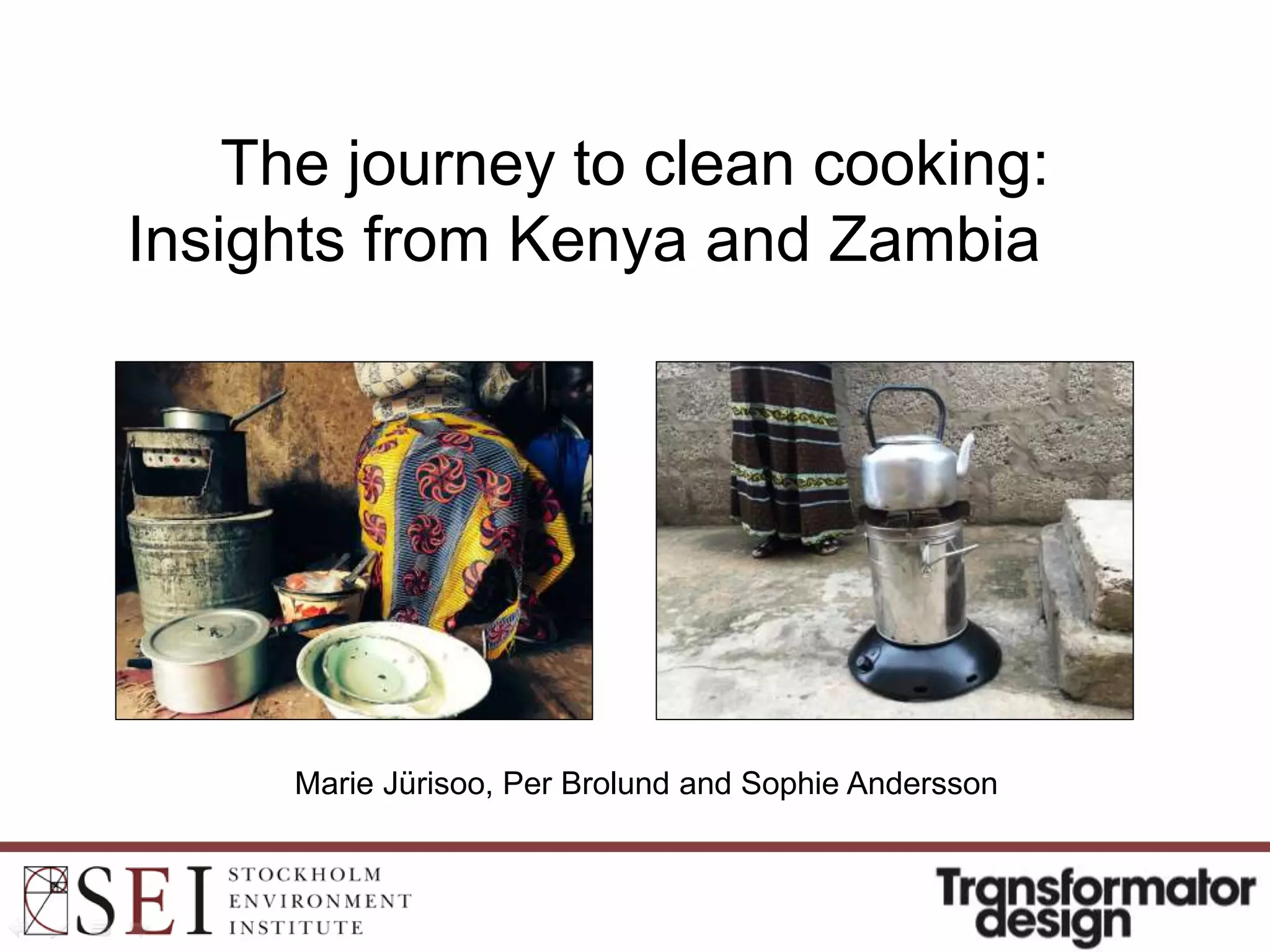

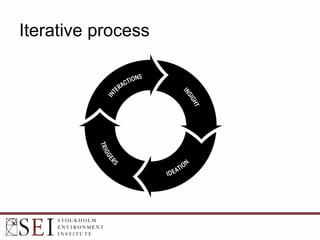

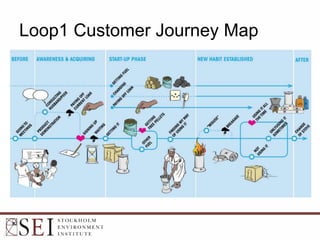

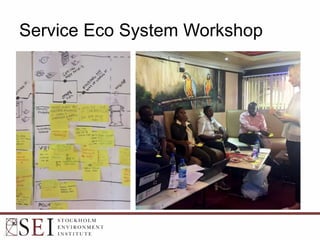

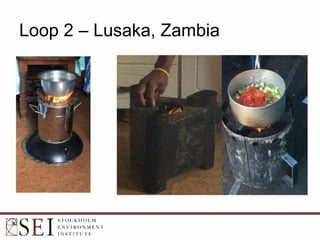

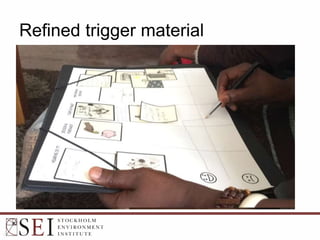

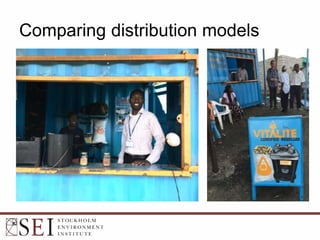

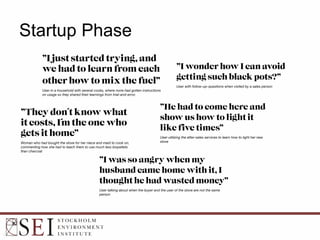

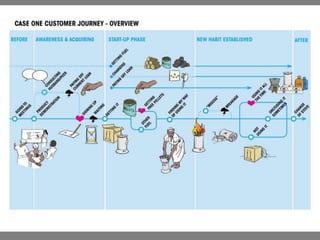

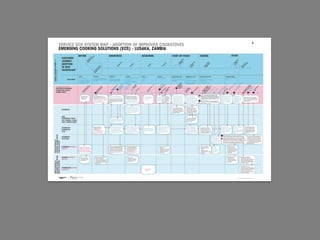

The document discusses insights from Kenya and Zambia regarding clean cooking initiatives led by the Stockholm Environment Institute (SEI). It details an iterative research process aimed at understanding user interactions and refining strategies for promoting sustainable decision-making at the household level. The initiative includes workshops and customer journey mapping to identify effective behavioral change models.