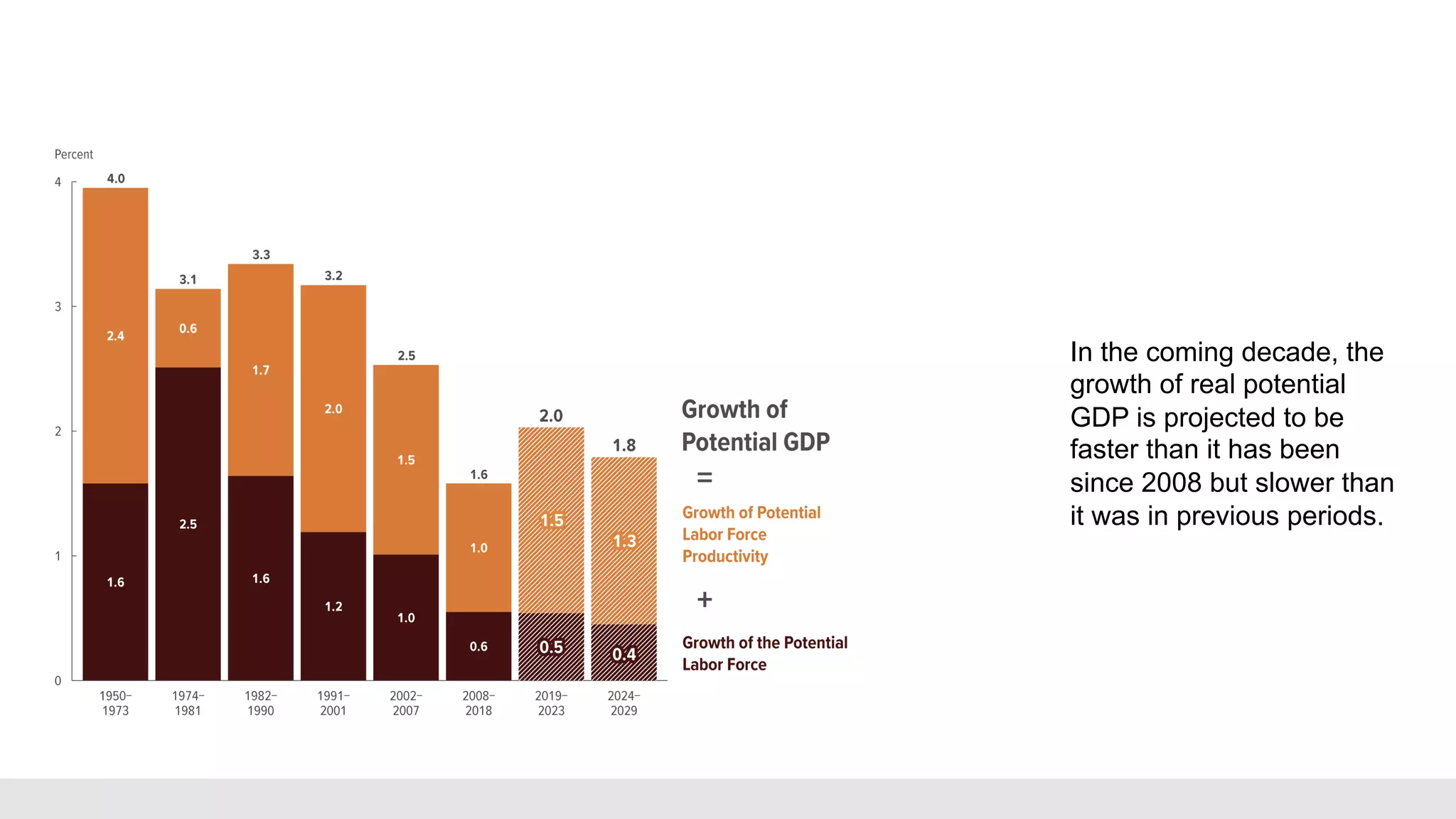

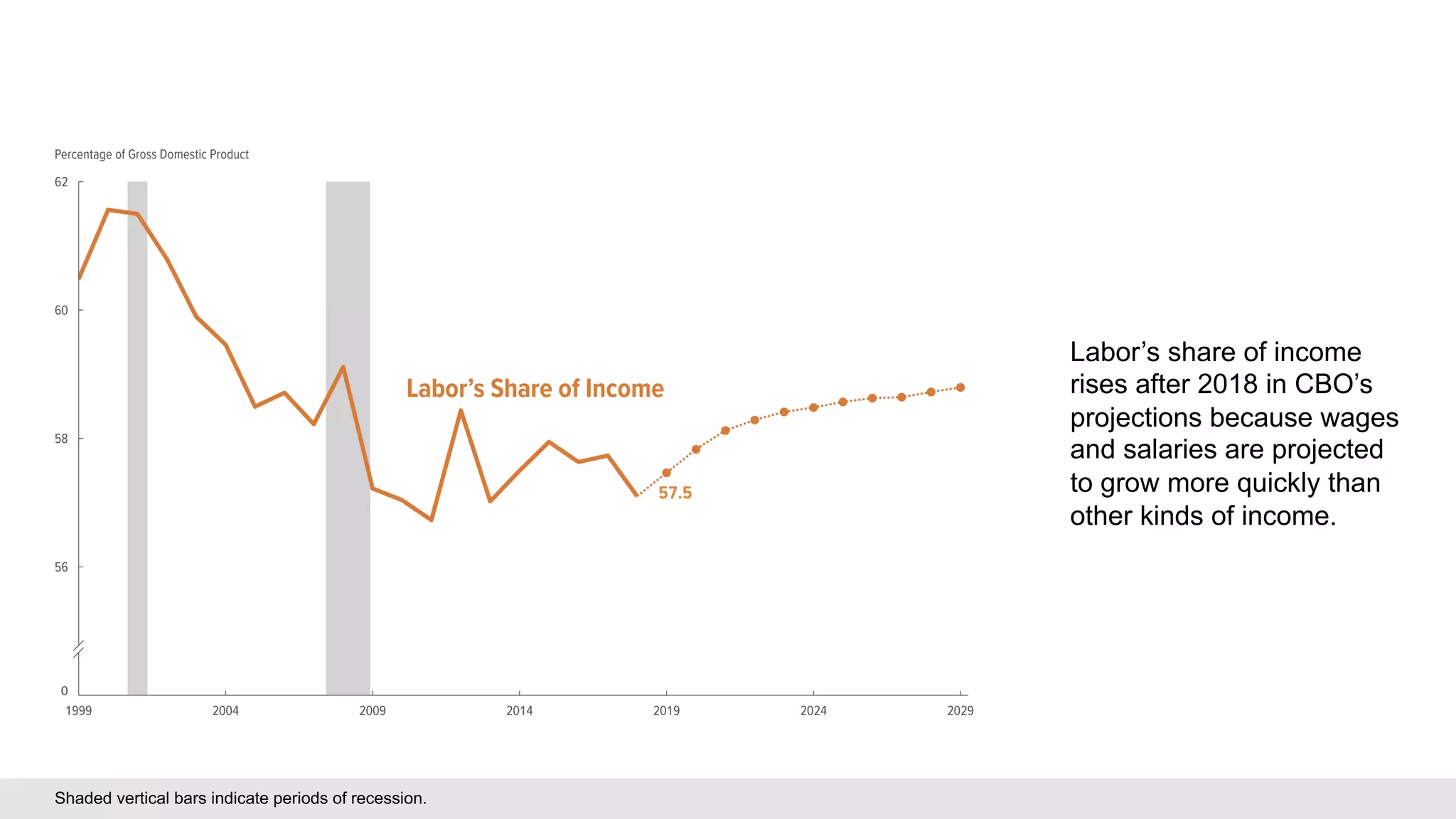

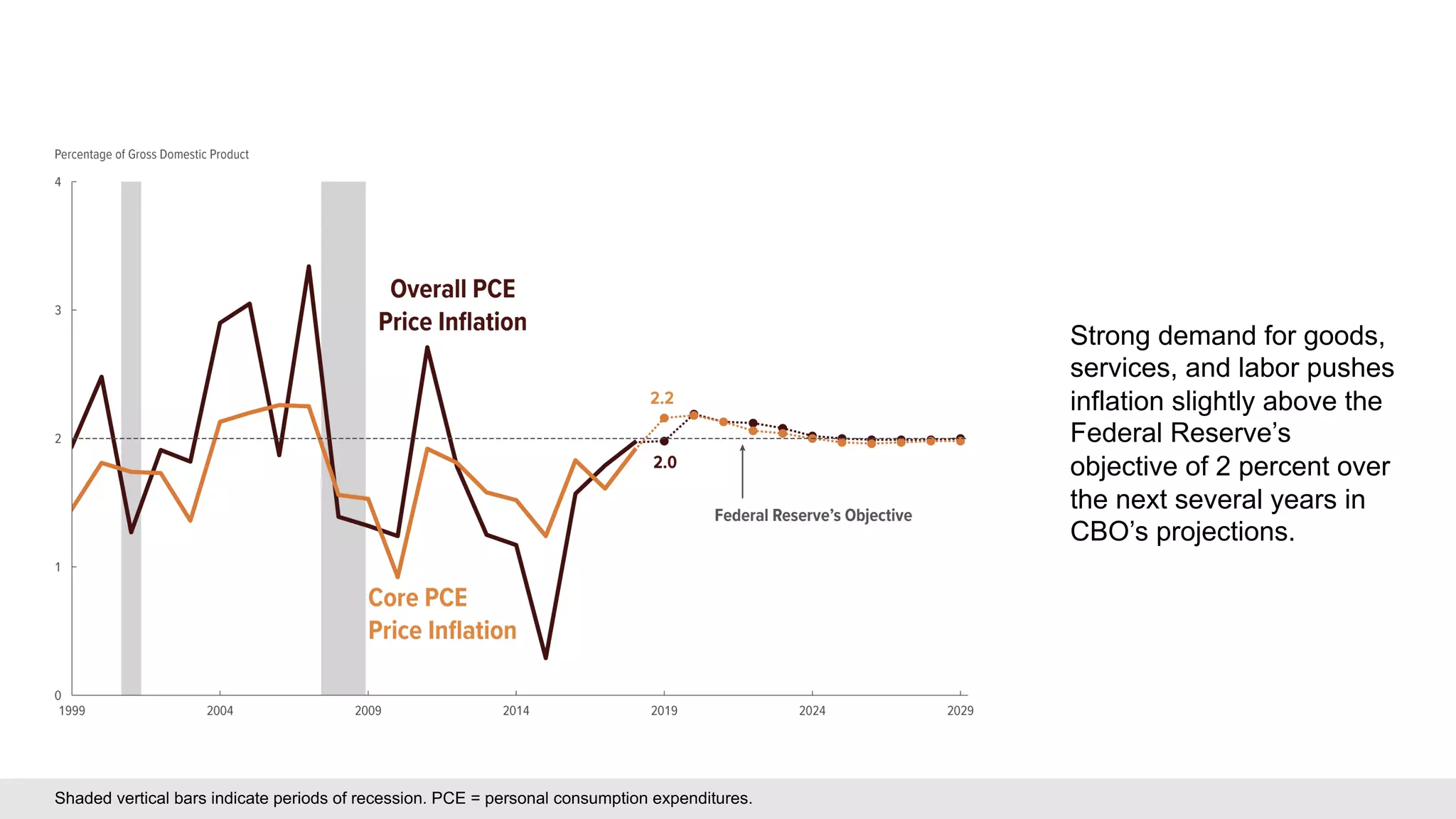

The Congressional Budget Office (CBO) projects that real GDP will grow by 2.3% in 2019, followed by an average annual growth of 1.9% from 2019 to 2023. The labor market is expected to experience increased demand for jobs, with the unemployment rate initially falling but rising again as growth slows. Inflation is anticipated to exceed the Federal Reserve's 2% target, prompting potential increases in the federal funds rate.