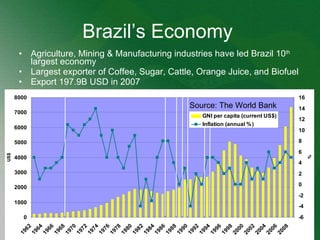

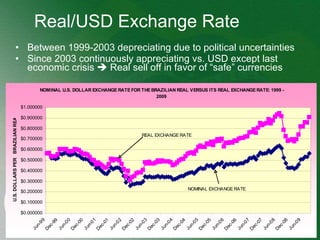

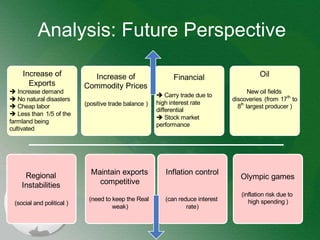

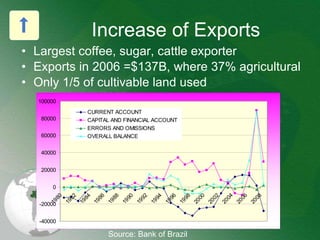

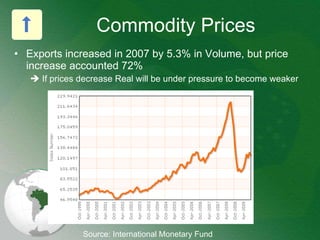

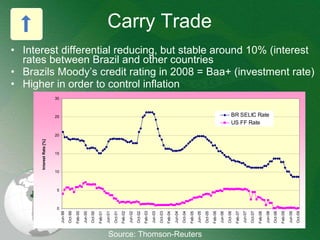

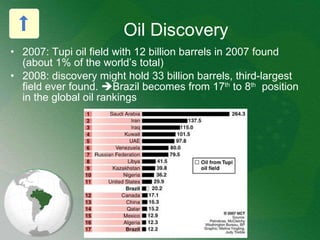

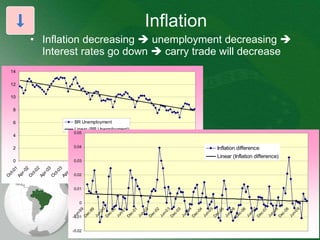

Brazil has the 5th largest area and population in the world, and the 10th largest economy. Agriculture, mining, and manufacturing industries have led Brazil's economy, and it is the largest exporter of coffee, sugar, cattle, and orange juice. The value of the Brazilian Real has fluctuated over time depending on economic and political conditions both domestically and globally. Looking to the future, further growth in key exports, commodity prices, foreign investment, and recent oil discoveries suggest the Real will continue to appreciate against the U.S. dollar, though the government may intervene to support export competitiveness.