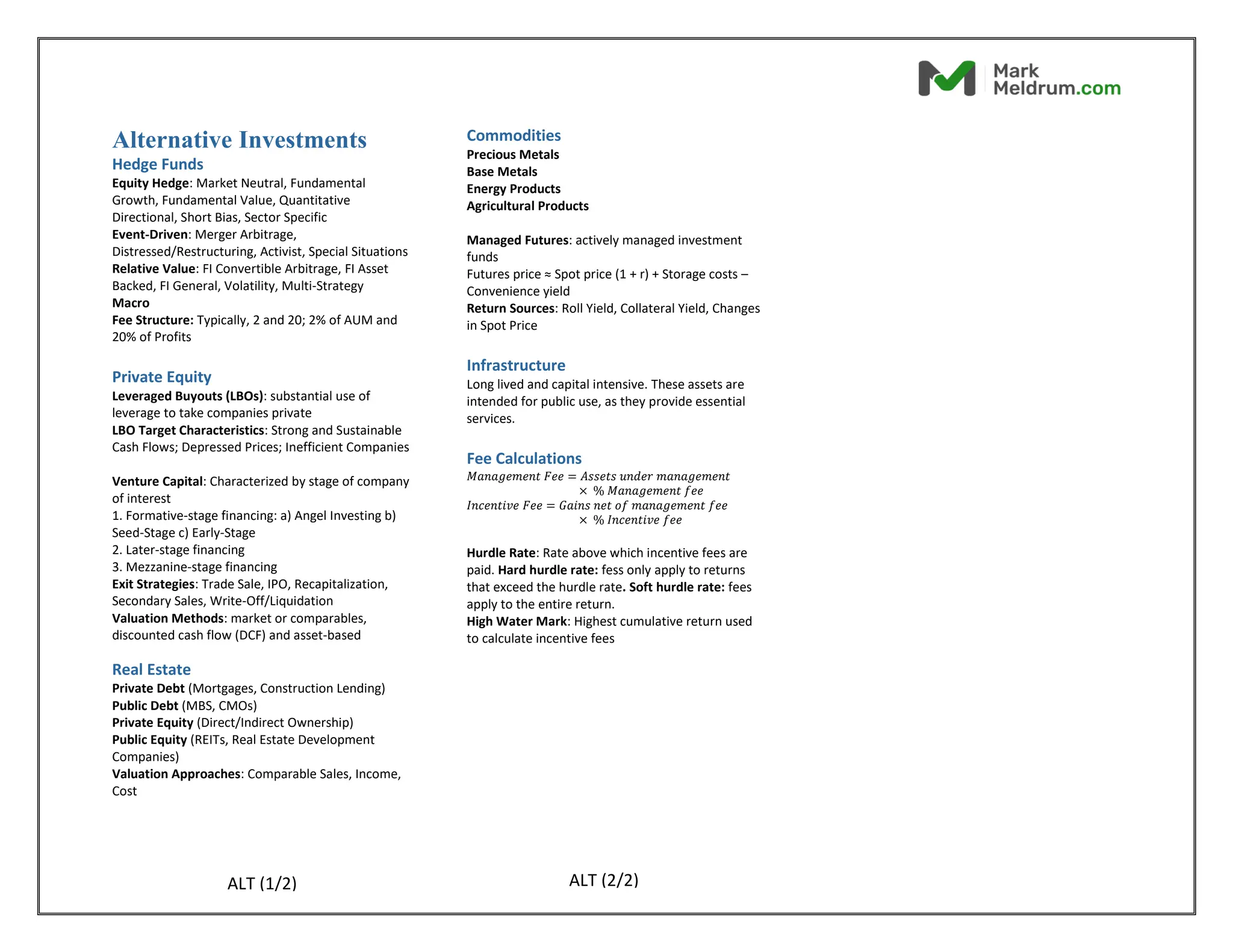

![Quantitative Methods

Financial Calculator Keys

N = Number of Compounding Periods

I/Y = Interest Rate per Year

*In whole numbers (i.e. 5% is entered as 5)

PV = Present Value

PMT = Payment

FV = Future Value

End-of-period payments

*Used for regular annuity

2nd [BGN]

2nd Enter

Display END

Beginning-of-period payments

*Used for annuity due

2nd [BGN]

2nd Enter

Display BGN

Cash Flow Worksheet

CFn = cash flow at time period n

Using the arrow keys and the ENTER key to input

cash flow amounts and their frequencies.

Solving for net present value: the NPV key will

prompt you to input a discount rate (I). Then

pressing the down key and CPT to find the NPV.

Solving for the internal rate of return: use the IRR

key and press CPT.

ICONV

Used to calculate effective rates

Nom = Nominal Rate

C/Y = Compounding Frequency

EFF-> CPT = outputs effective rate

Other Helpful Keys

STO = allows you to store values.

RCL = allows you to recall stored values.

FORMAT

2nd + FORMAT allows you to change the number of

decimal places displayed on the calculator.

DATA & STAT

Computes multiple values (mean, standard

deviation, etc...)

2nd + DATA allows you to your input variables. Once

inputted, exit the page, and click 2nd + STAT to find

the computed outputs. Use the down arrow keys

scroll through the various outputs.

Future Value (FV) of a single cash flow

𝐹𝑉 = 𝑃𝑉 × (1 + 𝑟)𝑁

Present Value (PV) of a single cash flow

𝑃𝑉 =

𝐹𝑉

(1 + 𝑟)𝑁

Present Value (PV) of Perpetuity

𝑃𝑉(𝑝𝑒𝑟𝑝𝑒𝑡𝑢𝑖𝑡𝑦) =

𝐴

𝑟

𝐴 = 𝑃𝑎𝑦𝑚𝑒𝑛𝑡 𝑎𝑚𝑜𝑢𝑛𝑡

Future Value (FV) with continuous

compounding

𝐹𝑉𝑁 = 𝑃𝑉𝑒𝑟𝑠𝑁

Effective Annual Rate (EAR)

𝐸𝐴𝑅 = (1 + 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑟𝑎𝑡𝑒)𝑚

− 1

𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑟𝑎𝑡𝑒

=

𝑆𝑡𝑎𝑡𝑒𝑑 𝐴𝑛𝑛𝑢𝑎𝑙 𝑅𝑎𝑡𝑒

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑖𝑛𝑔 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑂𝑛𝑒 𝑌𝑒𝑎𝑟

𝑚 = 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑖𝑛𝑔 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑂𝑛𝑒 𝑌𝑒𝑎𝑟

EAR with continuous compounding

𝐸𝐴𝑅 = 𝑒𝑟𝑠 − 1

Relative Frequency

Relative Frequency

=

𝐴𝑏𝑠𝑜𝑙𝑢𝑡𝑒 𝑓𝑟𝑒𝑞𝑢𝑒𝑛𝑐𝑦 𝑜𝑓 𝑒𝑎𝑐ℎ 𝑖𝑛𝑡𝑒𝑟𝑣𝑎𝑙

𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠

Cumulative Relative Frequency

Cumulative Relative Frequency

= 𝐴𝑑𝑑 𝑡ℎ𝑒 𝑟𝑒𝑙𝑎𝑡𝑖𝑣𝑒 𝑓𝑟𝑒𝑞𝑢𝑒𝑛𝑐𝑖𝑒𝑠 𝑤ℎ𝑖𝑙𝑒 𝑝𝑟𝑜𝑐𝑒𝑒𝑑𝑖𝑛𝑔

𝑓𝑟𝑜𝑚 𝑡ℎ𝑒 𝑓𝑖𝑟𝑠𝑡 𝑡𝑜 𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑖𝑛𝑡𝑒𝑟𝑣𝑎𝑙

