Embed presentation

Download as PDF, PPTX

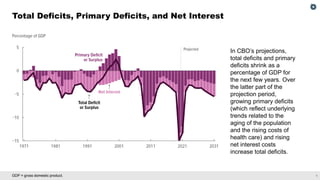

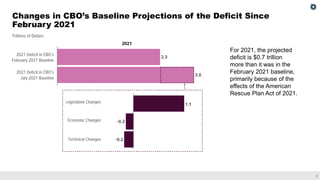

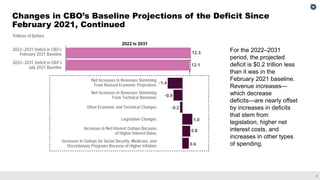

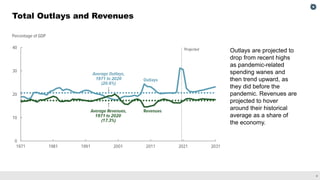

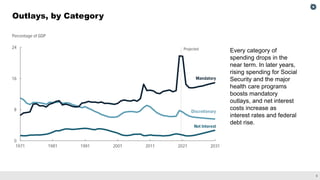

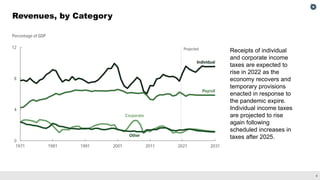

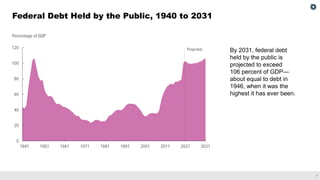

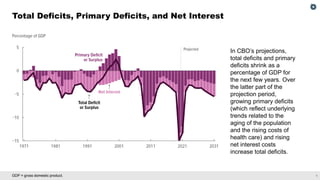

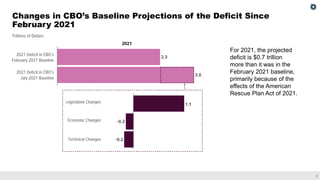

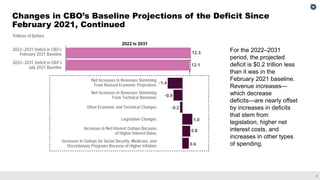

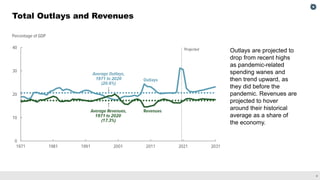

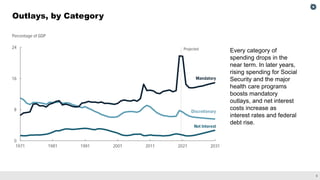

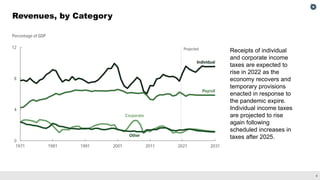

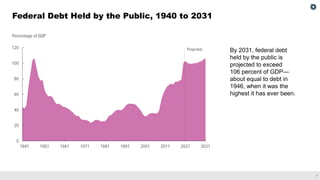

The CBO's updated budget projections reveal shrinking total and primary deficits as a percentage of GDP in the short term, but rising primary deficits and net interest costs will increase total deficits in the long term. The projected deficit for 2021 is $0.7 trillion higher than earlier estimates due to the American Rescue Plan, while projections for 2022-2031 show a $0.2 trillion decrease influenced by revenue increases offsetting additional spending. By 2031, federal debt held by the public is expected to exceed 106% of GDP, comparable to the post-World War II high.