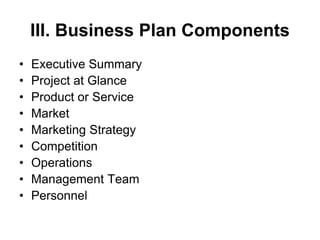

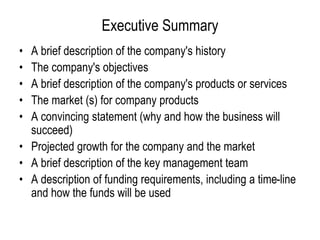

The business plan outlines the key components needed to start and operate a successful business, including an executive summary, description of products/services, market analysis, marketing strategy, competitors, operations, management team, personnel needs, and financial projections. It serves several important purposes such as assessing feasibility, obtaining financing, and providing a roadmap for managing the business as it grows. The business plan should be written by the business owner and include details on the company's objectives, products/services, target markets, strategies for success, management qualifications, and financial forecasts.