Arithmetic Mean

x

̅ =

∑ 𝑋

𝑛

𝑡=1

𝑁

Median

In an ordered sample of n items:

For even number of observations

= Mean of values

𝑛

2

&

𝑛 + 2

2

For odd number of observations =

𝑛 + 1

2

Mode

the most frequently occurring value in a distribution

QM (1/14) QM (2/14) QM (3/14)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-2-2048.jpg)

![Weighted Average Mean

X

̅𝑤 = ∑ 𝑤𝑖 × 𝑋𝑖

𝑛

𝑖=1

Geometric Mean

G = √(1 + 𝑟1)(1 + 𝑟2)… (1 + 𝑟𝑛)

𝑛

with 𝑟𝑖 ≥ 0 for i = 1,2, … , n

Harmonic Mean

HM =

n

∑ (

1

𝑋𝑖

)

𝑛

𝑖=1

with X𝑖 > 0 for i = 1,2, … , n

Mean Absolute Deviation

MAD =

∑ |𝑥𝑖 − 𝑥̅|

𝑛

𝑖=1

𝑛

Percentile

Percentile = Ly = (n + 1) ×

y

100

Quartile =

Distribution

4

Quintile =

Distribution

5

Decile =

Distribution

10

Range

Range = Maximum value – Minimum value

Population Variance

𝜎2

=

∑ (𝑥𝑖 − 𝜇)2

𝑁

𝑖=1

𝑁

Sample Variance

𝑠2

=

∑ (𝑥𝑖 − 𝑥̅)2

𝑛

𝑖=1

𝑛 − 1

Standard Deviation

Square root of the variance value

Sample Target Semi-Deviation

𝑠Target =√ ∑

(𝑋𝑖 − 𝐵)2

𝑛 − 1

𝑛

𝑓𝑜𝑟 𝑎𝑙𝑙 𝑋𝑖≤ 𝐵

where B is the target and n is the total number of

sample observations.

Coefficient of Variation

𝐶𝑉 =

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑥

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑥

=

𝑠𝑥

𝑥̅

Skewness

Positive Skew; Mean > Median > Mode

Negative Skew; Mean < Median < Mode

Probability Stated as Odds

𝑂𝑑𝑑𝑠 𝑓𝑜𝑟 𝑎𝑛 𝐸𝑣𝑒𝑛𝑡 ′𝐸′ =

𝑃(𝐸)

1 − 𝑃(𝐸)

𝑂𝑑𝑑𝑠 𝑎𝑔𝑎𝑖𝑛𝑠𝑡 𝑎𝑛 𝐸𝑣𝑒𝑛𝑡 ′𝐸′ =

1 − 𝑃(𝐸)

𝑃(𝐸)

Probability of A or B

𝑃(𝐴 𝑜𝑟 𝐵) = 𝑃(𝐴) + 𝑃(𝐵) − 𝑃(𝐴𝐵)

Joint Probability of Two Events

𝑃(𝐴𝐵) = 𝑃(𝐴|𝐵) × 𝑃(𝐵)

Conditional Probability of A given B

𝑃(𝐴|𝐵) =

𝑃(𝐴𝐵)

𝑃(𝐵)

Joint Probability of any number of

independent events

𝑃(𝐴𝐵𝐶𝐷𝐸) = 𝑃(𝐴) × 𝑃(𝐵) × 𝑃(𝐶) × 𝑃(𝐷)

× 𝑃(𝐸)

Total Probability Rule

𝑃(𝐴) = 𝑃(𝐴|𝐵1) × 𝑃(𝐵1) + 𝑃(𝐴|𝐵2) × 𝑃(𝐵2)

+ 𝑃(𝐴|𝐵3) × 𝑃(𝐵3)

+ ⋯ 𝑃(𝐴|𝐵𝑛) × 𝑃(𝐵𝑛)

Expected Value of a Random Variable

𝐸(𝑋) = 𝑃(𝑋1)𝑋1 + 𝑃(𝑋2)𝑋2+. . . 𝑃(𝑋𝑛)𝑋𝑛 = ∑ 𝑃(𝑋𝐼)𝑋𝑖

𝑛

𝑖=1

Variance of a Random Variable

𝜎2

(𝑋) = ∑ 𝑃(𝑋𝑖)

𝑛

𝑖=1

[𝑋𝑖 − 𝐸(𝑋)]2

QM (4/14) QM (5/14) QM (6/14)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-3-2048.jpg)

![Portfolio Expected Return

𝐸(𝑅𝑝) = 𝑤1̇ 𝐸(𝑅1̇ ) + 𝑤2̇ 𝐸(𝑅2̇ ) + 𝑤3𝐸(𝑅3) … 𝑤𝑛𝐸(𝑅𝑛̇ )

Portfolio Variance

𝑣𝑎𝑟(𝑅𝑃) = 𝑤𝐴

2

𝜎2(𝑅𝐴) + 𝑤𝐵

2

𝜎2(𝑅𝐵)

+ 2𝑤𝐴𝑤𝐵𝜎(𝑅𝐴)𝜎(𝑅𝐵)𝜌(𝑅𝐴, 𝑅𝐵)

Covariance

𝑐𝑜𝑣(𝑅1,𝑅𝑗) = 𝐸[(𝑅𝑖 − 𝐸(𝑅𝑖̇)(𝑅𝑗 − 𝐸(𝑅𝑗̇)]

Correlation

𝜌(𝑅𝑖, 𝑅𝑗) =

𝑐𝑜𝑣(𝑅𝑖, 𝑅𝑗)

𝜎(𝑅𝑖)𝜎(𝑅𝑗)

Bayes’ Formula

𝑃(𝐸𝑣𝑒𝑛𝑡|𝐼𝑛𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛)

=

𝑃(𝐼𝑛𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛|𝐸𝑣𝑒𝑛𝑡)

𝑃(𝐼𝑛𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛)

× 𝑃(𝐸𝑣𝑒𝑛𝑡)

Multiplication Rule of Counting

n! = n(n − 1)(n − 2)(n − 3) … 1

Multinomial Formula for Labeling

Problems

n! =

n!

n1! n2! … nk!

Combination Formula

# of ways we can choose r objects from a total of n objects,

when order does not matter.

nCr =

n!

(n − r)! r!

Permutation Formula

# of ways that we can choose r objects from a total of n

objects, when order does matter.

nPr =

n!

(n − r)!

Probabilities for a Random Variable given

its Cumulative Distribution Function

To find F(x), sum up, or cumulate, values of the

probability function for all outcomes less than or

equal to x.

Probabilities given the Discrete Uniform

Function

𝐶𝑢𝑚𝑢𝑙𝑎𝑡𝑖𝑣𝑒 𝑑𝑖𝑠𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑓𝑢𝑛𝑐𝑡𝑖𝑜𝑛 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑛𝑡ℎ 𝑜𝑢𝑡𝑐𝑜𝑚𝑒

𝐹(𝑋𝑛) = 𝑛𝑃(𝑋)

Probability function for a Binomial

Random Variable

𝑃𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓𝑥 𝑠𝑢𝑐𝑐𝑒𝑠𝑠𝑒𝑠 𝑖𝑛 𝑛 𝑡𝑟𝑖𝑎𝑙𝑠

=

n!

(n − x)! x!

