Embed presentation

Download to read offline

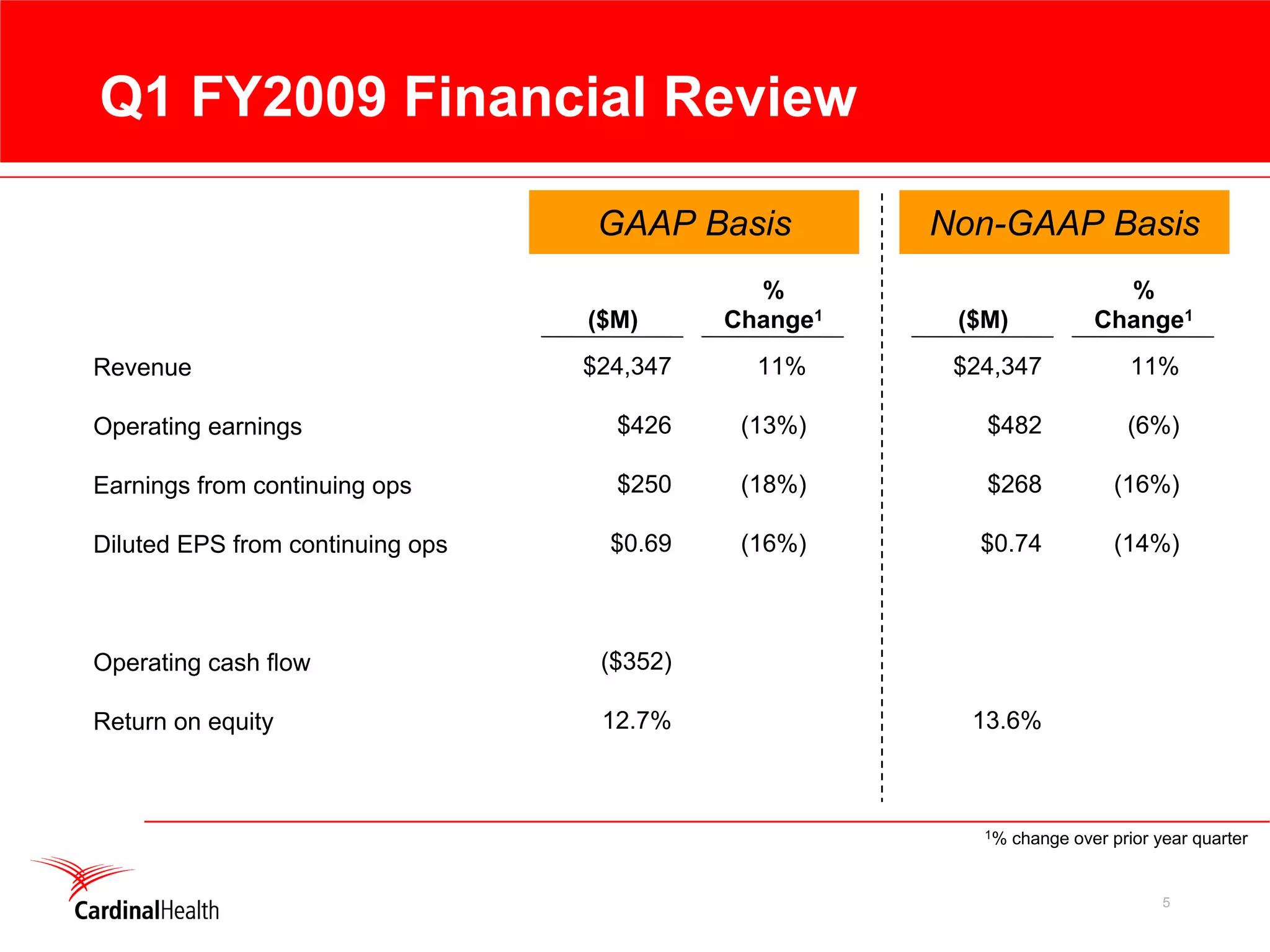

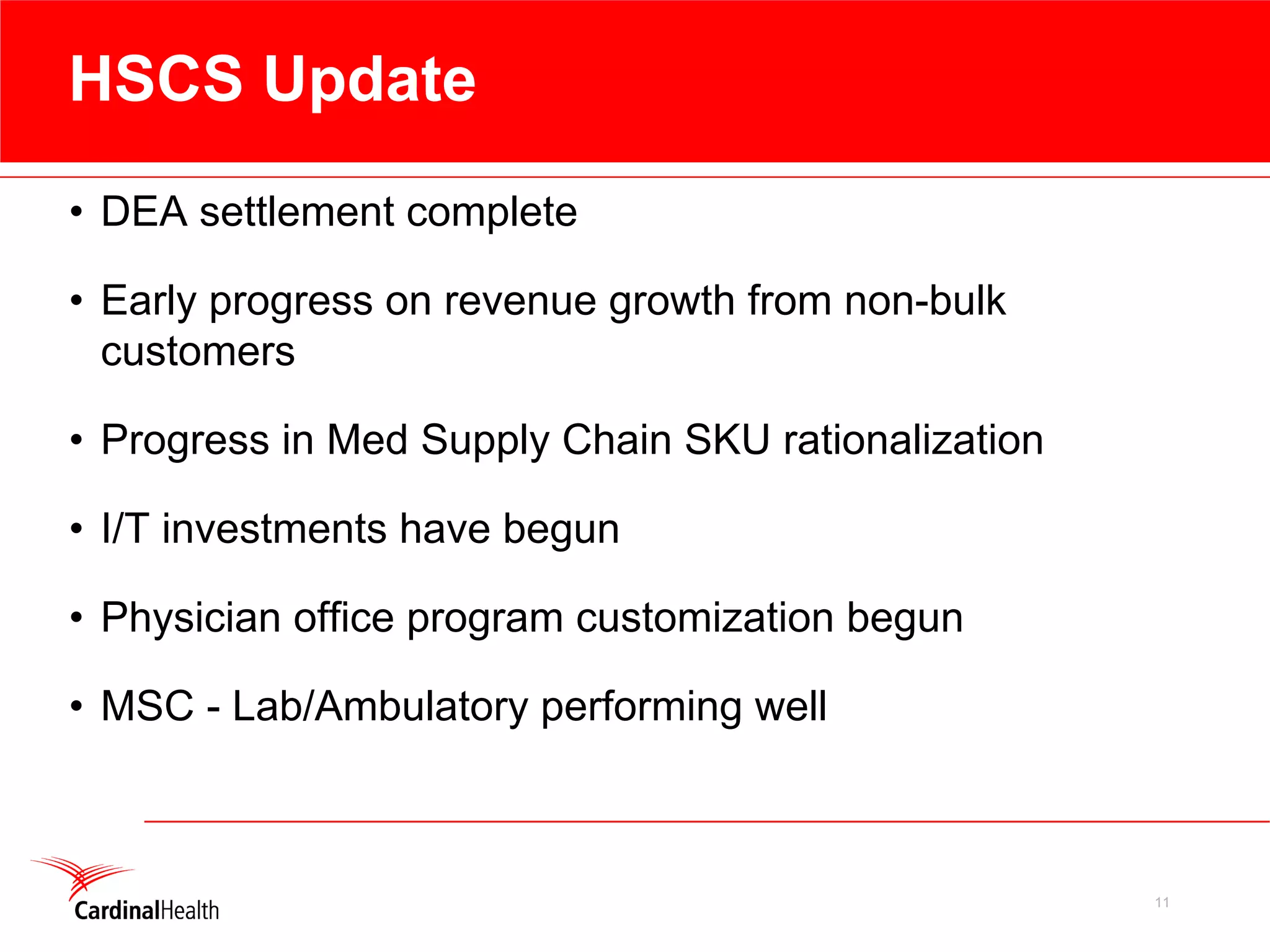

