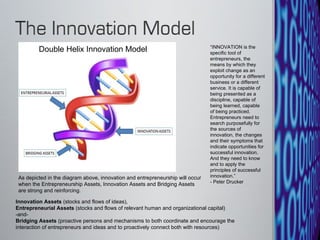

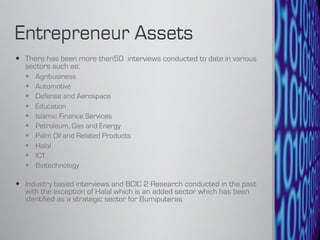

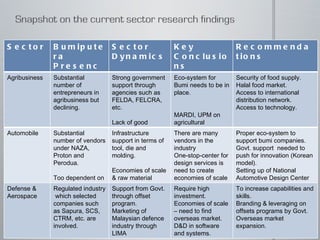

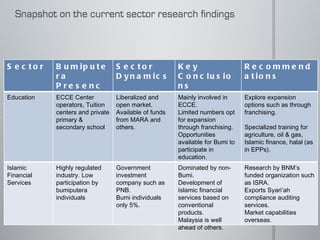

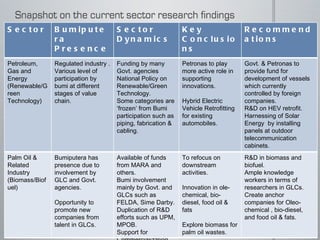

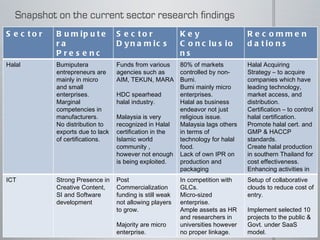

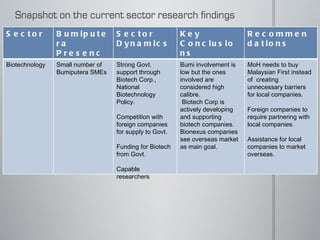

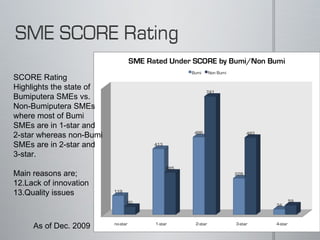

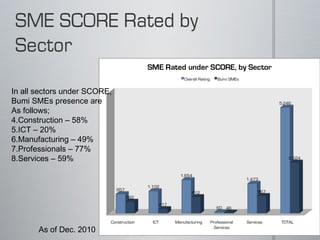

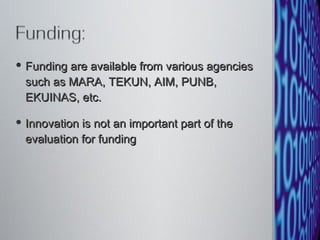

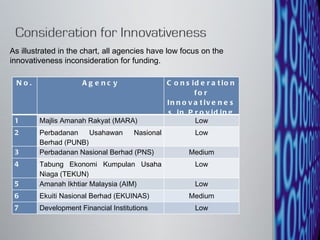

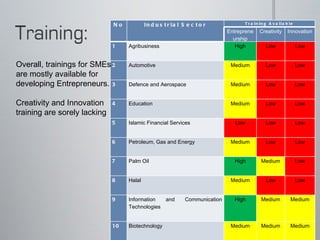

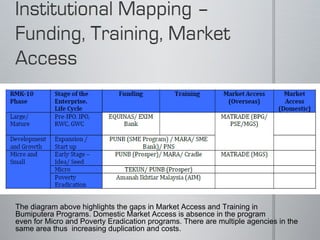

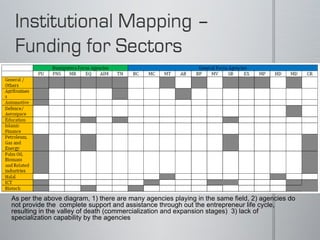

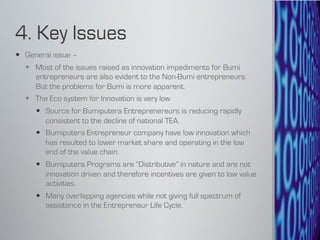

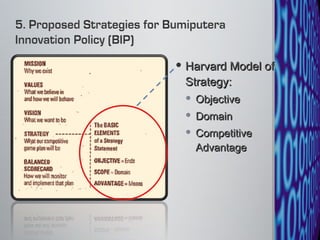

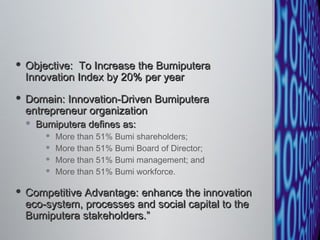

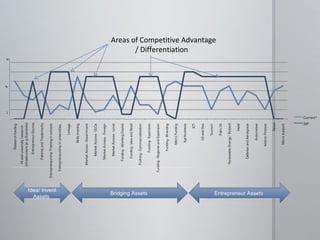

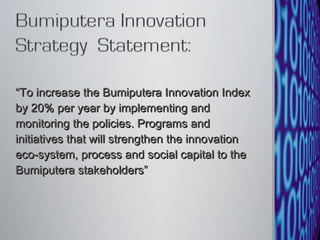

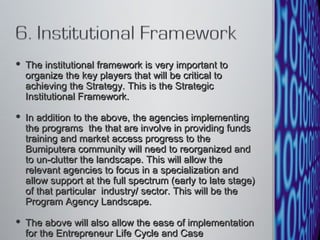

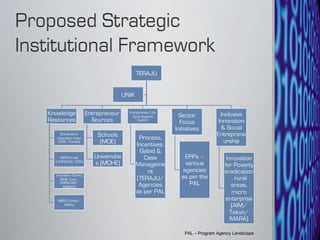

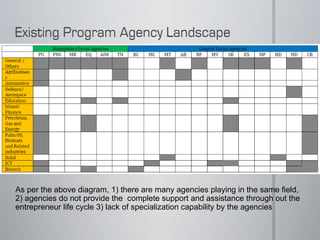

