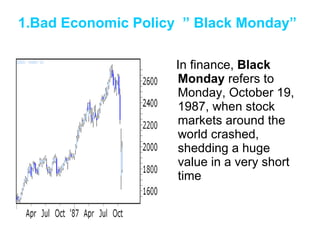

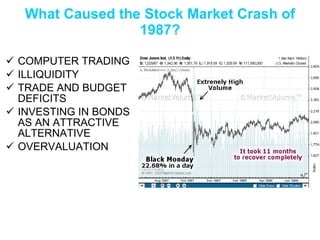

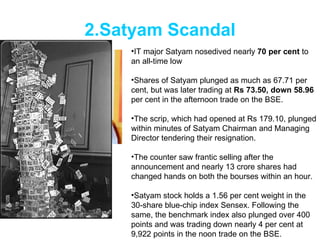

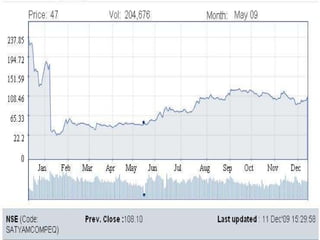

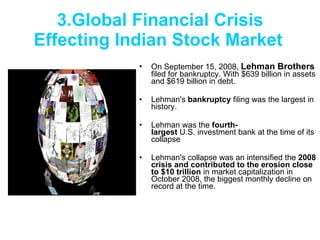

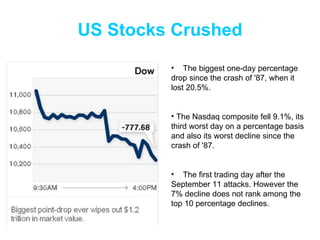

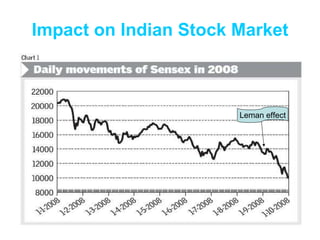

The document provides an overview of stock exchanges and stock market trading. It discusses key concepts like bull and bear markets, speculation, and the roles of various players like shareholders, debenture holders, brokers, and floor traders. It also examines causes of price fluctuations like economic policies, scandals, and global financial crises. Strategies and precautions for day trading are presented.