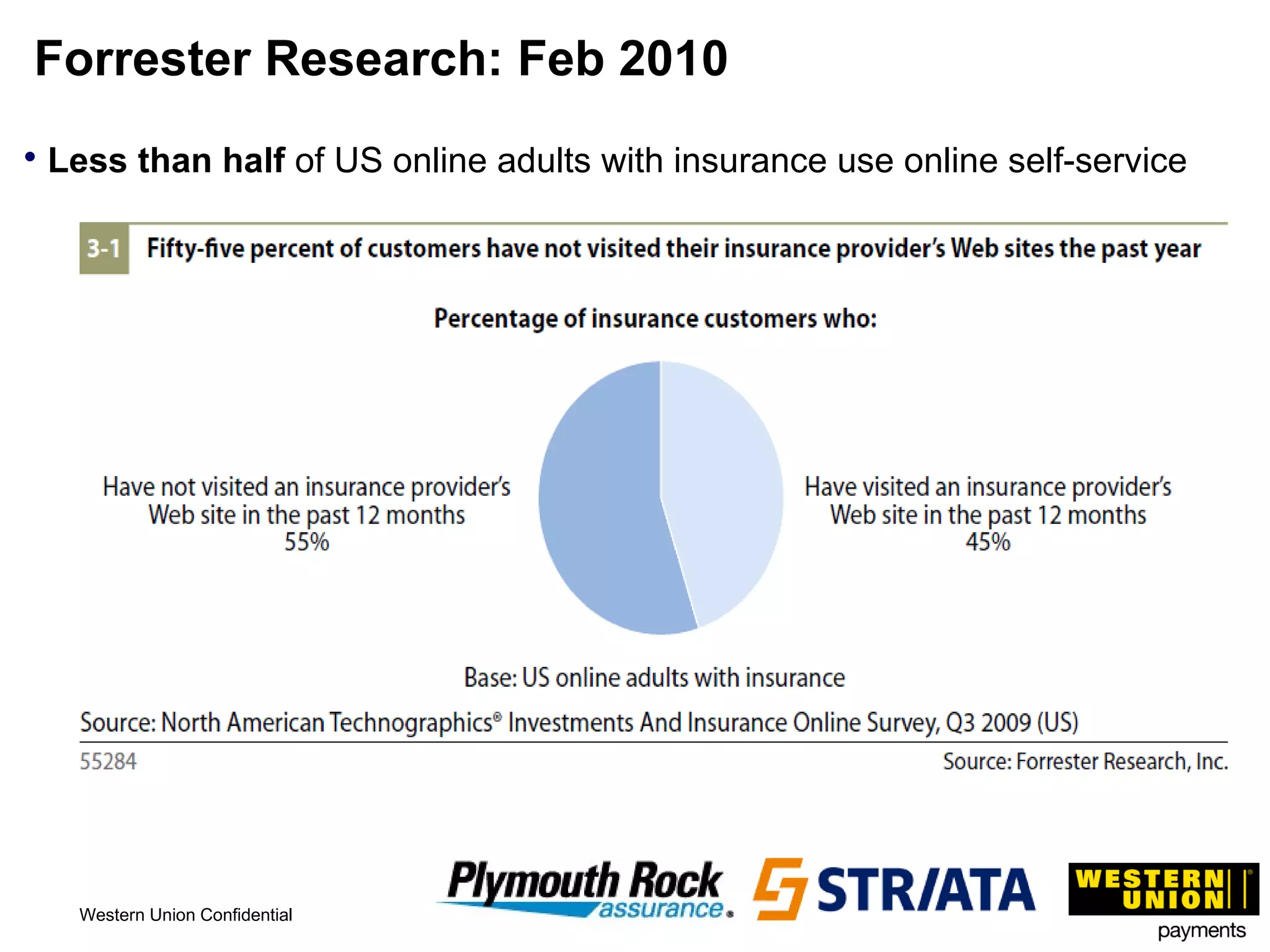

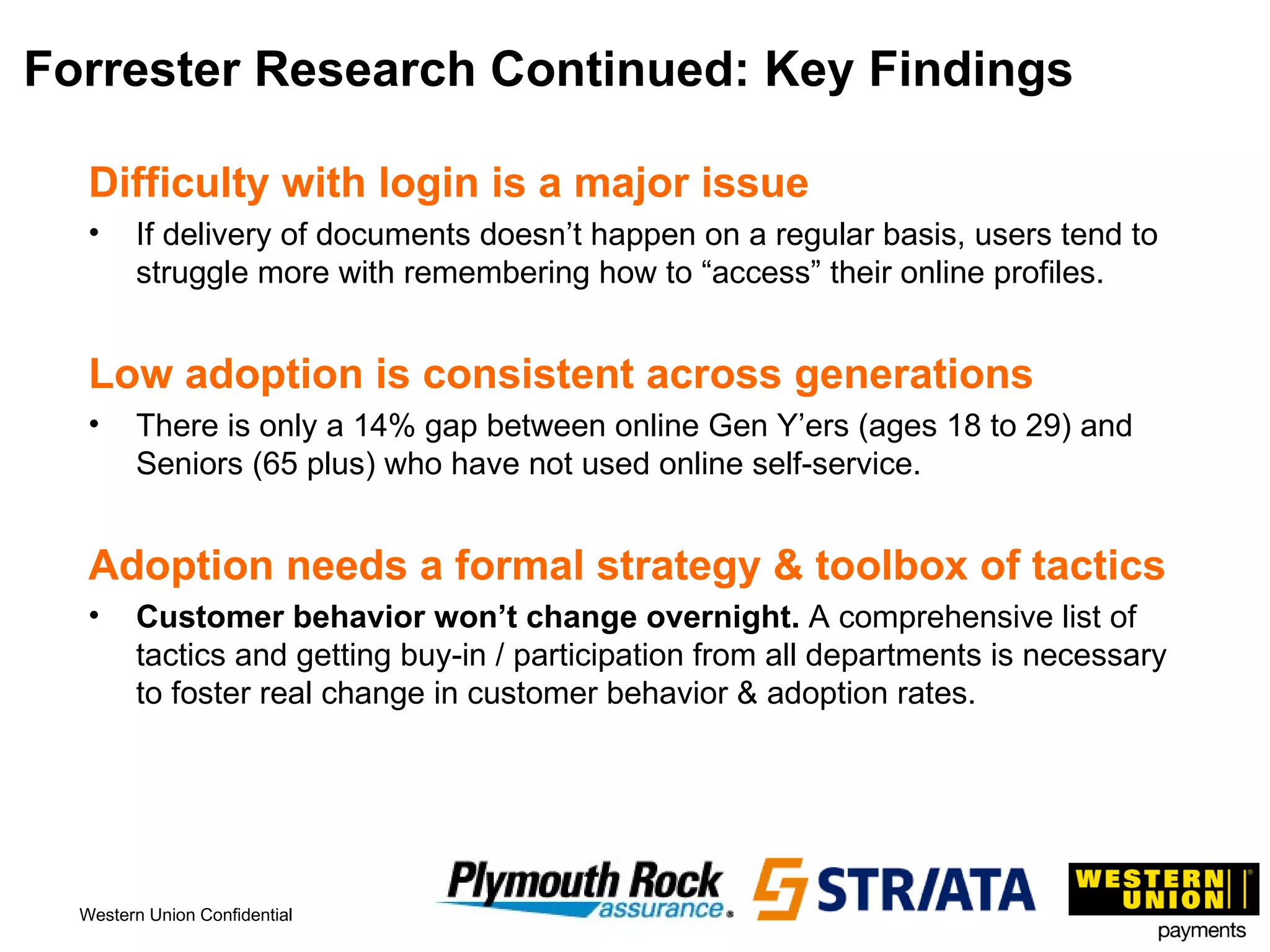

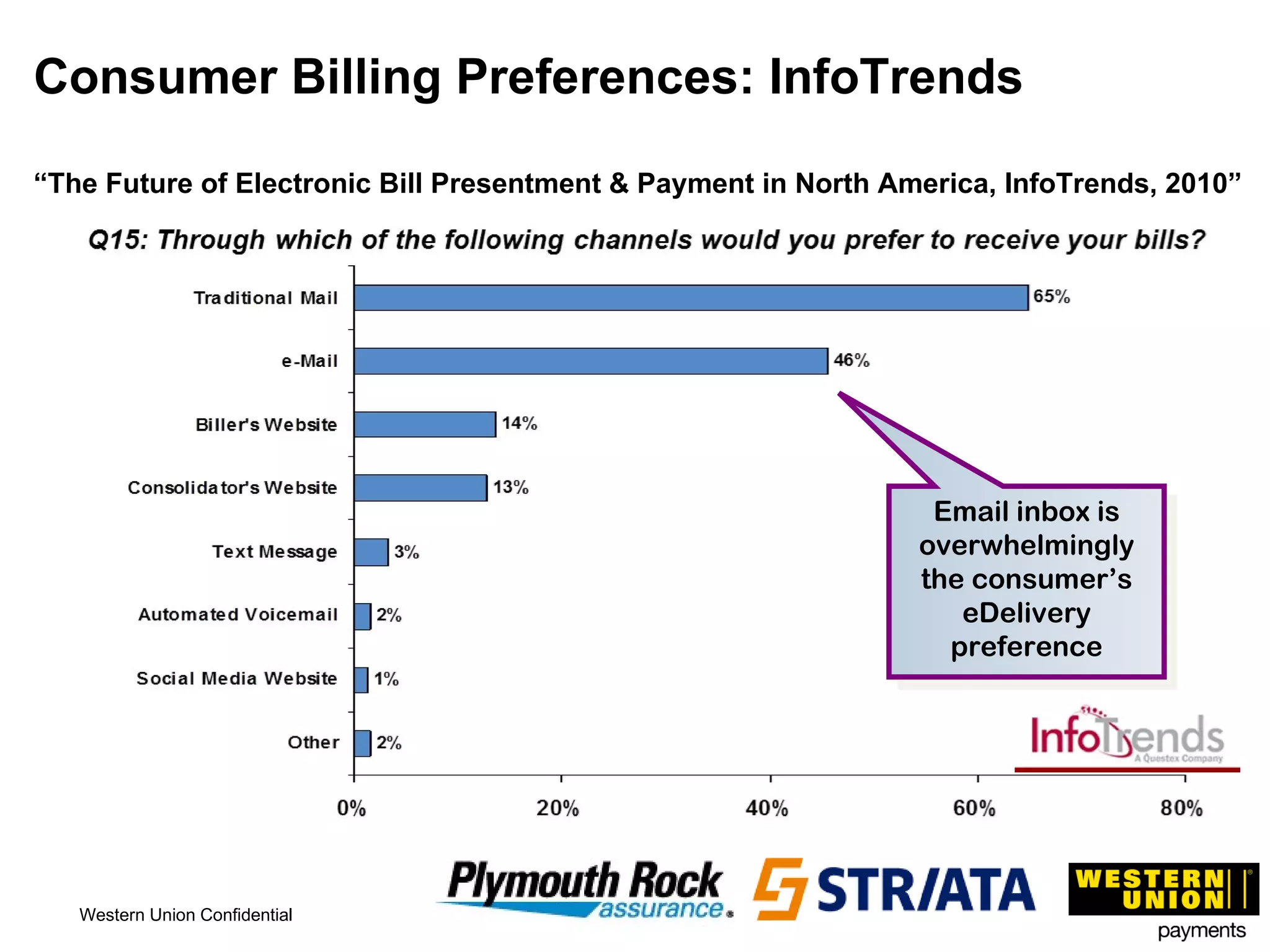

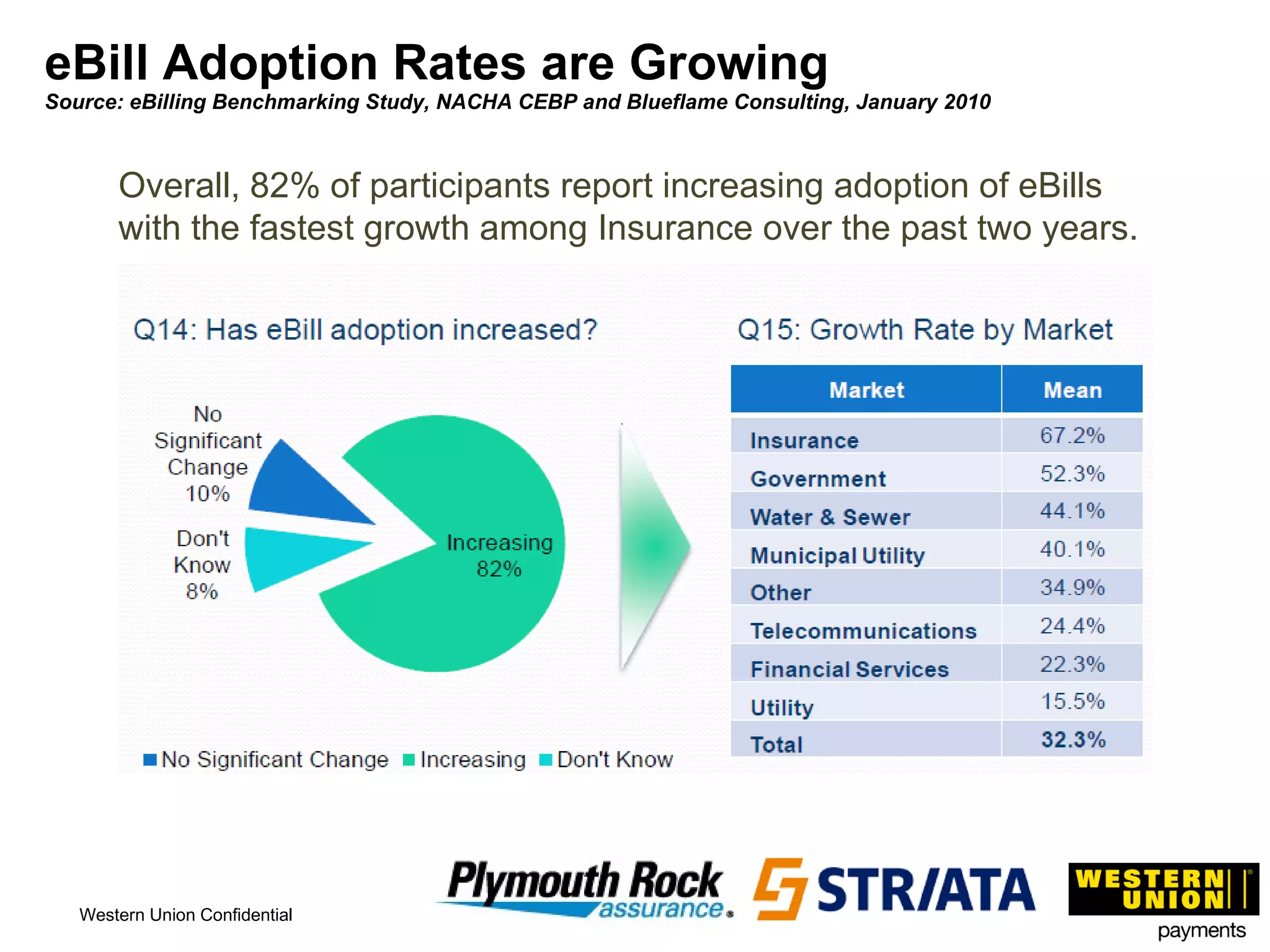