× 𝑝𝑥(1 − 𝑝)𝑛−𝑥

Expected Value and Variance of a

Binomial Random Variable

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑋 = nP

𝑉𝑎𝑟𝑖𝑎𝑛𝑐𝑒 𝑜𝑓 𝑋 = nP(1 − p)

Continuous Uniform Distribution

𝑓(𝑥) = {

1

𝑏 − 𝑎

𝑓𝑜𝑟 𝑎 < 𝑥 < 𝑏 𝑜𝑟 0

𝐹(𝑥) =

𝑥 − 𝑎

𝑏 − 𝑎

𝑓𝑜𝑟 𝑎 < 𝑥 < 𝑏

Standardizing a Random Normal Variable

𝑍 =

𝑋 − µ

𝜎

approximately…

50% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± (2 ∕ 3)𝜎

68% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± 1𝜎

95% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± 2𝜎

99% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± 3𝜎

Safety-First Ratio

𝑆𝐹𝑅𝑎𝑡𝑖𝑜 =

[𝐸(𝑅𝑝) − 𝑅𝑙)]

𝜎𝑝

Portfolio with the highest ratio is preferred

Continuously Compounded Return

from t = 0 to t = 1

𝑟0,1 = ln(

𝑆1

𝑆0

)

Degrees of Freedom of Student’s

T-distribution

𝑑𝑓 = 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠𝑎𝑚𝑝𝑙𝑒 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 − 1 = 𝑛 − 1

Standard Error of the Sample Mean

(σ known)

𝜎𝑋 =

σ

√n

(σ unknown)

𝑠𝑥 =

s

√n

QM (7/14) QM (8/14) QM (9/14)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-4-2048.jpg)

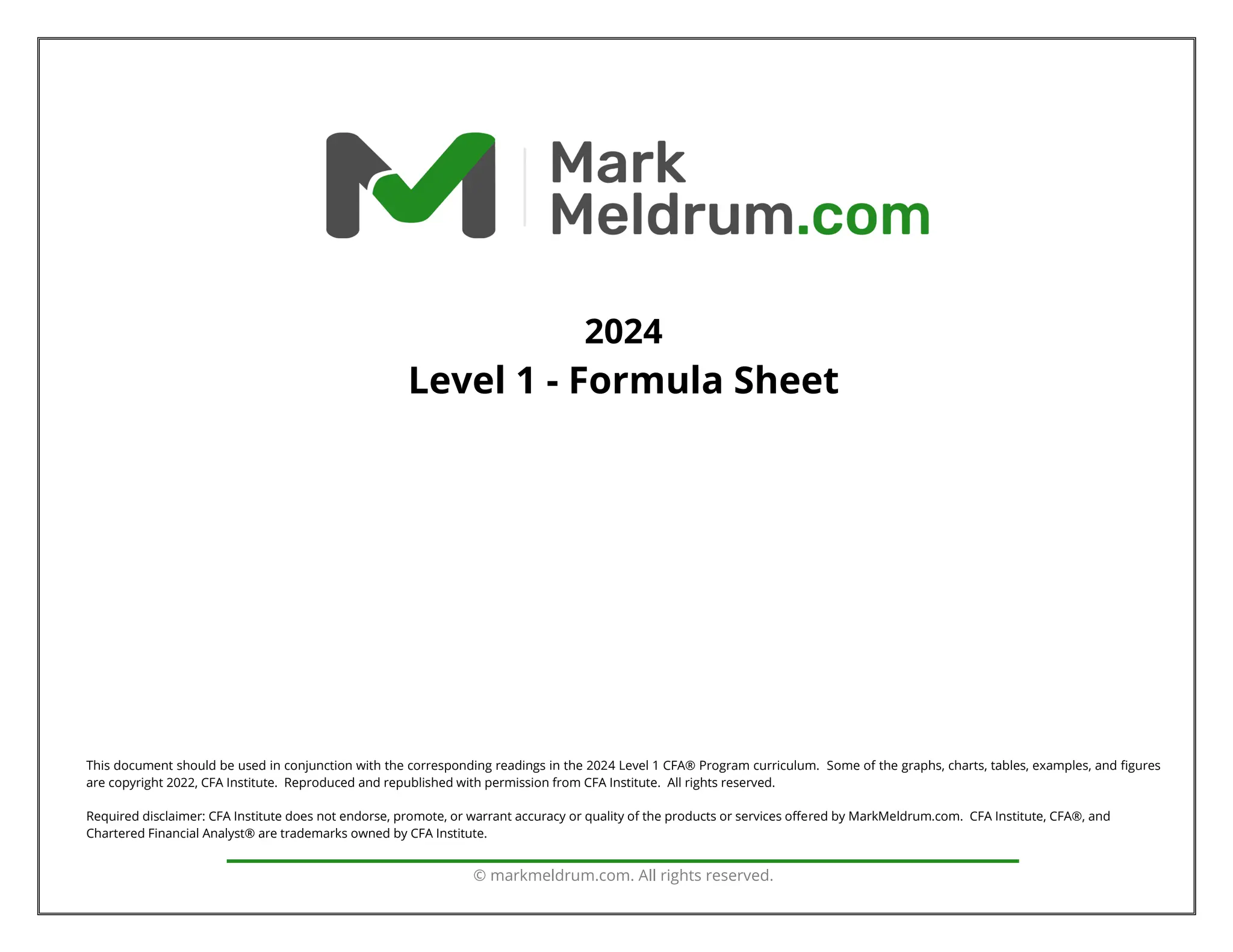

![Basic Earnings Per Share

Basic EPS =

𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

Diluted Earnings Per Share

𝐷𝑖𝑙𝑢𝑡𝑒𝑑 𝐸𝑃𝑆

=

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

+ 𝑁𝑒𝑤 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝐼𝑠𝑠𝑢𝑒𝑑 𝑎𝑡 𝐶𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛

*if-converted method

𝐷𝑖𝑙𝑢𝑡𝑒𝑑 𝐸𝑃𝑆

=

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 + 𝐶𝑜𝑛𝑣𝑒𝑟𝑡𝑖𝑏𝑙𝑒 𝐷𝑒𝑏𝑡 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 (1 − 𝑡)

−𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

+𝐴𝑑𝑑𝑖𝑡𝑖𝑜𝑛𝑎𝑙 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑡ℎ𝑎𝑡 𝑤𝑜𝑢𝑙𝑑

ℎ𝑎𝑣𝑒 𝑏𝑒𝑒𝑛 𝑖𝑠𝑠𝑢𝑒𝑑 𝑎𝑡 𝐶𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛

*if-converted method with convertible debt

𝐷𝑖𝑙𝑢𝑡𝑒𝑑 𝐸𝑃𝑆

=

(𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠)

[

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

+

(

𝑁𝑒𝑤 𝑠ℎ𝑎𝑟𝑒𝑠 𝑡ℎ𝑎𝑡 𝑤𝑜𝑢𝑙𝑑 𝑏𝑒 𝑖𝑠𝑠𝑢𝑒𝑑 𝑓𝑟𝑜𝑚 𝑂𝑝𝑡𝑖𝑜𝑛 𝐸𝑥𝑒𝑟𝑐𝑖𝑠𝑒 −

𝑆ℎ𝑎𝑟𝑒𝑠 𝑡ℎ𝑎𝑡 𝑐𝑜𝑢𝑙𝑑 𝑏𝑒 𝑝𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑑 𝑤𝑖𝑡ℎ 𝑐𝑎𝑠ℎ 𝑝𝑟𝑜𝑐𝑒𝑒𝑑𝑠 𝑓𝑟𝑜𝑚 𝑒𝑥𝑒𝑟𝑐𝑖𝑠𝑒

