Embed presentation

Download to read offline

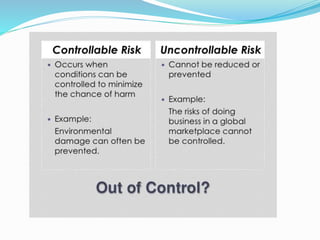

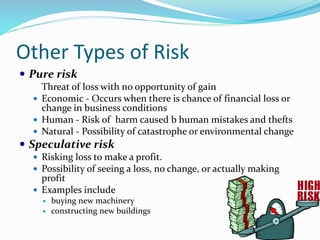

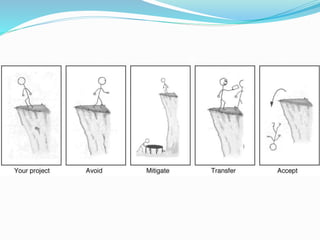

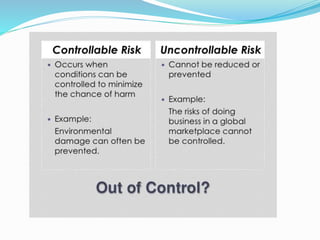

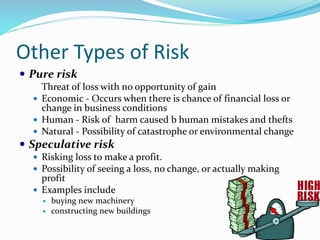

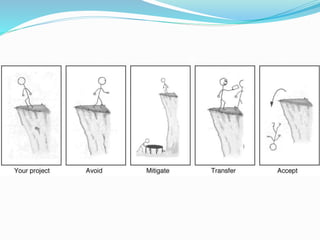

This document discusses risk and risk management for businesses. It defines business risk as the risk of loss naturally incurred by owning or operating a business. It states that the goal of risk management is to systematically manage risk to achieve business objectives, and that while risk cannot be eliminated, it can be reduced and managed. The document outlines different types of risk businesses may face, such as insurable or uninsurable, controllable or uncontrollable, pure risk, economic risk, human risk, natural risk, and speculative risk. It also discusses four common methods for handling risk: transfer, accept, reduce, and avoidance.