1. The document outlines the agenda for the 20th anniversary event of CCR, a Brazilian infrastructure company, including presentations on challenges in infrastructure, CCR's business over the past 10 years, and future opportunities.

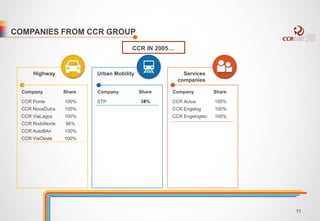

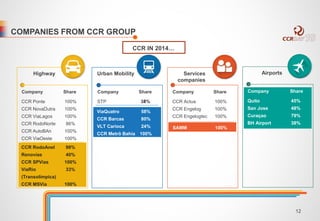

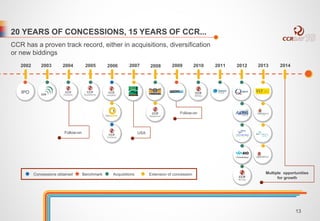

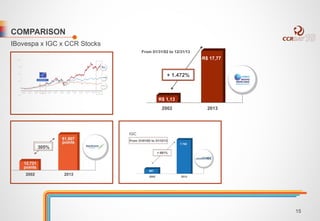

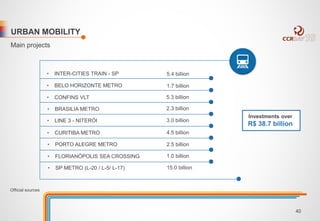

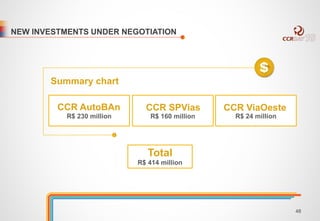

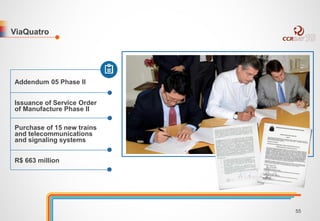

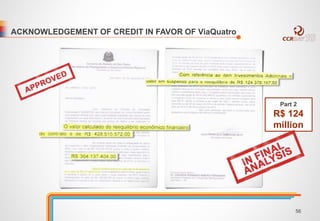

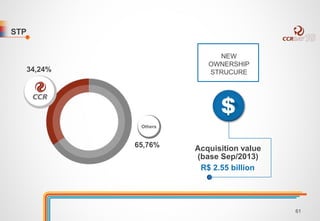

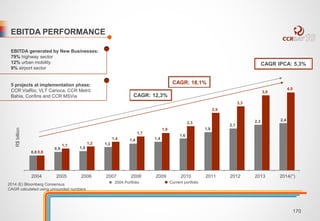

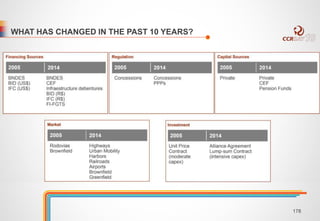

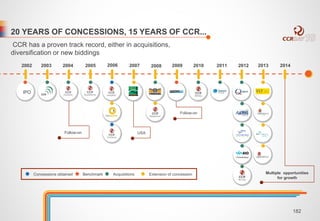

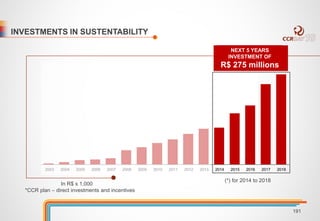

2. Over the past 10 years, CCR has expanded its operations beyond highways into new sectors like urban mobility and airports through acquisitions and partnerships.

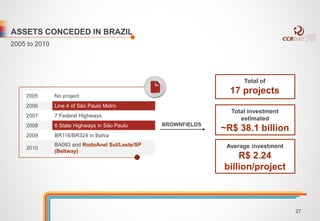

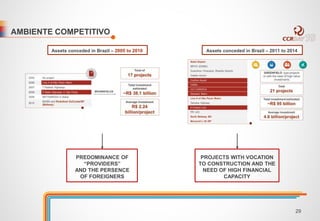

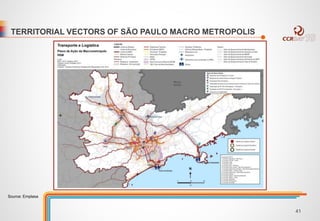

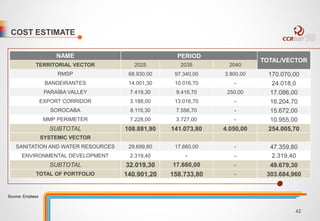

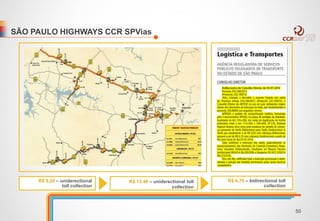

3. Upcoming infrastructure projects in Brazil include highways, railways, and urban mobility projects worth over $100 billion, representing opportunities for growth for CCR.