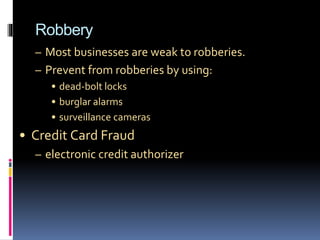

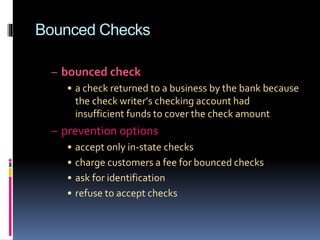

The document discusses different types of risks that businesses face including economic risks from factors like competitors or regulations, natural risks from disasters, and human risks from errors or unpredictable behavior. It defines risk management as actions to prevent or reduce loss, which can include avoiding, assuming, or transferring risk. The document recommends businesses identify risks, develop a risk management plan including roles and procedures, and communicate the plan to employees. It provides examples of risks from theft, robbery, fraud, and bounced checks and ways businesses can help prevent losses from these risks.