1) According to a 2012 report, 11% of consumers with a primary banking relationship were likely to switch banks that year, putting an estimated $675 billion in deposits at risk.

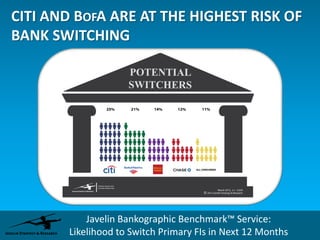

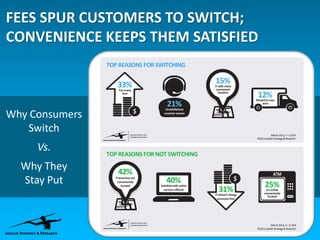

2) Large banks like Citi and Bank of America faced the highest risk of losing customers to bank switching due to fees charged.

3) To attract and retain customers, the report recommends that banks leverage mobile banking and bridge online and in-person services, while smaller banks and credit unions emphasize personal relationships.