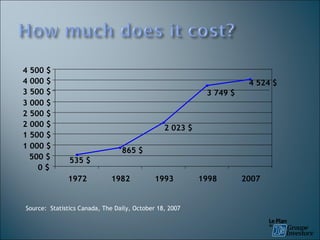

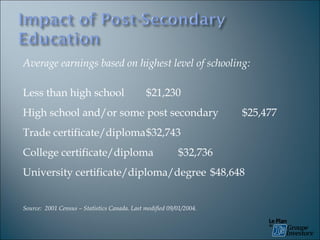

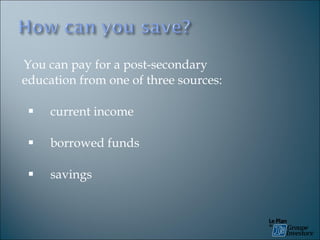

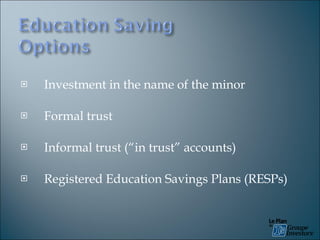

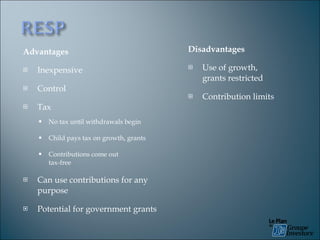

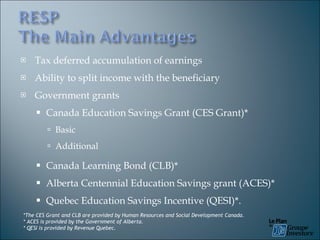

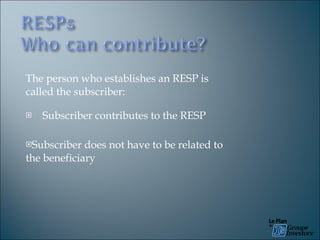

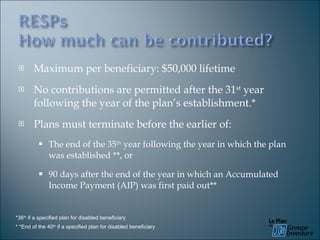

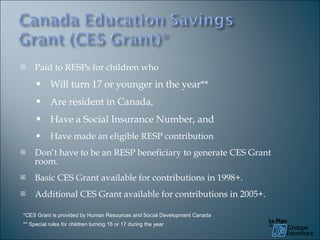

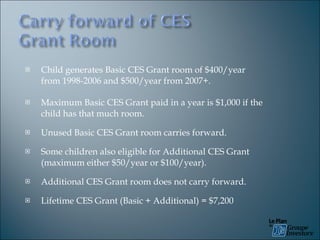

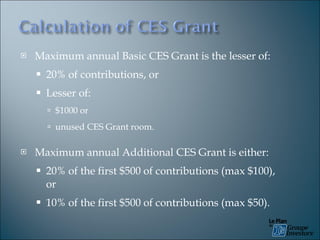

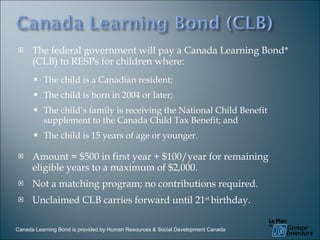

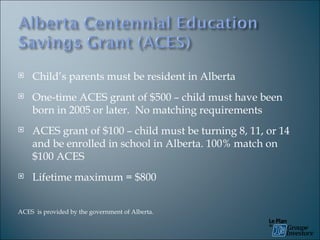

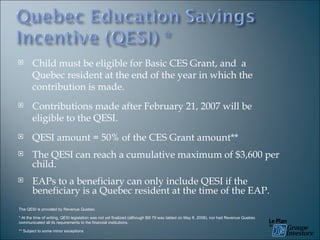

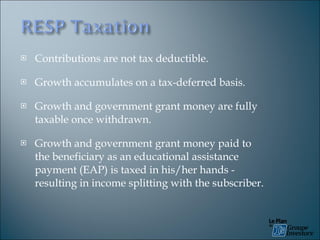

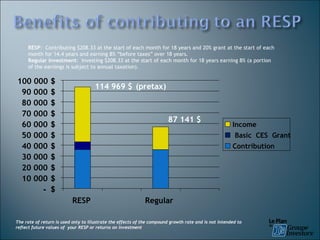

The document discusses strategies for saving for a child's post-secondary education. It outlines the rising costs of education and benefits of long-term planning. Various savings methods are examined, including RESPs, which provide tax benefits and potential grants. RESPs allow savings to grow tax-deferred, and withdrawals for educational expenses are taxed in the student's hands to allow income splitting.

![Turenne Joseph Security Financial Advisor, Mutual Funds Representative Licenced in Québec, Ontario and British Columbia Investors Group Financial Services Inc. (in Québec, a financial services firm.) [email_address] Is provided by Investors Group Financial Services Inc. (in Quebec, a financial services firm). Is specifically written and published by Investors Group and intended as a general source of information only, and is not intended as a solicitation to buy or sell specific investments, nor is it intended to provide legal advice. Clients should discuss their situation with their Investors Group Consultant for advice based on their specific circumstances. Trademark(s) owned by IGM Financial Inc. and licensed to its subsidiary corporations.](https://image.slidesharecdn.com/respcf3147ppseminar-12789581614301-phpapp01/85/Does-your-Education-savings-strategy-make-the-Grade-2-320.jpg)