This paper examines the capital structure of Real Estate Investment Trusts (REITs) to understand how they choose between different financing options. It analyzes whether there is a relationship between market-to-book ratios and leverage ratios for REITs, and whether market-to-book ratios have a temporary or long-term impact on leverage. The paper finds that REITs with high market-to-book ratios tend to have high leverage ratios, and that historical market-to-book ratios have a long-term persistent impact on current leverage ratios. These findings support pecking order theory for REIT capital structures.

![The pecking order theory developed by Myers and Majluf (1984) is more potent simply

because it provides a better description of actual managerial behavior. The model, based on

information asymmetry between shareholder and managers, says that if managers are more

informed than shareholders about the firm’s prospects, they would be tempted to sell new shares

only when they are overvalued. Wary shareholders will anticipate this and revalue shares

downwards. Under this scenario, stock prices will always react negatively to equity issues.

Consequently, managers who act in shareholders’ interest will always avoid issuing new stock,

and prefer issuing less risky debt instead. This implies that high growth firms, particularly those

with insufficient free cash flow will have high debt ratios. A more dynamic version of the theory

states that high growth firms may reduce leverage and use retained earnings for current

investment to avoid issuing equity if and when need for additional funds arises in the future. An

important implication of the theory is that no optimal capital structure exists, rather capital

structure evolves in response to the firm’s investment opportunities. Shyam-Sunder and Myers

(1999) report evidence consistent with the pecking order theory.

A third theory, known as the market timing theory [Baker and Wurgler (2003)], is more

behavioral in nature and scope and simply states that long-term capital structure is merely a

manifestation of manager’s attempts to time equity issues to coincide with high market valuation.

According to this theory, firms with high growth and investment opportunities have high market

values and tend to issue equity more often, resulting in low leverage ratios. The idea is that if

market associates high market values with low adverse selection costs, that presents high growth

firms with the opportunity to issue equity at an advantage. It is noteworthy that the market timing

theory and the simple pecking order theory have opposite implications for the relation between

market values and debt ratios. Neither theory identifies an optimal capital structure, however.

A final question that has attracted considerable attention is whether changes in capital

structure are permanent. Trade off theory implies that any change in capital structure is

temporary and firms regress to the long term optimum over time. There is no such implication

under the pecking order or the market timing theories. An evidence of a permanent relation

between the need (investment opportunities) and sources (financing choices) of capital is

sufficient to unequivocally reject the trade off theory.

While the theoretical underpinnings of the theories are well developed, the empirical

evidence is mixed, at best. It is only recently that the empirical enquiries have focused on the

dynamics of the evolution of capital structure over time. Shyam-Sunder and Myers (1999) claim

support for the pecking order theory, Frank and Goyal (2002) refute it, and Fama and French

(2002) report findings consistent with, and contrary to both trade off and pecking order stories. In

2](https://image.slidesharecdn.com/capitalstructurefengghoshsirman-120828053148-phpapp01/85/Capital-structure-feng-ghosh-sirman-3-320.jpg)

![the most comprehensive analysis of market timing theory to date, Baker and Wurgler (2002)

interpret the evidence to be in conformity with the market timing theory to the exclusion of the

other two. It is worth noting all studies of capital structure decisions over time reject trade off

theory unequivocally.

Because of their unique regulatory environment, we contend, REITs are an ideal

laboratory setting to provide additional evidence on these competing theories. First, REITs do

not pay any taxes if 95% of taxable earnings are paid out as dividends. Second, high payout

implies that REITs have low free cash flow, such that managers have little opportunity to waste

cash on non value-maximizing acquisitions. REITs face the usual costs of financial distress,

however. Absence of tax deductibility of interest payments, and reduced agency conflict,

immediately suggest REITs should have no debt in their capital structure. The anecdotal

evidence is clearly inconsistent with this notion.1

The requirement that 95% of the taxable earnings be paid out as dividends forces REITs

to raise funds from the capital market where debt is a less attractive alternative than taxable firms,

and the agency cost benefit of debt is also muted. Turning to equity, however, entails the costs of

adverse selection which must be borne by the existing shareholders. We argue that these costs

are particularly severe for REITs. For example, monitoring REIT managers calls for special

skills and knowledge about general and local economic trends, conditions of comparable

properties, complex financing arrangements, other specialized skills, and even inside information

