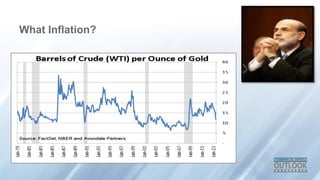

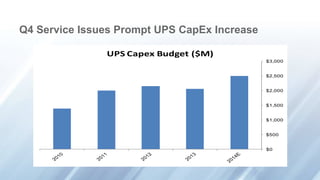

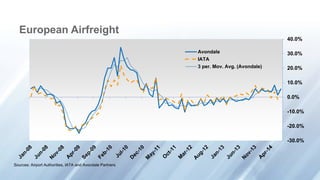

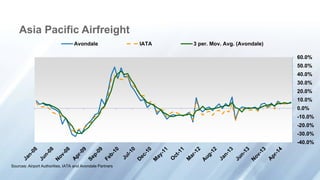

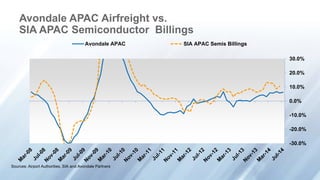

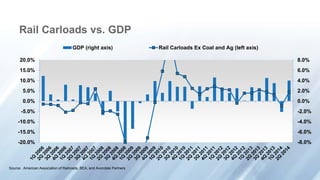

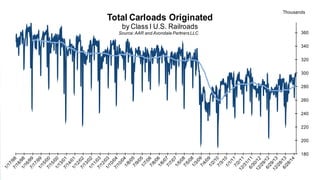

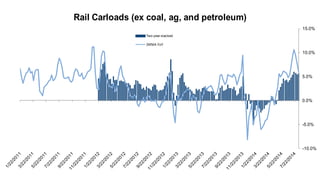

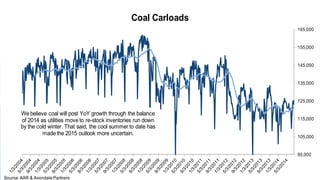

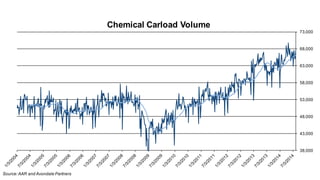

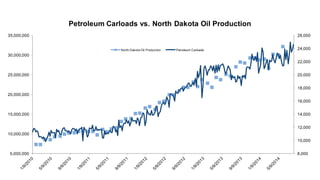

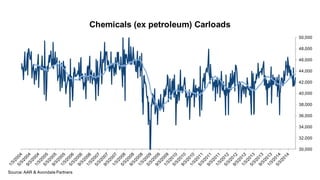

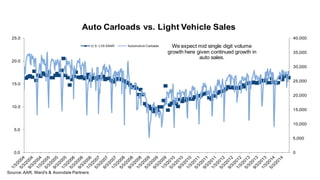

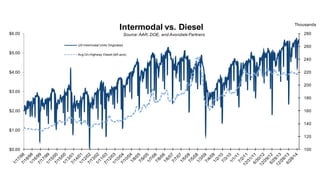

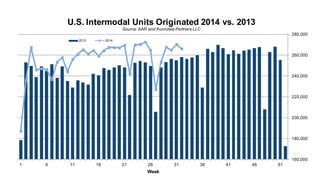

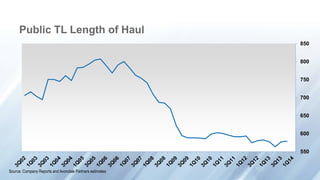

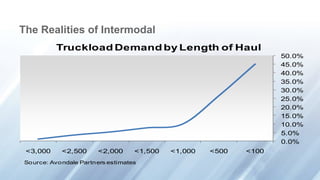

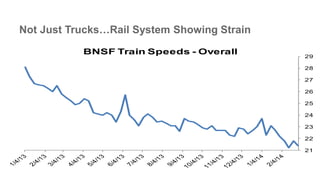

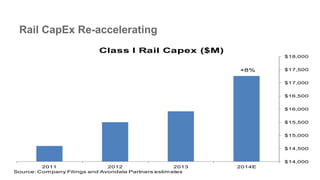

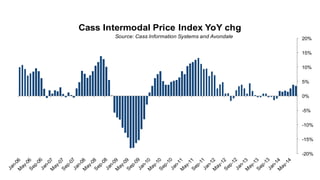

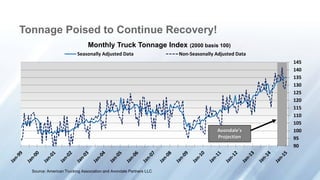

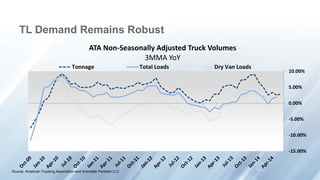

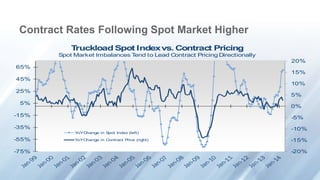

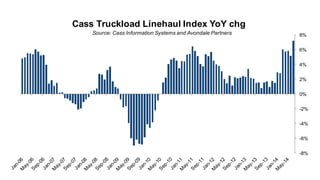

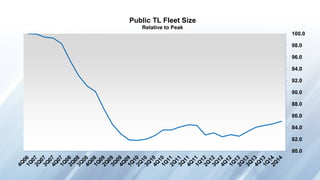

