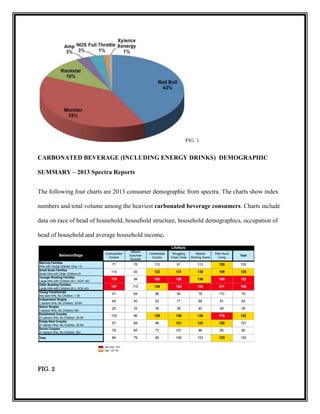

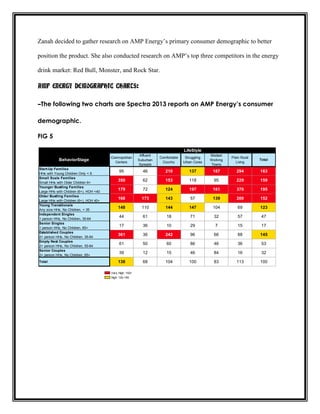

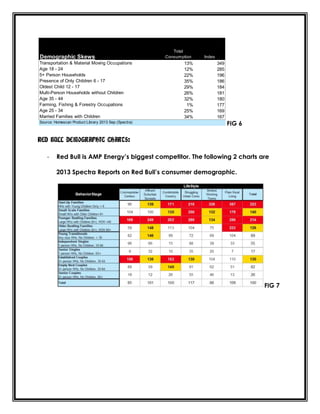

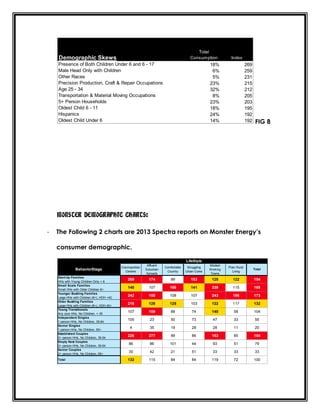

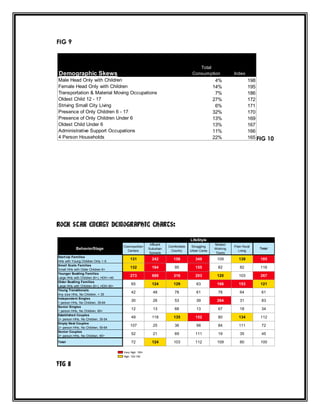

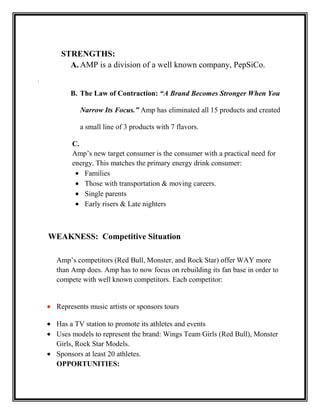

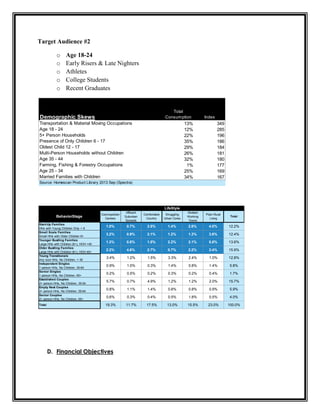

Zanah conducted research on the demographics of AMP Energy's primary consumers and its top three competitors - Red Bull, Monster, and Rock Star. The research included Spectra 2013 reports showing the lifestyle behaviors and demographic skews of highest consuming households. It also analyzed total consumption indexes based on factors like household size, age, occupation, race, and income. Zanah gathered this market data to help determine the best positioning strategy for AMP Energy to compete effectively in the energy drink market.