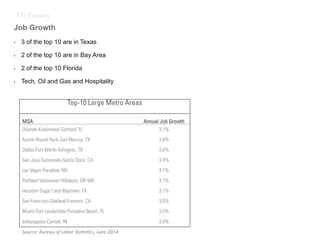

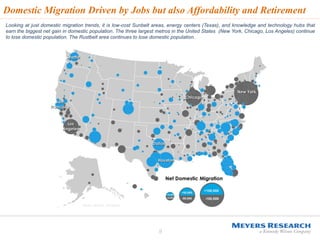

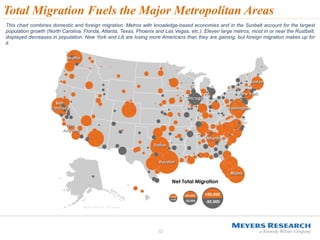

The document provides an overview of the U.S. job growth and housing market trends as of September 2014, highlighting significant improvements in job growth primarily in the West and South. It notes a decline in the homeownership rate, particularly among younger demographics, while emphasizing the impact of international migration and changing demographics on housing demand. The housing market is showing signs of recovery with increasing building permits, but challenges such as affordability and tight lending standards persist.