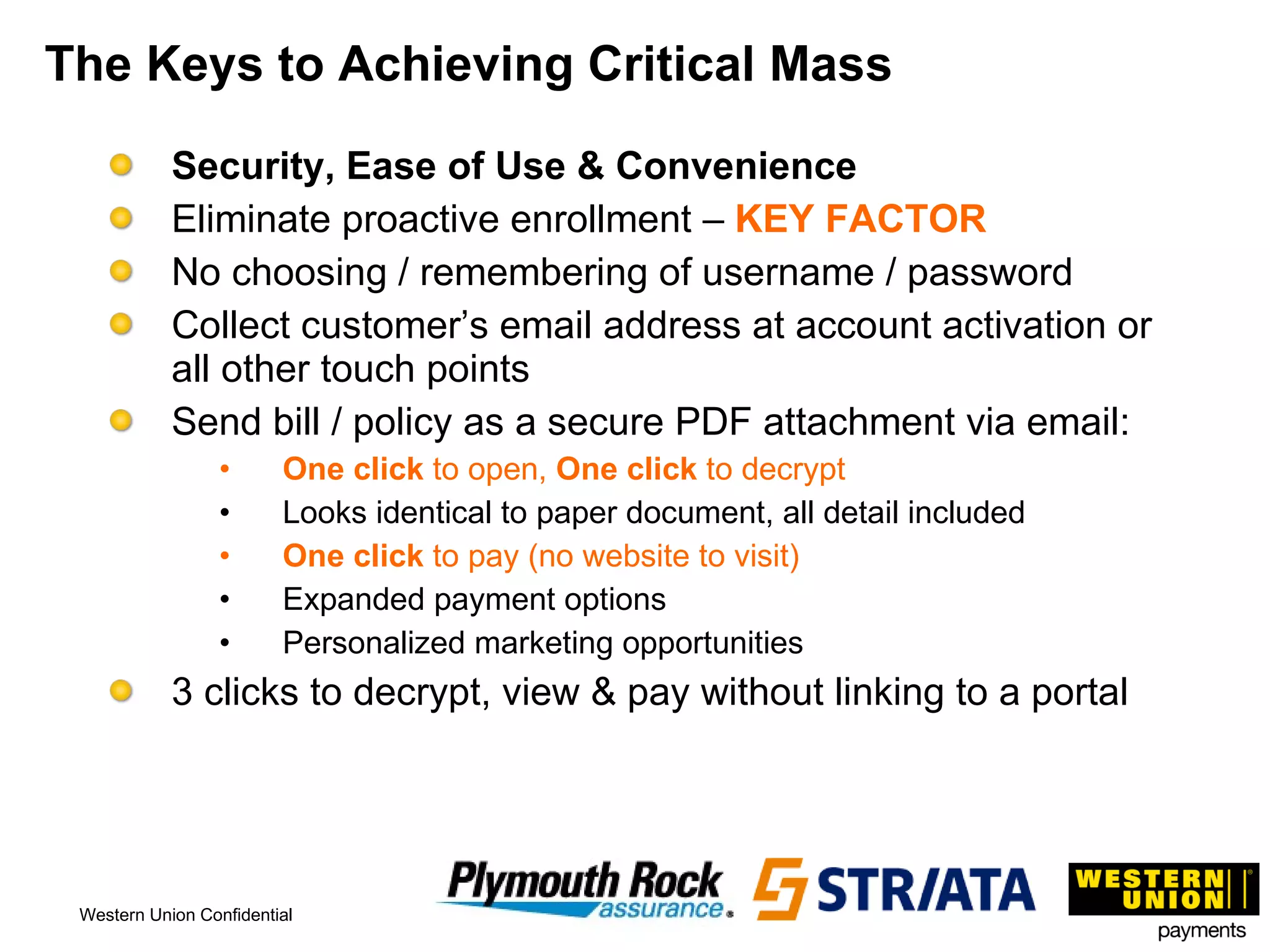

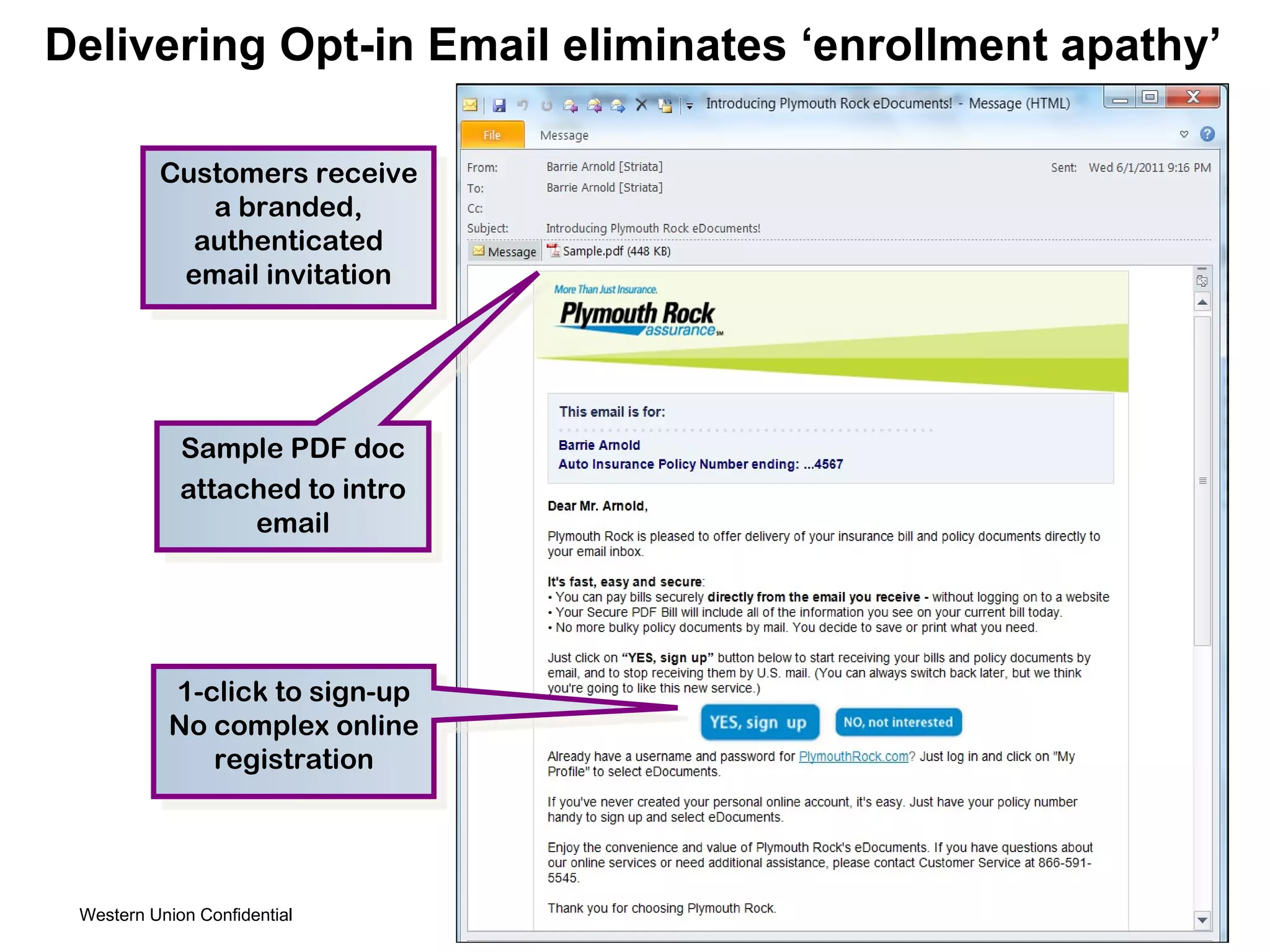

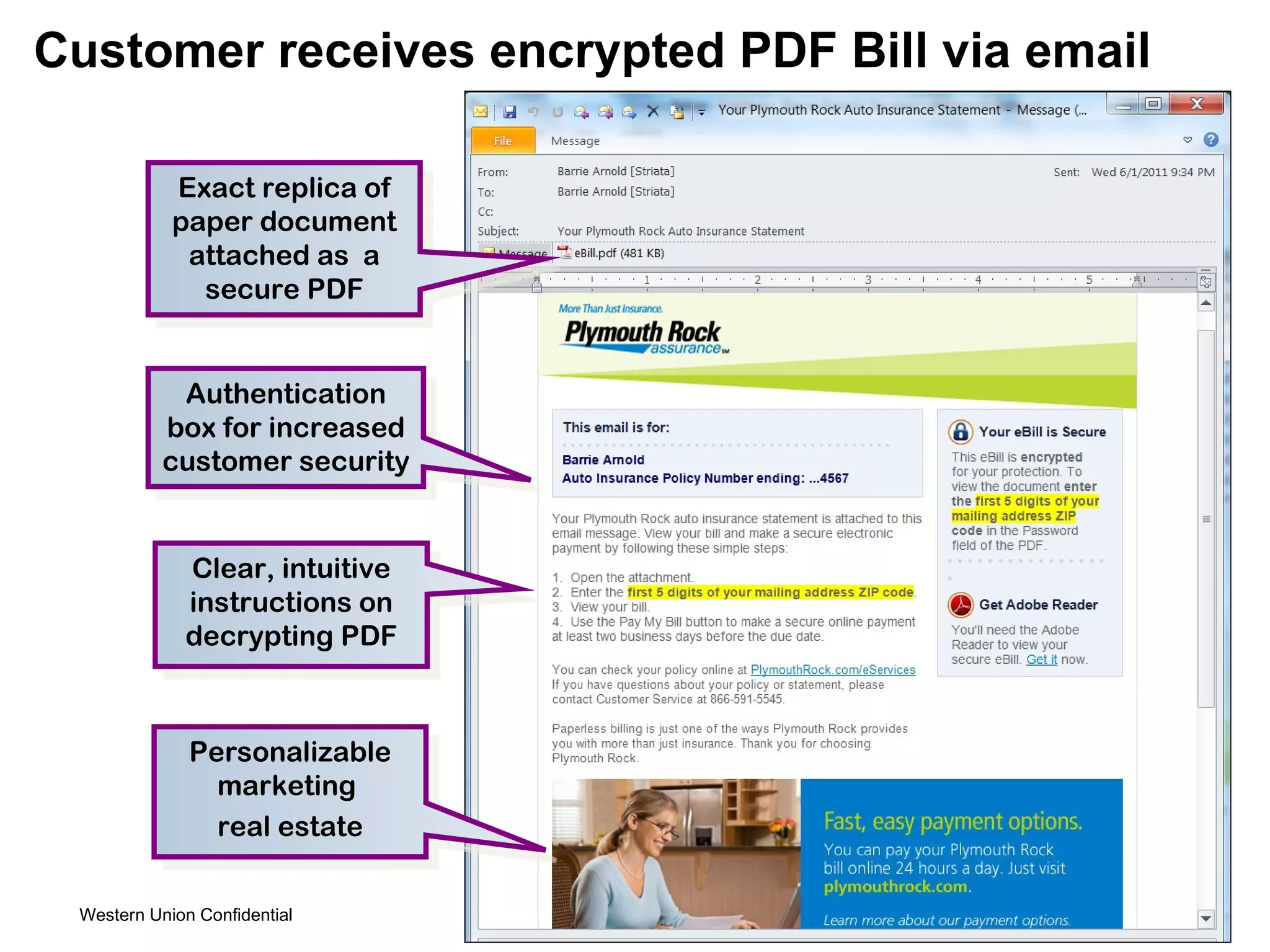

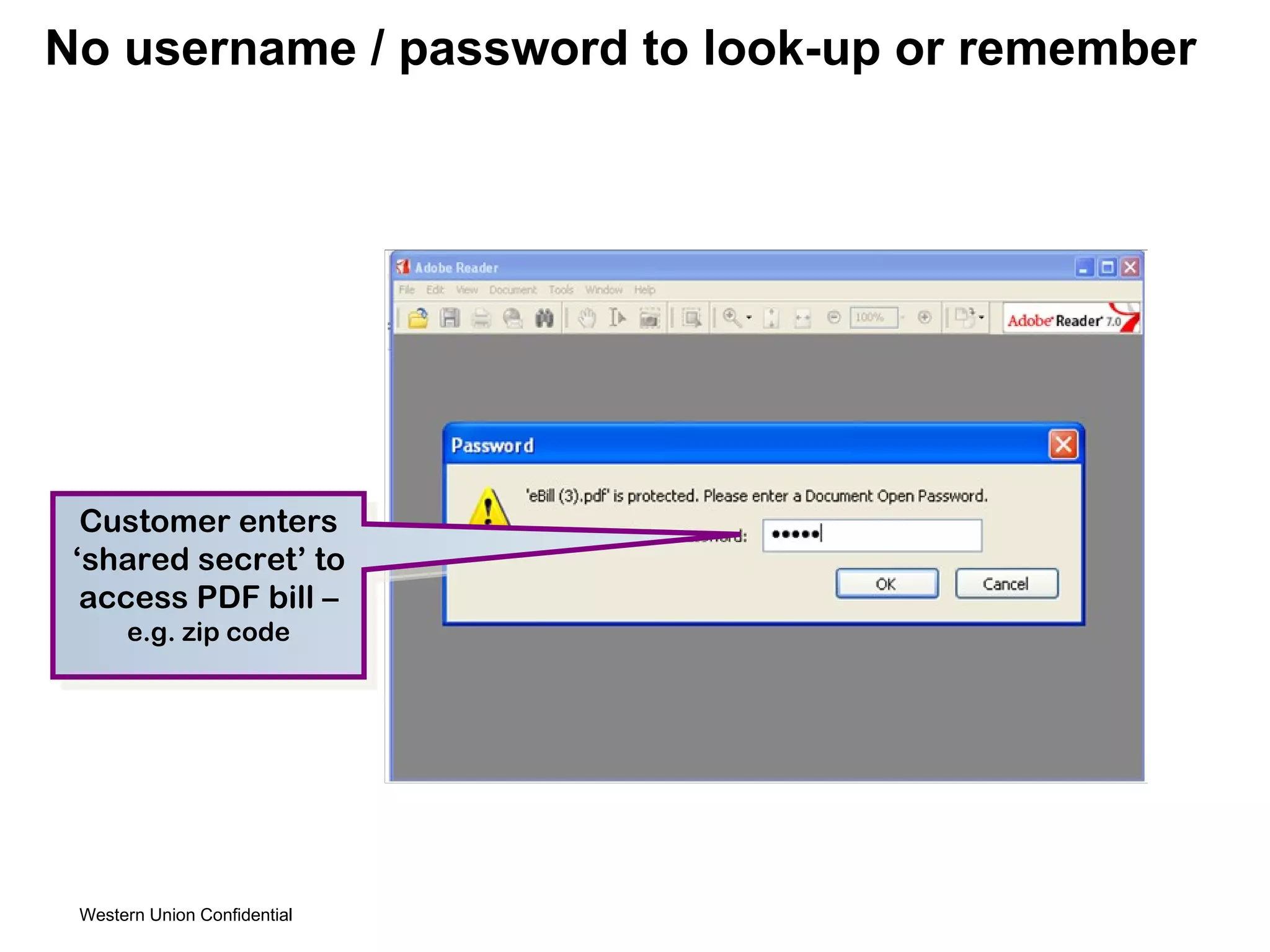

