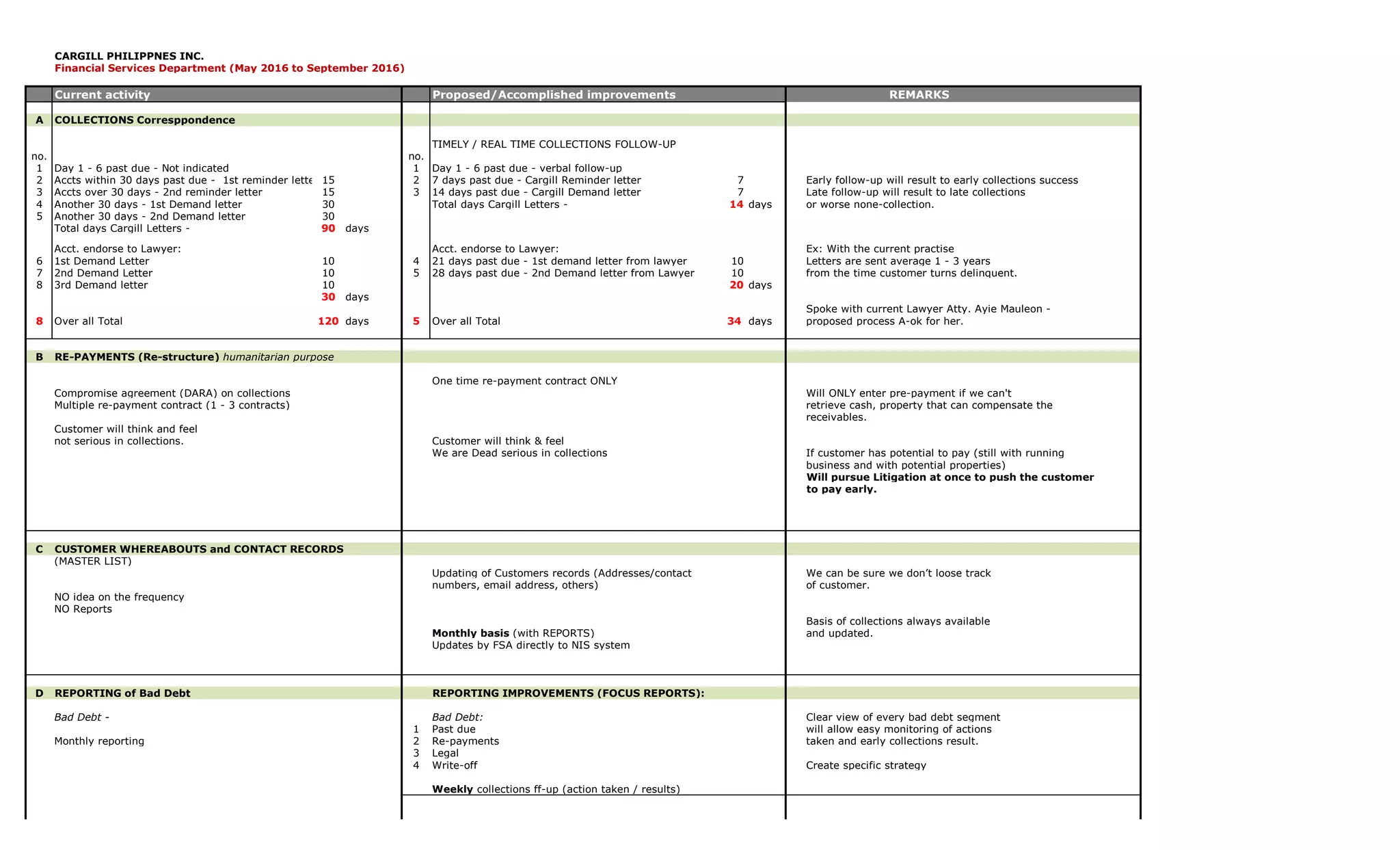

The document outlines proposed improvements to the financial services department of Cargill Philippines Inc. including timelier collections follow up, stricter repayment plans, increased monitoring through additional reports, strengthening credit application processes, requiring more collateral, and knowledge sharing between departments to streamline operations.