[Han (2004)]. In addition, since REITs are involved in real property transactions that include a

wide range of heterogeneous, illiquid assets, it is difficult for shareholders to determine the fair

market values of these transactions. This results in lack of transparency which makes monitoring

of managers critical. As Ghosh and Sirmans (2001, 2003, 2004), and Han (2004) observe,

however, REITs must abide by special regulations that can weaken or render ineffective the

standard governance mechanisms. To elaborate, to qualify as a REIT, the firm must maintain a

diversified ownership with at least 100 shareholders, the five biggest of which may not own more

than 50 percent of the total shares outstanding. Campbell et al. (2001) contribute the lack of

hostile takeovers among REITs to this regulation. This unique ownership structure diminishes

the effectiveness of monitoring by the market for corporate control, and exacerbates the lack of

transparency. In essence, issuing equity is a particularly costly proposition for REITs. Under

this scenario, pecking order theory predicts financing first with retained earnings, then debt, and

1

Brown and Riddiough (2003) reports that over the period September 1993 to March 1998, REITs made a 120 debt

offerings of $133m each, on average.

3](https://image.slidesharecdn.com/capitalstructurefengghoshsirman-120828053148-phpapp01/85/Capital-structure-feng-ghosh-sirman-4-320.jpg)

![small, growth firms) make the largest net new issues of equity which is contrary to the pecking

order theory. Among other authors to report evidence inconsistent with pecking order theory are

Helwege and Liang (1996) and Frank and Goyal (2002). Using a panel of IPO firms, Helwege

and Liang (1996) find no relationship between the decision to raise external funds and the

shortfall of internally generated funds. Studying the financial activities of US firms from 1971 to

1988, Frank and Goyal (2002) conclude that new equity issues track the financing deficit more

closely than debt issues, a clear contradiction of the pecking order model.

C. Market Timing Theory

Market Timing Theory suggests that firms tend to issue stock when the market condition

is favorable, and issue debt when the stock market is under the cloud. Graham and Harvey

(2001) report that most CFOs agree that prior stock price movement and perception of under- or

over-valuation of firms’ stock play important roles in their decision to raise external funds.

Assuming that the ratio of market value to book value reflects investment opportunities, the

market timing theory [Baker and Wurgler (2002)] asserts a negative relation between market

value to book value ratio and the firm’s leverage ratio. This is contradictory to the simple form of

the pecking order theory, but consistent with the more dynamic form. Baker and Wurgler (2002)

demonstrate that leverage is negatively related to ‘external finance weighted-average’ market-to-

book ratio which implies that past market valuation has a significant and persistently negative

impact on firm’s leverage ratio. Their data further reveal that most of the financing is done by

issuing equity, not through retained earnings. The authors reject the trade off and pecking order

models and interpret the result as supportive of the notion that current leverage ratio is a

cumulative outcome of firm’s previous attempts to time the market.

In summary, while the three theories have several overlapping implications, they also

make some predictions that can be useful to infer which one best fits observed capital structure

choices. We highlight the aspects of each theory that is unique. The trade off theory predicts a

target capital structure that firms regress to in the long run, implying that any relation between

capital structure and profitability or investments is transient. Neither the pecking order theory nor

the market timing theory identifies an optimum capital structure. For dividend-paying (non

dividend-paying) firms, the pecking order theory predicts a long run positive (negative) relation

between market to book value ratio and leverage ratio. The market timing theory leads to a long

run positive relation between market to book value ratio and leverage ratio for all classes of firms;

8](https://image.slidesharecdn.com/capitalstructurefengghoshsirman-120828053148-phpapp01/85/Capital-structure-feng-ghosh-sirman-9-320.jpg)

![the difference between the two is that under pecking order, funds are drawn from retained

earnings while for market timing, equity sales is the source for capital.