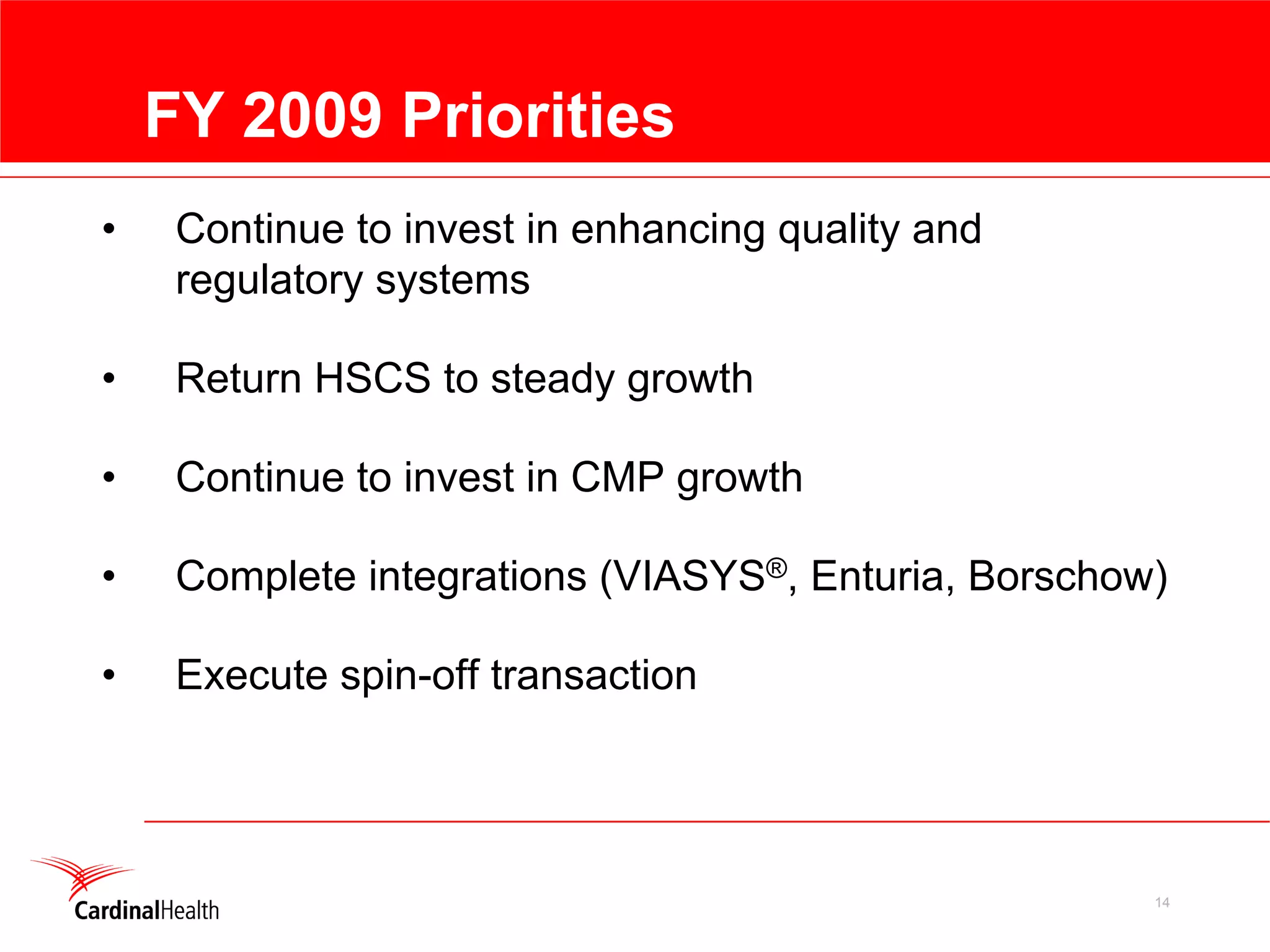

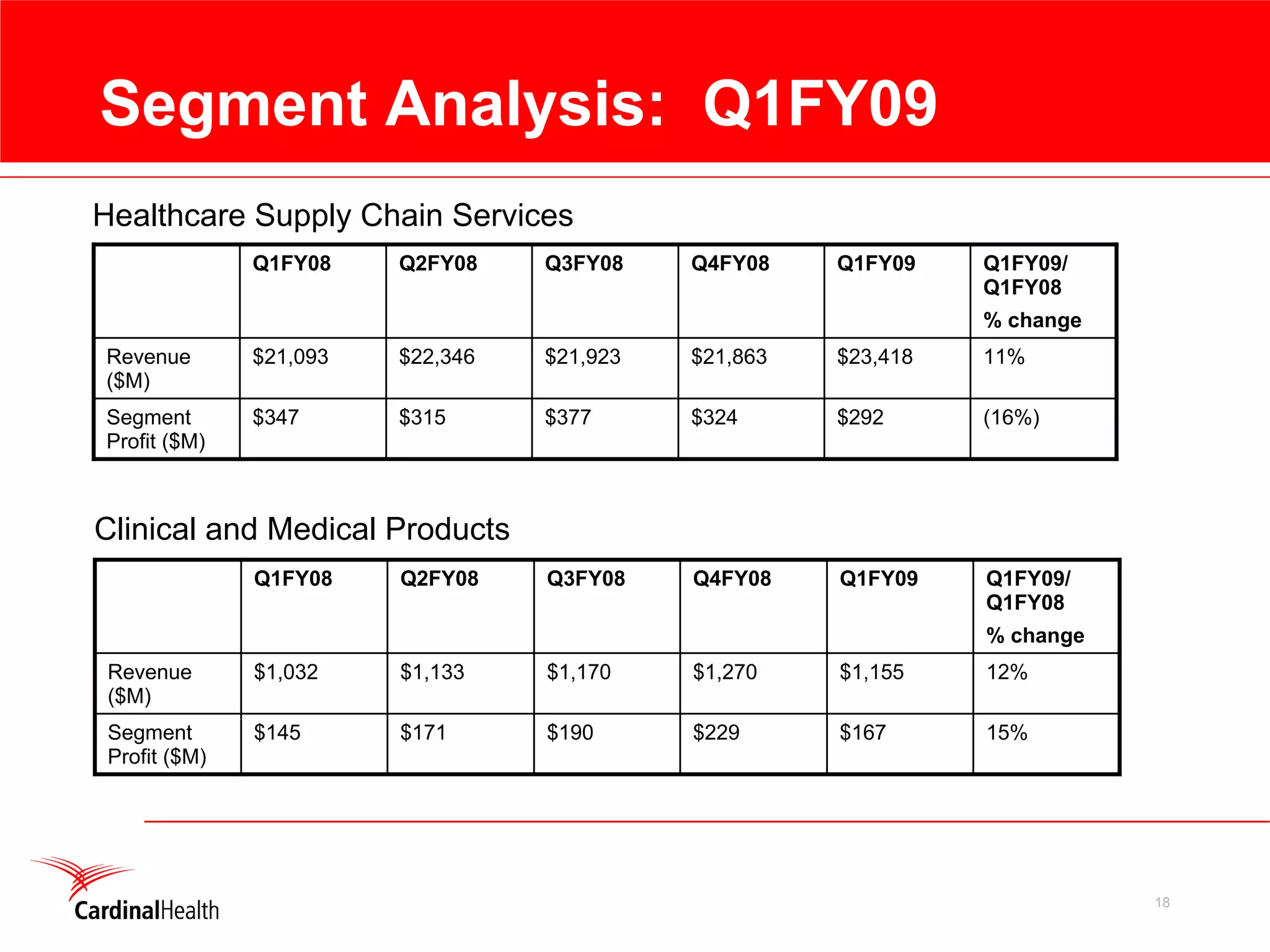

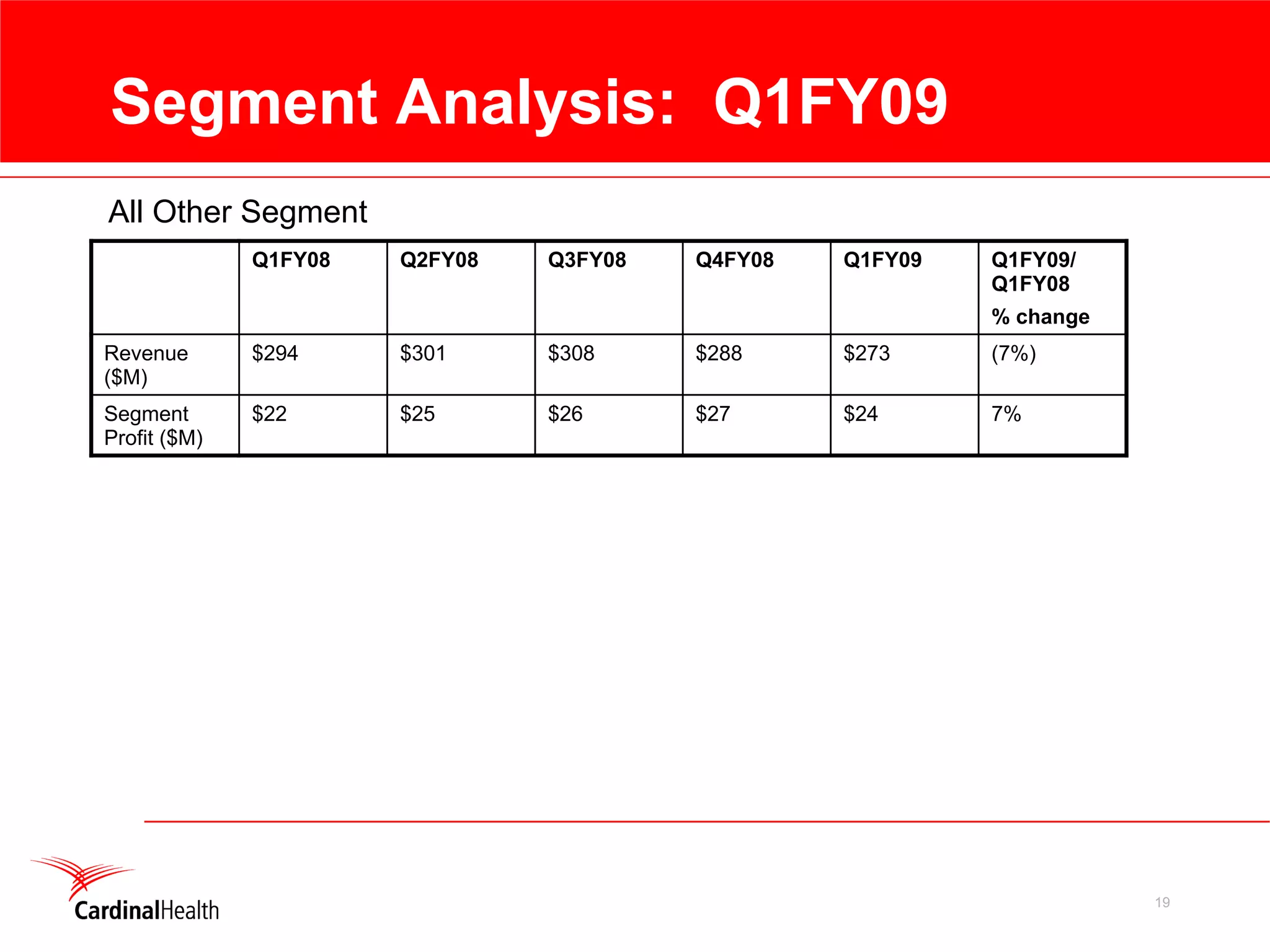