)

× (𝑃𝑟𝑜𝑝𝑜𝑟𝑡𝑖𝑜𝑛 𝑜𝑓 𝑌𝑒𝑎𝑟 𝐹𝑖𝑛𝑎𝑛𝑐𝑖𝑎𝑙 𝐼𝑛𝑠𝑡𝑟𝑢𝑚𝑒𝑛𝑡𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔) ]

*Treasury stock method

Comprehensive Income

Comprehensive Income = Net Income + Other

Comprehensive Income

Financial Asset Measurement

Held-for-trading: measured at fair value on B/S,

Dividends/Interest and Unrealized/Realized PnL on

I/S

Available-for-sale: measured at fair value on B/S;

realized PnL I/S; unrealized PnL OCI

Held-to-maturity: Amortized cost on B/S;

Coupons/Dividends through I/S; realized Pnl I/S

IFRS vs US GAAP

IFRS

Interest Received: Operating or Investing

Interest Paid: Operating or Financing

Dividends Received: Operating or Investing

Dividends Paid: Operating or Financing

US GAAP

Interest Received: Operating

Interest Paid: Operating

Dividends Received: Operating

Dividends Paid: Financing

Direct Method vs Indirect Method

Direct Method: disclose cash inflows by source and

cash outflows by use

Indirect Method: reconcile change in cash from net

income with non-cash items and net changes in

working capital

Free Cash Flow to the Firm (FCFF)

𝐹𝐶𝐹𝐹

= NI + NCC + Int(1 – Tax rate)– FCInv – WCInv

𝐹𝐶𝐹𝐹 = CFO + Int(1 – Tax rate)– FCInv

Free Cash Flow to Equity (FCFE)

𝐹𝐶𝐹𝐸 = 𝐶𝐹𝑂 – 𝐹𝐶𝐼𝑛𝑣 + 𝑁𝑒𝑡 𝑏𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔

𝐹𝐶𝐹𝐸 = 𝑁𝐼 + 𝑁𝐶𝐶 – 𝐶𝑎𝑝𝐸𝑥 – 𝛥𝑊𝑜𝑟𝑘𝑖𝑛𝑔 𝐶𝑎𝑝𝑖𝑡𝑎𝑙

+ 𝑁𝑒𝑡 𝐵𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔

Activity Ratios

Receivables Turnover =

Revenue

Average receivables

Days of sales outstanding =

Number of days in period

Receivables turnover

Inventory turnover =

Cost of sales or cost of goods sold

Average inventory

Days of inventory on hand =

Number of days in period

Inventory turnover

Payables turnover =

Purchases

Average trade payables

Number of days of payables =

Number of days in period

Payables turnover

Fixed asset turnover =

Revenue

Average net fixed assets

Total asset turnover =

Revenue

Average total assets

Liquidity Ratios

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑟𝑎𝑡𝑖𝑜 =

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝑄𝑢𝑖𝑐𝑘 𝑟𝑎𝑡𝑖𝑜

=

𝐶𝑎𝑠ℎ + 𝑆ℎ𝑜𝑟𝑡 𝑡𝑒𝑟𝑚 𝑀𝑎𝑟𝑘𝑒𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑐𝑢𝑟𝑖𝑡𝑖𝑒𝑠 + 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝐶𝑎𝑠ℎ 𝑟𝑎𝑡𝑖𝑜

=

𝐶𝑎𝑠ℎ + 𝑆ℎ𝑜𝑟𝑡 𝑡𝑒𝑟𝑚 𝑀𝑎𝑟𝑘𝑒𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑐𝑢𝑟𝑖𝑡𝑖𝑒𝑠

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

Defensive interval ratio

=

𝐶𝑎𝑠ℎ + 𝑆ℎ𝑜𝑟𝑡 𝑡𝑒𝑟𝑚 𝑀𝑎𝑟𝑘𝑒𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑐𝑢𝑟𝑖𝑡𝑖𝑒𝑠 + 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠

Daily cash expenditures

𝐶𝑎𝑠ℎ 𝑐𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛 𝑐𝑦𝑐𝑙𝑒

= Days of Inventory on hand

+ Day Sales Outstanding – Number of days of payables

FSA (2/10) FSA (3/10) FSA (4/10)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-9-2048.jpg)

![Internal Rate of Return (IRR)

∑

CFt

(1 + IRR)t

𝑁

𝑡=0

= 0

IRR is the discount rate that sets NPV to zero

*Refer to Cash Flow Worksheet under TVM section

Weighted Average Cost of Capital (WACC)

𝑊𝐴𝐶𝐶 = 𝑤𝑑𝑟𝑑 (1 – 𝑡) + 𝑤𝑝𝑟𝑝 + 𝑤𝑒𝑟𝑒

Cost of Equity using CAPM

𝐸(𝑅𝑖) = 𝑅𝐹 + 𝛽𝑖[𝐸(𝑅𝑀) − 𝑅𝐹]

Cost of Debt Capital

After tax cost of debt = r𝑑 (1 – t)

Cost of Preferred Stock

𝑟𝑝 =

D𝑝

P𝑝

Cost of Equity using DDM Approach

𝑟𝑒 =

𝐷1

𝑃0

+ 𝑔

Sustainable Growth Rate

𝑔 = (1 −

𝐷

𝐸𝑃𝑆

) × 𝑅𝑂𝐸

Estimating Beta

Unlevering the peer company’s beta

β𝑈𝑛𝑙𝑒𝑣𝑒𝑟𝑒𝑑 = β𝐸𝑞𝑢𝑖𝑡𝑦 [

1

[1 + ((1 − t) ×

D

E

)]

]

Relever using capital structure of the estimated company.

β𝐸𝑞𝑢𝑖𝑡𝑦 = β𝑢𝑛𝑙𝑒𝑣𝑒𝑟𝑒𝑑 [1 + ((1 − t) ×

D

E

)]

Operating & Cash Conversion Cycle

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑐𝑦𝑐𝑙𝑒

= 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦

+ 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠

𝐶𝑎𝑠ℎ 𝑐𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛 𝑐𝑦𝑐𝑙𝑒

= 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦

+ 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠

− 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑝𝑎𝑦𝑎𝑏𝑙𝑒𝑠

Accounts Payable Management

Cost of trade credit = (1 +

%𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡

1−%𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡

)

365

𝑑𝑎𝑦𝑠 𝑝𝑎𝑠𝑡 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡

− 1

Equity

Margin Call Price

𝑀𝑎𝑟𝑔𝑖𝑛 𝑐𝑎𝑙𝑙 𝑝𝑟𝑖𝑐𝑒 = 𝑃0 × (

1 − 𝑖𝑛𝑖𝑡𝑖𝑎𝑙 𝑚𝑎𝑟𝑔𝑖𝑛

1 − 𝑚𝑎𝑖𝑛𝑡𝑒𝑛𝑎𝑛𝑐𝑒 𝑚𝑎𝑟𝑔𝑖𝑛

)

Leverage

𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑒𝑞𝑢𝑖𝑡𝑦 % =

1

𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒 𝑟𝑎𝑡𝑖𝑜

𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒 𝑟𝑎𝑡𝑖𝑜 =

𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑝𝑜𝑠𝑖𝑡𝑖𝑜𝑛

𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑒𝑞𝑢𝑖𝑡𝑦 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡