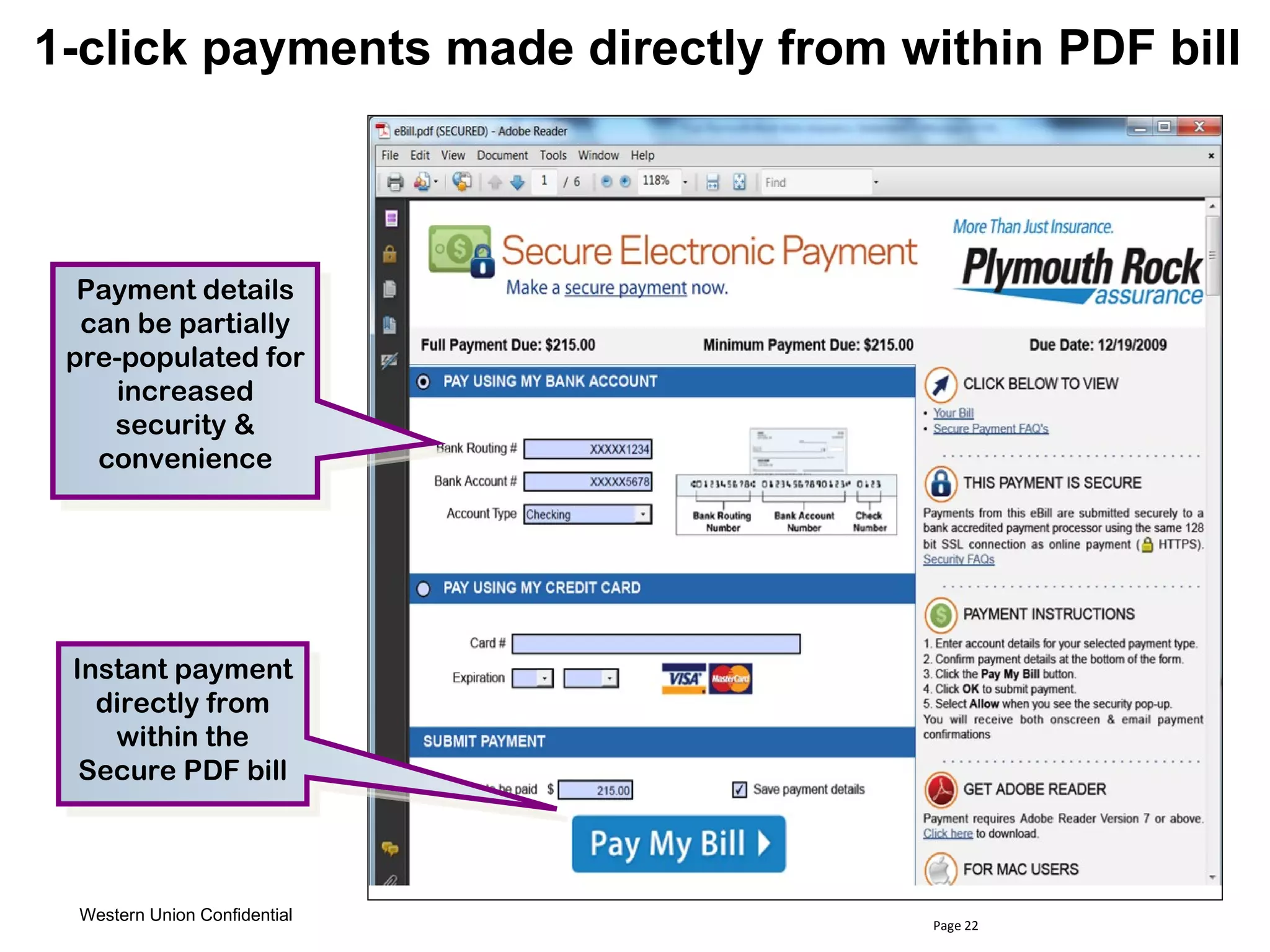

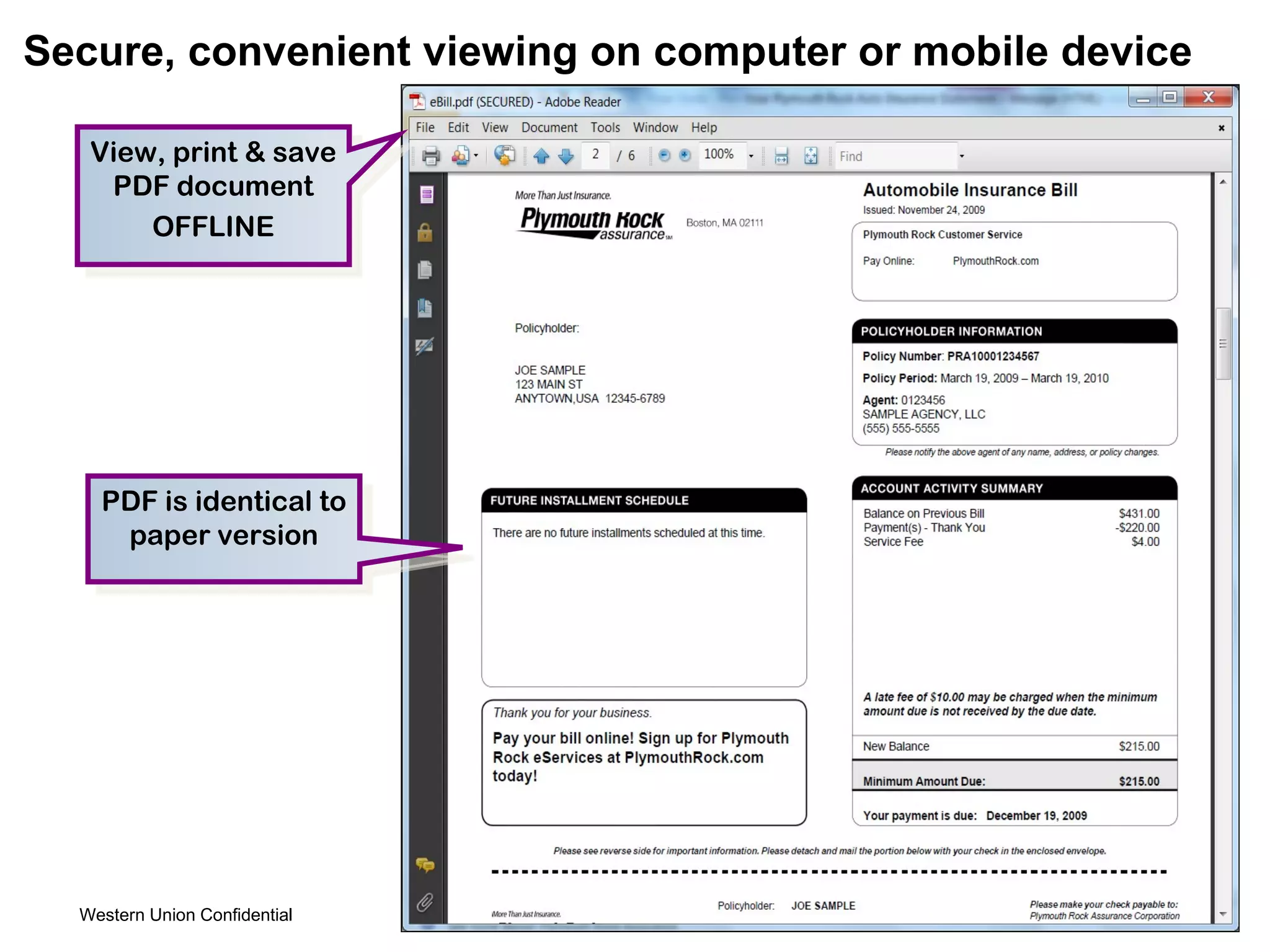

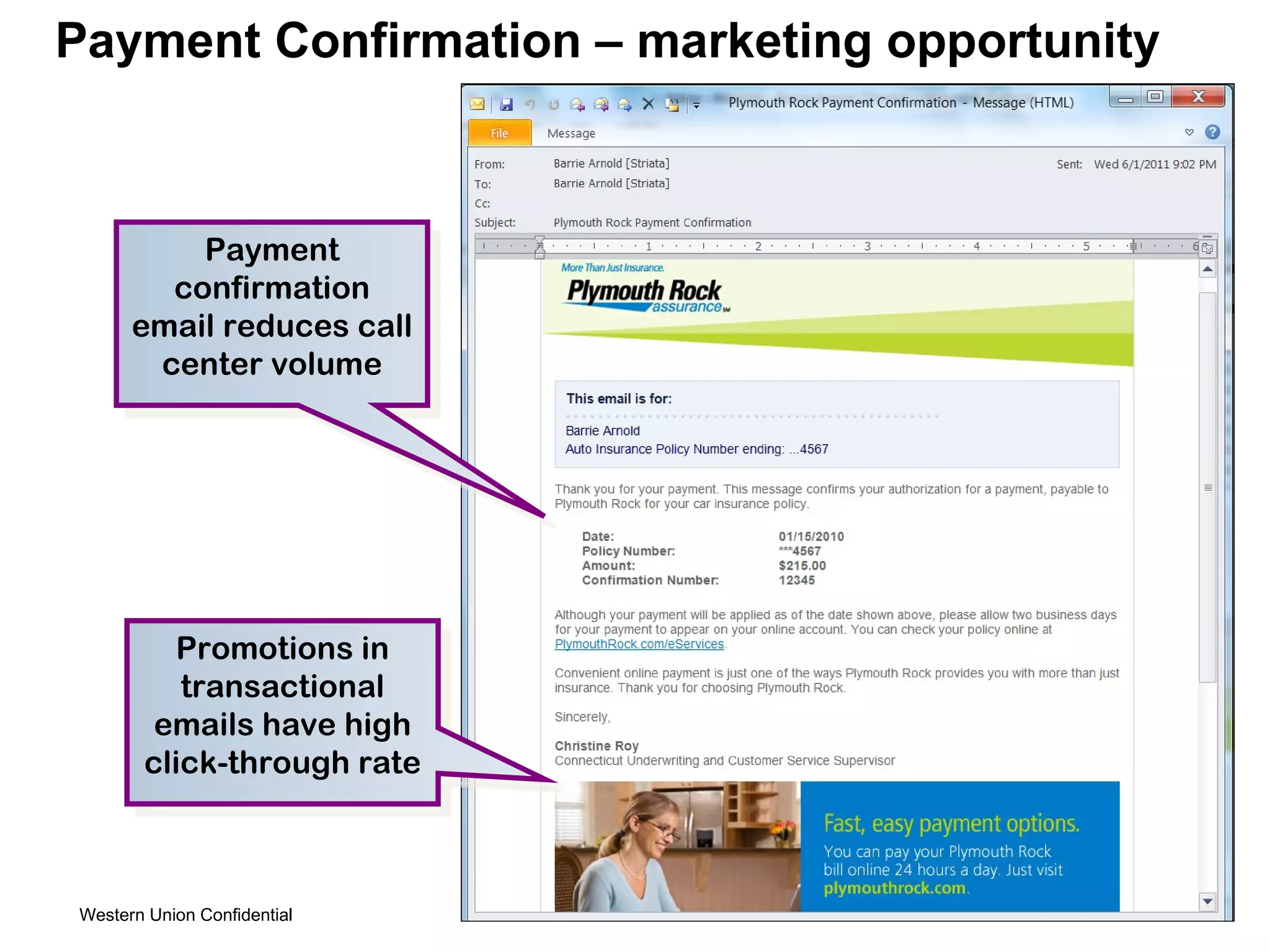

The presentation discusses implementing successful eBilling strategies. It covers how Plymouth Rock Assurance implemented an eBilling solution that delivers bills securely as PDF attachments in emails. This allows customers to view, pay and save bills with just one click. The solution has increased eBilling adoption rates and electronic payments. Challenges included gaining internal support, but the eBilling approach offers customers convenience and improved security compared to traditional online portals.

![Contact Information Jim Flynn: [email_address] Barrie Arnold: [email_address] Lori Beck: [email_address]](https://image.slidesharecdn.com/case-study-for-implementing-successful-ebilling-strategies4697/75/Presentation-Only-Case-Study-for-Implementing-Successful-eBilling-Strategies-32-2048.jpg)