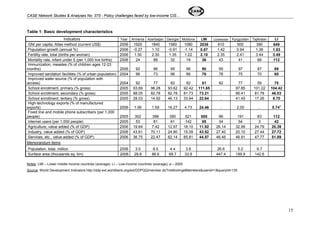

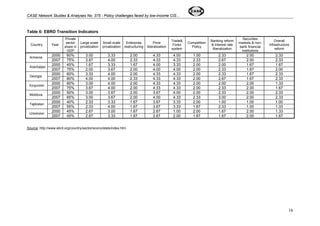

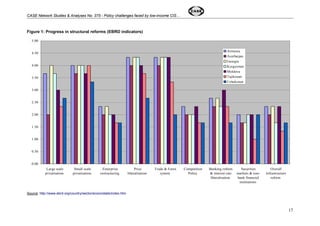

The document discusses the economic policy challenges faced by low-income countries in the Commonwealth of Independent States (CIS), particularly focusing on Moldova, Armenia, Azerbaijan, Georgia, Kyrgyzstan, Uzbekistan, and Tajikistan. It outlines their struggles with macroeconomic management, institutional weaknesses, and dependency on commodity exports, while also emphasizing the need for domestic reforms and international assistance to foster economic growth. The paper, published by the CASE network, provides an analytical narrative of each country's situation and proposes a development agenda for improvement.

![CASE Network Studies & Analyses No. 375 - Policy challenges faced by low-income CIS…

region (Middle East and North Africa). According to the ENP Strategy Paper, the declared

ENP objective was to avoid the emergence of new dividing lines between an enlarged EU

and its old and new direct neighbors as well as to strengthen the stability, security and well-being

in the entire mega-region. The EU offered its neighbors “…a privileged relationship,

building upon a mutual commitment to common values (democracy and human rights, rule of

law, good governance, market economy principles and sustainable development). The ENP

goes beyond existing relationships to offer a deeper political relationship and economic

integration. The level of ambition of the relationship will depend on the extent to which these

values are effectively shared” 25.

In the economic sphere, the ENP Strategy Paper (p.14)26 offered “... neighbouring countries

the prospect of a stake in the EU Internal Market [underlined by MD] based on legislative and

regulatory approximation, the participation in a number of EU programmes and improved

interconnection and physical links with the EU”. However, so far there is no clear

interpretation of what “a stake in the EU Internal Market” means in practice.

Recent ENP official documents27 put more emphasis on the necessity to use this

institutional framework as a tool for modernization and support for economic and institutional

reforms in neighborhood countries. Again, no specifics, especially in respect to incentives,

have followed as of yet.

Operationally, the ENP is conducted through bilateral Action Plans, which were signed in

2005-2006 between the EU and Moldova, Armenia, Azerbaijan and Georgia.

A general weakness of the ENP consists in the lack of balance between far-reaching

expectations in respect to neighbors’ policies and reforms and the limited and distant

rewards, which it can potentially offer (see Schweickert et al., 2008). This imbalance is

especially seen in such areas as migration policy where the EU is expecting extensive

cooperation on the part of neighboring countries in fighting illegal migration to the EU (very

often, against the interest of their own citizens) while offering very little in facilitating the legal

migration and freer movement of people (see Guild et al., 2007).

24

http://ec.europa.eu/world/enp/pdf/strategy/strategy_paper_en.pdf

25

http://ec.europa.eu/world/enp/policy_en.htm

26

http://ec.europa.eu/world/enp/pdf/strategy/strategy_paper_en.pdf

27

See e.g. “Strengthening the European Neighborhood Policy. Presidency Progress Report”, General Affairs and

External Relations Council (GAERC), June 18-19, 2007,

http://register.consilium.europa.eu/pdf/en/07/st10/st10874.en07.pdf

47](https://image.slidesharecdn.com/cnsa375-141028073426-conversion-gate01/85/CASE-Network-Studies-and-Analyses-375-Policy-Challenges-Faced-by-Low-Income-CIS-Economies-47-320.jpg)

![CASE Network Studies & Analyses No. 375 - Policy challenges faced by low-income CIS…

Mogilevsky, R. (2004): CIS-7 Perspective on Trade with EU in the Context of EU

Enlargement, CASE Network Studies and Analyses, No. 282.

Mogilevsky, R. & Atamanov, A. (2008): Technical Assistance to CIS Countries, CASE

Network Studies and Analyses, No. 369.

Paczynski, W. et al. (2008): The Economic Aspects of the Energy Sector in CIS

Countries, European Economy - Economic Papers, No. 328, CASE – Center for Social and

Economic Research, European Commission, Directorate-general for Economic and financial

Affairs, June.

Polterovich, V. & Popov, V. (2005): Democracy and Growth Reconsidered: Why

Economic Performance of New Democracies Is Not Encouraging,

http://ctool.gdnet.org/conf_docs/PopovDemocracy2004Aug.doc and

http://ctool.gdnet.org/conf_docs/PopovDemocracy-charts%202004.xls

Popov, V. (2000): Shock Therapy versus Gradualism: The End of the Debate

(Explaining the Magnitude of the Transformational Recession), Comparative Economic

Studies, Vol. 42, No. 1, pp. 1-57

Schweickert, R., Drautzburg, T., Gawrich, A., & Melnykovska, I. (2007): Institutional

Convergence of CIS towards European Benchmarks, CASE Network Reports, No. 82

Taran, S. (2008): Non-Tariff Barriers in the Selected CIS Countries, CASE Network

Studies and Analyses, No. 371.

Tochitskaya, I. et al. (2008): Osnovnye tendencii i prognoz razvitiya ekonomik

gosudartv-chlenov EvrAzES na srednesrochnuyu perspektivu (2007-2010 gg.) [Main

tendencies and forecast of economic development of EvrAzES member states in a medium-term

perspective (2007-2010)], CASE Network Studies and Analyses, No. 364.

54](https://image.slidesharecdn.com/cnsa375-141028073426-conversion-gate01/85/CASE-Network-Studies-and-Analyses-375-Policy-Challenges-Faced-by-Low-Income-CIS-Economies-54-320.jpg)