Rate of Return on Margin Transaction

𝑅𝑎𝑡𝑒 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛 =

𝑅𝑒𝑚𝑎𝑖𝑛𝑖𝑛𝑔 𝐸𝑞𝑢𝑖𝑡𝑦 − 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑂𝑢𝑡𝑙𝑎𝑦

𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑂𝑢𝑡𝑙𝑎𝑦

Price Weighted Index

𝑉𝑎𝑙𝑢𝑒𝑃𝑅𝐼 =

∑ 𝑛𝑖𝑃𝑖

𝑁

𝑡=1

𝐷𝑖𝑣𝑖𝑠𝑜𝑟

𝑤 𝑖

𝑃

=

𝑃𝑖

∑ 𝑃𝑖

𝑁

𝑡=1

Market-Value Weighted Index

𝑉𝑎𝑙𝑢𝑒𝑀𝑉𝑊 =

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑡𝑜𝑡𝑎𝑙 𝑚𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒

𝐵𝑎𝑠𝑒 𝑦𝑒𝑎𝑟 𝑡𝑜𝑡𝑎𝑙 𝑚𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒

× 𝐵𝑎𝑠𝑒 𝑦𝑒𝑎𝑟 𝑖𝑛𝑑𝑒𝑥 𝑣𝑎𝑙𝑢𝑒

𝑤𝑖𝑀

=

𝑄𝑖𝑃𝑖

∑ 𝑄𝑗𝑃

𝑗

𝑁

𝑗=1

Equal Weighted Index

𝑉𝑎𝑙𝑢𝑒𝐸𝑊 = 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑖𝑛𝑑𝑒𝑥 𝑣𝑎𝑙𝑢𝑒

× (1 + % 𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒)

𝑤 𝑖

𝐸

=

1

𝑁

Price and Total Return of an Index

𝑃𝑟𝑖𝑐𝑒 𝑅𝑒𝑡𝑢𝑟𝑛𝑖𝑛𝑑𝑒𝑥 =

𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒1 − 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0

𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0

𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑡𝑢𝑟𝑛𝑖𝑛𝑑𝑒𝑥

=

𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒1 − 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0 + 𝐼𝑛𝑐𝑜𝑚𝑒

𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0

Forms of Market Efficiency

Weak Form; security prices fully reflect all past

market data; past trading data is already reflected in

prices; technical analysis won’t lead to superior risk-

adjusted performance

Semi-Strong Form; prices reflect all publicly known

and available information; new information is

rapidly reflected in prices; fundamental and

technical analysis can’t achieve excess returns

Strong Form; security prices fully reflect both public

and private information; technical analysis,

fundamental analysis and private information can’t

be used to achieve excess returns

Porter’s Five Forces and Competitive

Strategies

Threat of Entry

Power of Suppliers

Power of Buyers

Threat of Substitutes

Rivalry among existing Competitors

Two Competitive Strategies: Product Differentiation

and Cost Leadership

EQ (2/4) EQ (3/4) EQ (4/4) PM (1/4)

CORP (2/3) CORP (3/3) EQ (1/4) EQ (2/4)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-12-2048.jpg)

![Value of Common Stock

Dividend Discount Model

𝑉𝑜 = ∑

𝐷0 × (1 + 𝑔𝑠)𝑡

(1 + 𝑟)𝑡

𝑛

𝑡=1

+

𝑉

𝑛

(1 + 𝑟)𝑛

Gordon Growth Model

𝑉0 =

𝐷0 × (1 + 𝑔)

𝑟 − 𝑔

𝑆𝑢𝑠𝑡𝑎𝑖𝑛𝑎𝑏𝑙𝑒 𝑔𝑟𝑜𝑤𝑡ℎ = (1 − 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑝𝑎𝑦𝑜𝑢𝑡 𝑟𝑎𝑡𝑖𝑜)

× 𝑅𝑂𝐸

𝑔 = 𝑏 × 𝑅𝑂𝐸

Value of Preferred Stock

𝑉0 =

𝐷0

𝑟

𝑉𝑜 = ∑

𝐷𝑡

(1 + 𝑟)𝑡

𝑛

𝑡=1

+

𝑃𝑎𝑟 𝑉𝑎𝑙𝑢𝑒

(1 + 𝑟)𝑛

Price Multiples

𝐽𝑢𝑠𝑡𝑖𝑓𝑖𝑒𝑑 𝑃/𝐸 =

𝐷1

𝐸1

𝑟 − 𝑔

=

𝑝𝑎𝑦𝑜𝑢𝑡 𝑟𝑎𝑡𝑖𝑜

𝑟 − 𝑔

𝑃/𝐸 =

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝑃/𝐶𝐹 =

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝐶𝑎𝑠ℎ 𝑓𝑙𝑜𝑤 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝑃/𝑆 =

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝑆𝑎𝑙𝑒𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝑃/𝐵 =

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

𝐵𝑜𝑜𝑘 𝑣𝑎𝑙𝑢𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

Enterprise Value Multiples

𝐸𝑉

𝐸𝐵𝐼𝑇𝐷𝐴

=

𝐸𝑛𝑡𝑒𝑟𝑝𝑟𝑖𝑠𝑒 𝑣𝑎𝑙𝑢𝑒

𝐸𝐵𝐼𝑇𝐷𝐴

Asset Based Model

𝐸𝑞𝑢𝑖𝑡𝑦 𝑣𝑎𝑙𝑢𝑒

= 𝑀𝑎𝑟𝑘𝑒𝑡 𝑜𝑟 𝑓𝑎𝑖𝑟 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦′

𝑠 𝑎𝑠𝑠𝑒𝑡𝑠

− 𝑀𝑎𝑟𝑘𝑒𝑡 𝑜𝑟 𝑓𝑎𝑖𝑟 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦′

𝑠 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

Portfolio Management

Return Measures

Holding Period Return

HPR =

𝑃1 − 𝑃0 + 𝐷1

𝑃0

Arithmetic Return

𝐴𝑟𝑖𝑡ℎ𝑚𝑒𝑡𝑖𝑐 𝑟𝑒𝑡𝑢𝑟𝑛 =

𝑅1 + 𝑅2 + 𝑅3 + 𝑅4 + ⋯ 𝑅𝑛

𝑛

Geometric Mean Return

𝐺𝑒𝑜𝑚𝑒𝑡𝑟𝑖𝑐 𝑚𝑒𝑎𝑛 𝑟𝑒𝑡𝑢𝑟𝑛

= [(1 + R1) × (1 + R2) × …

× (1 + R𝑛)]

1

n − 1

Money Weighted Rate of Return

∑

CFt

(1 + MWRR)t

𝑁

𝑡=0

= 0

*Use IRR function on calculator to solve this

Time Weighted Rate of Return

𝑟𝑇𝑊 = [(1 + r1) × (1 + r2) × … × (1 + r𝑁)]

1

N − 1

Nominal Return

𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛 (𝑟) = (1 + rrF ) × (1 + π) − 1

Variance (Asset Returns)

𝜎2

=

∑ (𝑅𝑡 − 𝜇)2

𝑇

𝑡=1

𝑇

𝑠2

=

∑ (𝑅𝑡 − 𝑅

̅)2

𝑇

𝑡=1

𝑇 − 1

Standard Deviation

Square root of variance

Covariance (Asset Returns)

𝑐𝑜𝑣(𝑅𝑖, 𝑅𝑗) =

∑ [(𝑅𝑖 − 𝐸(𝑅𝑖̇)(𝑅𝑗 − 𝐸(𝑅𝑗̇)]

𝒏

𝒕=𝟏

𝑛 − 1

Correlation (Asset Returns)

𝜌(𝑅𝑖, 𝑅𝑗) =

𝑐𝑜𝑣(𝑅𝑖, 𝑅𝑗)

