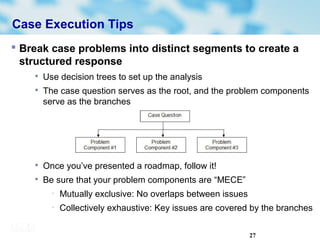

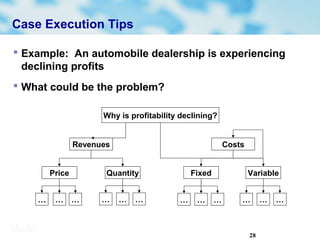

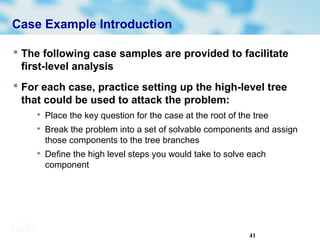

The document serves as a comprehensive guide for preparing for consulting case interviews, covering strategies for building relationships with target firms, resume preparation, and answering key interview questions. It includes tips on case execution, math tricks for estimation, and exercises for practicing interview techniques, alongside various case scenarios to enhance analytical and problem-solving skills. Additionally, it outlines important business concepts and case types relevant to the consulting field.

![16

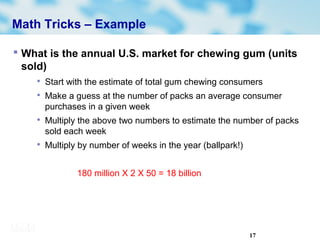

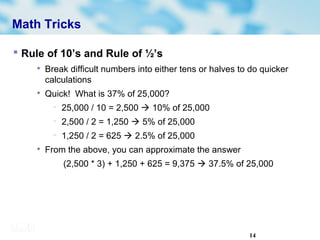

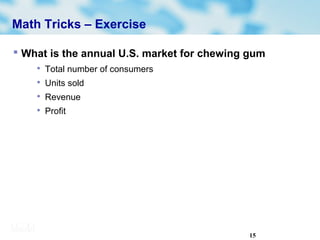

Math Tricks – Example

What is the annual U.S. market for chewing gum (total

number of consumers)

Estimate the total U.S. population (~300 million)

Segment the population based on some metric (hint: age is

usually a good metric)

Estimate the number of people in each population segment

Make a guess at the percentage of each segment that chews gum

[(100 m) * 80%] + [(150 m) * 60%] + [(50 m) * 20%] =

80 + 90 + 10 = 180 million](https://image.slidesharecdn.com/caseinterviewpreparationguidev5-12710021434674-phpapp02/85/Case-Interview-Preparation-Guide-V5-16-320.jpg)