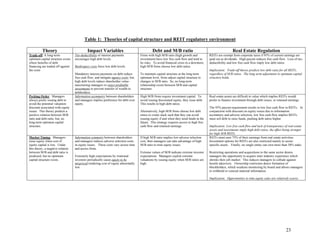

III. REIT Regulatory Environment and Capital Structure

In this section, we explore the implications of the various theories of capital structure

from the perspective of REIT regulatory environment, and develop the hypotheses. In addition,

we provide a review of the extant evidence on capital structure of REITs.

A. Theoretical considerations

REITs are not required to pay corporate taxes if they distribute 95% of taxable income as

dividends. This nullifies two significant benefits of debt financing. One, the tax deductibility of

interest payments and the tax shield is non-existent. Second, since most of the earnings is

distributed, debt servicing has only limited impact on agency cost of free cash flow. Accordingly,

REITs should have one hundred percent equity under the trade off theory. Costs of financial

distress further reinforce the preference for equity. The only effect that induces less than all

equity capital is that asymmetric information between shareholders and managers causes

valuation discounts. In the aggregate, if REITs have an optimum capital structure, it includes

relatively low level of debt.

The main motivation to prefer debt over equity issues is that managers may use

privileged information to sell overvalued equity and shareholders are aware of it. So, an equity

issue is always discounted by the market. Greater the information asymmetry, higher is the

discount. Information asymmetry is particularly severe in REITs because the transparency of the

underlying assets is less than perfect. For example, analysis of REIT assets may require special

skills and knowledge about general and local economic trends, conditions of comparable

properties, and complex financing arrangements. In addition, shareholders may find it difficult to

determine the fair market values of real estate transactions because they often include

heterogeneous, and illiquid assets.

Restrictions on REIT’s income sources and investment options may further exacerbate

the information asymmetry. The restrictions that REITs derive their income largely from real

estate activities, and that acquisitions and combinations be restricted to the real estate sector,

allow managers but limited opportunity to acquire inter industry skills, makes them less

employable, and induces them to avoid hostile takeovers [Campbell, Ghosh, and Sirmans]. The

9](https://image.slidesharecdn.com/capitalstructurefengghoshsirman-120828053148-phpapp01/85/Capital-structure-feng-ghosh-sirman-10-320.jpg)

![pecking order implication that issuing a security constitutes a negative signal that it is overvalued,

and the implied-cash-flow change hypothesis [Smith (1986)] which states that unexpected

security offerings suggest that operating cash flows are lower than expected. A positive reaction

to debt sales follows only from Ross’s (1977) assertion that debt issues convey the favorable

information that future earnings will be sufficiently large to support the mandatory interest

payments. Extant literature [Mikkelson and Partch (1986), and Eckbo (1986)] documents non-

positive to significantly negative reaction to debt offerings. Contrary to these studies, Howe and

Shilling (1988) find a significant positive reaction, which they interpret as weak support for

Ross’s signaling hypothesis.

In an important and comprehensive piece, Brown and Riddiough (2003) study the public

offerings by equity REITs between September 1993 and March 1998, and identify numerous

patterns in the issuance behavior. While the scope of the research seems limited to identifying

some stylized facts about REIT capital structure, certain results have bearing on our analyses. A

significant finding is that maturity of public REIT debt is positively related to offer spread. The

authors point out that if credit market participants assess that REITs issue debt when they are

aggressively leveraged, and if they anticipate that REIT balance sheets will strengthen in the

future, then credit spreads should decline with maturity. On the other hand, if REITs issue public

debt at long-term target leverage ratios, then credit spreads are predicted to increase with

maturity. The evidence therefore suggests the existence of a long-term target debt ratio.