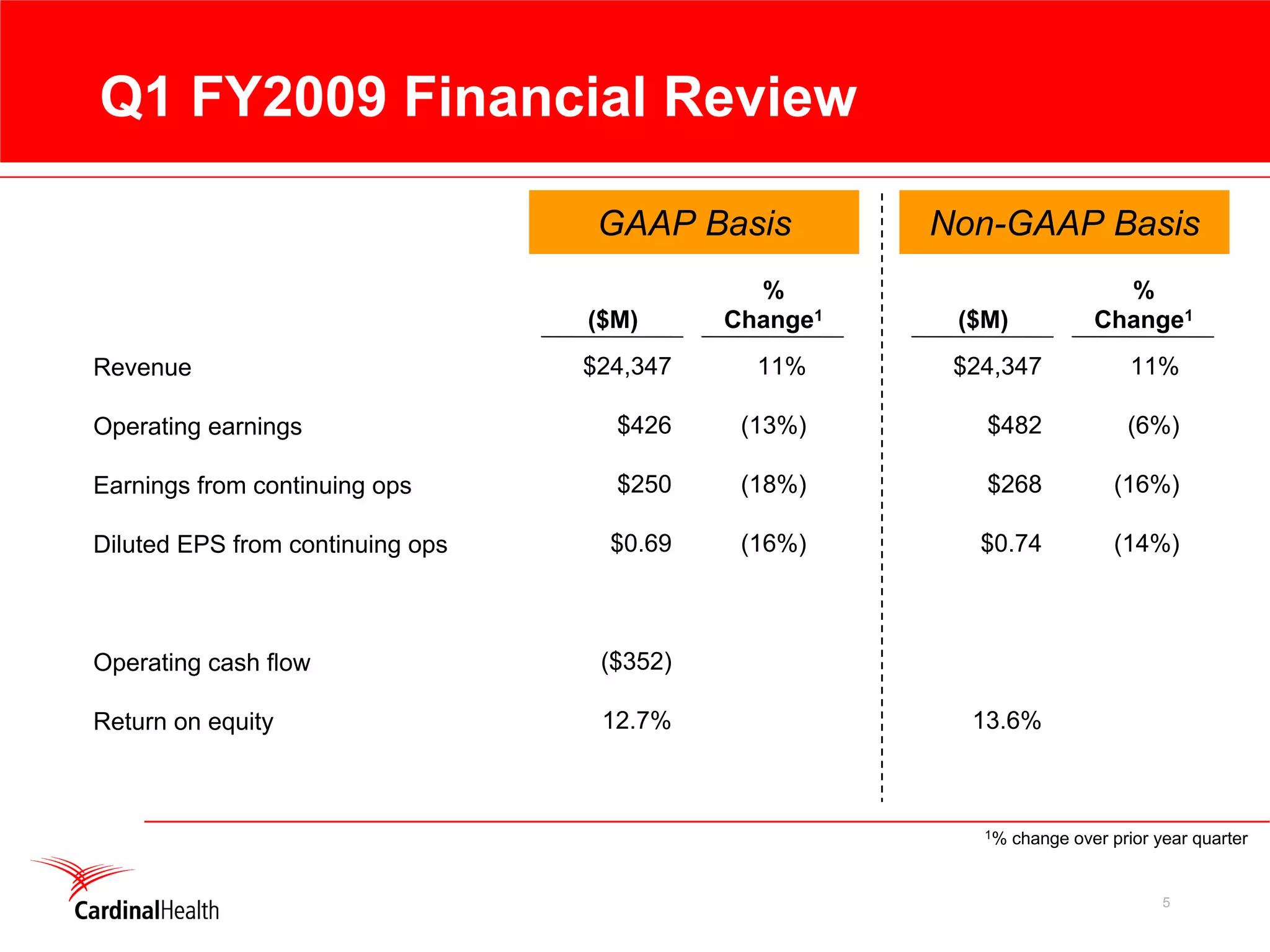

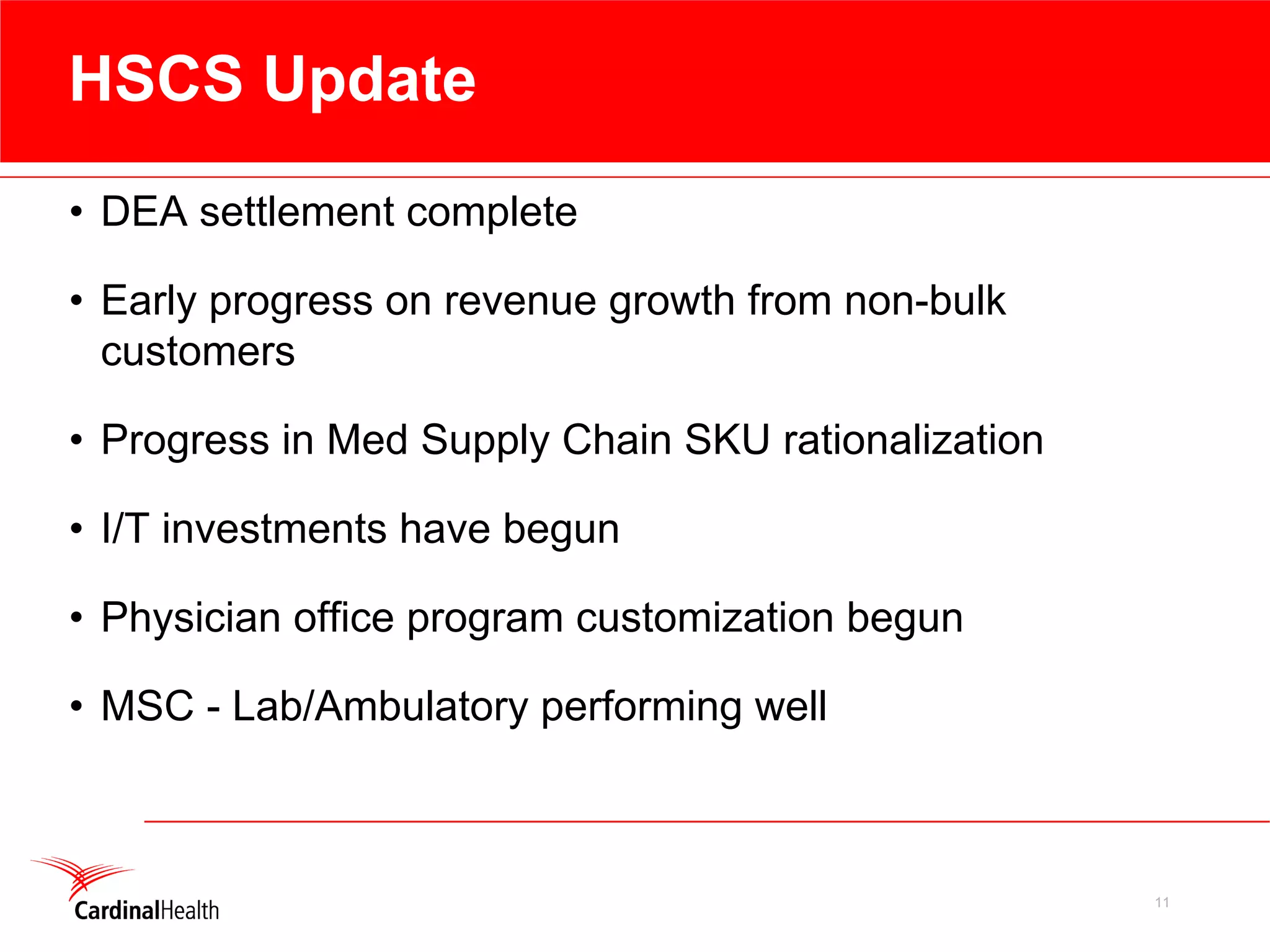

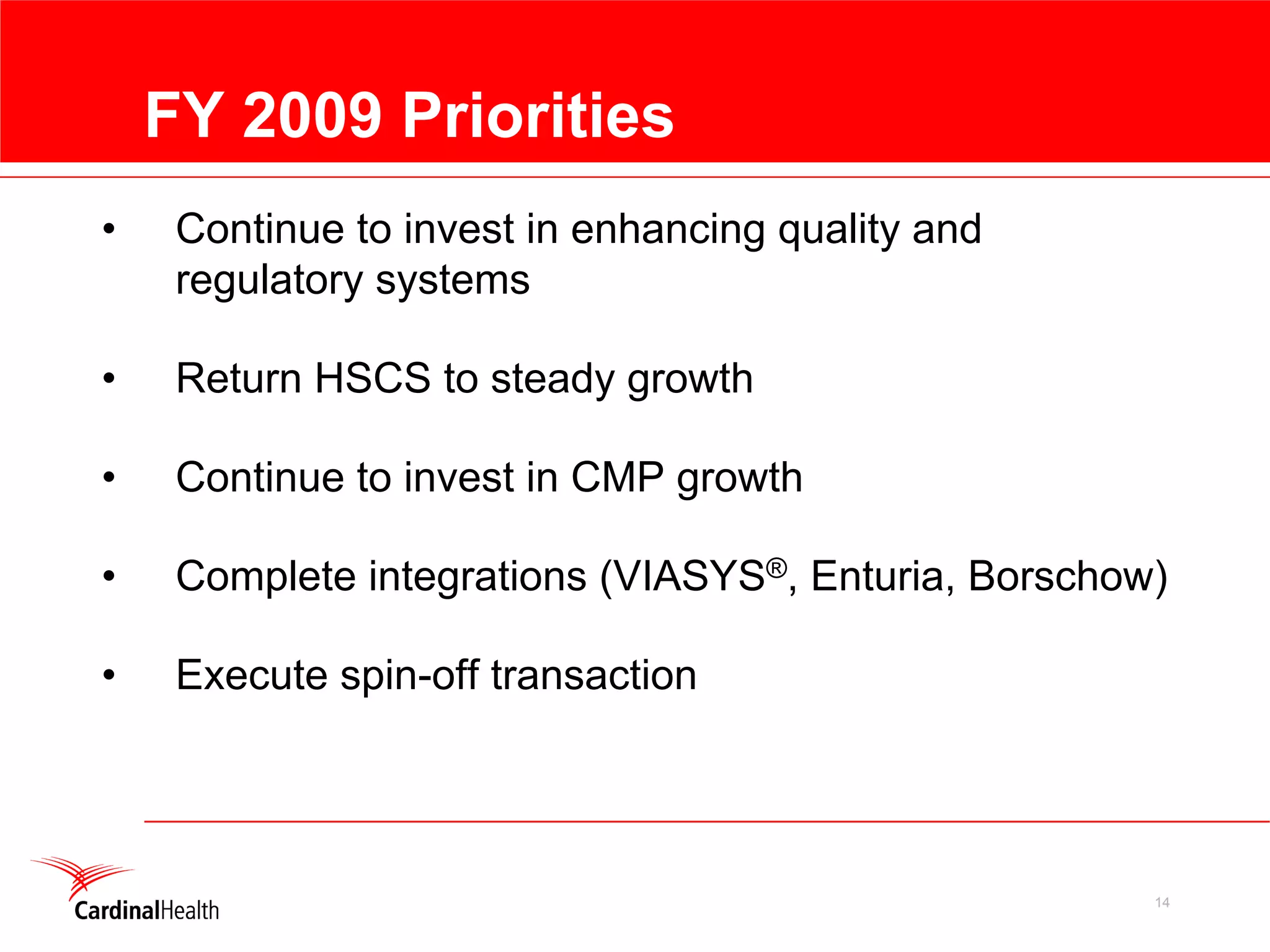

