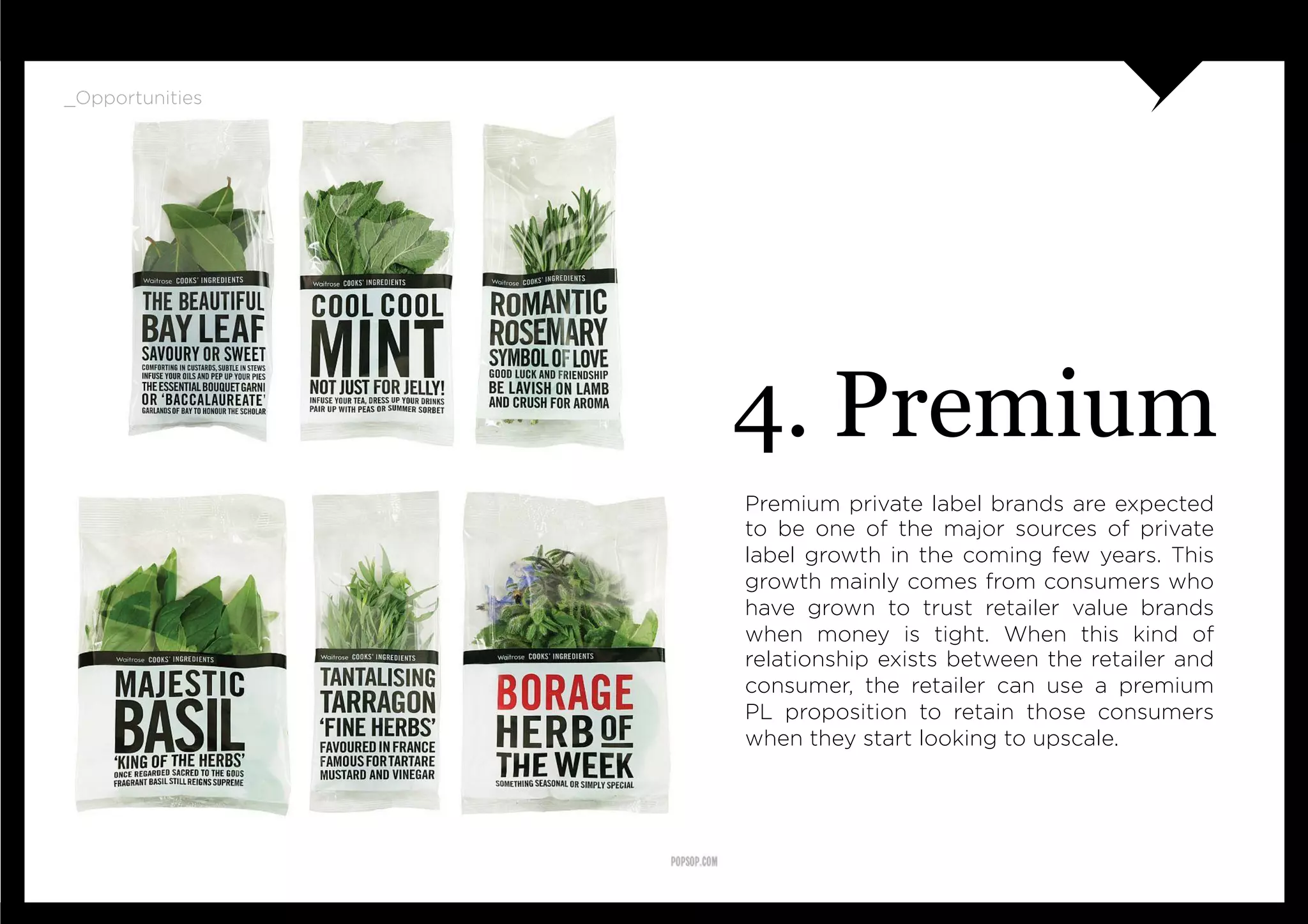

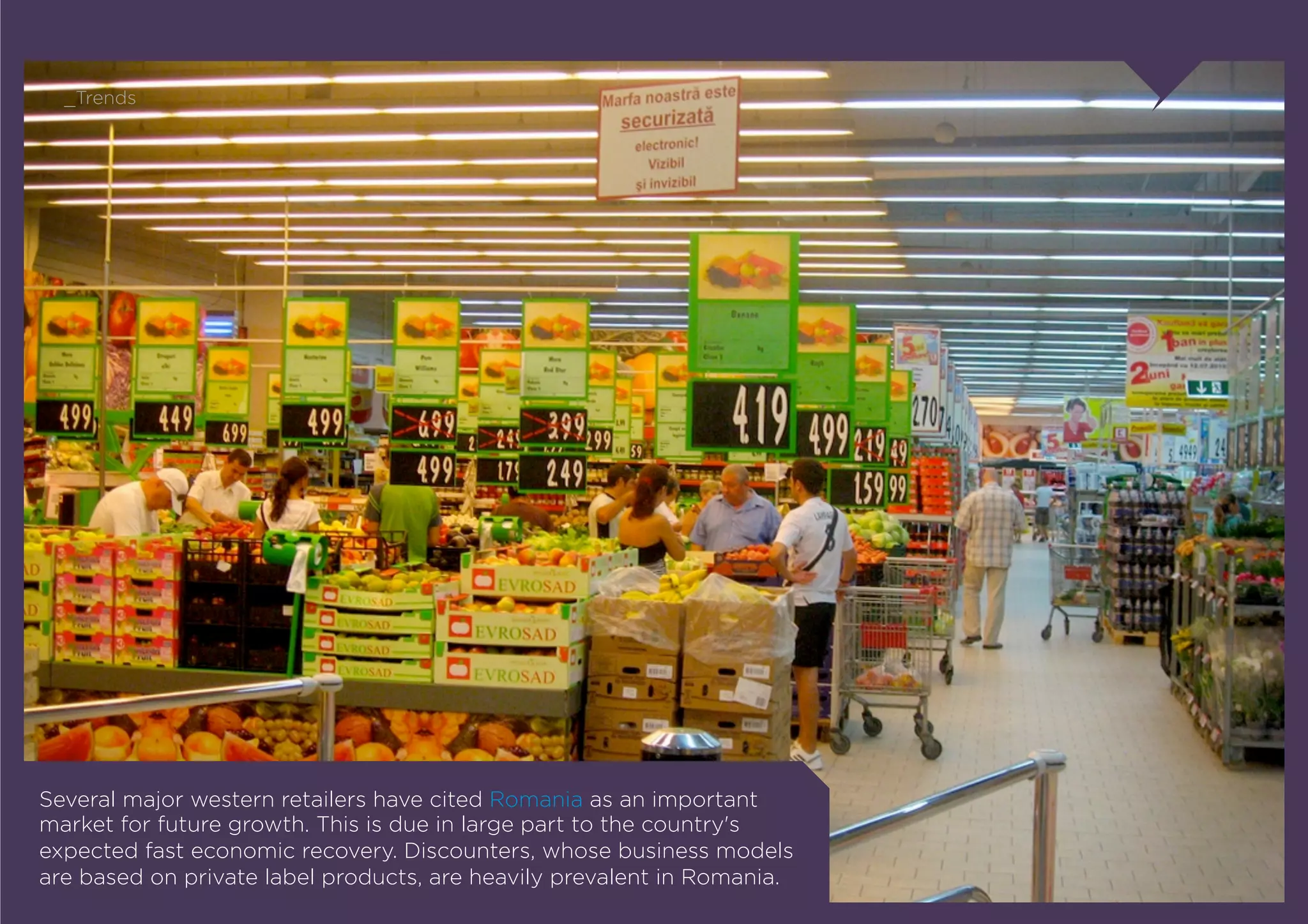

This document outlines the growth and opportunities in the private label market, particularly within Central and Eastern Europe, driven by trends such as value, local sourcing, organic products, and premium offerings. Retailers are encouraged to leverage these trends for portfolio expansion while navigating challenges in crowded markets. Key strategies include collaboration between retailers, innovative design, and addressing consumer demand for quality and sustainability.