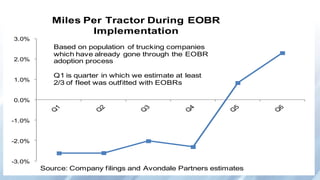

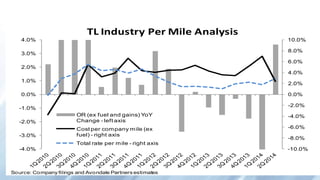

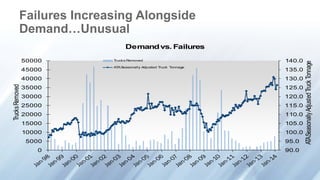

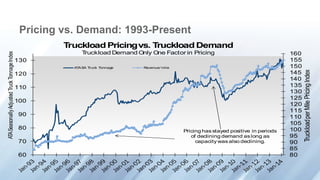

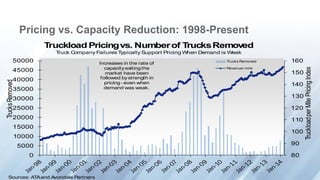

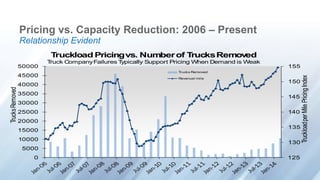

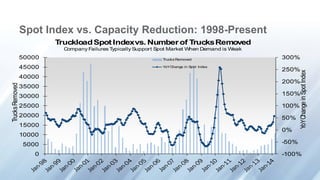

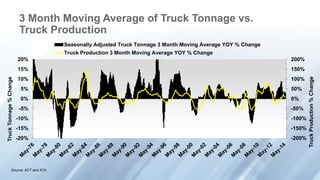

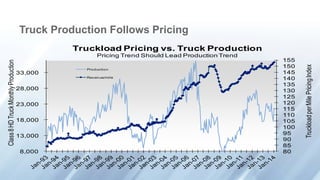

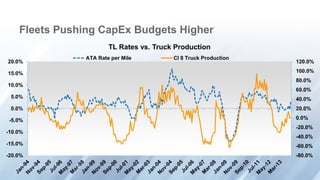

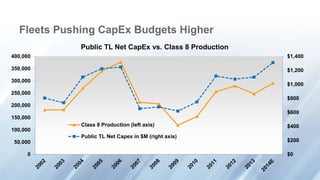

This document provides an analysis of macroeconomic and transportation industry trends by Donald Broughton, Senior Transportation Analyst at Avondale Partners. It includes charts and commentary on topics like inflation, interest rates, tonnage growth across transportation modes, capacity constraints in trucking and rail, and the relationship between freight demand, pricing, and trucking company failures. The overall message is that while macroeconomic indicators appear weak, transportation data tells a different story of recovery and tightening capacity that supports continued improvement in freight rates.