𝜎(𝑅𝑖)𝜎(𝑅𝑗)

Investment Utility

𝑈𝑡𝑖𝑙𝑖𝑡𝑦 = 𝐸(𝑟) −

1

2

𝐴𝜎2

𝐴 = 𝑚𝑒𝑎𝑠𝑢𝑟𝑒 𝑜𝑓 𝑟𝑖𝑠𝑘 𝑎𝑣𝑒𝑟𝑠𝑖𝑜𝑛

Portfolio Return

𝑅𝑝 = 𝑤1̇ (𝑅1̇ ) + 𝑤2̇ (𝑅2̇ ) + 𝑤3(𝑅3) … 𝑤𝑛(𝑅𝑛̇ )

Portfolio Standard Deviation

𝜎𝑝 = √(𝑤1̇

2

𝜎1̇

2

+ 𝑤2̇

2

𝜎2̇

2

+ 2𝑤1̇ 𝑤2̇ 𝜌1,2𝜎1𝜎2)

𝜎𝑝 = √(𝑤1̇

2

𝜎1̇

2

+ 𝑤2̇

2

𝜎2̇

2

+ 2𝑤1̇ 𝑤2̇ 𝐶𝑜𝑣(𝑅1,𝑅2))

Capital Allocation Line (CAL)

Portfolio Expected Return and Standard Deviation

Plot of combinations Risk-Free and Risky Asset

𝐸(𝑟𝐶) = 𝑟𝑓 + 𝜎𝐶

𝐸(𝑟𝑃) − 𝑟𝑓

𝜎𝑃

Capital Market Line (CML)

Tangency point of efficient frontier on Capital

Allocation Line. The risky portfolio becomes the

market portfolio.

EQ (3/4) EQ (4/4) PM (1/3) PM (2/3)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-13-2048.jpg)

![Beta

𝛽𝑖 =

𝐶𝑜𝑣(𝑅𝑖, 𝑅𝑚)

𝜎𝑚

2

=

𝜌𝑖,𝑚 𝜎𝑖

𝜎𝑚

Expected Return (CAPM)

𝐸(𝑅𝑖) = 𝑅𝐹 + 𝛽𝑖[𝐸(𝑅𝑀) − 𝑅𝐹]

Security Market Line

Expected Return and Beta Plot with CAPM used to

form the SML. Stocks above the line are

undervalued. Stocks below the line are overvalued.

Sharpe Ratio

𝑆ℎ𝑎𝑟𝑝𝑒 𝑅𝑎𝑡𝑖𝑜 =

𝑅𝑝 − 𝑅𝑓

𝜎𝑝

Treynor Ratio

𝑇𝑟𝑒𝑦𝑛𝑜𝑟 𝑚𝑒𝑎𝑠𝑢𝑟𝑒 =

𝑅𝑝 − 𝑅𝑓

𝛽𝑝

M-Squared

𝑀2

= (𝑅𝑝 − 𝑅𝑓)

𝜎𝑀

𝜎𝑝

− (𝑅𝑀 − 𝑅𝑓)

Jensen’s Alpha

𝛼𝑝 = 𝑅𝑝 − [𝑅𝐹 + 𝛽𝑖(𝐸(𝑅𝑀) − 𝑅𝐹)]

Total Risk

Total Risk = Systematic Risk + Non-Systematic Risk

Investment Policy Statement (IPS)

Introduction

Statement of Purpose

Statement of Duties and Responsibilities

Procedures

Investment Objectives (Risk and Return Objectives)

Investment Constraints (Liquidity, Time Horizon,

Regulatory Requirements, Tax Status)

Investment Guidelines

Evaluation and Review

Fixed Income

Basic Features of Fixed-Income Securities

Coupon Rate: Interest rate issuer agrees to pay

Maturity: Time until principal paid

Par Value: Bond’s Principal/Face Value

Issuer: Sovereign Governments, Corporate Issuers

Sinking Fund Provision: Periodic payments to retire

bonds early

Types of Bonds

Callable Bonds: Issuer can force investors to sell

their bonds. Increases yield and lowers duration.

Putable Bonds: Investor can sell bond back to

issuer. Lowers yield and duration.

Convertible Bonds: Bondholders can convert bonds

to common shares

Eurobond: international bond denominated in

currency not native to country where it is issued.

𝐸𝑚𝑏𝑒𝑑𝑑𝑒𝑑 𝑂𝑝𝑡𝑖𝑜𝑛 𝑉𝑎𝑙𝑢𝑒

= 𝐵𝑜𝑛𝑑 𝑉𝑎𝑙𝑢𝑒 𝑤𝑖𝑡ℎ 𝑂𝑝𝑡𝑖𝑜𝑛

− 𝐵𝑜𝑛𝑑 𝑉𝑎𝑙𝑢𝑒 𝑤𝑖𝑡ℎ𝑜𝑢𝑡 𝑂𝑝𝑡𝑖𝑜𝑛

Structured Financial Instruments

Collateralized Debt Obligations (CDO): securities

backed by pool of debt obligations

Capital Protected Instruments: Zero coupon bond +

Option Payoff

Yield Enhancement Instruments: Credit Linked Note

Participation Instruments: Floating Rate Bonds

Leveraged Instruments: Inverse Floater

Bond Pricing

Annual Bond

𝑃𝑉

=

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑌𝑇𝑀)

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑌𝑇𝑀)2

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑌𝑇𝑀)3

+. . +

𝐶𝑜𝑢𝑝𝑜𝑛 + 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙

(1 + 𝑌𝑇𝑀)𝑁

Semi-Annual Bond

𝑃𝑉

=

𝐶𝑜𝑢𝑝𝑜𝑛

(1 +

𝑌𝑇𝑀

2

)

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 +

𝑌𝑇𝑀

2

)

2

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 +

𝑌𝑇𝑀

2

)

3 +. . +

𝐶𝑜𝑢𝑝𝑜𝑛 + 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙

(1 +

𝑌𝑇𝑀

2

)

𝑁×2

Pricing with Spot Rates

𝑁𝑜 𝑎𝑟𝑏𝑖𝑡𝑟𝑎𝑔𝑒 𝑝𝑟𝑖𝑐𝑒

=

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑆1)

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑆2)2

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑆3)3

+. . +

𝐶𝑜𝑢𝑝𝑜𝑛 + 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙

(1 + 𝑆𝑛)𝑁

Pricing with Forward Rates

𝐵𝑜𝑛𝑑 𝑣𝑎𝑙𝑢𝑒

=

𝐶𝑜𝑢𝑝𝑜𝑛

1 + 𝑆1

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑆1) × (1 + 1𝑦1𝑦)

+

𝐶𝑜𝑢𝑝𝑜𝑛

(1 + 𝑆1) × (1 + 1𝑦1𝑦) × (1 + 2𝑦1𝑦)

Forward rate and Spot rate calculation

(1 + 𝑆2)2

= (1 + 𝑆1)1

× (1 + 1𝑦1𝑦)

Flat Price

𝐹𝑙𝑎𝑡 𝑝𝑟𝑖𝑐𝑒 = 𝐷𝑖𝑟𝑡𝑦 𝑝𝑟𝑖𝑐𝑒(𝐹𝑢𝑙𝑙 𝑝𝑟𝑖𝑐𝑒)