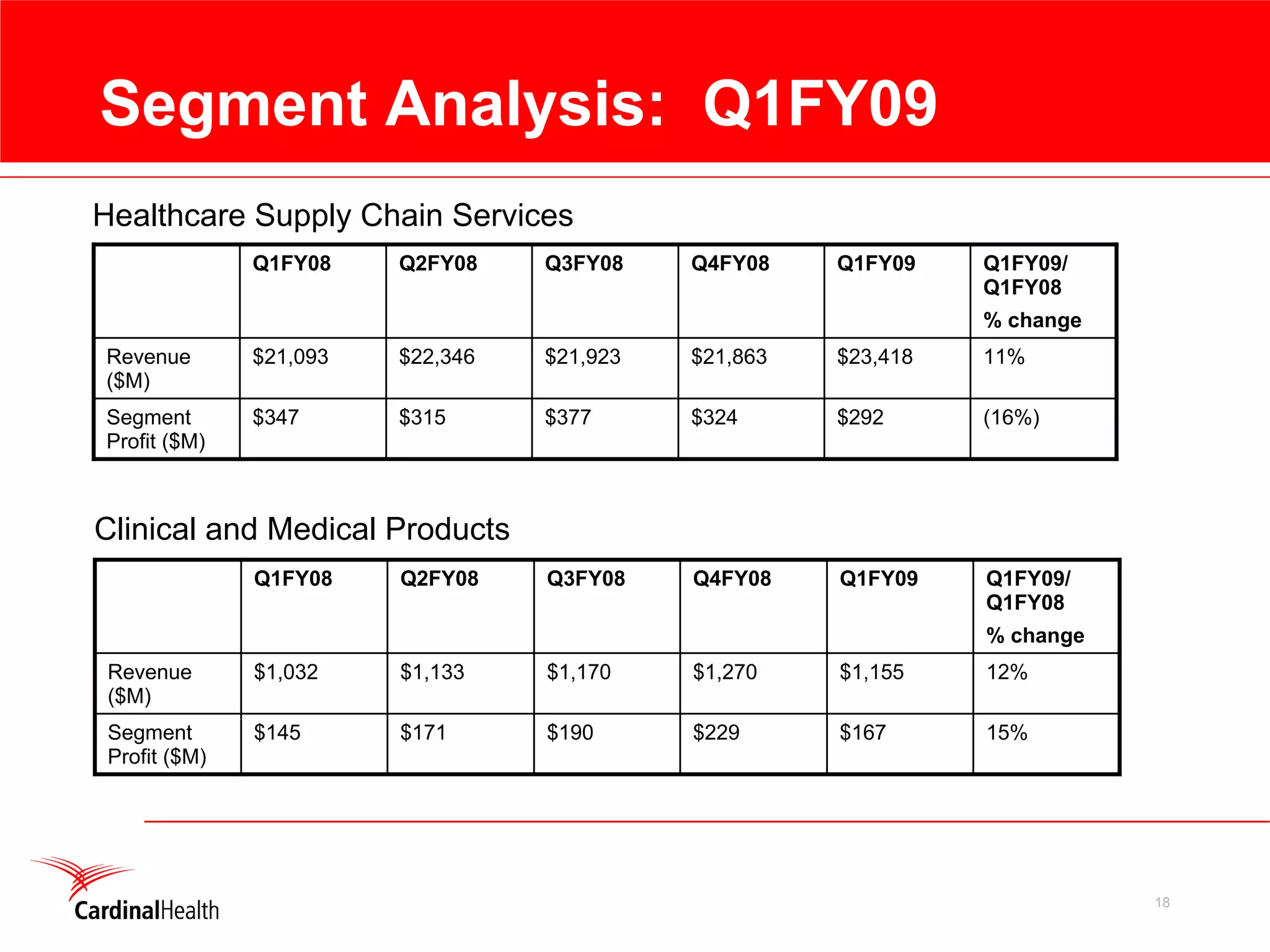

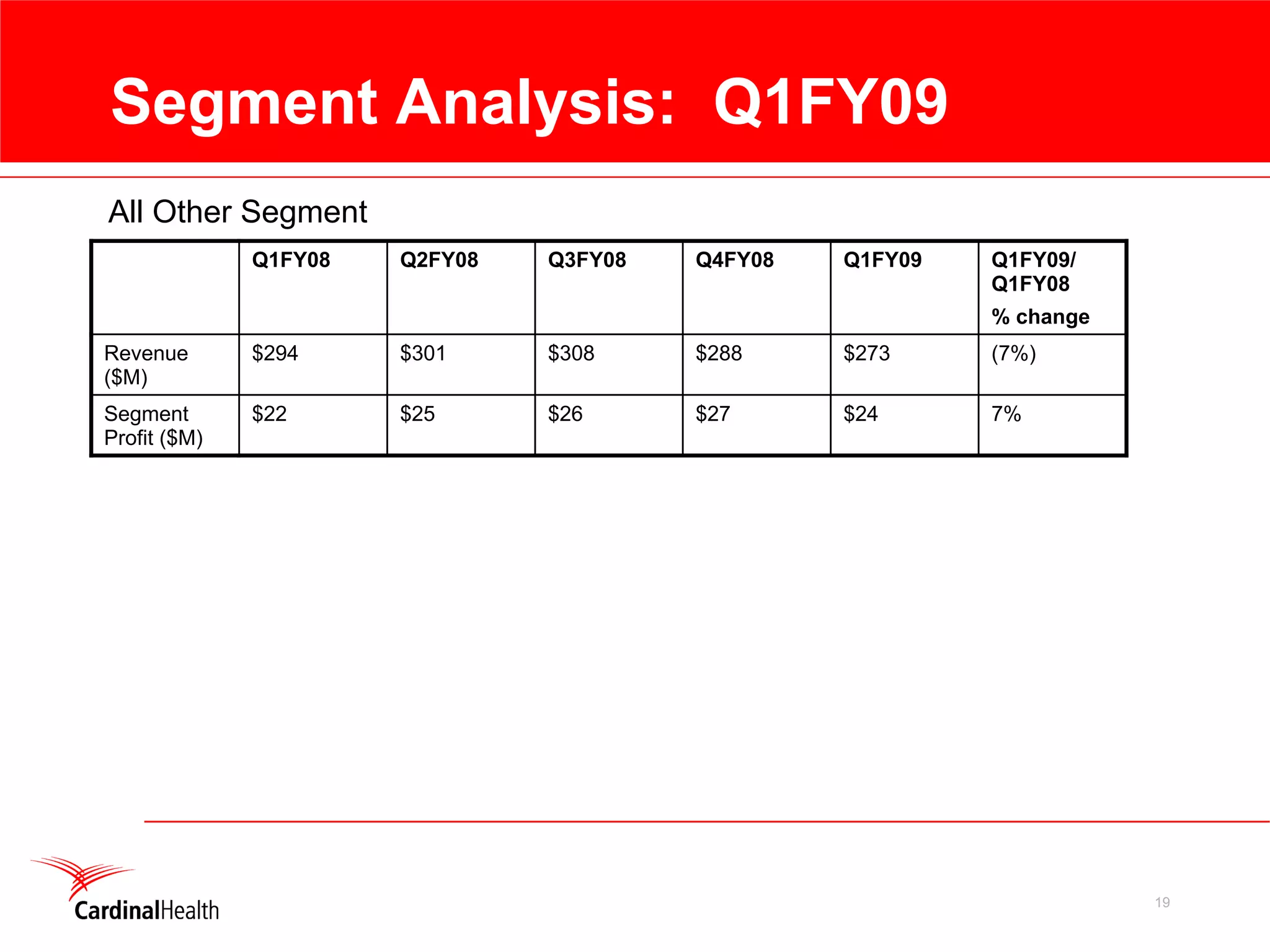

This document contains the key details from Cardinal Health's Q1 FY2009 investor call on October 29, 2008. It discusses Cardinal's financial results for Q1, including revenue of $24.3 billion (up 11% year-over-year) and operating earnings of $426 million (down 13% year-over-year). It also provides updates on Cardinal's Healthcare Supply Chain Services and Clinical and Medical Products segments. The document outlines Cardinal's financial goals for FY2009 and assumptions, and addresses questions from analysts on the call.