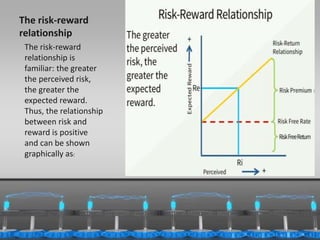

This document discusses capital budgeting and project risk. Capital budgeting is the process of measuring, evaluating, and selecting long-term investment opportunities. Capital projects have elements of both risk and reward. There are various types of risks that can impact a project, such as incomplete analysis, unanticipated actions from other parties, and unforeseen economic changes. Diversifying a portfolio of projects can help reduce overall risk to the firm. While some risks can be reduced through diversification, risks from macroeconomic factors generally cannot be diversified away. The relationship between risk and reward is positive - the greater the perceived risk of a project, the greater expected reward is required to undertake it.