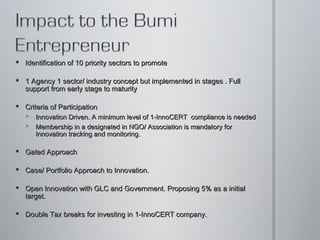

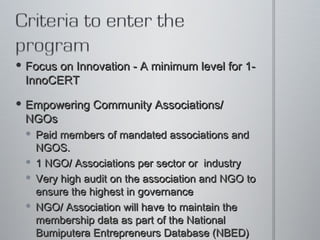

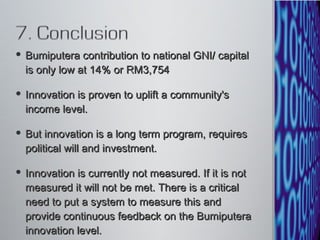

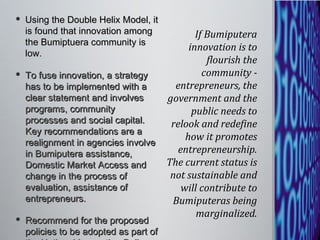

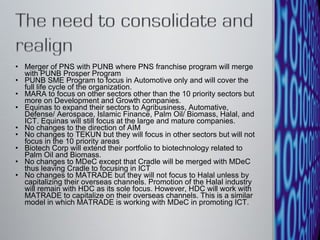

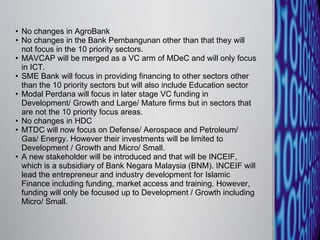

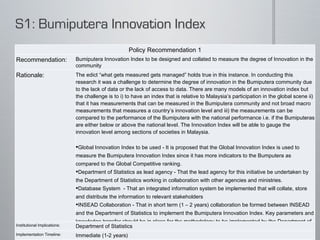

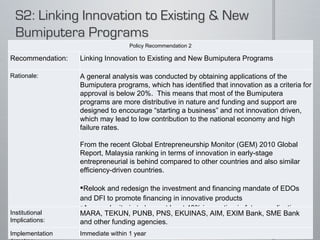

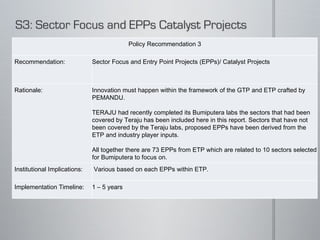

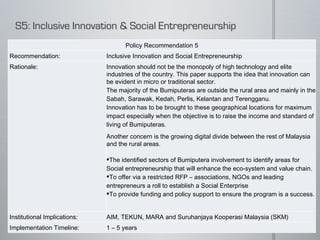

The document discusses bumiputera involvement in innovation in Malaysia. It analyzes sectors where bumiputera have strategic presence and identifies key issues hindering their innovation success. These include a lack of R&D skills and funding, as well as low entrepreneurial activity rates. The document proposes addressing these issues through improved institutional support for bumiputera entrepreneurs and increasing collaboration between industry and universities.