Two, the authors report that majority of the firms are clustered just above the investment-

grade rating, and REITs that issue public debt are debt capital constrained. While this result also

suggests a target long-run debt ratio, an alternative explanation – consistent with pecking order

theory -- is that as long as REITs can attain minimum investment-grade credit rating, they prefer

to issue debt instead of equity to boost their credit ratings. Further, a significant number of

REITs that issue equity are highly leveraged and remain so subsequently. Apparently, firms issue

equity only when bankruptcy threat looms large, and even at this juncture, they raise just enough

equity capital to mitigate the funding pressure. Finally, REITs with higher total assets and

revenues are more likely to issue debt, another indication that when bankruptcy risk is low,

managers choose debt financing, just as pecking order prescribes. Also in conformity with the

pecking order model, REITs largely fund investment with bank lines of credit and other sources

of private debt. When these sources are exhausted, REITs access the public capital market and

use the issue proceeds to pay down credit lines in order to prepare for the next round of financing.

Overall, Brown and Riddiough’s (2003) data suggest that despite no obvious tax

advantage, the standard deadweight costs of financial distress, and the pecking order and free

11](https://image.slidesharecdn.com/capitalstructurefengghoshsirman-120828053148-phpapp01/85/Capital-structure-feng-ghosh-sirman-12-320.jpg)

![then debt, and finally equity. It follows that if profitability and investments are persistent,

leverage is lower for profitable firms, and higher for firms with more investment opportunities.

Dividend payment reinforces the relationship. Market timing theory predicts that managers time

equity issues when equity is overvalued. If investment opportunities are persistent, a long-term

negative relation between market to book ratio and leverage ratio is predicted.

A. The relationship between market-to-book and leverage ratios

In this section, we investigate the determinants of annual changes in leverage. Following

Baker and Wurgler (2002) and Rajan and Zingales (1995), we include three variables that are

correlated with leverage.

⎛D⎞ ⎛D⎞ ⎛M ⎞ ⎛ REinvestment ⎞ ⎛ EBITDA ⎞

⎜ ⎟ − ⎜ ⎟ = a + b⎜ ⎟ + c⎜ ⎟ + d⎜ ⎟

⎝ A ⎠t ⎝ A ⎠t −1 ⎝ B ⎠t −1 ⎝ A ⎠t −1 ⎝ A ⎠t −1

⎛D⎞

+ e log( S ) t − 1 + f ⎜ ⎟ + u t (1)

⎝ A ⎠ t −1

The sign of coefficient b is the main focus of this equation. Both tradeoff and market timing

theory predict a negative sign, while pecking order suggests the opposite. A more complicated

version of pecking order asserts that firms with larger expected dividends may keep current

leverage low to preserve debt capacity so as to avoid funding future investments with new risky

securities [Myers (1984)]. For REITs, however, such a strategy may not be feasible because of

the 95% payout requirement.

We use percentage of real estate investment as proxy for asset tangibility in equation (1).

Tangible assets may be used as collateral and hence may be associated with higher leverage.

However, REITs are expected to have most of the assets as tangible assets, such that much

variability is not expected in the data. Hence, we do not expect a relationship between tangible

assets and leverage ratios. Profitability is associated with the availability of internal cash flows,

which implies lower leverage ratio under the pecking order theory. However, REITs are required

to pay out 95 percent of the earnings as dividends. Hence, there is limited free cash flow and a

significant relationship between profitability and leverage may not emerge. The natural

logarithm of total revenue is used as a proxy for firm size. As large firms are less likely to suffer

financial distress, they might be associated with high leverage if the financial distress costs are

considered to be of first-order importance to the firms (as tradeoff theory suggests). Fama and

15](https://image.slidesharecdn.com/capitalstructurefengghoshsirman-120828053148-phpapp01/85/Capital-structure-feng-ghosh-sirman-16-320.jpg)