− 𝑎𝑐𝑐𝑟𝑢𝑒𝑑 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡

Accrued Interest

𝐴𝑐𝑐𝑟𝑢𝑒𝑑 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡

= 𝐶𝑜𝑢𝑝𝑜𝑛 𝑝𝑎𝑦𝑚𝑒𝑛𝑡

×

(𝐷𝑎𝑦𝑠 𝑏𝑒𝑡𝑤𝑒𝑒𝑛 𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑐𝑜𝑢𝑝𝑜𝑛 𝑑𝑎𝑡𝑒 𝑎𝑛𝑑 𝑠𝑒𝑡𝑡𝑙𝑒𝑚𝑒𝑛𝑡 𝑑𝑎𝑡𝑒)

(𝐷𝑎𝑦𝑠 𝑏𝑒𝑡𝑤𝑒𝑒𝑛 𝑡ℎ𝑒 𝑡𝑤𝑜 𝑐𝑜𝑢𝑝𝑜𝑛 𝑑𝑎𝑡𝑒𝑠)

Full Price

𝑃𝑉𝐹𝑢𝑙𝑙

= 𝑃𝑉(1 + 𝑟)𝑡/𝑇

= 𝑃𝑉𝐹𝑙𝑎𝑡

+ 𝐴𝑐𝑐𝑟𝑢𝑒𝑑 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡

Option-Adjusted Price

Value of non-callable bond

= 𝐹𝑙𝑎𝑡 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑐𝑎𝑙𝑙𝑎𝑏𝑙𝑒 𝑏𝑜𝑛𝑑

+ 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑒𝑚𝑏𝑒𝑑𝑑𝑒𝑑 𝑐𝑎𝑙𝑙 𝑜𝑝𝑡𝑖𝑜𝑛

PM (3/3) FI (1/6) FI (2/6)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-14-2048.jpg)

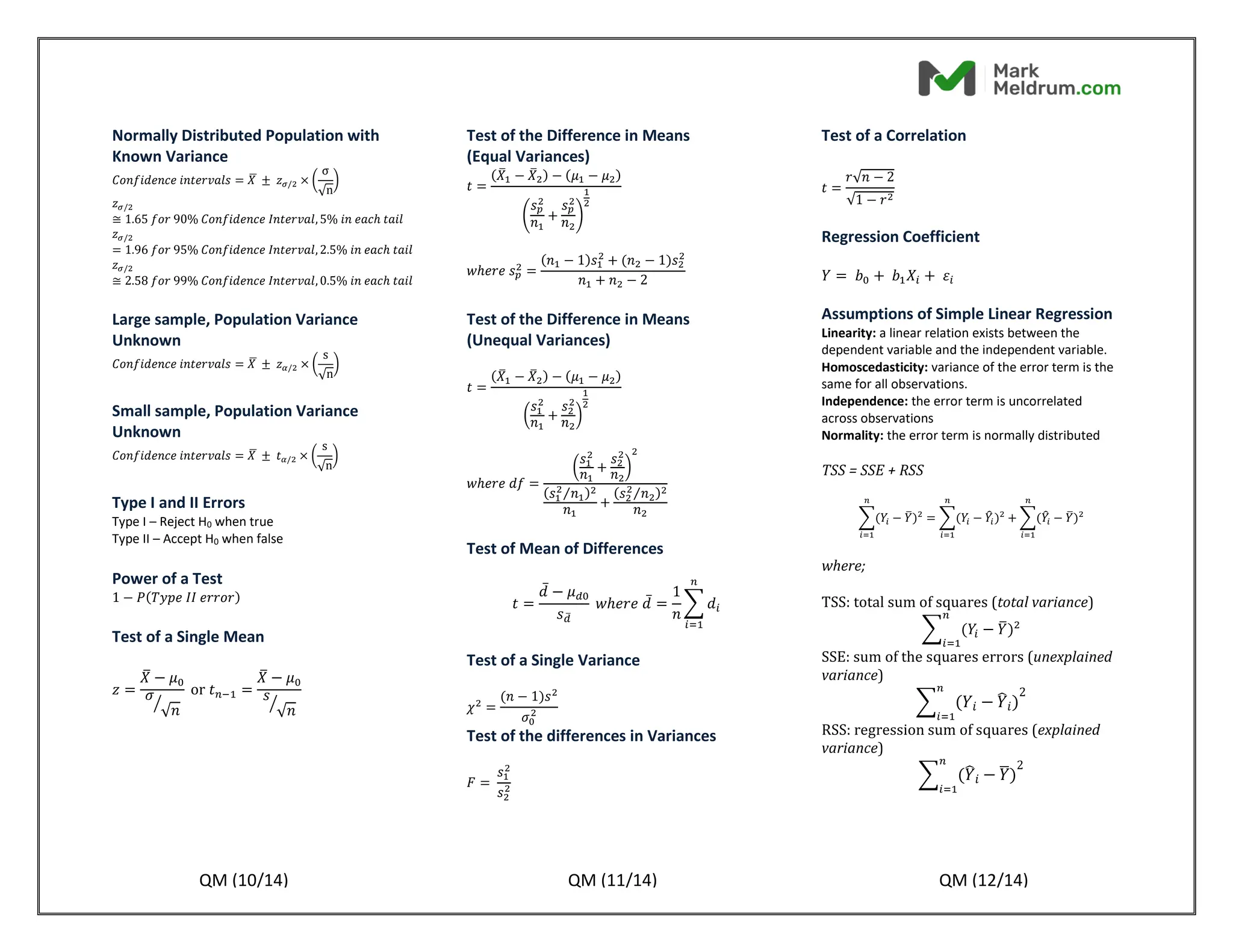

![Yield Measures

Current Yield

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑌𝑖𝑒𝑙𝑑 =

𝑎𝑛𝑛𝑢𝑎𝑙 𝑐𝑎𝑠ℎ 𝑐𝑜𝑢𝑝𝑜𝑛 𝑝𝑎𝑦𝑚𝑒𝑛𝑡

𝑏𝑜𝑛𝑑 𝑝𝑟𝑖𝑐𝑒

Effective Annual Yield

𝐸𝐴𝑌 = (1 + 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑟𝑎𝑡𝑒)𝑚

− 1

𝑚 = 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑖𝑛𝑔 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑂𝑛𝑒 𝑌𝑒𝑎𝑟

Conversion for Periodicity

(1 +

𝐴𝑃𝑅𝑚

𝑚

)

𝑚

= (1 +

𝐴𝑃𝑅𝑛

𝑛

)

𝑛

Money Market Instruments

𝑀𝑜𝑛𝑒𝑦 𝑚𝑎𝑟𝑘𝑒𝑡 𝑦𝑖𝑒𝑙𝑑

= (

𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒 − 𝑃𝑟𝑖𝑐𝑒

𝑃𝑟𝑖𝑐𝑒

)

× (

360

𝐷𝑎𝑦𝑠 𝑡𝑜 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦

)

𝐵𝑜𝑛𝑑 𝑒𝑞𝑢𝑖𝑣𝑎𝑙𝑒𝑛𝑡 𝑦𝑖𝑒𝑙𝑑

= (

𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒 − 𝑃𝑟𝑖𝑐𝑒

𝑃𝑟𝑖𝑐𝑒

)

× (

365

𝐷𝑎𝑦𝑠 𝑡𝑜 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦

)

𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑏𝑎𝑠𝑖𝑠 𝑦𝑖𝑒𝑙𝑑 = (

𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒−𝑃𝑟𝑖𝑐𝑒

𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒

) ×

(

360

𝐷𝑎𝑦𝑠 𝑡𝑜 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦

)

