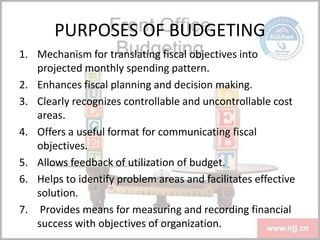

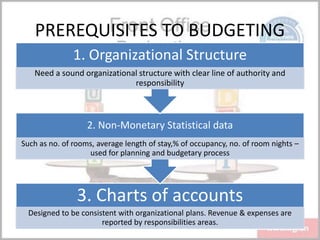

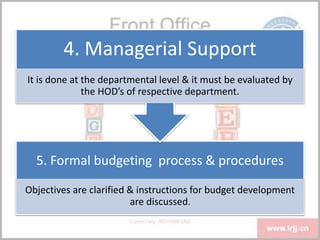

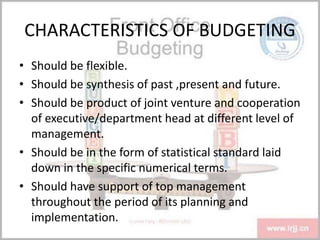

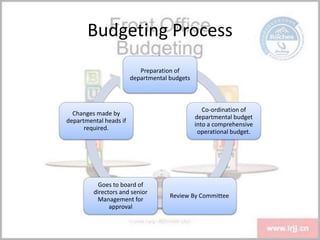

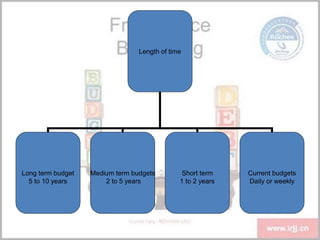

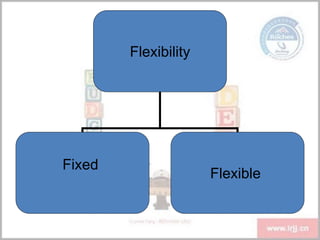

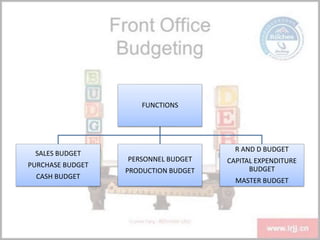

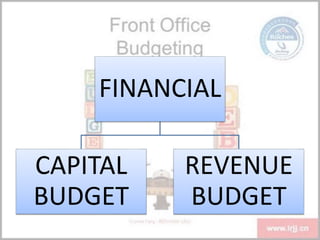

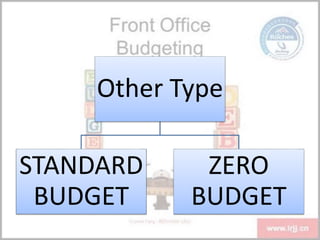

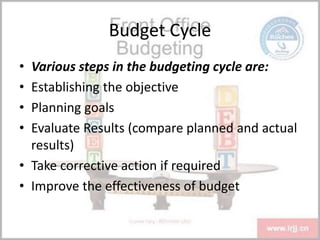

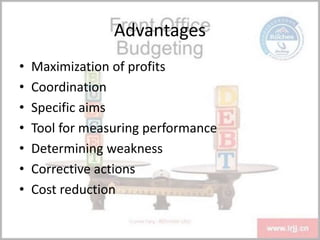

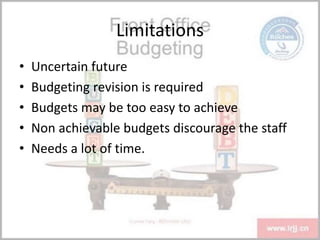

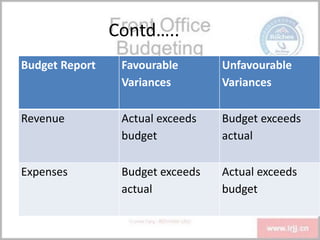

The document discusses budgeting in the hotel industry. It defines budgets and explains that budgets are financial plans that estimate revenues and expenses. It outlines the budgeting process, including preparing departmental budgets and consolidating them into an operational budget. It also discusses budget types, the budget cycle, advantages and limitations of budgets, and how to prepare and refine budgets. Specifically, it explains how the front office manager is responsible for preparing the rooms revenue budget and budgets are evaluated by comparing actual results to planned budgets through monthly reports.