Yield Spreads

G-Spread

𝐺 𝑠𝑝𝑟𝑒𝑎𝑑 = 𝑌𝑇𝑀𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝐵𝑜𝑛𝑑 − 𝑌𝑇𝑀𝐺𝑜𝑣𝑒𝑟𝑛𝑚𝑒𝑛𝑡 𝐵𝑜𝑛𝑑

I-Spread

𝐼 𝑠𝑝𝑟𝑒𝑎𝑑 = 𝑌𝑇𝑀𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝐵𝑜𝑛𝑑 − 𝑆𝑤𝑎𝑝 𝑟𝑎𝑡𝑒

Z-Spread

𝑃𝑉 =

𝑃𝑀𝑇

(1 + 𝑧1 + 𝑍)

+

𝑃𝑀𝑇

(1 + 𝑧2 + 𝑍)2

+ . . +

𝑃𝑀𝑇 + 𝐹𝑉

(1 + 𝑧𝑛 + 𝑍)𝑁

Option-Adjusted-Spread

𝑂𝐴𝑆 = 𝑍 𝑠𝑝𝑟𝑒𝑎𝑑 − 𝑂𝑝𝑡𝑖𝑜𝑛 𝑣𝑎𝑙𝑢𝑒 (bps per year)

Securitization Parties

Seller of the Collateral (Pool of Loans)

Loan Servicer

Special Purpose Entity (SPE)

Asset-Backed Securities

Collateralized Debt Obligations (CDOs): MBS,

Automotive Loans, Credit Card Loans

*can be tranched by credit risk and prepayment risk

Prepayment Risk: Contraction and Extension Risk

𝑃𝑎𝑠𝑠 𝑡ℎ𝑟𝑜𝑢𝑔ℎ 𝑟𝑎𝑡𝑒

= 𝑀𝑜𝑟𝑡𝑔𝑎𝑔𝑒 𝑟𝑎𝑡𝑒 𝑜𝑛 𝑡ℎ𝑒 𝑢𝑛𝑑𝑒𝑟𝑙𝑖𝑛𝑔 𝑝𝑜𝑜𝑙 𝑜𝑓 𝑚𝑜𝑟𝑡𝑔𝑎𝑔𝑒𝑠

− 𝑆𝑒𝑟𝑣𝑖𝑐𝑖𝑛𝑔 𝑓𝑒𝑒 − 𝑂𝑡ℎ𝑒𝑟 𝑓𝑒𝑒

𝑆𝑖𝑛𝑔𝑙𝑒 𝑀𝑜𝑛𝑡ℎ 𝑀𝑜𝑟𝑡𝑎𝑙𝑖𝑡𝑦 𝑅𝑎𝑡𝑒 (𝑆𝑀𝑀)

=

𝑃𝑟𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑚𝑜𝑛𝑡ℎ

𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑀𝑜𝑛𝑡ℎ𝑙𝑦 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙 −

𝑆𝑐ℎ𝑒𝑑𝑢𝑙𝑒𝑑 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙 𝑅𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡

Credit Risk Ratios

Debt-Service-Coverage Ratio (DSCR)

=

𝑁𝑒𝑡 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒

𝐷𝑒𝑏𝑡 𝑠𝑒𝑟𝑣𝑖𝑐𝑒

Loan-to-Value ratio (LTV)

=

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑚𝑜𝑟𝑡𝑔𝑎𝑔𝑒 𝑎𝑚𝑜𝑢𝑛𝑡

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑝𝑝𝑟𝑎𝑖𝑠𝑒𝑑 𝑣𝑎𝑙𝑢𝑒

Bond Return

𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑡𝑢𝑟𝑛

= (

𝐶𝑜𝑢𝑝𝑜𝑛 & 𝑅𝑒𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 + 𝑃𝑛

𝑃0

)

1

𝑛

− 1

Duration

Macaulay Duration

𝑀𝑎𝑐𝐷𝑢𝑟 = {

1 + 𝑟

𝑟

−

1 + 𝑟 + [𝑁 × (𝑐 − 𝑟)]

(𝑐 × [(1 + 𝑟)𝑁 − 1] + 𝑟}

} − (

𝑡

𝑇

)

Modified Duration

𝑀𝑜𝑑𝐷𝑢𝑟 =

𝑀𝑎𝑐𝐷𝑢𝑟

1 + 𝑌𝑇𝑀

𝐴𝑝𝑝𝑟𝑜𝑥𝑖𝑚𝑎𝑡𝑒 𝑀𝑜𝑑𝐷𝑢𝑟 =

𝑉

− − 𝑉+

(2 × 𝑉0 × ∆𝑌𝑇𝑀)

Effective Duration

𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝑑𝑢𝑟𝑎𝑡𝑖𝑜𝑛 =

𝑉

− − 𝑉+

(2 × 𝑉0 × ∆𝐶𝑢𝑟𝑣𝑒)

Portfolio Duration

𝑃𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜 𝑑𝑢𝑟𝑎𝑡𝑖𝑜𝑛 = 𝑤1̇ (𝐷1̇ ) + 𝑤2̇ (𝐷2̇ )

+ 𝑤3(𝐷3) … 𝑤𝑛(𝐷𝑛̇ )

Money Duration

𝑀𝑜𝑛𝑒𝑦 𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛 = 𝐴𝑛𝑛𝑢𝑎𝑙 𝑀𝑜𝑑𝑖𝑓𝑖𝑒𝑑 𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛

× 𝑃𝑉𝐹𝑢𝑙𝑙

∆𝑃𝑉𝐹𝑢𝑙𝑙

= −𝑀𝑜𝑛𝑒𝑦 𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛 × ∆𝑌𝑖𝑒𝑙𝑑

𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛 𝑔𝑎𝑝 = 𝑀𝑎𝑐𝑎𝑢𝑙𝑎𝑦 𝑑𝑢𝑟𝑎𝑡𝑖𝑜𝑛

− 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 ℎ𝑜𝑟𝑖𝑧𝑜𝑛

Price Value of a Basis Point

𝑃𝑉𝐵𝑃 =

𝑉

− − 𝑉+

2

Convexity

𝐴𝑝𝑝𝑟𝑜𝑥𝑖𝑚𝑎𝑡𝑒 𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝐶𝑜𝑛𝑣𝑒𝑥𝑖𝑡𝑦 =

𝑉

− + 𝑉+ − 2 × 𝑉0

(∆𝑌𝑇𝑀)2 × 𝑉0

𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝐶𝑜𝑛𝑣𝑒𝑥𝑖𝑡𝑦 =

𝑉

− + 𝑉+ − 2 × 𝑉0

(∆𝑐𝑢𝑟𝑣𝑒)2 × 𝑉0

Price Change Estimate

∆𝑃𝑟𝑖𝑐𝑒 = −𝑎𝑛𝑛𝑢𝑎𝑙 𝑀𝑜𝑑𝐷𝑢𝑟 × (∆𝑌𝑖𝑒𝑙𝑑)

+

1

2

× 𝑎𝑛𝑛𝑢𝑎𝑙 𝑐𝑜𝑛𝑣𝑒𝑥𝑖𝑡𝑦

× (∆𝑌𝑖𝑒𝑙𝑑)2

Expected Loss

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑙𝑜𝑠𝑠 = 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 × (1

− 𝑟𝑒𝑐𝑜𝑣𝑒𝑟𝑦 𝑟𝑎𝑡𝑒)

FI (3/6) FI (4/6) FI (5/6)

M.M140077214.](https://image.slidesharecdn.com/l12024formulasheet-240918075754-180fcea8/75/CFA-Formula-Cheat-Sheet-All-Topics-covered-15-2048.jpg)